- WIF has surged by 53.72% over the past month.

- Market sentiment suggested that dogwifhat could reach a five month of $3.5.

As a seasoned crypto investor with over a decade of experience, I have learned to navigate the volatile and often unpredictable world of digital assets. Recently, I’ve found myself intrigued by the performance of dogwifhat [WIF]. After an impressive 53.72% surge over the past month, it has experienced a slight dip, trading at $2.64 as of now.

Following a prolonged increase lasting nearly a month, the value represented by the symbol WIF has noticeably dropped significantly over the course of the last seven days. As we speak, WIF is being transacted at $2.64. This decrease translates to a 5.53% drop when compared to weekly price trends.

Prior to this, dogwifhat had been on an upward trajectory, hiking by 53.72% on monthly charts.

Contrary to the downward trend seen over the week, there’s been a noticeable uptick in recent trading activity for WIF, as evidenced by a significant increase in its trading volume. Specifically, over the past 24 hours, WIF’s trading volume jumped by approximately 79.29% to reach a total of $402.14 million.

Therefore, current market conditions raise questions over the memecoin’s future trajectory.

At the current moment, according to AMBCrypto’s analysis, Dogecoin (DOGE) is showing significant and favorable public opinion in the markets.

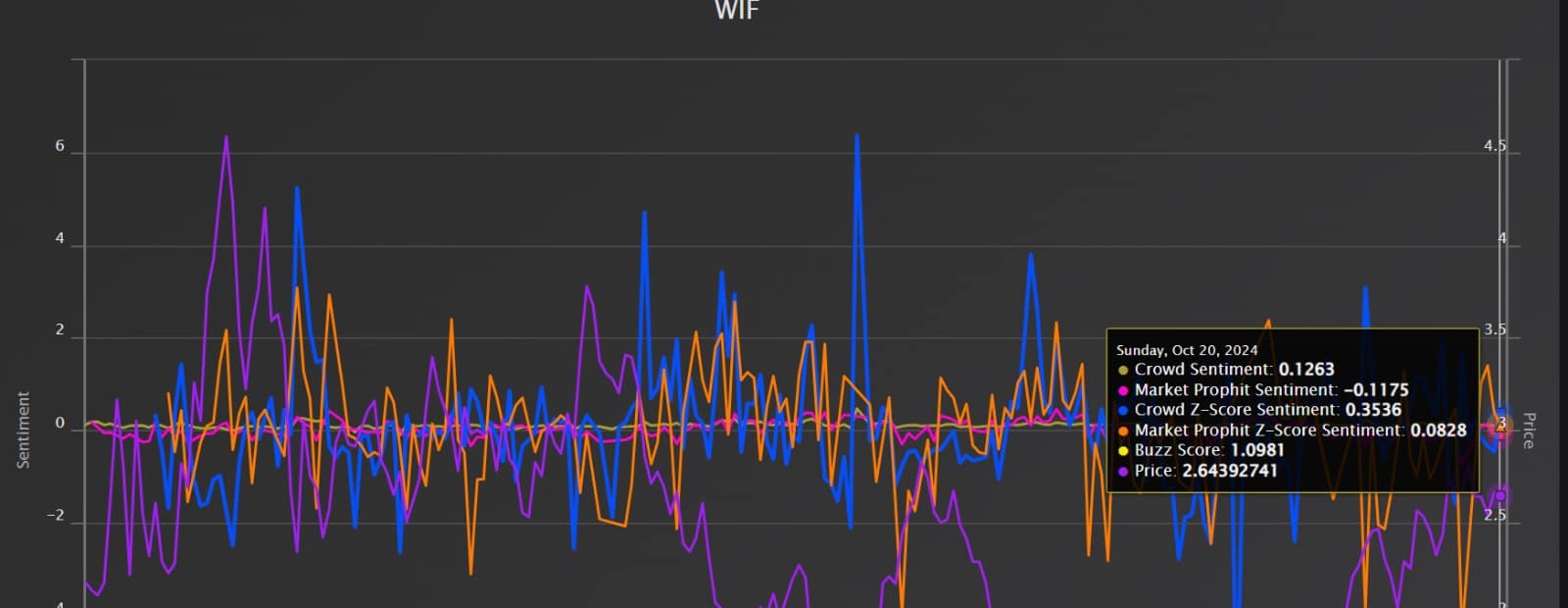

According to Market Prophit’s data, the crowd sentiment for WIF was favorable at 0.1263, and its Buzz Score was 1.098. Similarly, the memecoin displayed a positive community sentiment as well as a positive market sentiment based on the data from Market Prophit.

Although there has been a recent decrease, many investors continue to be hopeful and expect prices to increase in the short-term.

What WIF’s charts say

It appears from what we’ve seen so far that WIF is currently benefiting from positive market trends, which might lead to increased value on its price graphs in the future.

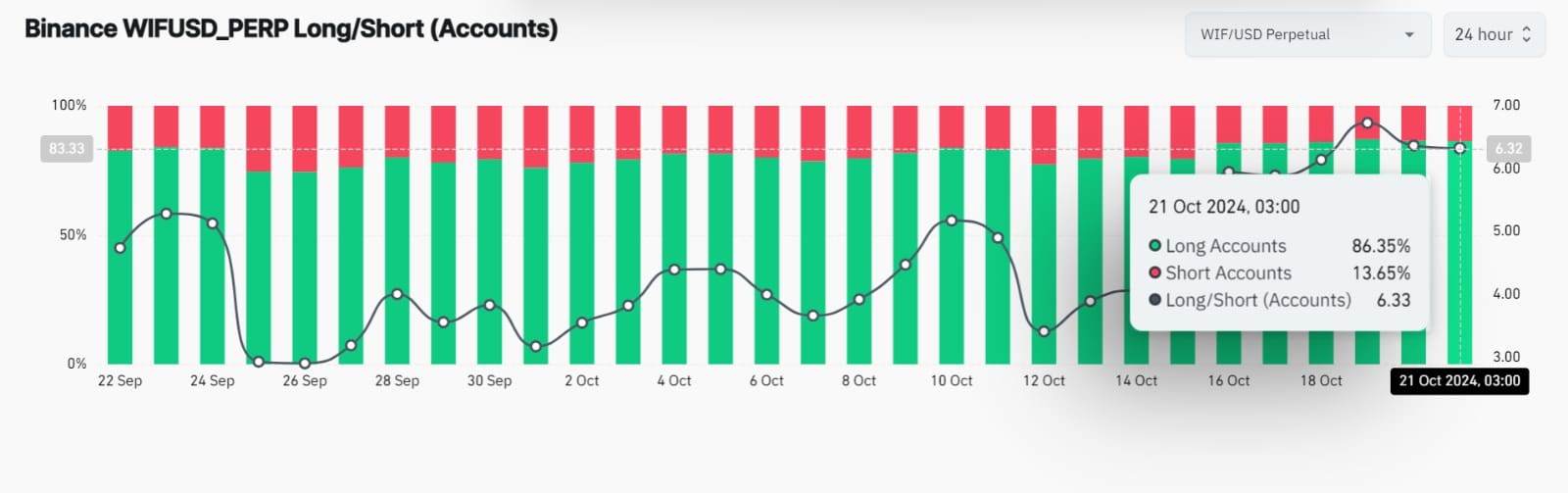

To illustrate, it’s clear from Binance‘s perpetual futures data that most investors tend to hold long positions rather than shorts. Approximately 86.35% of the accounts are long, whereas only 13.65% are short.

These market circumstances indicate a significant preference for maintaining long positions in the perpetual Futures market, suggesting that investors are quite optimistic.

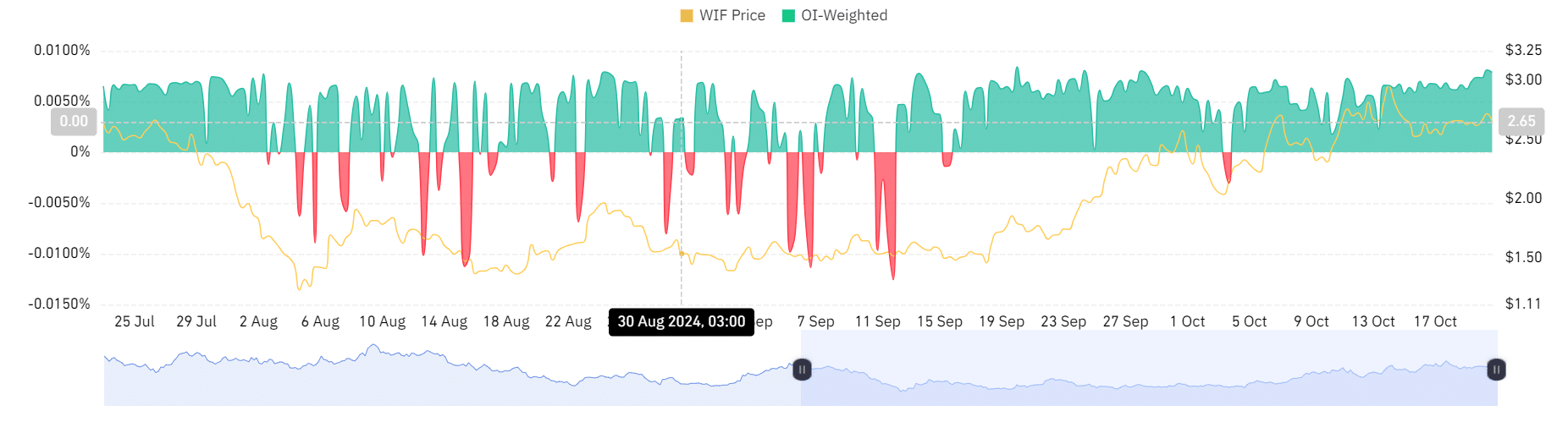

This demand for long positions is further strengthened by a positive OI-Weighted Funding Rate.

Read dogwifhat’s [WIF] Price Prediction 2024 – 2025

Over the last three weeks, I’ve found myself in a favorable position, as it seems I’ve been rewarded for holding onto my long positions. It appears short traders have had to compensate me for maintaining their trades.

As a crypto investor, I find myself observing a market where the general sentiment seems optimistic, suggesting that many fellow investors expect the prices to continue climbing higher.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-10-22 01:43