-

dogwifhat has experienced a sustained upward momentum.

WIF has surged by 29.74% in 7 days as trading volume rose by 116.2% in 24 hours.

As a seasoned researcher with over a decade of experience in the crypto space, I’ve seen my fair share of market fluctuations and trends. However, the recent surge of dogwifhat [WIF] has left me quite intrigued.

In simple terms, WIF (short for DogeWhat), the fourth-largest meme coin in terms of market capitalization, has been exhibiting robust growth momentum during the last month. This upward trend has led to a substantial rebound on WIF’s price graphs.

Currently, at this moment, the stock price for WIF stands at $1.99. Over the last seven days, this represents an impressive rise of approximately 29.74%.

Remarkably, during this span, there’s been a significant increase in interest for memecoins, particularly in trading. This surge in demand has led to an impressive 116.2% jump in WIF‘s trading volume, reaching $727.7 million over the past 24 hours.

Increased trading activity accompanied by notable price increases implies a shift in the market’s overall attitude.

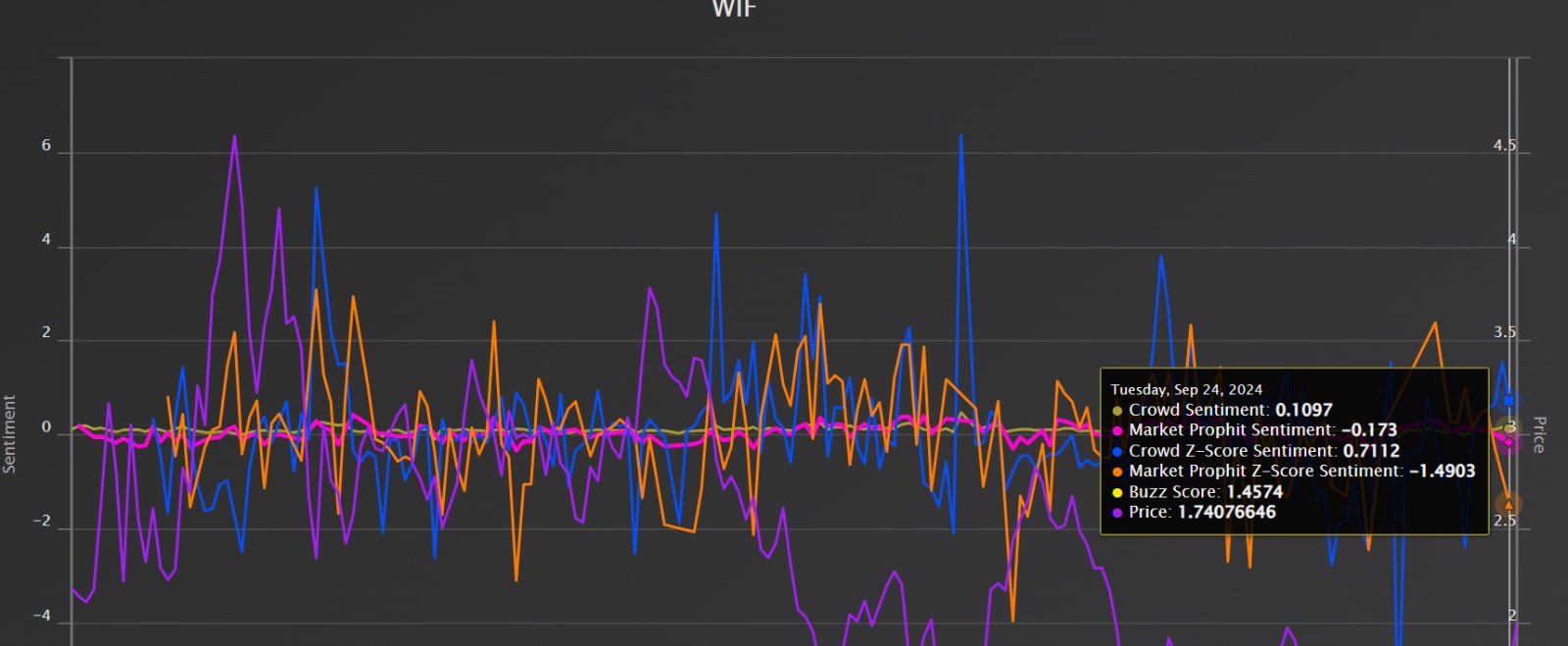

In summary, the Market Prophit analysis indicates that WIF is receiving favorable market opinion, scoring 1.4 on the Buzz metric and 0.1 on the Crowd Sentiment scale.

What WIF charts suggest

Undoubtedly, the prevailing market sentiment sets dogwifhat for further gains on the price charts.

Initially, it’s worth noting that the Directional Movement Index (DMI) indicates a robust upward trend. Here, the positive index stands at 31.06, surpassing the negative index which is at 15.1.

This suggests that the positive force is overpowering the negative one, pointing towards an optimistic or rising market trend.

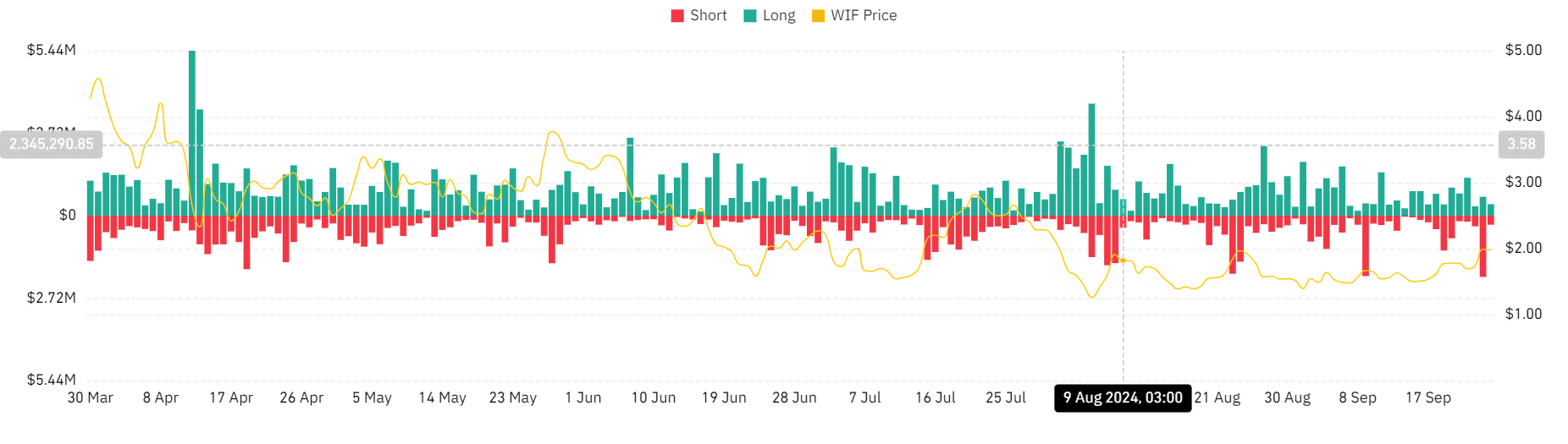

Furthermore, the accumulated liquidation for short positions at WIF has significantly increased over the past three days. Specifically, yesterday alone accounted for approximately $2.3 million in liquidation for short positions.

This implies that individuals who have taken a stance opposite to the market (short sellers) must exit their positions, whereas those who have bought and held (long position holders) maintain their trades.

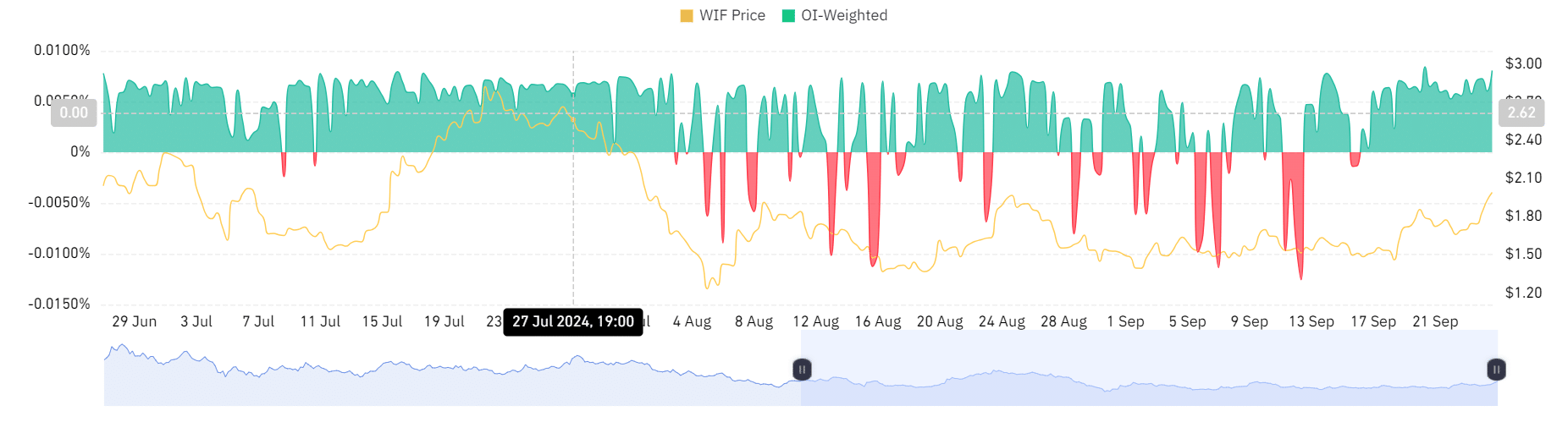

This occurrence is additionally demonstrated through a net positive funding rate across exchanges, which indicates that more traders are opting for long positions rather than short ones, according to Santiment’s data. Over the last seven days, this funding rate has remained positive, implying increased demand for long positions.

Thus, signaling investors are willing to pay a premium and hold their positions.

In summary, our investigation into Coinglass reveals that a bullish outlook remains prevalent in the market, underscored by a favorable weighted funding rate. As previously noted, a positive OI-weighted funding rate implies that numerous traders are adopting long positions, suggesting optimism about the market’s direction.

Read dogwifhat’s [WIF] Price Prediction 2024–2025

Therefore, the current market sentiment shows higher favorability for the memecoin.

As a researcher, I’m observing that if the current market conditions persist, it appears that WIF could potentially surpass its next substantial resistance point at roughly $2.36. If this level is breached, we might witness DogWifhat reaching a 2-month peak around $2.90.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-09-25 16:39