- WIF formed a symmetrical triangle pattern, which suggests the possibility of a rally beyond its all-time high.

- Technical indicators support the likelihood of an upcoming rally, while other metrics suggest that the downside risk is minimal.

As a seasoned analyst with over two decades of market analysis under my belt, I’ve seen countless patterns and trends come and go. However, the current bullish momentum of WIF is truly intriguing. The symmetrical triangle pattern, combined with the strong technical indicators, paints a compelling picture for an upcoming rally that could potentially surpass its all-time high.

The bullish trend for dogwifhat [WIF] picked up speed following an impressive 48.19% weekly increase, with this uptrend carrying over to the daily chart as well, where the price has soared by an additional 27%. This suggests a potential continuation of the upward trajectory.

On the other hand, numerous measurement tools provide diverse perspectives about the magnitude of the rally, shedding light from various angles on the direction of the asset’s price trend.

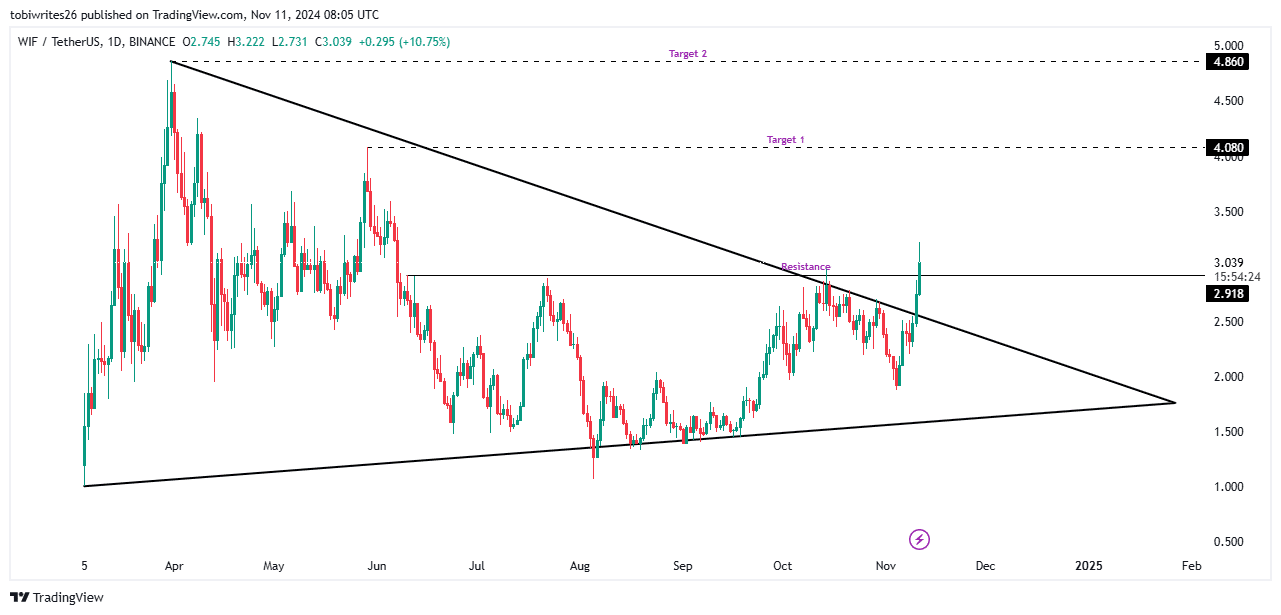

Symmetrical triangle gives WIF an edge

At present, the WIF is moving inside a symmetrical triangle structure, which is usually considered a positive sign, often leading to an upward price trend that could extend past the upper boundary of the channel.

In this situation, it’s predicted that the channel’s highest point will reach $4.860. However, for the rally to fully develop and cause a substantial increase, WIF needs to initially breach the resistance level at $2.918. This could possibly transform into a support level later on.

Moving forward, our immediate goal is set at approximately $4.080, followed by a secondary objective of around $4.860. This could potentially lead to a significant jump, possibly setting new record highs for the WIF.

Further analysis by AMBCrypto suggests that a rally is likely for the asset in the near term.

Indicators signal continued upside for WIF

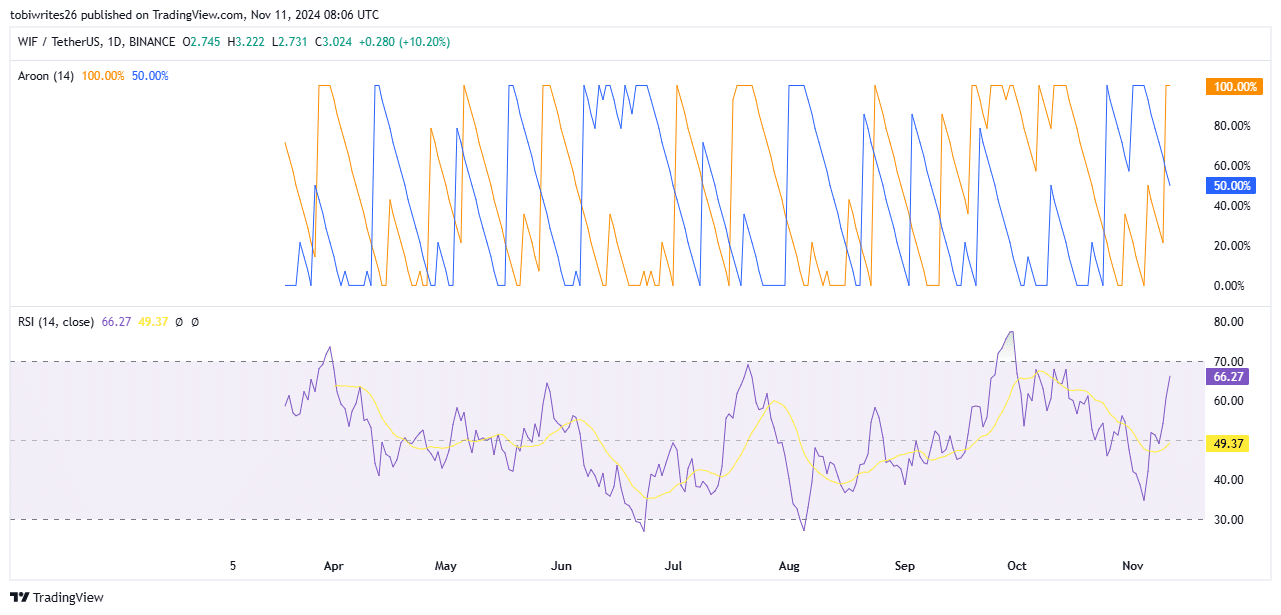

Based on the analysis using the Aroon Line, AMBCrypto indicates that we’re primarily experiencing a bullish market trajectory. This potentially robust bullish trend might continue to boost WIF’s upward momentum.

The Aroon Line is a technical indicator used to assess both the strength and direction of a trend. It consists of two components: the Aroon Up (orange) and Aroon Down (blue).

In simpler terms, when the upward trend (Aroon Up) surpasses the downward trend (Aroon Down), it indicates a positive market outlook. Right now, the Aroon Up line stands at 100%, and the Aroon Down is at 50%. This difference implies that the market might continue its bullish phase.

Furthermore, the Relative Strength Index (RSI), a tool that gauges the rate at which market momentum rises or falls, is on an upward trajectory and continues to stay within its optimistic region.

Currently at 66.27, the Relative Strength Index (RSI) suggests a robust bullish trend, suggesting potential for more growth in WIF’s price trajectory if this momentum persists.

Mixed sentiment, but mostly neutral

The count of derivative contracts yet to be settled in the market, referred to as Open Interest, has experienced a notable surge, rising by approximately 23.27%. This upward trend places it in a advantageous position.

Over the last day, there’s been a significant increase in taking long positions, which currently totals approximately $549.55 million.

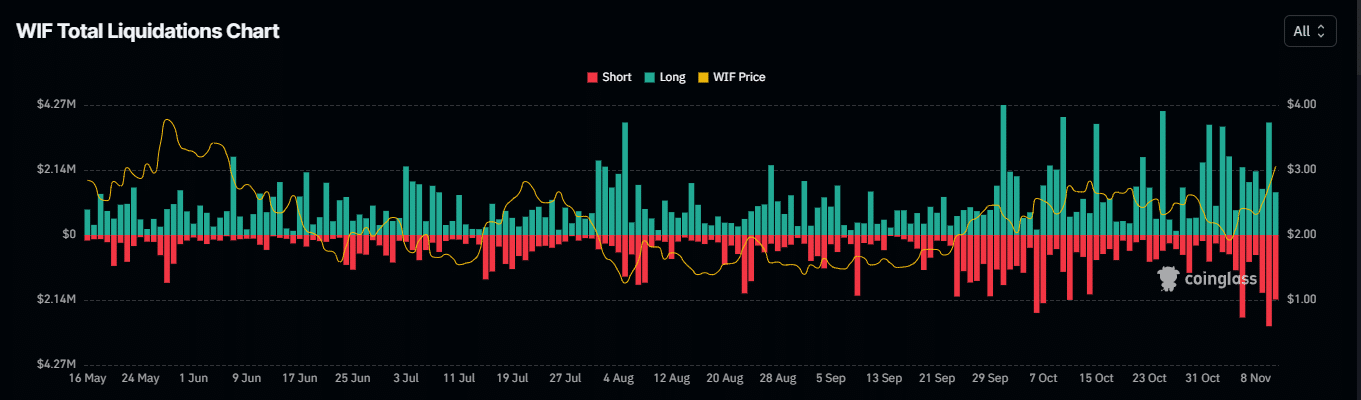

Conversely, data on liquidations shows that there’s almost an equal number of long and short liquidations, suggesting a market sentiment that is neither bullish nor bearish.

Is your portfolio green? Check the dogwifhat Profit Calculator

In simpler terms, we saw long positions being closed out for approximately $4.3 million, and short positions totaled about $4.52 million. The difference between these amounts (long versus short) is quite small, standing at around 0.9786, which is nearly equal to the zone where neither position has an advantage over the other.

A shift in these metrics toward a more bullish skew could position WIF for a significant rally.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-11-12 04:07