- Six accounts containing 499 BTC recently became active.

- The BTC are now worth over $47 million.

As a seasoned researcher who has been observing and analyzing the cryptocurrency market for over a decade now, I must admit that the recent awakening of six dormant Bitcoin wallets holding 499 BTC is nothing short of intriguing. The sheer magnitude of the value increase from $380,000 in 2013 to over $47 million at present has left me scratching my graying beard in awe.

For approximately a week from November 28th through December 1st, six previously inactive Bitcoin wallets, each containing hundreds of Bitcoins, became active again, ending their lengthy period of dormancy lasting almost 11 years.

In this group of transactions, the biggest one was initiated by a digital wallet containing 429 Bitcoins, which currently translates to more than $41 million given Bitcoin’s current value around $95,900 per coin.

As a researcher, I’ve found myself intrigued by the abrupt surge in transactions from these digital wallets. This development has piqued my interest in understanding the driving forces behind these activities and how they could potentially impact the market dynamics.

Dormant Bitcoin wallets resurface after a decade

Activating six Bitcoin wallets that had been idle since the end of 2013 signifies a noteworthy occurrence. The largest wallet contained 429 Bitcoins, with a total inactive duration of about 10.9 years. These wallets last transferred funds when Bitcoin was priced around $700-$900.

As I currently analyze, my calculations reveal that at this moment, the total worth of their assets surpasses forty-one million dollars – a staggering growth of over 4,500%. Such an astronomical rise in value is truly remarkable to observe.

Based on information from Whale Alert, the most recent activity on December 1st was linked to a Bitcoin account that hadn’t been active for approximately 11 and a half years, containing 11 Bitcoins.

Waking up these wallets frequently indicates unusual situations. This might be finding old keys again, experiencing safety issues, or cashing out during a bullish market trend.

On-chain insights and whale activity

Examining transactions on the blockchain shows that infrequent activities from previously inactive wallets can have significant effects, frequently sparking discussion and speculation among cryptocurrency enthusiasts.

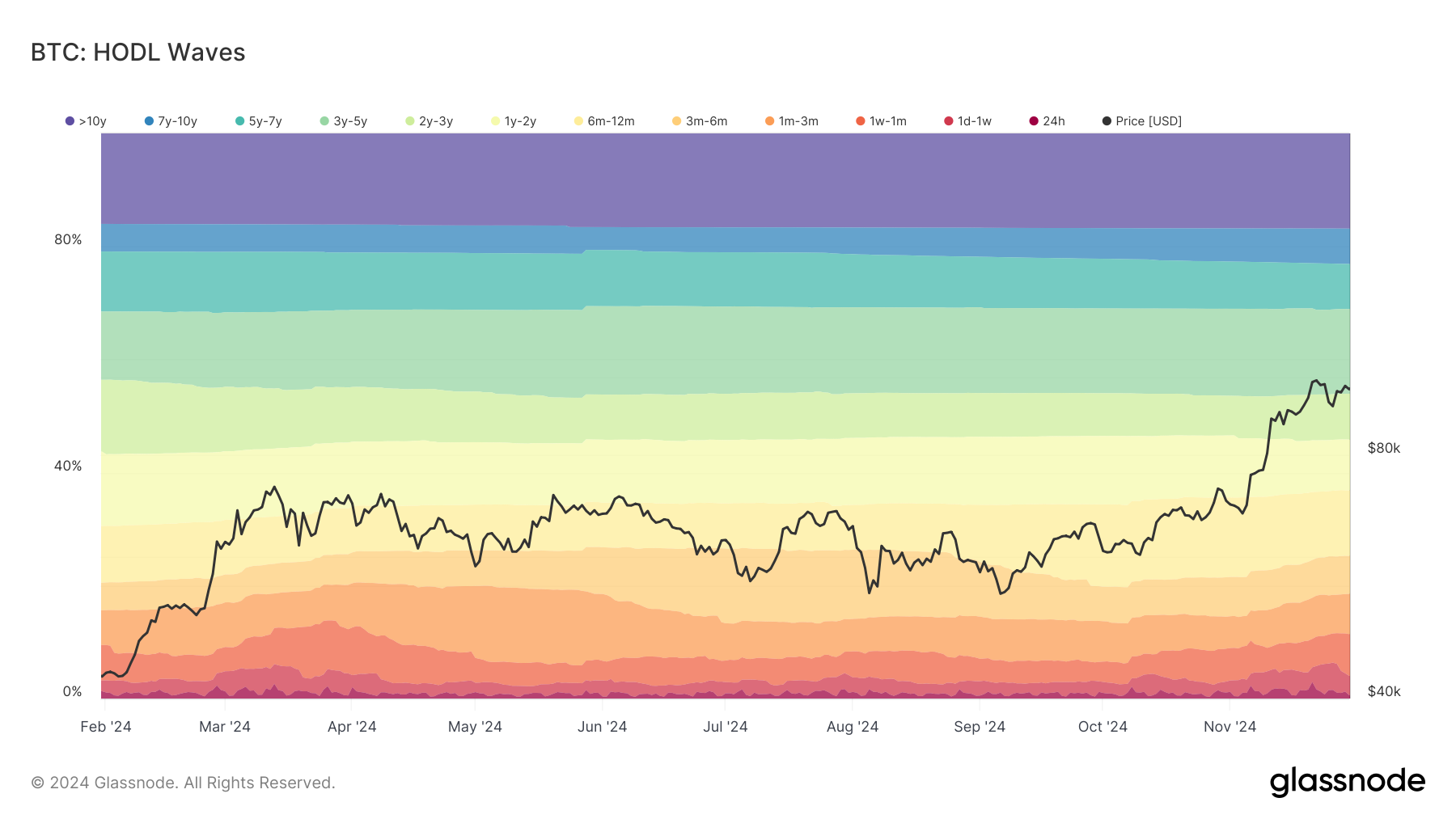

As reported by Glassnode’s HODL Waves, a significant portion of Bitcoins is stored in wallets that have been dormant for over a decade, underscoring the commitment of long-term investors to their holdings.

As an analyst, I cannot help but notice that transactions originating from certain wallets have the potential to cause unease among market participants. This is because they might speculate that these activities could be precursors to a potential sell-off, leading to increased feelings of fear, uncertainty, and doubt (FUD).

Enhancing the market excitement, as reported by Lookonchain, a large whale has transferred 1,000 BTC (equivalent to around $97.5 million) into Binance within the last four hours.

Over a period spanning from the 14th of March to the 31st of October, this exact whale amassed approximately 11,657 Bitcoins (worth around $780.5 million) through Binance, with an average cost per Bitcoin of roughly $66,953.

Although these fluctuations occur, Bitcoin’s price is still hovering around $95,900, implying robust demand and market assurance.

Overwhelming deposits into trading platforms often spark worries about excessive selling activity. However, so far, the market hasn’t shown any signals of fear or panic, suggesting instead a robust and resilient state.

Historical context: Bitcoin’s value then and now

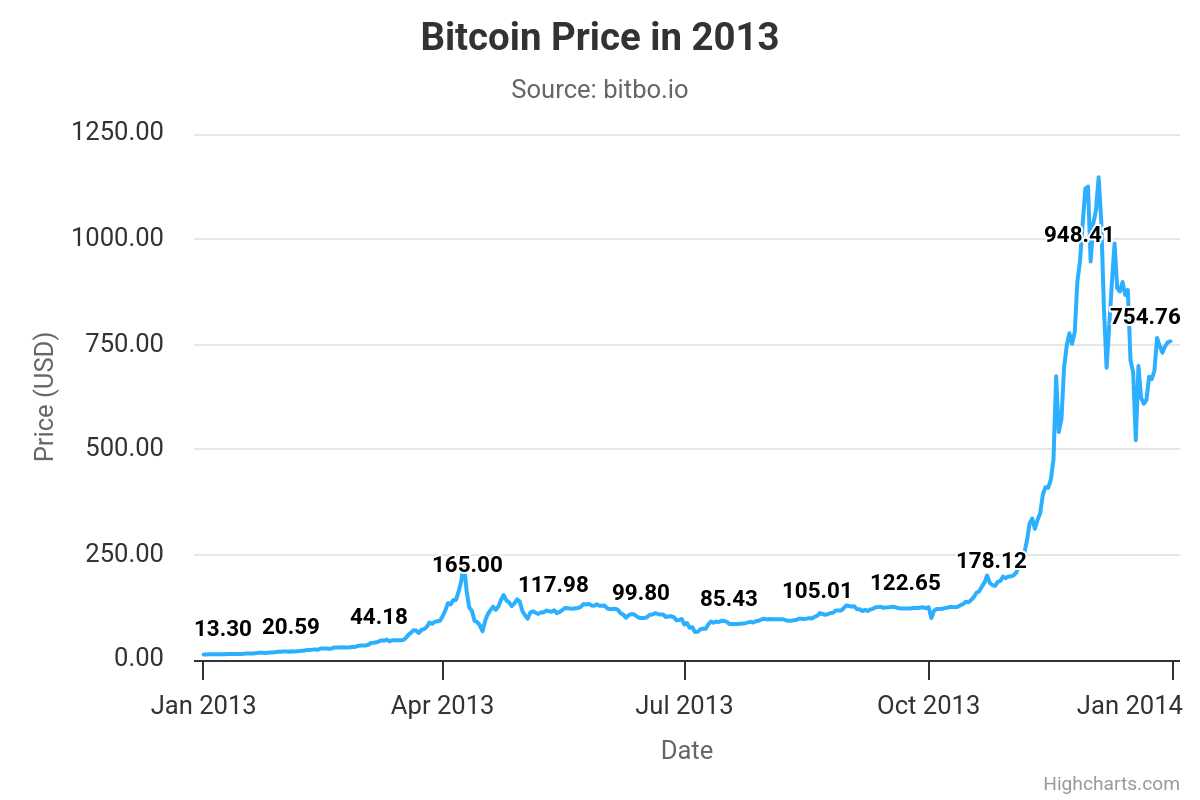

wallets that had been dormant were last used during Bitcoin’s significant surge in late 2013, which took the cryptocurrency from under $100 to almost $1,200. This incredible increase was then followed by a steep decline due to the notorious Mt. Gox crash.

Read Bitcoin (BTC) Price Prediction 2024-25

For long-term investors, the increase in value has been immense. The Bitcoin (BTC) from the biggest wallet, which was only worth around $400,000 in 2013, is now worth more than $41 million.

With Bitcoin reaching an all-time high of over $95,900, we may start seeing previously inactive digital wallets and calculated actions from ‘whales’ (large investors) becoming more prominent. Whether these activities will lead to further price increases or potentially trigger a market correction is yet to be determined.

Read More

2024-12-02 16:08