-

WIF’s value has grown by over 10% in the last week.

However, according to readings from some key technical indicators, it may be due for a decline.

As a researcher with experience in analyzing cryptocurrency markets, I’ve noticed that WIF‘s price has experienced significant growth over the last week, with an increase of over 10%. However, based on some technical indicators, it appears that this token may be due for a decline.

The dogwifhat with a theme of dogs, represented by the WIF token, could experience a decrease in its double-digit price increases, according to its chart analysis, which indicates persistent bearish trends.

At present, the value of WIF is being traded for $2.98 per unit. Over the past week, this digital currency has experienced a 12% price increase based on information from CoinMarketCap.

WIF to lose its bark?

The price surge of the memecoin is reflecting the broader market growth we’ve seen recently, as evidenced by a 4% increase in the total value of all cryptocurrencies according to CoinGecko’s data, driven by heightened trading activity over the past week.

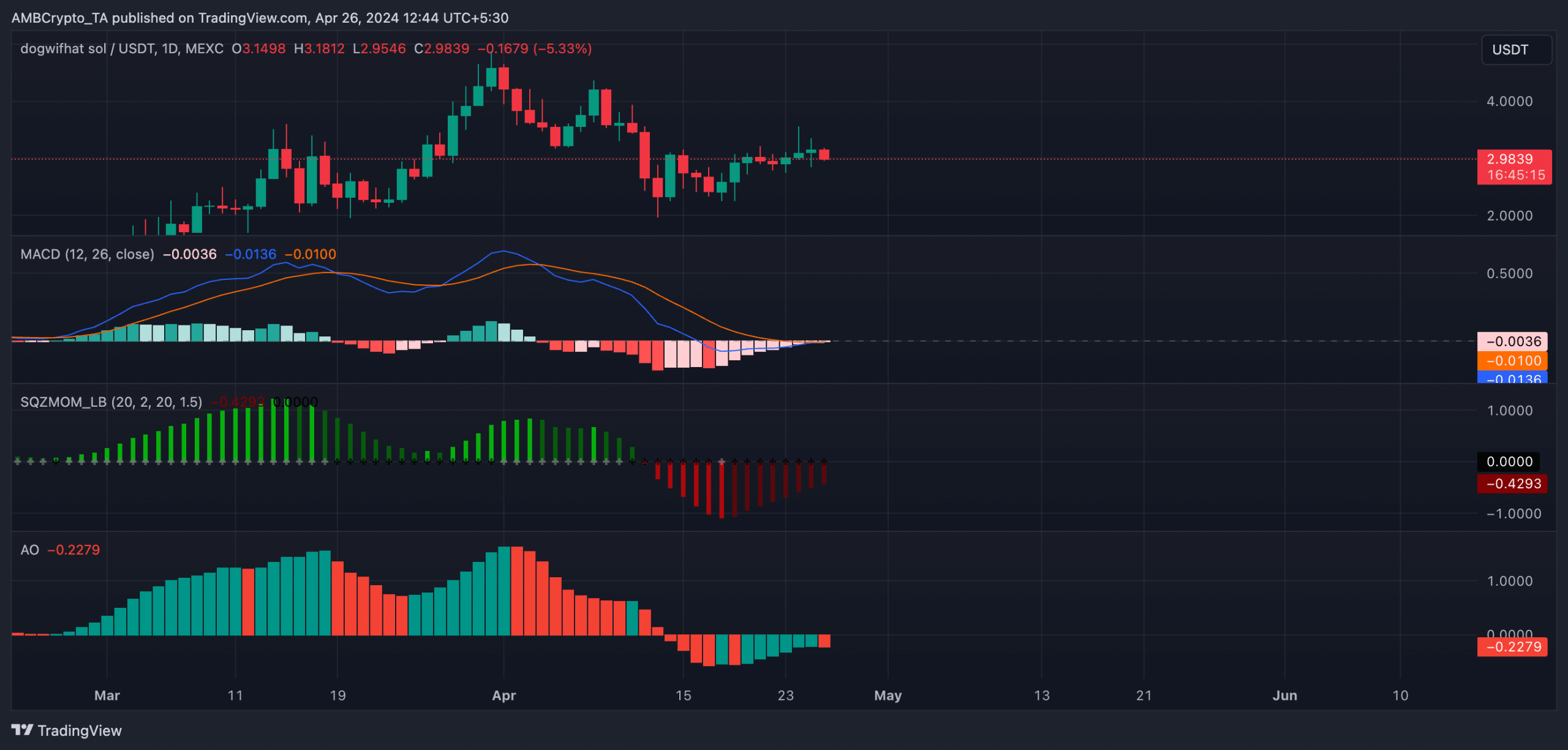

Some signs from WIF‘s technical indicators on the daily chart suggested that its price might drop in the near future.

As a crypto investor closely monitoring WIF‘s price action, I’ve noticed that the token’s Squeeze Momentum Indicator has shown negative values consistently since April 13th. This particular indicator is crucial for me as it measures WIF’s momentum and helps identify its consolidation phase during sideways market conditions.

When it shows downward-facing red bars, the asset in question is experiencing a downward momentum.

At present, the Awesome Oscillator indicator for WIF signaled a downtrend with a negative value and a red upward bar.

In simpler terms, red bars on an asset’s Awesome Oscillator can be seen as a warning signal, indicating increased demand to sell the asset.

Additionally, the MACD line of WIF‘s chart (represented by the blue line) was below its signaling line (orange) at the present moment. This implied that the short-term moving average of the meme coin was lower than its long-term moving average. For traders, this is a sign that the asset might experience continuous selling pressure.

The bulls hold their own

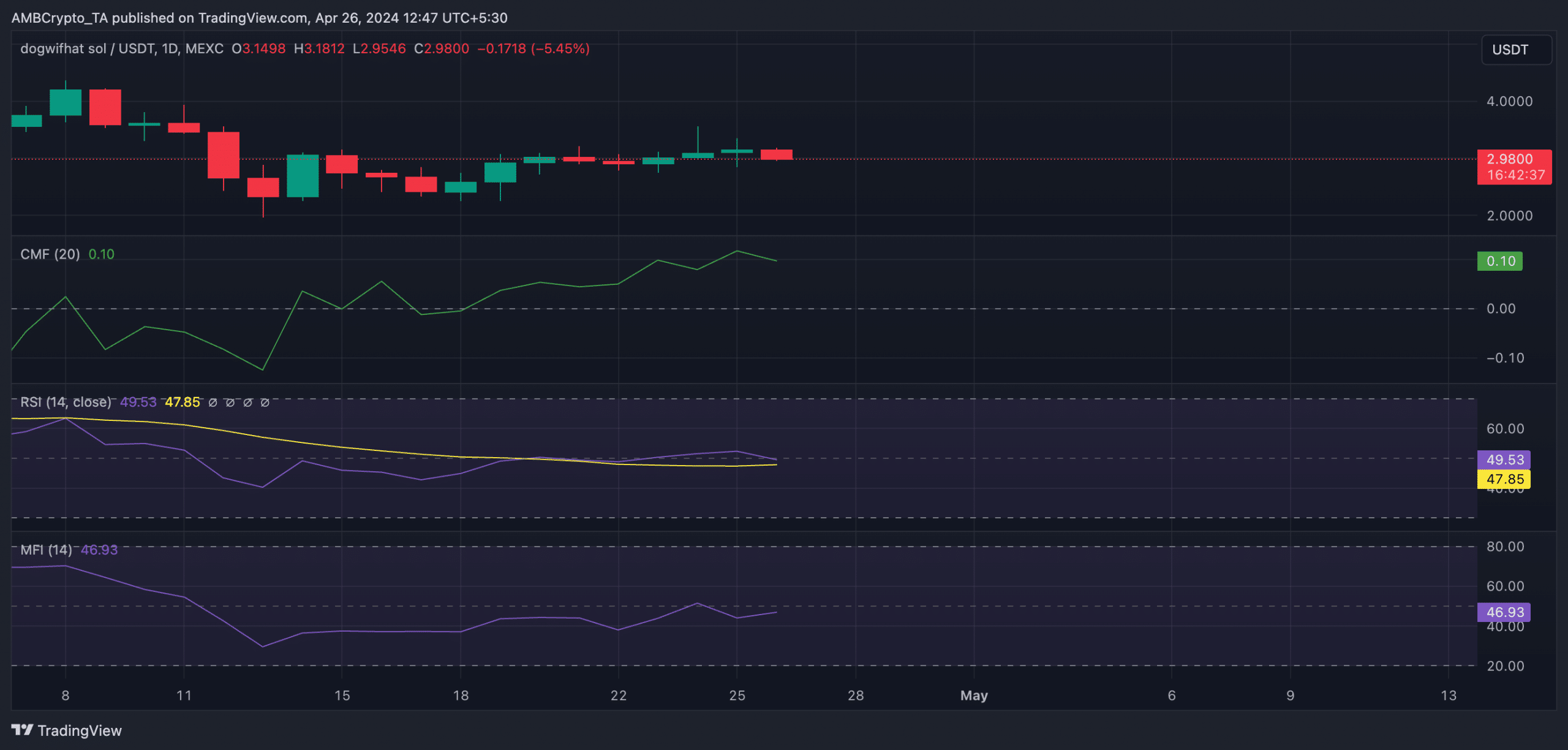

While bearish sentiments linger in the WIF market, the bulls continue to wield an influence.

As of now, the altcoin’s Relative Strength Index (RSI) and Money Flow Index (MFI) indicators were on the verge of surpassing their respective midpoints, implying a potential surge in buying interest for the token.

The Relative Strength Index (RSI) for WIF stood at 49.53, while its Moving Average Four-Price (MFI) indicator read 46.93. Additionally, the Chaikin Money Flow (CMF), indicative of money inflows and outflows in the market, was reported as 0.10.

As a researcher studying meme coins, I’ve observed that a consistent supply of liquidity is essential for the price growth of these digital assets. In simpler terms, this means that there needs to be an adequate amount of the coin available in the market for buying and selling, which can help maintain its value and stability.

Read More

2024-04-27 02:15