-

DOGS token set for a potential surge as technical breakout hints at short-term bullish rally.

On-chain metrics show decreased user activity, but stable transactions suggest DOGS may be primed for a rebound.

As a seasoned analyst with over two decades of experience in the cryptocurrency market, I’ve seen my fair share of bull and bear markets. Looking at Dogs [DOGS], it seems we might be on the verge of a short-term bullish rally. Despite the recent downtrend, technical indicators suggest an upside potential.

Dogs [DOGS] has experienced a downtrend against the U.S. dollar over the past week.

At this moment, the price of DOGS stands at $0.001056. Over the last 24 hours, there has been a 3.47% drop in its value, while over the past week, it has decreased by 18.37%.

Currently, the Dogs project has a total circulating supply of about 520 billion tokens. At the moment of reporting, this project’s market capitalization stood at approximately $545,919,186.

The recent downtrend has occurred despite a strong start, as DOGS has been one of the newest additions to the rapidly growing Toncoin ecosystem.

Should the anticipated surge happen, it might signify a substantial shift in the token’s temporary pricing trend.

Technical indicators suggest potential upside

Currently, DOGS‘ price stands at approximately $0.0010587. It’s holding steady around the midpoint of its Bollinger Bands. The lower band is set at about $0.0009783, while the upper band rests at $0.0011140, suggesting a time of reduced price fluctuations.

The 1.04% rise seen in the most recent 4-hour period could be an early indication that the market is starting to level out following its recent downturns.

Furthermore, the Money Flow Index (MFI) was measured at 55.26, indicating a moderate level of buying activity that didn’t push the market into an overbought state.

Based on my years of experience in the market, it appears that there could be a potential for a price increase in the near future, but I would only feel confident in calling it a bullish trend if the MFI (Money Flow Index) rises above 75. In my experience, when this indicator reaches such levels, it often signals a strong upward momentum in the market, which could lead to significant gains for investors. However, as always, I would urge caution and remind everyone that past performance is not always indicative of future results. It’s important to do your own research and make informed decisions based on your risk tolerance and investment objectives.

Currently, the Relative Strength Index (RSI) stood at 45.72, indicating a market leaning slightly towards bearish, yet it’s not strongly so and remains close to being neutral.

Traders might keep an eye on the Relative Strength Index (RSI) crossing above 50, as this potential move could indicate a surge in purchasing energy.

Decline in network activity raises concerns

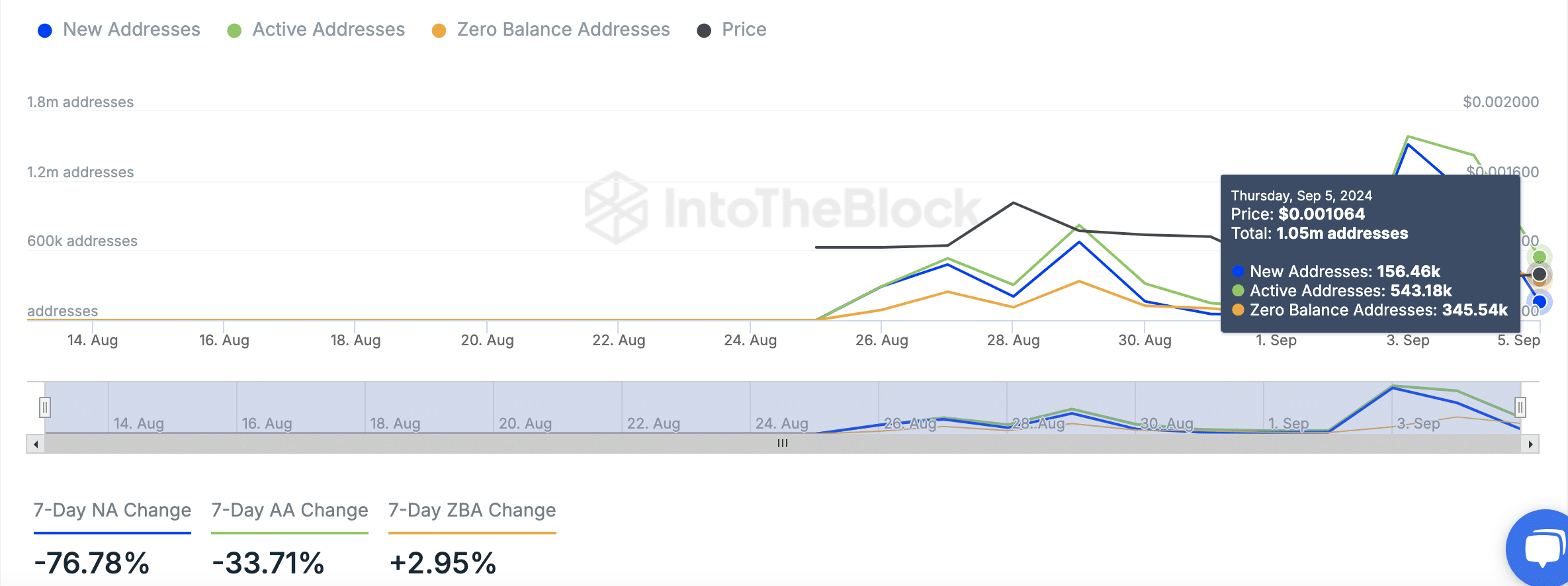

Based on data from IntoTheBlock, we’ve seen a significant decrease in the number of daily active addresses over the last seven days, as indicated by on-chain analysis.

On September 5th, there was a peak of approximately 1.05 million active addresses, however, over the course of the following seven days, there was a decrease of about 33.71%.

This drop could indicate a significant reduction in user engagement, possibly connected to the recent dip in DOGS‘ value.

Read Dogs’ [DOGS] Price Prediction 2024–2025

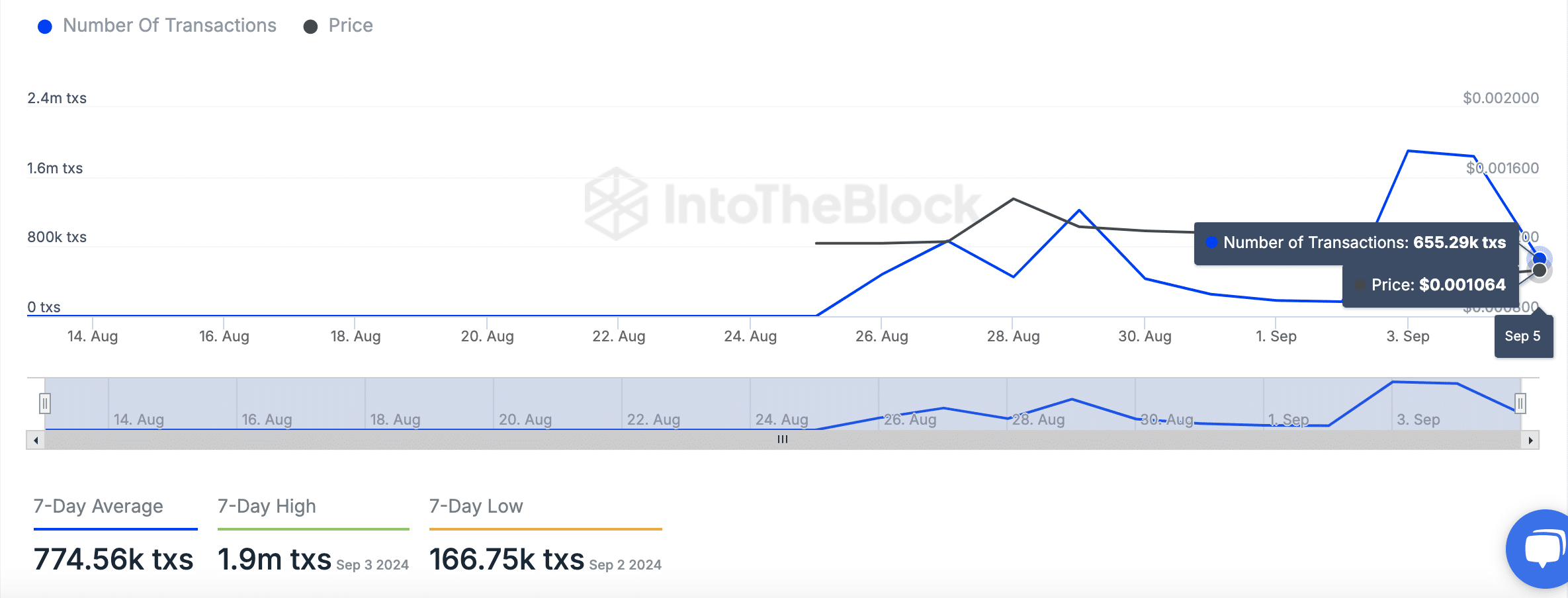

As a crypto investor, I’ve noticed an interesting trend: Although the number of active addresses has dropped, the daily transaction volumes have managed to stay relatively consistent. On September 5th, these transactions peaked at approximately 655,290, which is slightly lower than the average of around 774,560 transactions over the past week.

After reaching a high of 1.9 million transactions on September 3rd, the fluctuating number of transactions indicates that user activity has been unsteady in the past few days.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-09-07 00:08