-

WIF declines by 35% on weekly charts amidst declining open interest.

Analysts predict a further decline to $1.

As a seasoned researcher with a decade of experience in the cryptocurrency market, I’ve seen it all – from meteoric rises to crushing falls, and everything in between. The current state of the market is no exception, with altcoins like Dogwifhat (WIF) taking a significant hit.

Over the last few months, the cryptocurrency market has shown unprecedented fluctuations. In fact, during the last week alone, almost every digital currency in the market has plummeted significantly.

Initially, Bitcoin dropped 9.84%, landing at approximately $60,780. This decrease in BTC has triggered a substantial selling of altcoins, causing Ethereum to lose 9.36% on its weekly charts and Solana to drop by 21.09%, setting its price at around $141.

This volatility has hit dogwifhat [WIF] the most, declining by 36% on weekly charts.

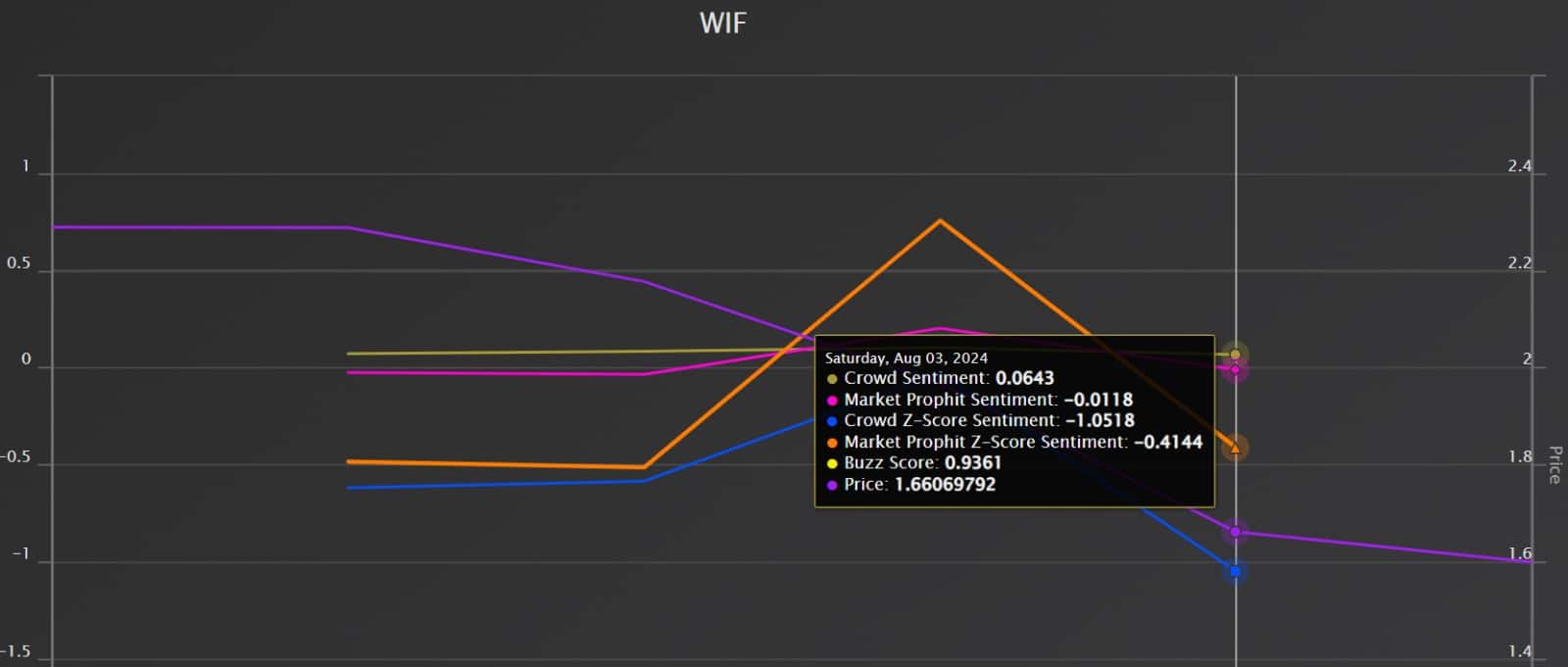

Dogwifhat’s market sentiment

In light of the waning influence of the WIF, I find the overall market sentiment to be distinctly bearish. Analysts, myself included, have expressed their skepticism about any potential recovery, instead anticipating a continued downturn. For example, in my recent analysis on X, I expressed doubts about a turnaround, pointing out that further declines could be expected.

“The price of Dogwhisker (WIF) might decrease to $1: Its major assets have declined, and a large investor has sold 14.53 million WIF tokens. Currently trading at $1.71, it could potentially drop to around $1.40 or even $0.90. Keep an eye on crucial resistance levels at $1.58 and $1.76.”

As an analyst, based on the current trend where all significant cryptocurrencies are experiencing a downward trajectory, I anticipate that the price of WIF could dip below $1, reaching approximately $0.90. This potential drop would reinforce the month-long descent of WIF’s value in the market.

Based on my years of experience in analyzing cryptocurrency markets, I have found that Market Prophit’s analysis of AMBCrypto confirms a prevailing bearish sentiment among traders. From my perspective, this is not surprising given the market’s volatility and the current economic climate. However, it’s important to remember that market sentiment can change quickly, so it’s crucial to stay informed and adaptable in order to make smart investment decisions.

Based on the market forecast, the Crowd Z Score stands at a negative -1.05, indicating a pessimistic outlook, while the market forecast sentiment is also negative at -0.0118.

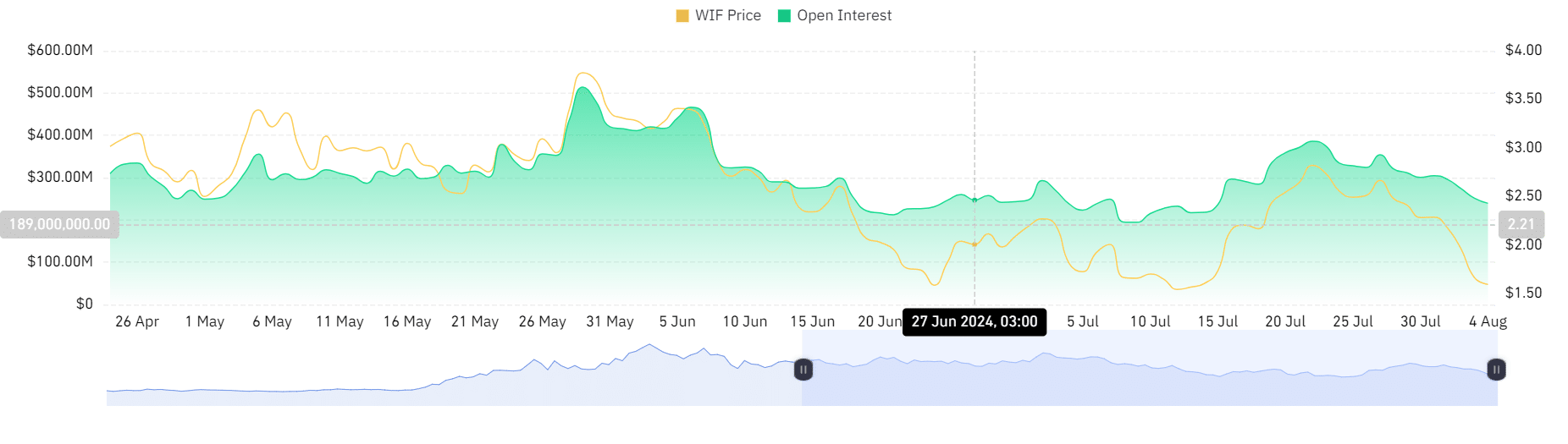

WIF Decline amidst low open interest and higher liquidation

It appears that the continuous drop in the value is caused by an increase in the selling of long-term investments and a decrease in the number of active contracts, as observed in Coinglass’s analysis of WIF over the last seven days.

Based on data from Coinglass, the value of open positions for WIF dropped from approximately $385.98 million to $239.2 million within the last week. This decrease indicates that investors are liquidating their existing positions rather than initiating new ones.

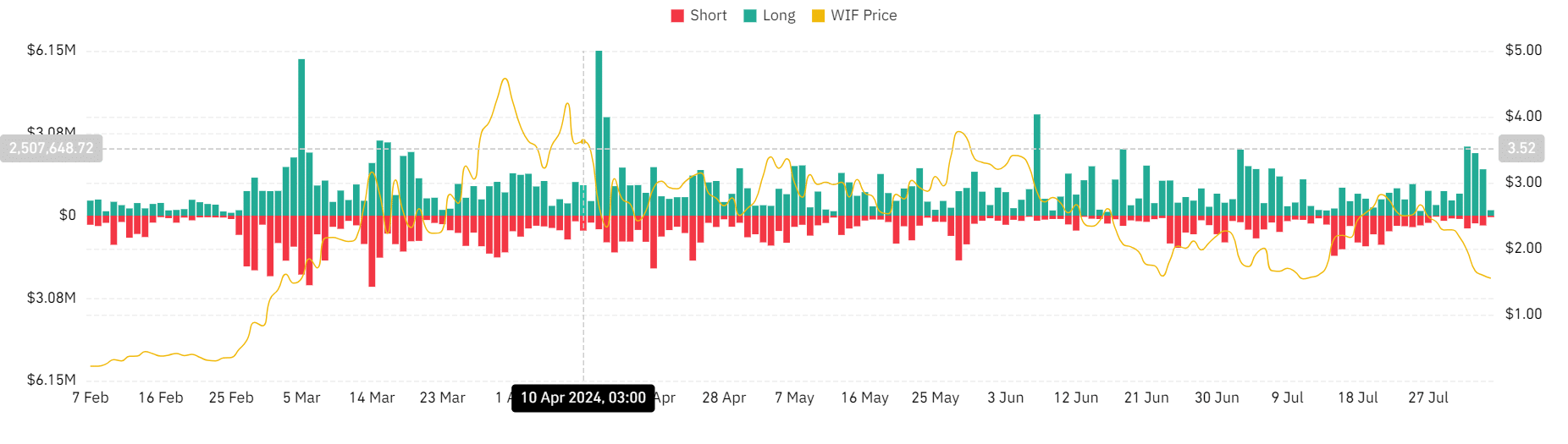

LookonChain reported such an incident with a whale selling WIF after 8 months. They reported that,

“5 wallets(may belong to the same person) sold 14.53M $WIF($24M) .”

Moreover, as reported by Coinglass, WIF has witnessed significant selling off of long positions. In the recent seven days, the volume of long position liquidations has escalated dramatically, rising from an initial value of $176,000 to a staggering $2.85 million.

When the demand for closing long positions significantly increases, investors are compelled to sell off their investments. Often, they end up selling at a loss because they’re unwilling to continue holding onto their positions with rising premiums.

What price charts indicate

Currently, the trading value of WIF stands at $1.55 following a 8.84% decrease in its daily price chart. In conjunction with this price fall, the trading volume of WIF has also decreased by approximately 32.93%, amounting to $353.5 million over the past 24 hours.

Consequently, it appears that WIF is undergoing significant negative trends, as indicated by the RVGI value of -0.3794, which implies that the closing prices are consistently lower than the initial trading process.

As a researcher, I can affirm that my analysis indicates a downward trend in the market, suggesting that sellers have significant influence over trading activities. Consequently, this increased seller dominance leads to an escalation of selling pressure.

In simpler terms, when the Awesome Oscillator (AO) showed a value of -0.244, it suggests that the short-term price movement’s strength is less compared to its longer-term trend.

In other words, the market is currently showing a significant downward trend, with the Average Oscillator reinforcing this trend’s continuation. Similarly, the Moving Average Convergence Divergence (MACD) supports this perspective as it sits below zero at -0.109, indicating a bearish condition persists.

Will WIF drop below $1?

In my analysis of the monthly chart, I’ve noticed a significant downtrend for the memecoin WIF. Over the last week, there’s been a 35% drop in its value. If this trend persists, I anticipate that WIF may continue to decrease in value.

Realistic or not, here’s WIF’s market cap in BTC’s terms

If the daily candles of cryptocurrency WIF consistently hover beneath the significant support threshold at $0.50, it’s likely that the altcoin’s price will drop towards the subsequent support zone at $1.00.

If it continues to hold at this level and subsequently rebounds, it will follow the traditional pattern observed since July 12, where it had previously tested the same support level before rising to $2.82.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

2024-08-04 19:04