- WIF’s Stochastic RSI has dropped to 11 showing that the meme coin is oversold.

- The number of WIF short sellers has increased to a monthly high, increasing the likelihood of a short squeeze.

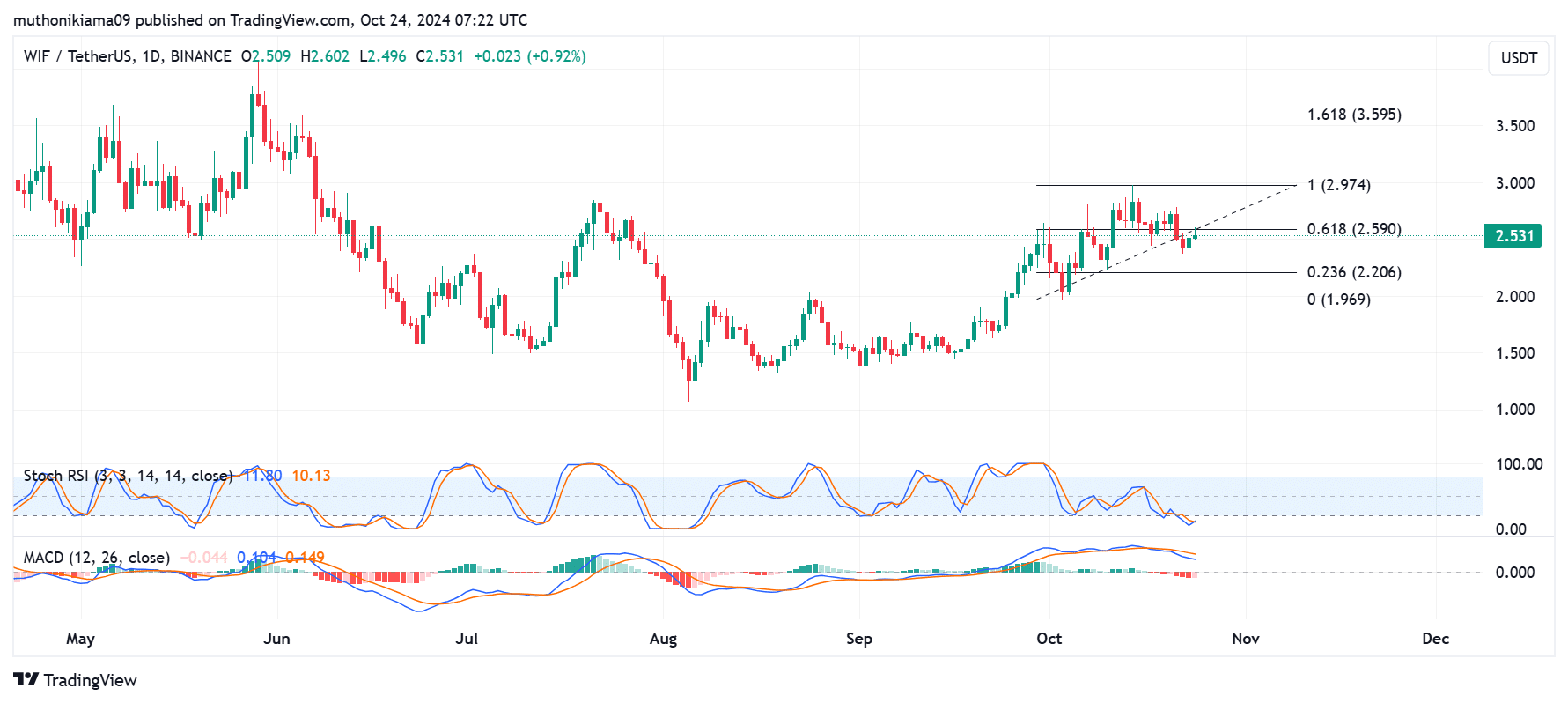

As a seasoned crypto investor with a knack for spotting trends and interpreting technical indicators, I find myself intrigued by the current state of WIF (the largest meme coin on Solana). The Stochastic RSI dropping to 11 indicates oversold conditions, which could potentially signal a reversal from the bearish trend. However, the MACD remaining below the signal line and the histogram bars being negative suggest that bears might still be in control.

At the moment of reporting, dog-with-hat (WIF) was trading at $2.57 following a 4.7% increase over the past 24 hours. WIF, the top meme token on Solana [SOL], has faced bearish trends lately, dipping by 2.5% in the last week.

In the past day, the market value of meme coins built on the Solana platform has seen a significant increase of approximately 7%. This surge follows a broader recovery within the Solana meme coin ecosystem, as indicated by data from CoinGecko.

After these recent profits, WIF appears to be indicating a shift away from its downward trend. On the daily graph, WIF’s Stochastic RSI (Relative Strength Index) has dipped to an oversold level of 11, suggesting potential growth.

It appears that the decline in WIF was likely driven by increased selling, as traders sought to limit their losses. Moreover, the Stochastic RSI is now approaching the signal line from below, indicating that a potential turnaround might be happening.

On the other hand, the Moving Average Convergence Divergence (MACD) indicates a pessimistic trend since it falls beneath the signal line and the histogram bars exhibit negativity. This implies that the bears could potentially dominate the market’s direction.

If WIF succumbs to the bearish trends, it could drop to find support at the 0.236 Fibonacci level ($2.2).

If sellers run out of steam and buyers take over, the price of WIF could experience a significant surge beyond $3, potentially reaching the 1.618 Fibonacci level at approximately $3.50.

dogwifhat short sellers are increasing their positions

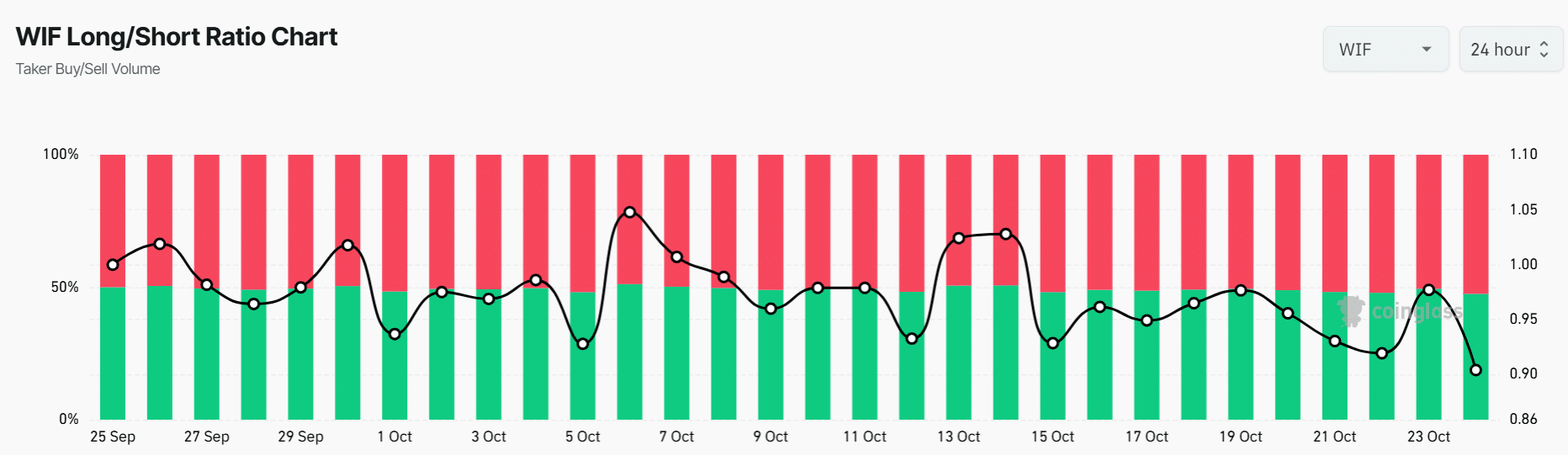

As a researcher, I’ve noticed an unexpected surge in the number of short positions being taken on WIF. This shift is evident in the long/short ratio, which has dipped to 0.90 – its lowest point in the last 30 days. Interestingly, approximately 52% of derivative traders are currently opening short positions for WIF, while slightly fewer, around 47%, are opening long positions.

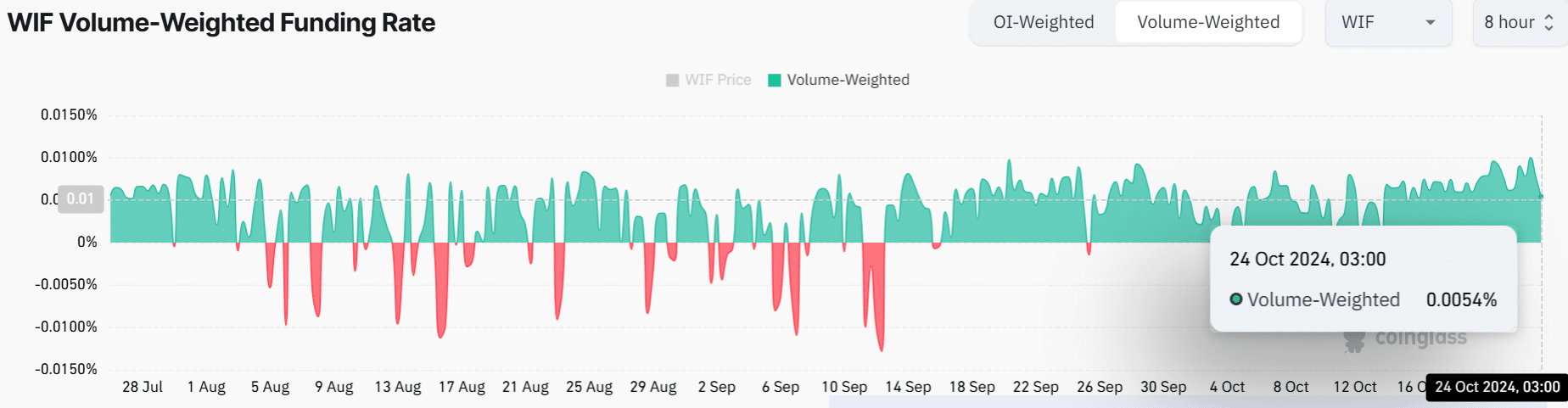

The rise in the number of traders shorting WIF (Working Interbank Fund) is also reflected in its funding rate, which has recently reached a peak not seen for several weeks at 0.01%. This indicates that long-term investors are prepared to pay more in fees to keep their positions active.

At this moment, the funding rate fell to 0.0054%, suggesting that long traders were choosing to exit their positions.

Is your portfolio green? Check the dogwifhat Profit Calculator

An increase in short positions might lead to a situation known as a “short squeeze.” If WIF maintains its upward momentum, the short sellers may be compelled to purchase shares, thereby strengthening the uptrend even more.

According to Market Prophit, there’s a strong indication that the upward trend for WIF might continue, given the optimistic public opinion surrounding it. This optimism could potentially spark increased purchasing activity, thereby lessening the impact of bearish tendencies.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

2024-10-24 22:15