-

The market structure of WIF was bullish.

Traders can expect sideways and slightly higher instead of a breakout and rally.

As a seasoned crypto investor with a knack for technical analysis, I’ve seen my fair share of market structures and trends. And based on my observation of the WIF market, I believe we are looking at a consolidation phase rather than a bullish breakout.

In simpler terms, the price of Dogecoin (WIF) dropped back below its previous highs during late May, indicating that the initial breakout wasn’t sustainable. Trading activity also decreased significantly over the last ten days, potentially signaling uncertain market sentiments.

Although the memcoin has remained relatively stable since April, it has nevertheless crept upward on the price graphs. This is noteworthy given the significant price swings experienced by Bitcoin [BTC] over the last two months.

Will the rejection see WIF post more losses?

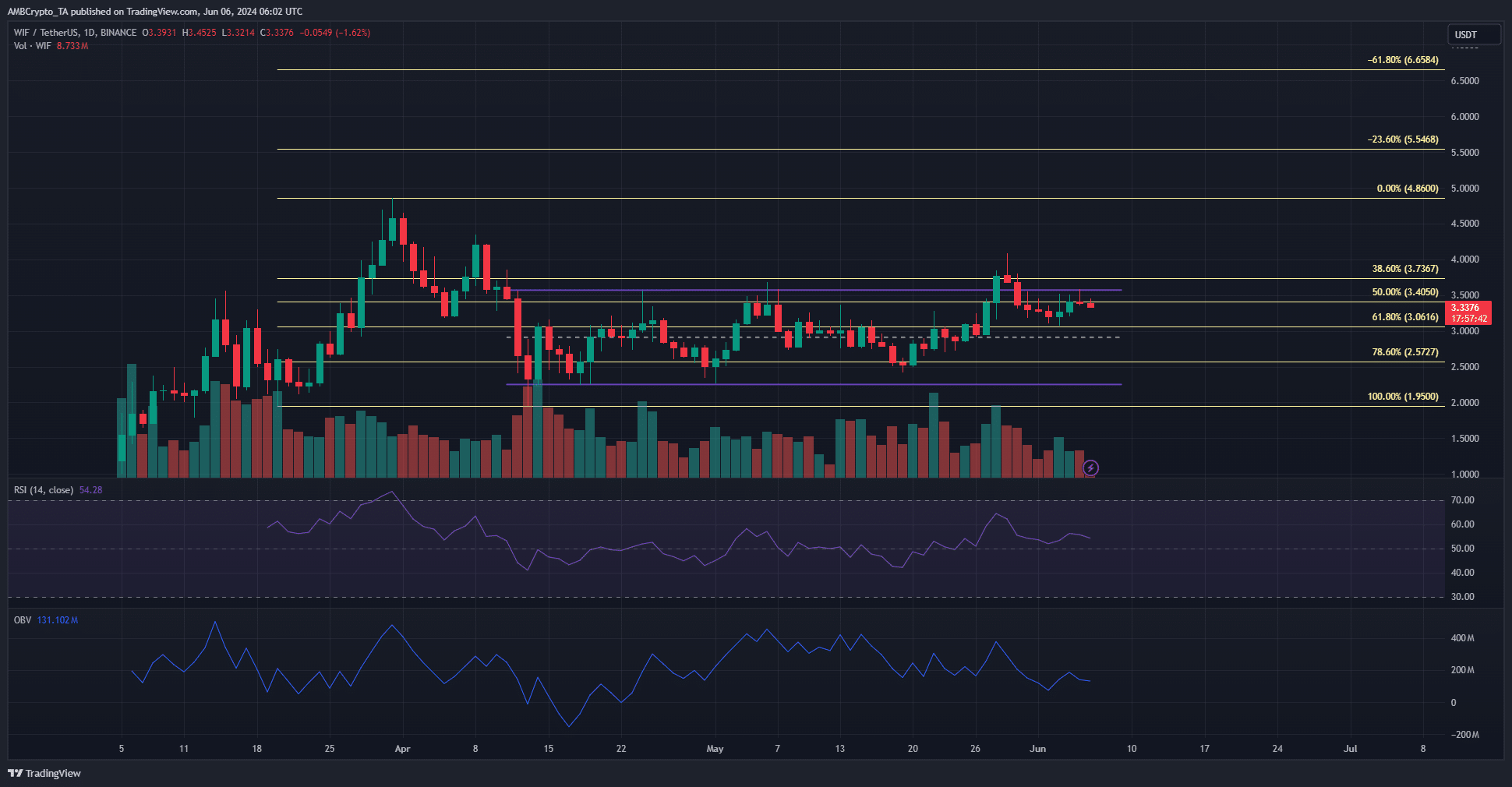

On May 29th, WIF reached its peak locally at $4.08. Since then, its value has decreased by 18.5%. At present, it is being traded under the $3.4 mark, which serves as both a resistance level and the halfway point of the Fibonacci retracement.

On the daily chart, the buying momentum was mildly positive, as indicated by an RSI reading of 54. Nevertheless, the On-Balance Volume (OBV) was stable within its range, mirroring the price action. Until the OBV breaks above its current high, it’s plausible that WIF will continue trading within a narrow range.

The absence of motion in the OBV suggests equilibrium between purchasing and selling forces, typically signaling a period of consolidation. To the south, the $2.9 mid-range mark serves as the subsequent support level where the token might elicit a favorable response.

Speculators were ready to go long but might not be successful

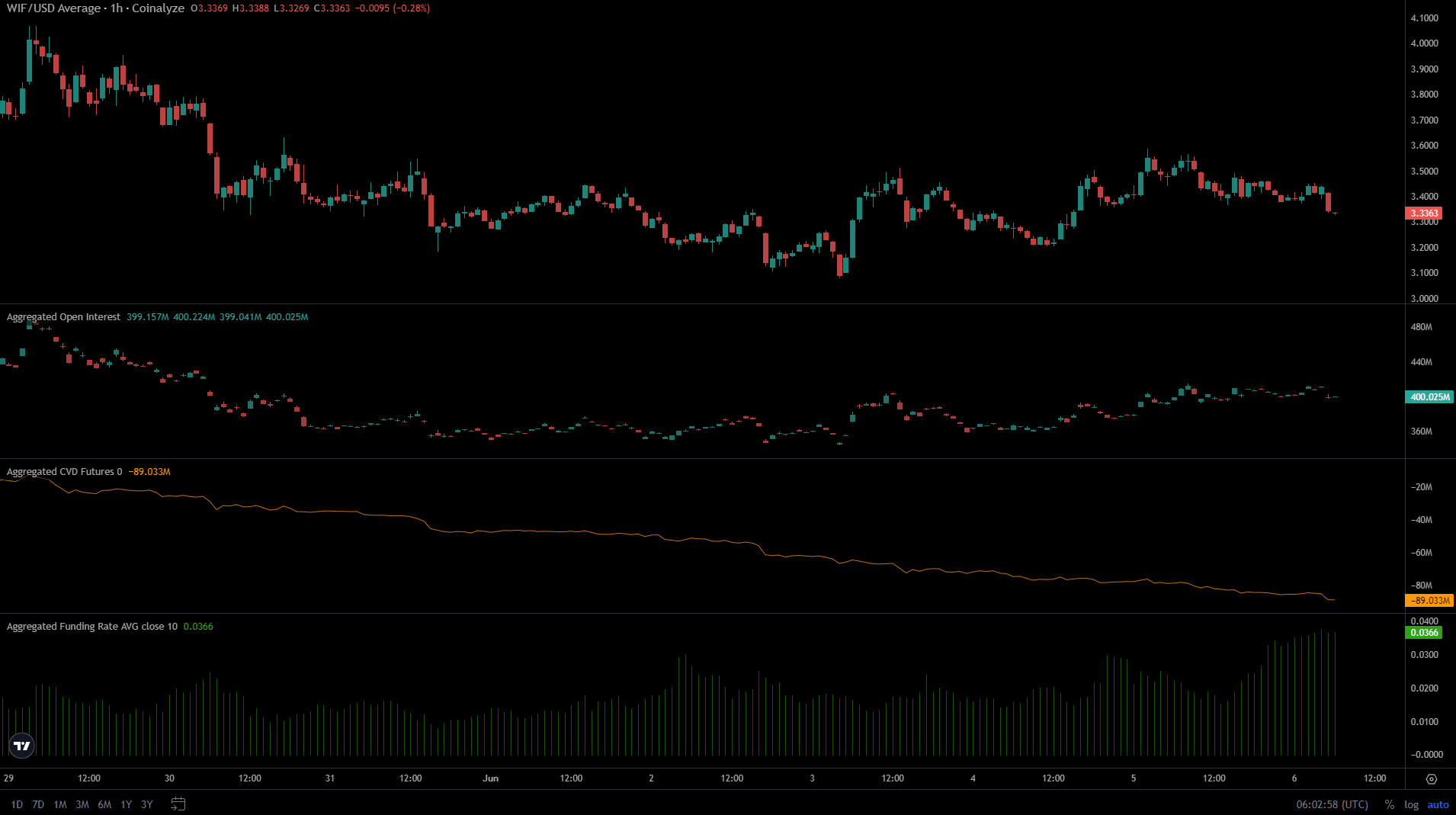

Over the past few days, each time the price of dogwifhat bounced, the Open Interest surged higher.

Is your portfolio green? Check the WIF Profit Calculator

In the past three days, most of the short-term price increases have been reversed, but open interest continued to increase.

As a crypto investor, I observed that despite rising funding rates, which indicated buyers’ readiness to hold long positions, there was a noticeable lack of genuine demand in the market. The downtrending spot CVD (Coin Value Differential) further emphasized this observation.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-06-06 19:03