-

The WIF whale held a substantial profit of $68 million at press time.

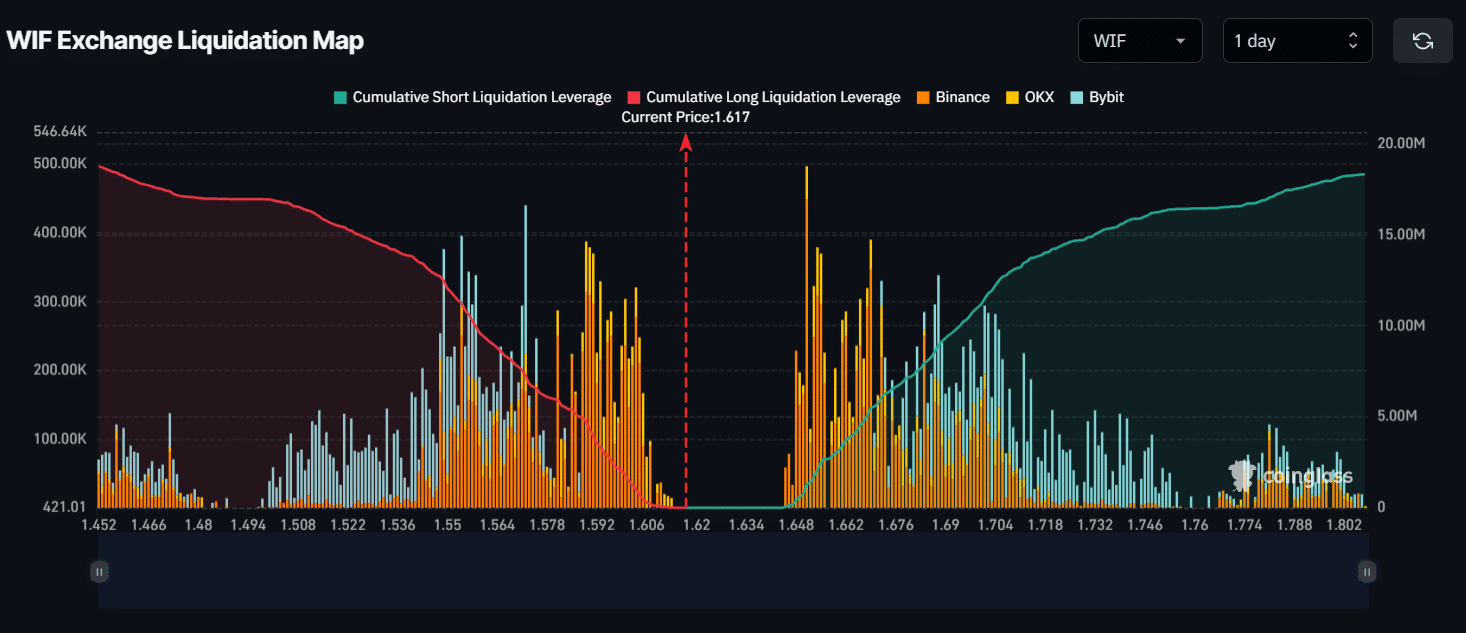

The memecoin’s major liquidation levels were near the $1.57 level on the lower side and $1.65 on the upper side.

As an analyst with over two decades of experience in the financial markets, I have witnessed numerous bull and bear cycles, market manipulations, and whale activities that significantly impacted various assets. The recent activity surrounding the Solana-based memecoin, dogwifhat [WIF], has caught my attention due to its potential for substantial gains.

There’s been growing interest within the cryptocurrency world for Dogwhate (WIF), a well-known memecoin that operates on the Solana blockchain.

On the 23rd of August 2024, it was reported by Lookonchain, an on-chain analytics firm, that during a market downtrend, the largest WIF token holder made a significant purchase, acquiring more than 1.8 million WIF tokens valued at approximately $2.61 million.

Crypto whale buys 1.8 million WIF tokens

As per a recent update on X (previously known as Twitter), it appears that the whale took out a loan of approximately 2.61 million USDC from Kamino in order to acquire some well-known cryptocurrency tokens.

A significant purchase of tokens took place close to a vital resistance point, coinciding with the development of a bullish double bottom formation in the price chart.

From the 13th to the 15th of December 2023, this whale invested a total of $226,000 and acquired 19.86 WIF tokens, with each token costing an average of $0.00114.

After completing the transaction, the whale currently owns approximately 27.2 million WIF tokens valued at around $44.36 million, representing a total gain exceeding $68 million.

Price analysis and Open Interest

As a researcher, I’ve recently observed an intriguing acquisition of WIF. However, at the moment of my report, this memecoin is trading around $1.63, representing a 2% decrease in its value over the past day.

During that timeframe, the trading volume decreased by more than 13%, suggesting less involvement from traders.

Despite no changes in Open Interest for WIF over the past 24 hours, as reported by on-chain analytics firm Coinglass.

WIF: Key levels

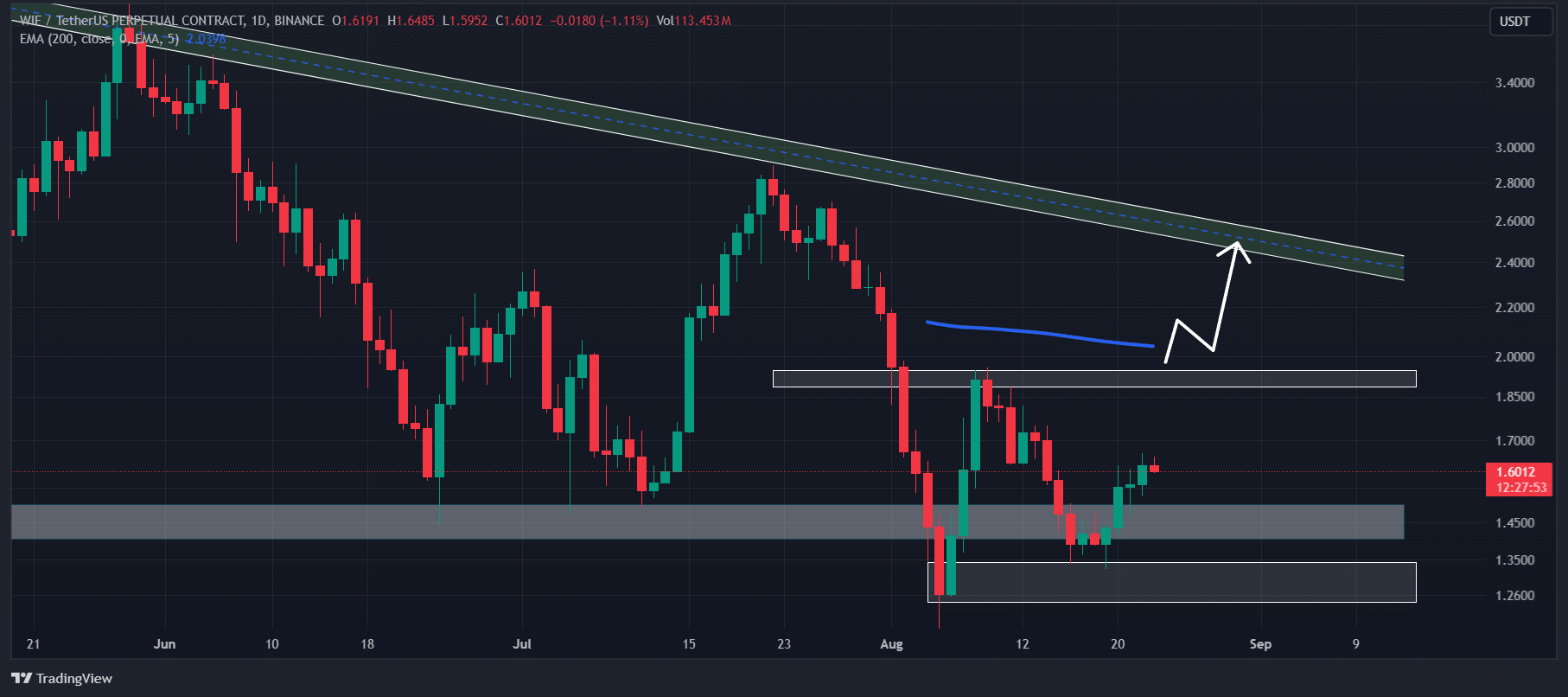

Based on AMBCrypto’s assessment, WIF appeared optimistic even though it was trading under the 200 Daily Exponential Moving Average (EMA).

The potential reason behind this bullish outlook is the formation of a double-bottom price action pattern and the crucial support level of $1.4.

Historically, when the price of WIF hits that particular support level, it often triggers a significant price increase. Now, there’s a similar anticipation among investors and traders that this could happen again.

The development of a bullish double bottom pattern in WIF‘s price action implies an initial surge towards $2, followed by further growth to approximately $2.8 after a breakout occurs.

Major liquidation levels

As of the current reporting, the significant selling points for WIF were close to the $1.57 mark on the downside and $1.65 on the upside. This is because traders had high levels of leverage at this point, as indicated by Coinglass.

Read dogwifhat’s [WIF] Price Prediction 2024–2025

If the market maintains a positive outlook and the price reaches around $1.65, approximately $1.27 million in short positions will need to be closed.

If the sentiment reverses and the price drops to the $1.57 mark, approximately $7.26 million in long positions will need to be closed out.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-08-23 21:44