-

Dofwifhat experienced a strong downward momentum nearly collapsing to $1.

However, over the past 24 hours, things changed as WIF surged by 22%.

As a seasoned analyst with over a decade of experience in the volatile world of cryptocurrencies, I have seen market fluctuations that would make a rollercoaster blush. The past month has been particularly challenging, with the market nearly crashing and altcoins like dogwifhat [WIF] plummeting.

For the last month, there’s been a significant up-and-down trend in the crypto market. This volatility reached its highest point on July 5th, when the market came very close to collapsing.

When Bitcoin experienced a two-month low during the market downturn, its price dipped to $49,577. This drop affected all other cryptocurrencies as well, leading to approximately $1 billion in liquidations and a decrease of around $300 billion in the overall Crypto market value.

As a result, similar to other alternative cryptocurrencies and meme coins, Dogecoin [WIF] witnessed a substantial drop, extending a downtrend that has persisted for over a month.

WIF gains after weeks of decline

Over the last seven days, the value of WIF significantly dropped, with the fall worsening during the latest stock market plunge. Interestingly, however, dogwifhat’s charts show considerable increases on a day-to-day basis.

Currently, WIF is being traded for $1.7, marking a 22% rise in the past day. This spike occurred after the memecoin had been on a noticeable downtrend.

Therefore, on a daily basis, WIF exhibits robust uptrends that persist, suggesting it will finish its recovery process.

Is WIF safe from the $1 decline scare?

Although WIF showed improvements on daily price graphs, it continues to exhibit a bearish trend. Over the last week, WIF experienced a drop of 26.34%, and its daily trading volume decreased by 37%.

According to previous reports from AMBCrypto, the drop in dogwhathit’s value had analysts concerned about it falling even lower. But with its recent increase in daily trading, there seems to be a growing optimism that this positive trend could continue and potentially push the price even higher.

Based on AMBCrypto’s assessment, while there were daily price increases, WIF was exhibiting a significant downtrend. The Directional Movement Index indicates a robust bearish movement, as the negative value of 28 is higher than the positive value of 17.

Furthermore, the Aroon line underscores the strength of the current downtrend since it stands at 85.71% while the Aroon Up line is significantly lower at 21.43%. This indicates a predominant downward trend in the market.

Similarly, the RVGI indicates that the trend of the WIF continues to decline beneath the zero mark, specifically at -0.4355, which is also below its signal line situated at -0.4339.

Upon closer examination, our study of Santiment data reveals that the open interest across exchanges has decreased over the last week. At its peak, this figure stood at approximately $146.7 million; however, as we speak, it has dropped to $109.1 million.

Over the past day, I’ve noticed an increase in Wrapped Bitcoin (WBTC) open interest across exchanges. This trend seems to indicate that crypto investors like myself might be cashing out or closing their existing positions without immediately opening new ones, which could suggest a potential market consolidation or reduction in overall activity.

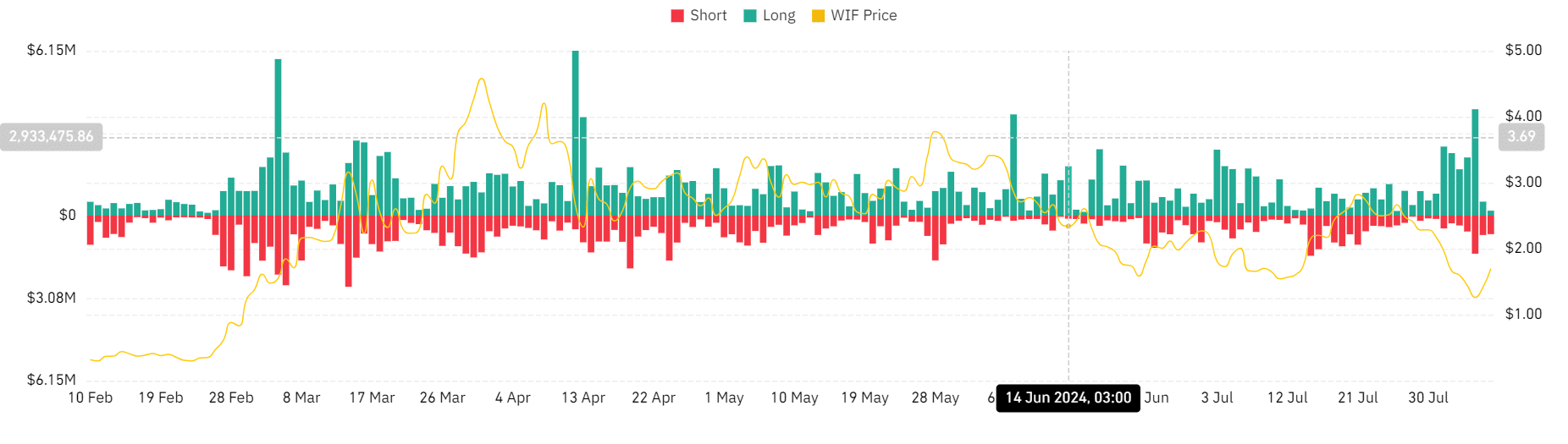

After a week, data from Coinglass indicates that more long positions for WIF have been closed out with larger amounts compared to the previous days.

Realistic or not, here’s WIF’s market cap in BTC’s terms

On a day-to-day basis, it appears that more short positions were liquidated compared to long positions, with the latter staying relatively low.

If the day’s profits are sustained, it’s likely that WIF could aim for a substantial resistance point near $2.3. But keep in mind, should the broader market trend continue, WIF might still be vulnerable to falling back to around $1.05.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-08-08 04:08