-

WIF bulls are eyeing the “dip,” signaling that $2 could be the market bottom.

If this trend holds, a breakout to $2.40 might be next.

As a seasoned crypto investor with a few battle scars from past market swings, I find myself cautiously optimistic about the current WIF situation. The recent dip to $2 has been a familiar sight for me, and it’s always a bittersweet reminder of the rollercoaster ride that is cryptocurrency investing.

In simpler terms, the price of bulls (which I assume refers to some digital asset or cryptocurrency like Dogecoin) is currently at $2.07, representing a 6% drop from the closing price of the previous day. Given Bitcoin‘s volatile October performance, the future direction for bulls remains unclear.

Interestingly, AMBCrypto observes a notable pattern on the daily price graph. Despite Bitcoin’s dip causing market turbulence at around $60K, WIF bulls appear determined to dislodge weaker investors and potentially breach the resistance level of $2.40 set in mid-July. If they manage this feat, it could trigger a bullish surge. However, before that can happen, they must first overcome this initial hurdle.

Flipping $2 into support is key

180 days back, around late March, WIF hit a new high of approximately $4.5851. However, since that time, its trend has turned downwards (bearish), and so far, buyers have found it difficult to push the price back above the $3 level.

For the past two months, I’ve observed our asset (WIF) trading predominantly within the one-dollar range. Bullish investors made three distinct efforts to surpass the $2 resistance level, but it wasn’t until late September that we managed to break through, peaking at $2.40.

Source : TradingView

On the daily chart, three successive red candles appeared during Bitcoin’s decline, pushing its price back towards $2. Yet, it seems that there might be additional factors at play beyond simply following Bitcoin’s path of movement.

As a researcher, I’ve observed from AMBCrypto’s findings that historically, $2 has served as a generational entry point for WIF. Should this level transform into support due to renewed activity, the next potential resistance might lie around $2.40. If this level is successfully maintained, a surge toward $3 could become a realistic possibility.

WIF bulls are eyeing the “dip”

Previously, speculative traders often aimed to buy at the low points of WIF to avoid any potential reversals. Consequently, for the $2 price level to be maintained as a strong support, the buyers (bulls) must resume their accumulation of the asset again.

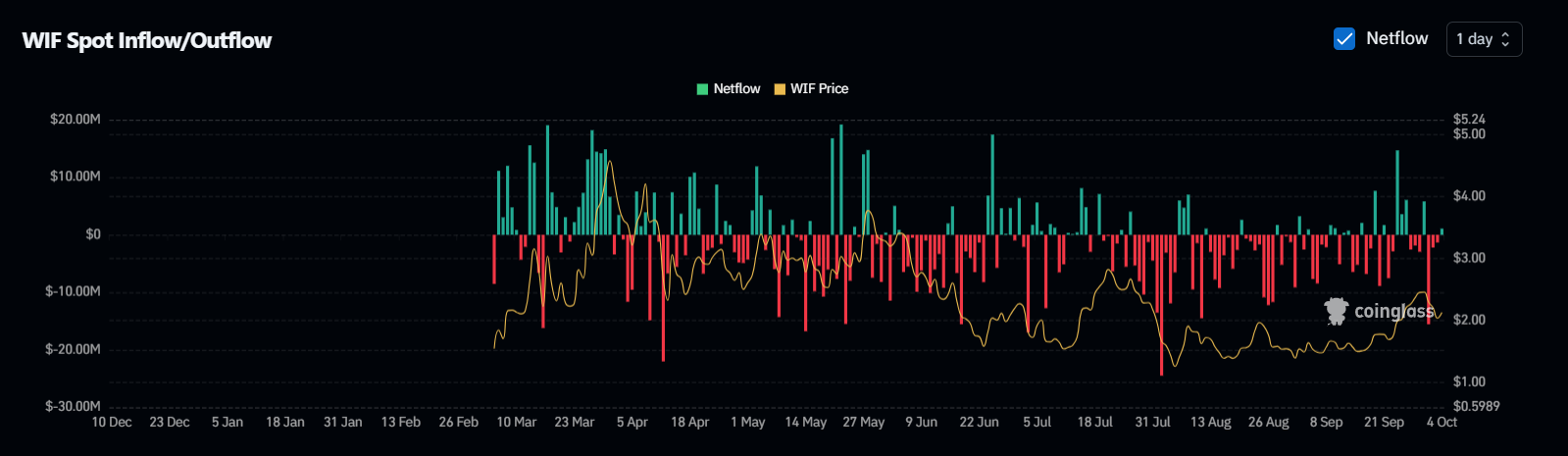

Currently, a significant increase in withdrawals indicates that optimistic investors (bulls) might be pulling their funds out in expectation of an upcoming surge towards $3, as previously predicted.

Source : Coinglass

If this pattern persists over multiple days, it might signal that the previous $2 resistance level has now become a support level instead.

Realistic or not, here’s WIF’s market cap in BTC’s terms

Given these circumstances, WIF could potentially grow more appealing to potential new investors, particularly as the market becomes increasingly unpredictable.

Therefore, it’s crucial to closely watch over this scenario. Should the inflow of capital towards WIF persist and increase, a surge towards $2.40 is likely with minimal obstacles, making WIF an attractive choice compared to other meme and altcoins.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-10-04 15:03