- dogwifhat could make some serious gains if it breaches a nearby resistance zone.

- The high buying volume was an encouraging sign.

As a seasoned researcher with over two decades of experience in the crypto market, I’ve seen my fair share of meme coins and their unpredictable behaviors. The recent surge in dogwifhat [WIF] has certainly caught my attention, and it seems like this coin might be on its way to making some serious gains if it breaches the nearby resistance zone.

On or around Monday, the 23rd of September, dogwifhat [WIF] experienced a 37% surge in value up until now. Notably, this meme coin has also breached its seven-week range formation, which peaked at $1.98.

Given that it’s the initial phase for this project, an extended growth over time is possible, even similar to Dogecoin‘s surge in 2021. Here are some points to consider for investors and swing traders.

The Fibonacci retracement levels could repulse the bulls

Every day, the market’s overall trend was robustly positive (bullish), and the On-Balance Volume (OBV) indicated significant buying activity. The recent surge of the volume indicator beyond its peak in August, as well as the earlier peaks in July, suggested that this breakout might exceed the $2.9 mark.

In simpler terms, we drew Fibonacci lines using the decline that occurred in the second half of July. The point where the price might potentially rebound 78.6% of the way back up from the drop was around $2.5. This level acted as a support earlier in July but later shifted to become a potential resistance barrier.

In simpler terms, if Bitcoin‘s [BTC] price finishes each day higher than its current level, it could be a crucial turning point for the ongoing bullish trend. However, a potential drop in BTC’s price might cause other cryptocurrencies like WIF to also decrease. A retreat of BTC isn’t expected but remains possible.

The $2.5 zone is crucial in the short-term

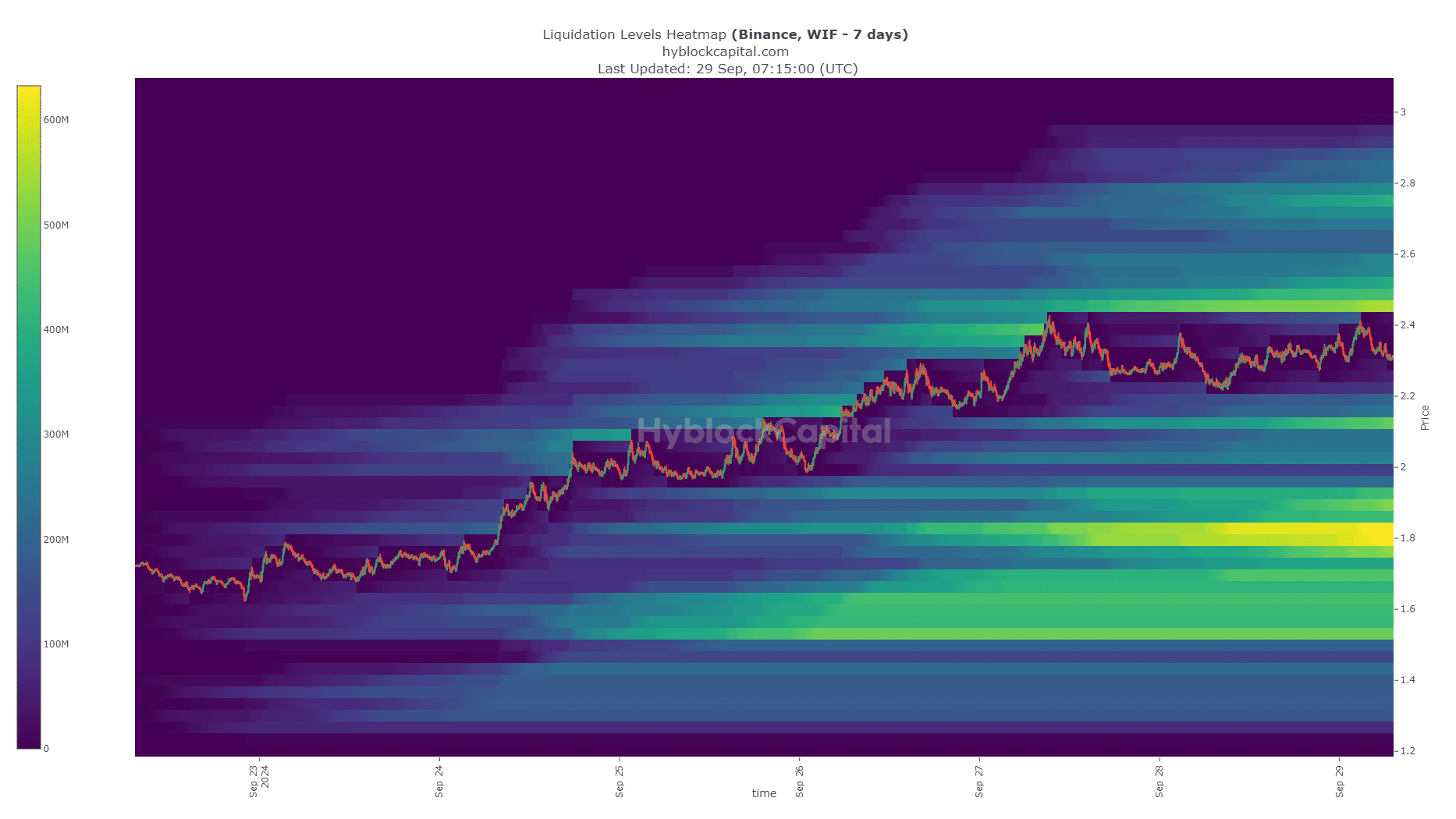

Over the last seven days, the data from the liquidation heatmap highlighted the areas between $2.45 and $2.5, as well as $1.8 to $1.9, as crucial short-term resistance and support levels. Additionally, a significant amount of liquidity was observed at $2.12.

Realistic or not, here’s WIF’s market cap in BTC’s terms

It might be beneficial to explore these magnetic areas while the price is still increasing, as they could serve as potential obstacles when the trend reverses. The Fibonacci levels and the liquidity cluster around $2.5 make it a strong resistance point for bulls to surmount in dogwhatever.

Read More

- Masters Toronto 2025: Everything You Need to Know

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-09-29 18:15