-

DOT hiked by almost 12% in the last 7 days

Sustained developments and RWA integrations have changed the market sentiment too

As a researcher with experience in crypto analysis, I find DOT‘s recent price surge and market sentiment shift towards bullish quite intriguing. The altcoin’s 11.88% gain over the past week is noteworthy, considering the overall bearish trend in the crypto space.

Despite a general downturn for many altcoins in recent times, there’s growing excitement among crypto analysts regarding Polkadot (DOT). Michael Van De Poppe reports that DOT’s charts indicate a significant uptick of 11.88% over the last week, fueling optimism about the cryptocurrency’s future prospects.

As a crypto investor, I’m quite optimistic about the future trajectory of this altcoin based on my analysis.

“Polkadot’s $DOT token is strongly anticipated to mirror Ethereum‘s growth spree. Consequently, the present market assessments of Polkadot appear undervalued. Given the upcoming developments within its ecosystem, I hold high expectations for Polkadot.”

RWAs driving DOT’s market sentiment

One significant reason for DOT‘s recent robustness is its implementation and assimilation of tangible assets. Indeed, as mentioned in Esra Bulut’s article on X, Real-World Assets (RWAs) have become the focal point of the current optimistic sentiment towards DOT. Esra noted,

In the rapidly evolving crypto sphere, Real World Assets (RWAs) are making waves and taking center stage. Leading this charge is Polkadot ($DOT), whose groundbreaking advancements in this area set it apart. The incorporation of RWAs by Polkadot’s team marks a pivotal moment, opening up exciting possibilities for the future and pointing towards a promising bullish trend.

The integration is fueling a positive market outlook for various reasons.

To begin with, Reusable Water Systems (RWAS) are expanding and hold substantial market value. Predictions indicate that the RWAS market could reach anywhere from $4 to $16 trillion by the year 2030. Consequently, the DOT (Decentralized Open Technology) platform holds immense potential within the RWAS sector due to its capacity for expansion and robust security features.

As a market analyst, I would argue that Reliable, Secure, Scalable, and Affordable (RWAs) are essential features for blockchain projects in traditional markets. Given these requirements, Polkadot’s multi-chain architecture and interoperability capabilities position it favorably to meet the demands of this sector.

Is DOT Set for Uptrend?

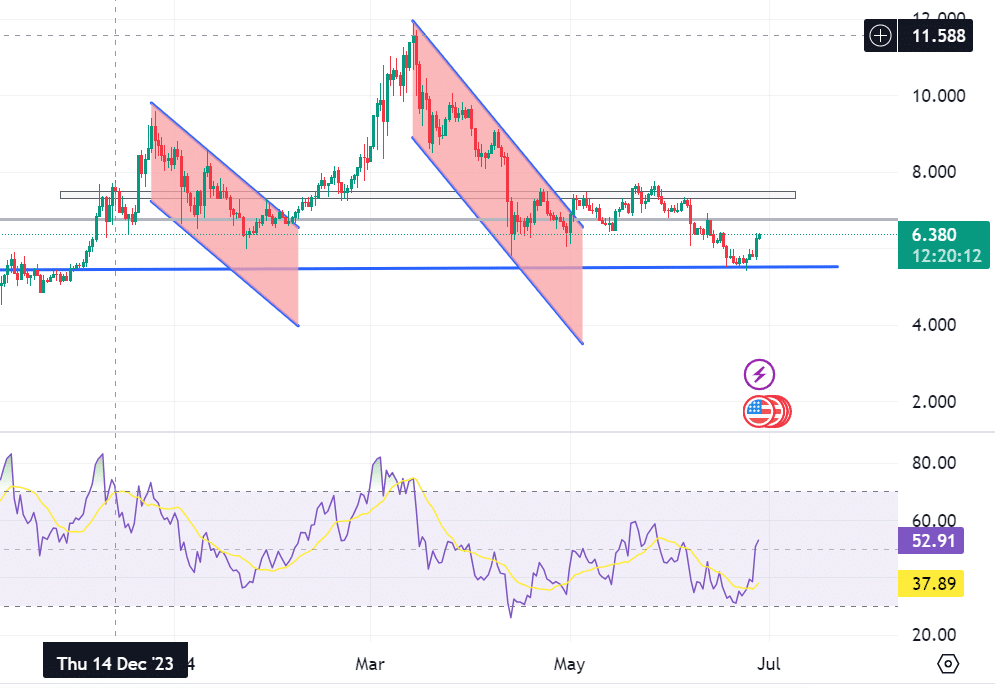

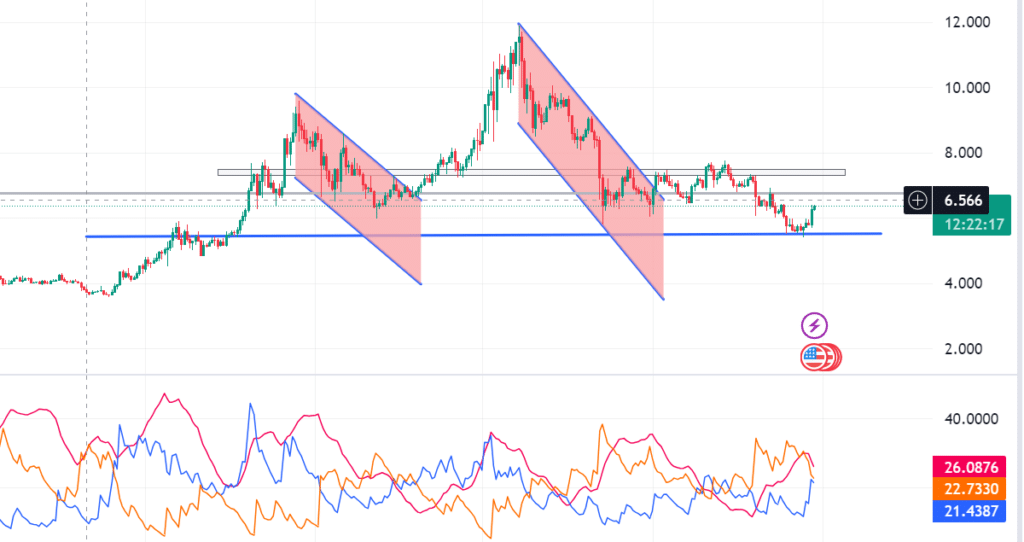

Over the past week, the altcoin experienced a notable surge in value as indicated by its price charts. This upward trend was also acknowledged in AMBCrypto’s assessment, which demonstrated how the market sentiment transitioned from bearish to bullish following an unexpected price increase and a surge in demand.

In their assessment, AMBCrypto observed that the MACD and Signal lines for DOT formed in a bearish fashion, while the histogram indicated a bullish trend.

When the positive histogram aligns with the MACD being above its signal line, it typically signals the beginning of a trend reversal from bearish to bullish. In simpler terms, the downtrend appears to be losing strength, and the market is showing early signs of transitioning into an uptrend.

Similarly, the Relative Strength Index (RSI) 51, only slightly above neutral territory, signaled the initiation of an uptrend. Over the past three days, the RSI climbed from 39 to 51, suggesting a prolonged lessening of bearish pressure.

Lastly, the DMI signaled a bullish divergence. Specifically, the positive directional indicator rebounded strongly from a low of 12.4 to reach a high of 21.

Over the past week, the bearish indicator experienced a significant drop, decreasing from a peak of 33 to a low of 26. This downturn implies a lessening of pessimistic market pressure, potentially allowing bulls to regain control.

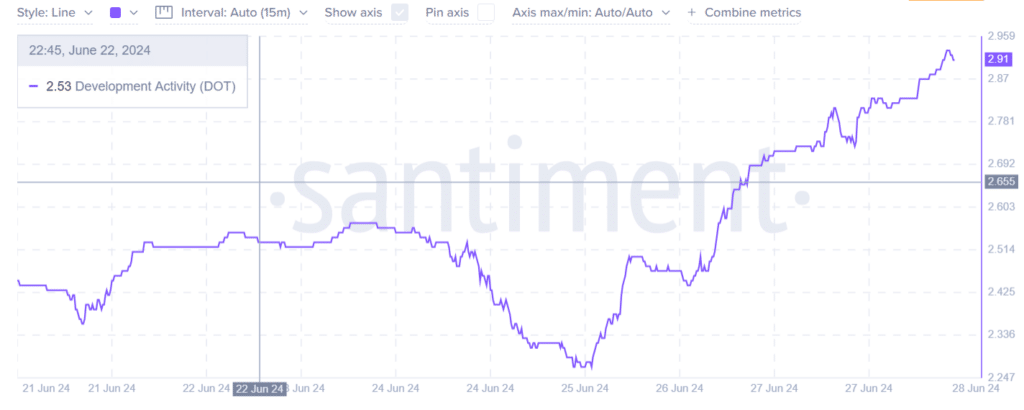

As a researcher, I would like to highlight that it’s essential to consider other metrics besides the one we have been focusing on. For instance, in the past week, development activity has seen a significant increase from 2.2 to 2.9. This surge in development can be perceived as a positive sign, indicating consistent progress on Polkadot. Consequently, this may attract investors and traders due to its potential for future growth.

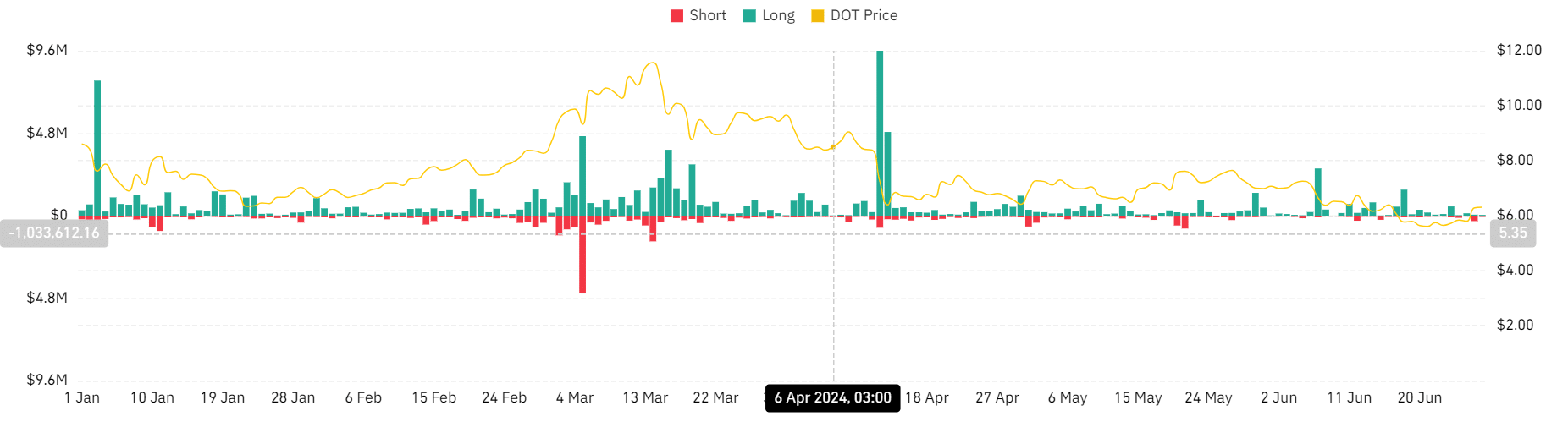

To put it another way, Coinglass noted a decrease in forced sales for both short and long positions. A reduced number of liquidations reflects market tranquility, suggesting that investors are choosing to keep their assets instead of selling them immediately.

The current trend is strong with few investors taking profits or selling off, leading to a sense of security or certainty in its continuation.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Rick and Morty Season 8: Release Date SHOCK!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-06-29 06:15