Right then, let’s have a go at this. A bit of crypto-nonsense, eh? One might as well be discussing the merits of gin versus bathtub gin. 🍸 Here’s the thing, though:

Crypto’s Fatal Flaw? 💸

What to know:

- Cryptocurrency’s value, one gathers, should be tethered to its utility and adoption, rather than this vulgar price speculation. So says William Mougayar, a chap who fancies himself at the Ethereum Market Research Centre.

- Bitcoin, naturally, is viewed as a speculative bauble. Ethereum, on the other hand, is supposedly linked to functionality and real-world whatnots.

- A jolly collaboration between Bitcoin and Ethereum, should it ever occur, might enhance both networks. Bitcoin’s liquidity combined with Ethereum’s decentralized finance… one shudders to think.

Cryptocurrency, you see, is far too often appraised through the most frightfully narrow lens: price. The dominant drivel surrounding Bitcoin, Ethereum, and the whole crypto shebang has become quite fixated on the notion that numbers must go up. Did Bitcoin, pray tell, breach \$100,000? Did Ethereum double in a month? Is this altcoin, heaven forbid, going to the moon? 🚀

The financial press, those X (formerly Twitter) pundits, and even crypto’s most ardent advocates routinely reduce an entire technological revolution to a rather vulgar race toward ever-higher prices. It’s akin to judging Apple or Nvidia solely by their stock ticker, whilst ignoring the iPhone or those GPUs that power the AI apocalypse. A superficial exercise, wouldn’t you agree? And in crypto, positively dangerous. ⚠️

In traditional markets, value is, at the end of the day, grounded in usage. The more trinkets a company hawks, the more revenue it generates. The more users it retains, the stronger its network effect. Apple isn’t a \$3 trillion behemoth merely because its stock price ascended; it’s because a billion souls use its ecosystem daily. Nvidia didn’t become Wall Street’s latest infatuation through sheer momentum; it cobbled together the most essential chips of the AI age. Stock price, you see, follows product-market fit. In crypto, this principle is often inverted – price comes first, and everything else becomes frightfully secondary, or optional. 🤔

READ MORE: Ethereum Advocate William Mougayar to Lead Ecosystem’s New Profile-Raising Initiative

Nowhere is this philosophy more deeply entrenched than in what one might term Saylorism – the ideology peddled by MicroStrategy’s Michael Saylor, the loudest of evangelists for Bitcoin-as-collateral. Under this worldview, the core utility of Bitcoin isn’t transacting, building, or innovating – it’s simply holding. One buys Bitcoin, never sells, borrows against it, and repeats the process. The usage, if you can call it that, is the hoarding. 🏦

Bitcoin, under Saylorism, is not a currency or platform – it’s a speculative vault for value, designed to appreciate ad infinitum and justify further borrowing. In essence, every company becomes a leveraged Bitcoin fund, building its capital structure around a single wager: that the number shall always ascend. 🙄

This is a rather radical departure from the logic that underpins healthy businesses. Traditional firms grow by creating value for others, through products, services, and infrastructure. Under Saylorism, value is internalized, circular, and ultimately recursive: one buys more Bitcoin because it’s going up, which makes it go up, which justifies buying more. It resembles a corporate Ponzi scheme, not in legal terms, mind you, but in structural dynamics, where external adoption matters less than internal leverage. The market doesn’t need new users; it merely requires existing holders to maintain their faith. 🙏

Compare that to Ethereum, the second-largest cryptocurrency by market cap, which has taken a different tack. While Ethereum is also subject to the gravitational pull of price speculation, and no one would argue that “number go up” doesn’t matter; its value proposition is fundamentally rooted in usage. ETH is not just a store of value; it is the fuel of an economy. It powers decentralized applications, settles billions in stablecoin transactions, tokenizes real-world assets, mints NFTs, facilitates decentralized finance, and supports governance. ETH has demand because the network has demand. The more people use Ethereum, the more ETH is needed. And the more ETH is burned through transaction fees, the more supply becomes constrained. Price here reflects activity, not just belief. 🔥

This distinction is, dare I say, profound. Ethereum’s growth is tied to its functionality, to what it enables for users and developers. It resembles a traditional business more than a vault. It’s like Amazon in the early 2000s: difficult to value by conventional metrics but serving a growing ecosystem. 🌳

The difference between these two models – Bitcoin as gold and Ethereum as infrastructure – has sparked endless debate over whether they’re even in competition. Some argue they’re entirely different species: Bitcoin is a monetary metal; Ethereum is a decentralized world computer, perhaps likened to digital oil. 🛢️

It’s fair to ask: what’s ultimately more valuable, the gold you keep or the dollar you spend? Bitcoin’s value depends on people holding it. Ethereum’s value depends on people using it. Both are succeeding, but the paths are not the same. 🛤️

If cryptocurrency is to evolve beyond its speculative adolescence, it must shift away from price obsession and toward utility obsession. This means asking harder questions: What is this protocol used for? Who depends on it? What problem does it solve? Valuation must come from participation, not just price action. A blockchain that delivers real-world utility for finance, identity, coordination, or computation deserves appreciation. But it must earn it through adoption, not ideology. 🤔

What if, instead of competing, Bitcoin and Ethereum found common ground and worked together? 🤝

That’s where the opportunity emerges: Ethereum serves as the most robust gateway for Bitcoin holders looking to access the broader world of decentralized finance. No network rivals Ethereum in terms of DeFi’s depth and maturity. By converting BTC into Ethereum-compatible assets, holders can engage in a dynamic ecosystem of lending, staking, and yield generation, turning dormant Bitcoin into active, value-producing capital. Platforms like Aave, Lido, Ethena, ether.fi, and Maker enable BTC to participate in ways that static holding simply can’t. 💡

The outcome? 🤔

Mutual benefit: Ethereum attracts more liquidity, while Bitcoin gains much-needed utility. It’s a powerful synergy that amplifies the strengths of both networks. ➕

Cryptocurrency is not just a dumb financial asset It’s programmable money, digital property, frictionless transactions, decentralized coordination, and trustless finance. It’s a reimagining of the internet’s economic layer. But its long-term success depends on moving past the dopamine of daily price charts. Because in the end, the most valuable technologies aren’t the ones with the flashiest tickers; they’re the ones that get used. 💻

And usage, not hoarding, is what builds lasting value. 💯

Note: The views expressed in this column are those of the author and do not necessarily reflect those of CoinDesk, Inc. or its owners and affiliates. 📰

Ether More Favored by Traders as Volatility Against Bitcoin Hits Highest Since FTX Crash

DeFi Leader Aave Debuts on Sony-Backed Soneium Blockchain

TON Rises 4.1%, Suggesting Further Upside Potential

AVAX Up 4.2% as It Establishes Uptrend Channel

Aave, Uniswap, Sky Tokens Surge Over 20% as SEC Roundtable Spurs DeFi Optimism

Ether Holds Steady Above $2,500 as ETF Demand Signals Institutional Confidence

Bitcoin Pushes Toward $107K Even as Trump Sends National Guard to Los Angeles

Bitcoin Struggles as Hang Seng Cheers U.S.-China Trade Talks; U.S. Inflation Eyed

Shiba Inu Recovers Amid Massive $36M Whale Transaction; Still Stuck in Downward Channel

Asia Morning Briefing: Michael Saylor Downplays BTC’s Quantum Threat

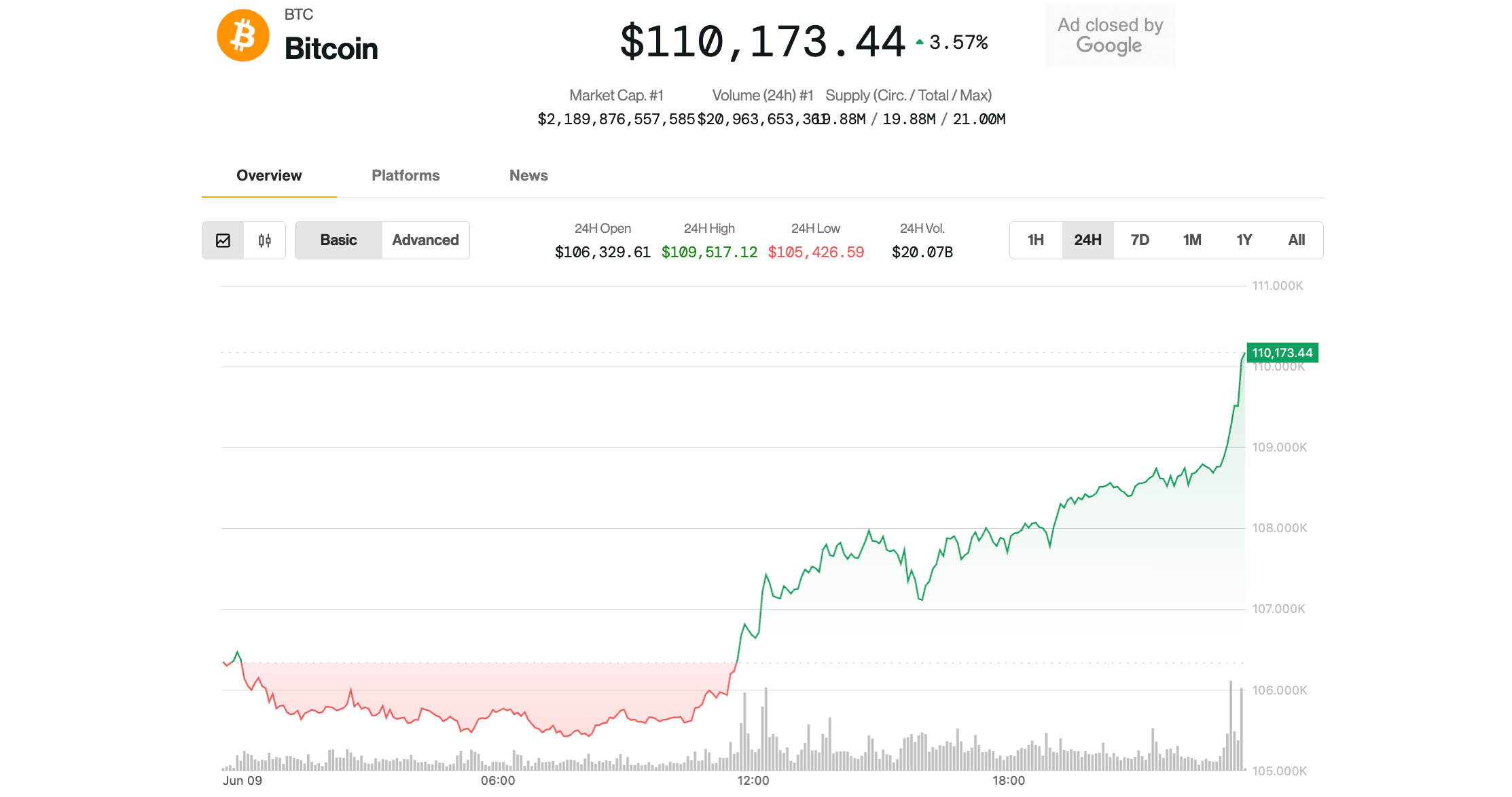

Bitcoin Climbs Above $110K, ‘At Crossroads’ for Next Major Move

There you have it. A bit cynical, a touch world-weary, and hopefully just the ticket. 😉

Read More

2025-06-10 19:29