- The asset risks losing its current support level within the bullish pattern it is trading in, potentially leading to a deeper correction.

- Metrics reveal active participation from both long and short traders, but with a clear direction.

As a seasoned analyst with over two decades of market observation under my belt, I must say that WIF‘s current situation is intriguing yet cautionary. The asset appears to be in a bullish pattern, but the recent decline has brought it dangerously close to its support level.

The symbol “dogwifhat” (WIF) has mainly shown bearish behavior, as its monthly market performance stands at -43.11%. Yet, there are indications suggesting a potential halt to this downward trend in the forthcoming trading periods.

It’s quite possible that the current price of WIF will decrease even more before a rally occurs, considering the 14.69% drop observed within the last day might continue.

WIF remains bullish but risks a short-term drop

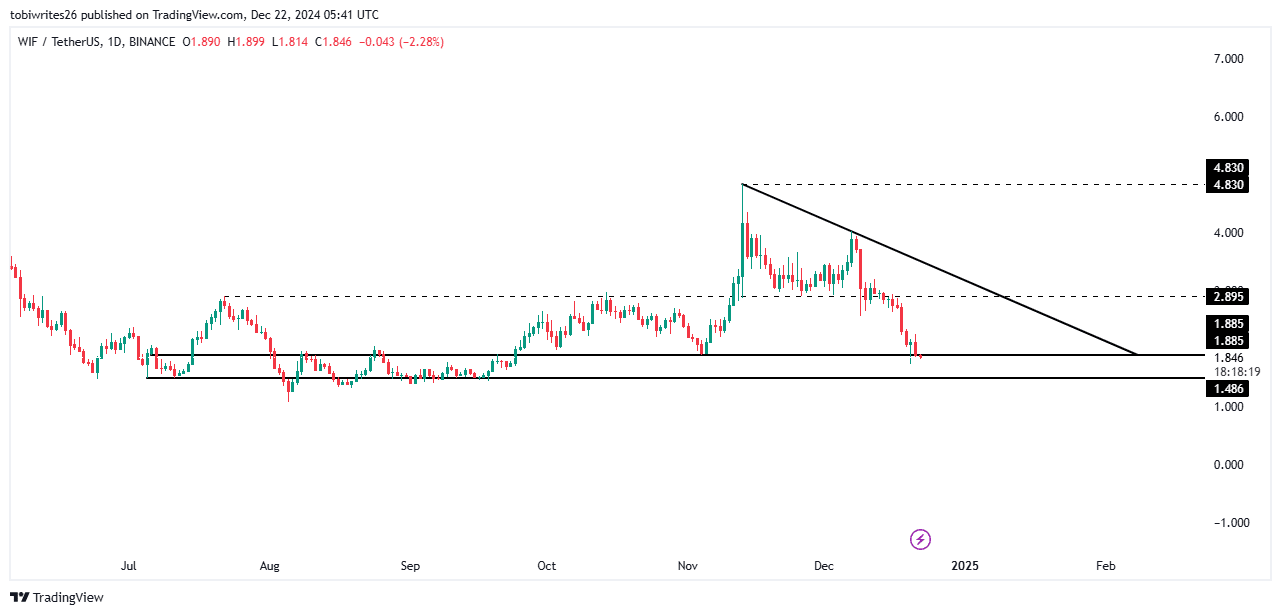

According to the graph, WIF is displaying a bullish configuration. Currently, it’s trading near the support line of this pattern at 1.885, a point usually followed by an upward movement. Yet, as of now, substantial buying action at this level seems to be absent.

Should the 1.885 level prove insufficient, the WIF could weaken and potentially slide within a lower range. A subsequent supportive area might emerge around 1.486, offering the asset an opportunity to regain strength and possibly rebound.

After an upward movement begins, WIF may encounter two significant barriers that could halt its progress towards a rally. The initial barrier is located at 2.895, followed by the upper limit of the bullish trend. Overcoming these obstacles might result in WIF reaching a new high at $4.830.

A drop in WIF’s price is imminent

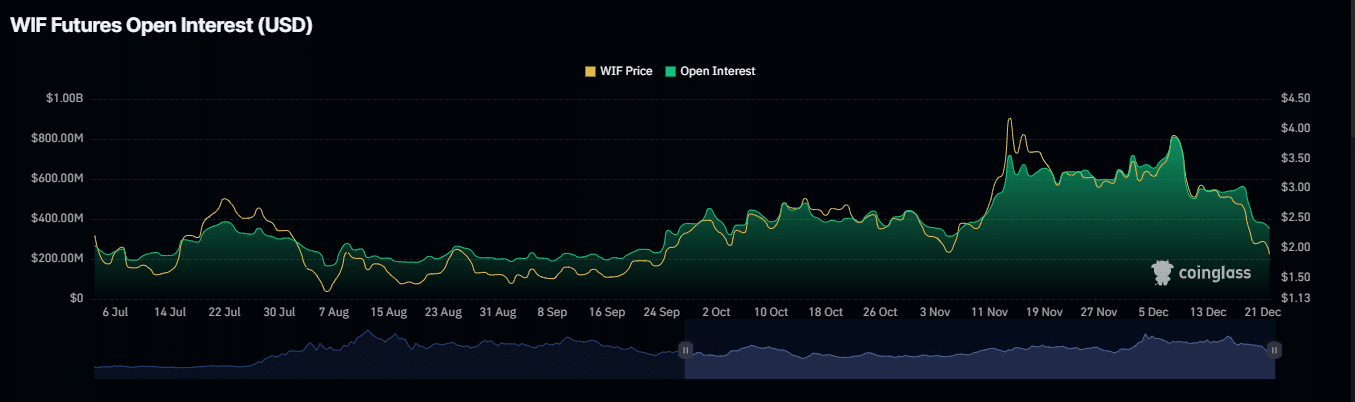

The amount of outstanding contracts for WIF (Working Interest Fee) has consistently dropped. Presently, it stands at approximately $360.94 million, representing a decrease of around 11.25%.

The decrease in Open Interest (OI) is being fueled by derivative traders closing their trades due to the ongoing fall in the asset’s price. Consequently, Worldwide Investment Financial’s (WIF) market capitalization has fallen by 14.29% to reach $1.88 billion, and its trading volume has dropped sharply by 44.16% to $496.58 million.

Furthermore, it’s observed that the market mood has changed, as there are more bets on a decrease (short contracts) compared to an increase (long contracts). At present, the number of long contracts is less than the number of short ones by approximately 1 to 1.11 (0.89 long-to-short ratio), suggesting a higher prevalence of short positions over long ones.

When this ratio remains below 1, it means bearish dominance in the market.

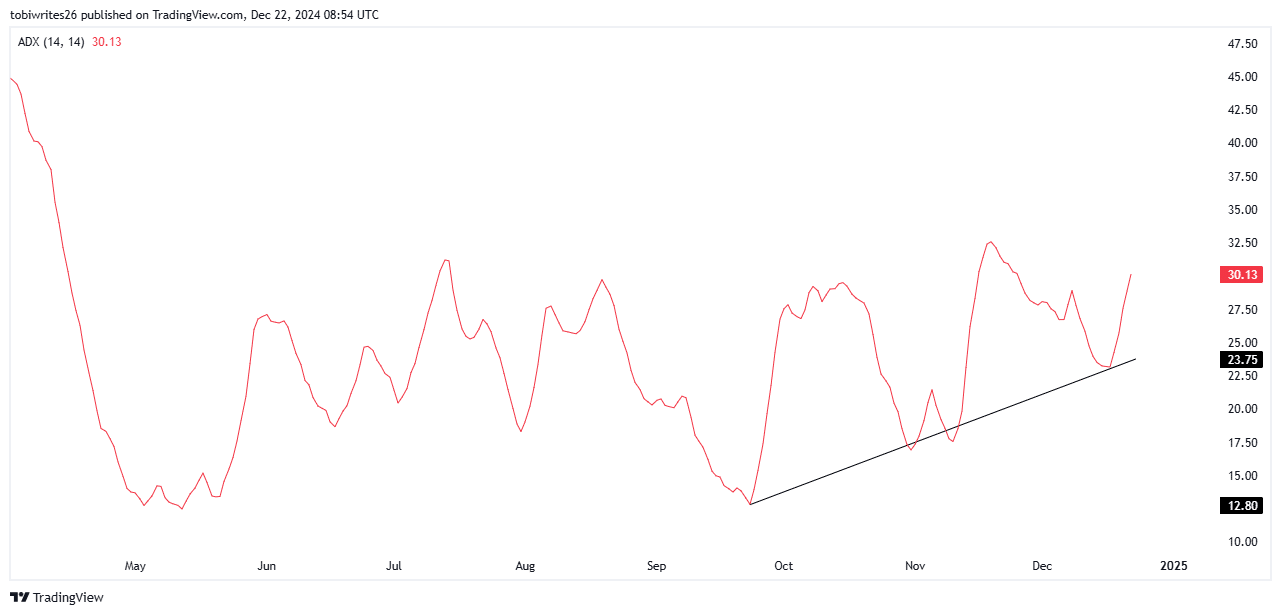

Evidence suggests a possible price decrease, as the Average Directional Index (ADX) stands at 30.19, indicating a powerful downward trend. As the ADX rises while prices fall, it signals that the downward pressure is growing stronger.

With these metrics aligning, the asset’s price is expected to fall below its current support level.

Bullish strength remains high despite a minor drop ahead

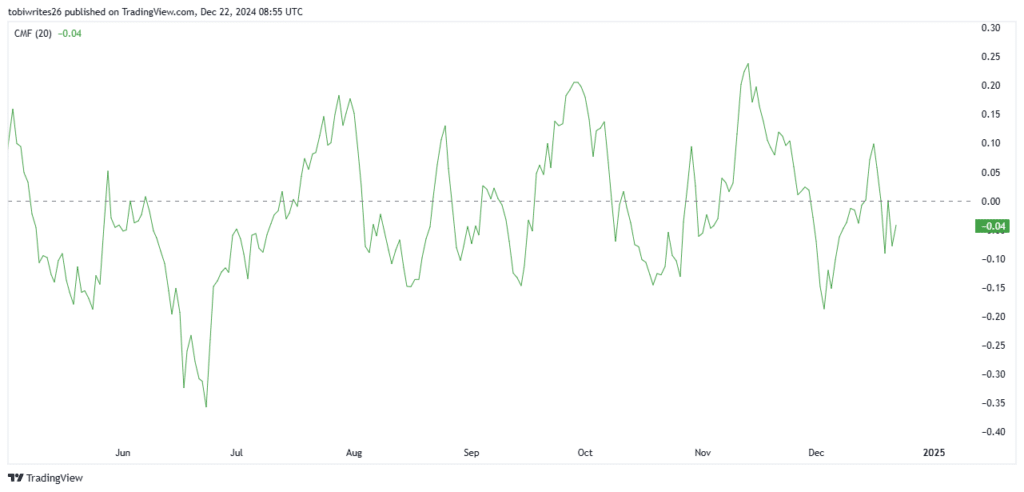

The optimistic outlook in the market remains strong, reinforced by the rising Chaikin Money Flow (CMF) that’s approaching the critical zero-line mark.

When the Cumulative Match Factor (CMF) increases, it signals that more shares are being bought than sold, potentially suggesting an upcoming bullish trend. If the CMF breaks above its zero line, it might fuel a rise in price.

At present, the continuous positioning of Capital Management Fund (CMF) indicates persistent stockpiling at the support point. Yet, this buildup could momentarily press down the price, leading to a brief decline, after which the bullish trend is expected to grow stronger.

Read dogwifhat’s [WIF] Price Prediction 2024–2025

Moreover, it’s observed that more and more WIF holders who engage in spot trading are shifting their assets into personal wallets for secure, long-term storage. Currently, around $5.5 million worth of WIF has been transferred in this fashion.

As a researcher, I’m maintaining an overall positive perspective on WIF, but I anticipate a minor dip in its price within the immediate future.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-12-22 20:08