-

WIF’s social mindshare has dropped significantly.

Investors’ interest has also waned, dragging WIF’s prices as a result.

As a seasoned analyst with over a decade of experience in the crypto market, I’ve seen countless coins rise and fall like the tides. WIF, or “Woof It Forward,” seems to be going through a challenging phase right now. The decline in its social mindshare and investor interest is a clear red flag that can’t be ignored.

As a crypto investor, I’ve noticed a concerning dip in the social presence of Dogewifhat [WIF]. Based on Kaito’s findings, WIF’s influence on the platform formerly known as Twitter (X) has taken a significant hit, dropping from its peak between March and April.

Afterward, there wasn’t much engagement on WIF-related social posts.

Throughout the entire surge of the $WIF, I noticed that critical Technology (CT) accounts showed exceptionally high levels of interaction with relevant tweets. However, after this period, it appears they shifted their focus elsewhere.

WIF’s investor interest dropped

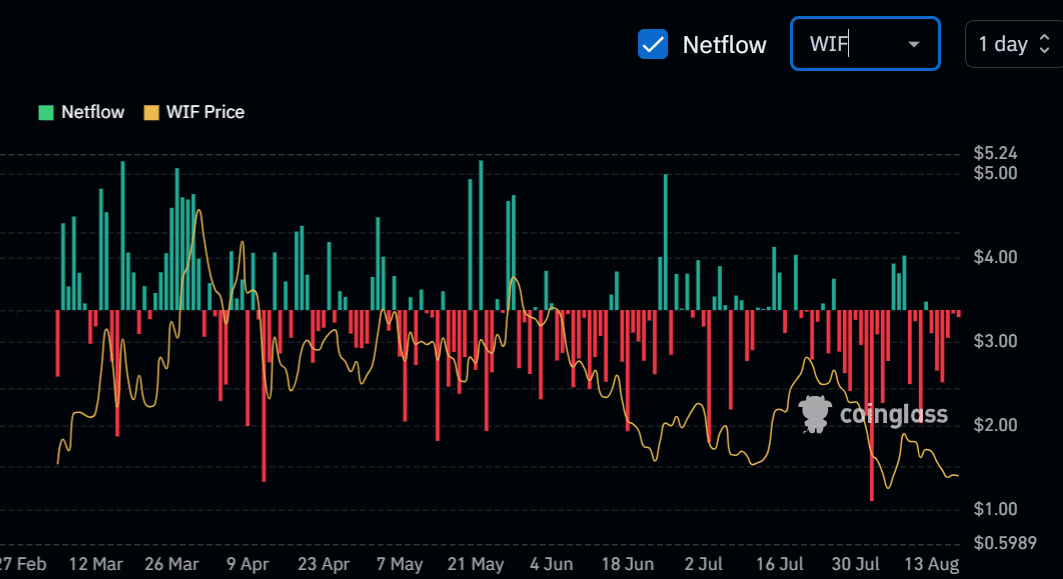

During the same timeframe, the decrease in social engagement and popularity was mirrored by a shift in investor and trader attitude. As depicted in the WIF‘s flow chart of spot net transactions, there has generally been a negative trend in total net flows.

In August, WIF’s outflows intensified, dragging the meme coin to a new low of $1.07.

Approximately $24 million was withdrawn from the meme coin between August 12th and August 18th, indicating a low interest or demand from investors and traders during that period.

WIF price action

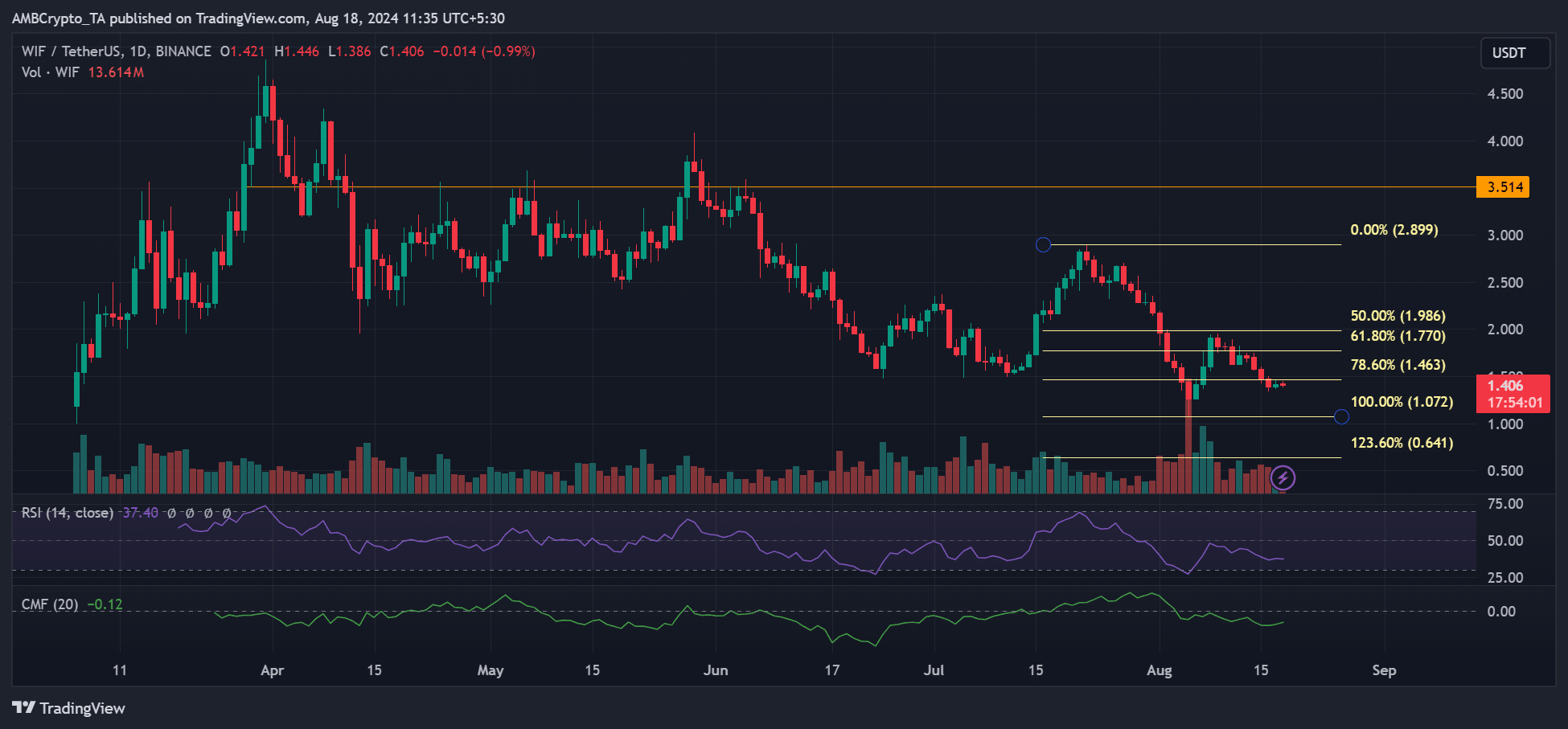

In August, the relatively low interest in WIF was further indicated by subdued values from both the Relative Strength Index (RSI) and Chaikin Money Flow (CMF).

In August, the technical chart indicators have been running below their typical levels, adding more limitations to WIF‘s potential for a robust comeback.

Even though WIF has surpassed other meme coins such as Dogecoin in a small increase recently, this growth didn’t manage to reverse investors’ negative sentiment towards it.

At the time of writing, WIF reversed the attempted recovery gains and traded below $1.5.

With Bitcoin [BTC] struggling to convincingly stay above $60K, WIF’s strong rebound could be delayed.

For the short term, it’s worth keeping an eye on the significant levels of $2.0, $1.0, and $1.5 as identified by the Fibonacci retracement tool, which was plotted between the July highs and August lows. These levels could potentially influence the market’s movement.

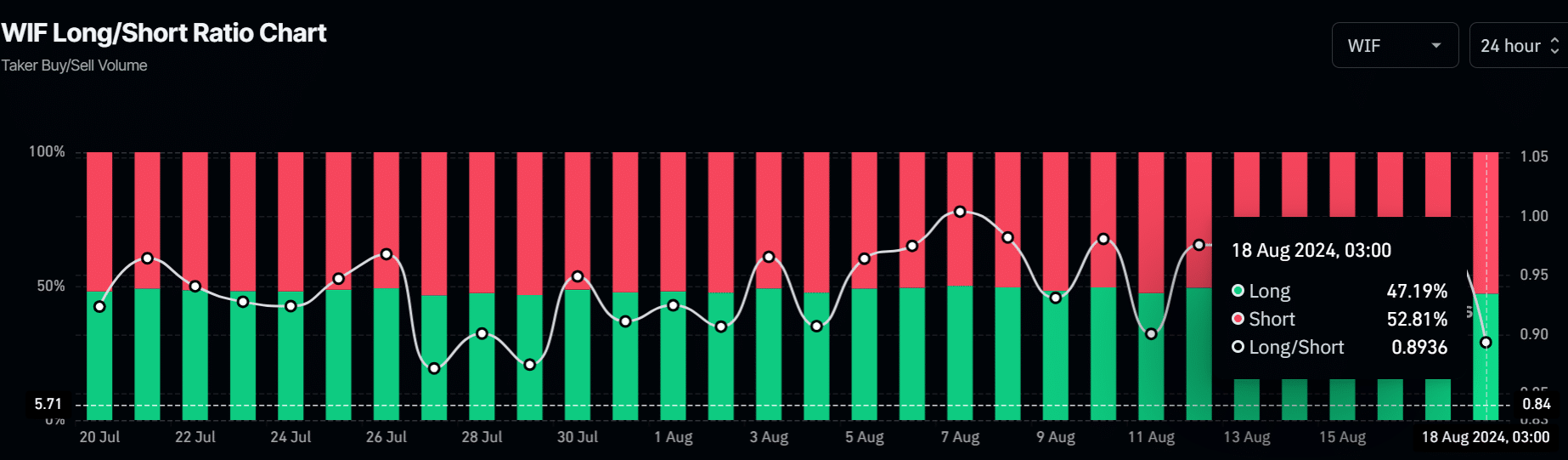

Additionally, more speculators on the Futures market were shorting the memecoin in record numbers.

Over the weekend, nearly 53% of future positions were betting against WIF’s recovery, reinforcing the bearish sentiment.

From my perspective as an analyst, the subdued behavior of WIF‘s price might continue given its minimal presence in public discourse (record-low social mindshare) and Bitcoin’s unpredictable price fluctuations.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-08-18 17:11