-

WIF saw a dramatic whale accumulation, marking the second major move in just a week.

Despite the surge in whale activity, WIF’s road to recovery still seems distant.

As an analyst with years of experience navigating the tumultuous seas of the cryptocurrency market, I can attest to the fact that whale activity is often a significant indicator of a token’s potential trajectory. However, when it comes to dogwifhat (WIF), the recent surge in whale accumulation seems to be falling short in driving its recovery.

A well-known whale, often compared to a dog due to its significant impact, has once again drawn attention following a month of quiet behavior. This event marks the second instance within a week where whales have been observed accumulating or buying.

Through this latest purchase, it’s clear that the whale remains confident about the coin’s future prospects. But the question arises: Can this meme-based cryptocurrency hold its ground amidst the present market fluctuations and potentially soar even higher? AMBCrypto delves into the matter to find out.

Whale accumulation falls short for WIF recovery

Regardless of the ongoing market fluctuations, WIF saw a significant 11% rise during the last seven days. On August 24th, the coin nearly broke through the $2 barrier, but then dipped again afterwards.

As reported by Lookonchain, a significant investor (often referred to as a ‘whale’) transferred approximately 700,000 WIF, equivalent to around $1.25 million, into MarginFi. This whale then obtained 197,000 USDC to purchase an additional 110,000 WIF. As a result, the whale now owns a total of roughly 3.3 million WIF, valued at around $5.94 million.

Interestingly, although there’s been considerable whale activity, Dogwhatever hasn’t demonstrated a commensurate increase and is trending towards its earlier support level of $1.316 instead.

Spurred on by this doubt, AMBCrypto delved into the activities of exchanges and uncovered some intriguing observations instead.

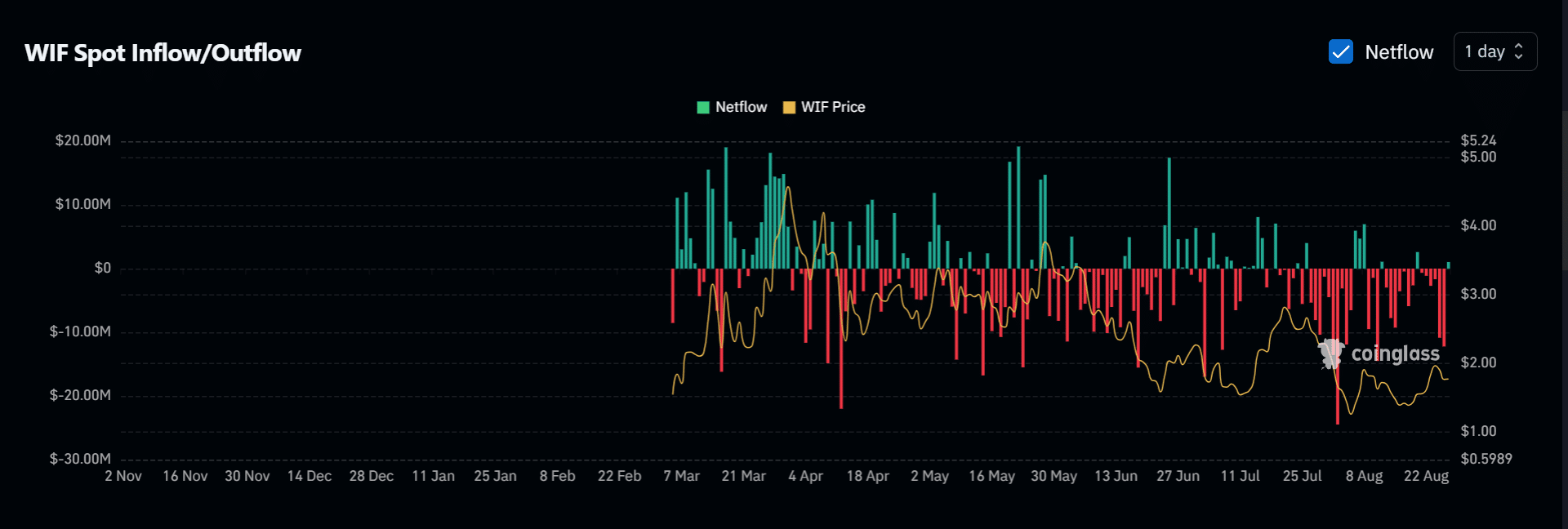

Contrarily to what many might think, when WIF saw a significant price surge and hit its All-Time High (ATH) on the 31st of March, this event was in fact accompanied by a massive transfer of WIF tokens into exchanges.

Essentially, speculative traders and large investors (known as ‘whales’) were purchasing WIF. This action served to counteract the increased supply of tokens entering the exchanges due to selling pressure.

From my perspective as a cryptocurrency investor, the latest actions indicate a downward trend in net outflows, implying that instead of offloading their WIF, investors are choosing to hold onto it.

Regardless, the unpredictable market fluctuations outweighed the whale’s attempts to amass assets, leading to a drop in prices.

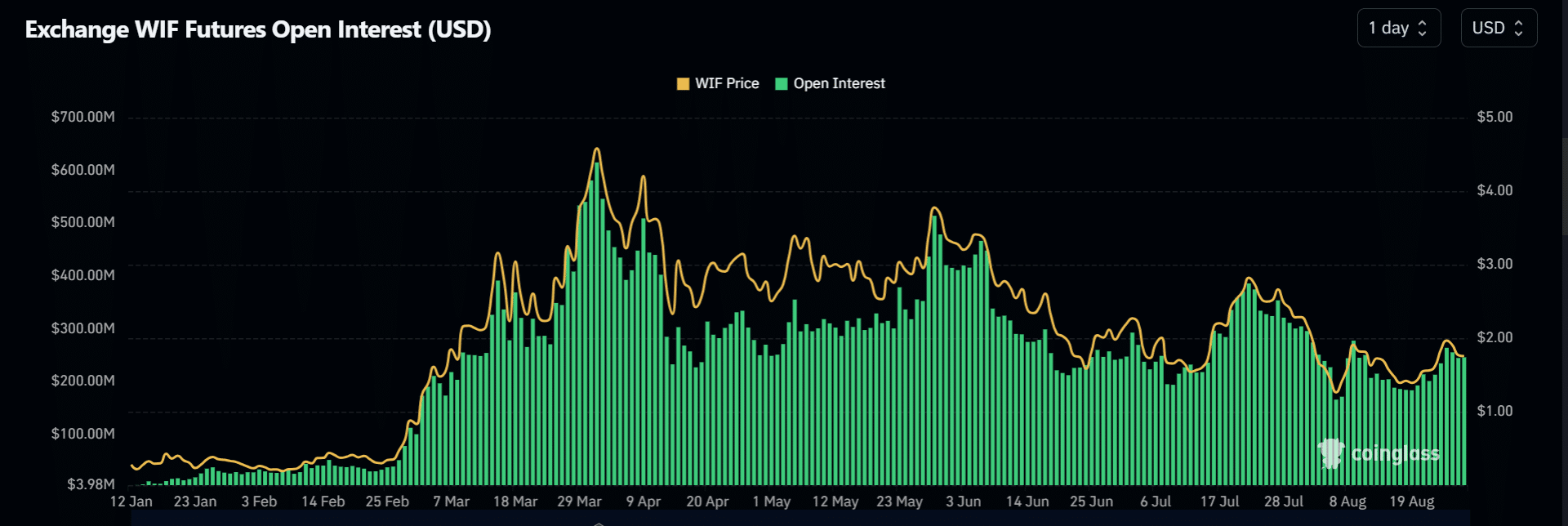

Previously noted, traders specializing in future contracts contributed to the surge of WIF towards $4.60 during the early April upswing. Concurrently, the Open Interest peaked at a record-breaking level of $615.16 million.

As a crypto investor, I noticed that the dramatic rise in prices was largely due to the heavy use of leveraged positions and speculative trading, both playing crucial roles in this upward trend.

Consequently, given the current dip in dogwifhat, there’s been a decrease in open interest from $265 million on August 25 to $246 million as we speak. This suggests that traders are less optimistic about WIF‘s future possibilities.

To put it simply, whales’ attempts to build up more WIF may not seem adequate when compared to broader market movements. Is that the case?

dogwifhat rebound unlikely

Source : Santiment

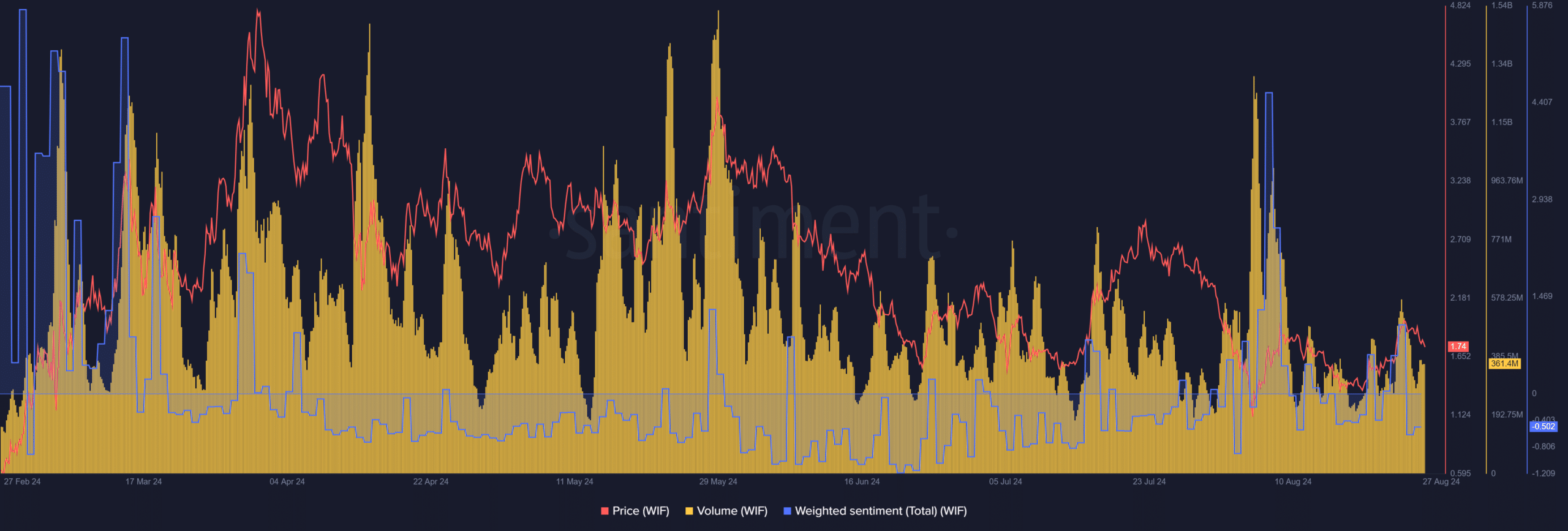

As an analyst, I’ve observed a substantial drop in value compared to earlier releases. This decline has dipped below the prices we saw as early as August, a period when Dogwhatever experienced one of its most severe price plummets.

Currently, the overall amount has reached $365 million, which represents a decrease of approximately 31% compared to the figure of $532.66 million recorded on the 24th of August.

A decrease in trading volume might indicate less market engagement or enthusiasm, a point emphasized by the downward trend in the number of open contracts (open interest).

Despite maintaining a favorable stance, recent events may be causing doubts among bullish investors. Moreover, the shift in the Weighted Sentiment from optimistic to pessimistic suggests that there might be an impending alteration in the overall market perspective.

In simpler terms, it appears that the current market pattern isn’t favorable for any significant recovery in the near future for Dogecoin (DOGE). Moreover, as AMBCrypto points out, these market patterns seem to be overpowering the recent attempts by large investors (whales) to accumulate DOGE.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-08-27 18:16