- Polkadot aims for a 101% rally to $12.61 but risks revisiting $4.15 if $8.60 support fails.

- Positive funding rates and bullish patterns signal optimism as DOT retests its critical $8.60 level.

As a seasoned analyst with over two decades of experience in the financial markets, I find myself intrigued by Polkadot’s current price action. The historical precedent at the $8.60 level is undeniable, and it presents an opportunity for both bullish and bearish scenarios.

On its weekly chart, Polkadot (DOT) managed to break above the significant $8.60 barrier, a level that has previously influenced the price trend of DOT considerably.

Based on Rekt Capital’s assessment, Polkadot (DOT) is currently testing the $8.60 level as potential support. This action may influence its upcoming trend.

In 2021, reaching this level again led to a surge past previous record highs exceeding $50. Contrastingly, in the early part of 2023, DOT was unable to maintain $8.60 as a base, triggering a significant drop down to its lowest point for the year at $4.15.

Historical precedent and price targets

Previously, the price level of around $8.60 has shown significant importance for Polkadot, acting as a turning point. Back in 2021, when Polkadot revisited this price, it led to extraordinary growth, culminating in DOT reaching its peak value ever recorded.

Personally, the unsuccessful retest earlier this year resulted in substantial losses for me, underscoring the crucial significance of this pivotal zone for any serious crypto investor like myself.

If the retest proves successful, the Digital Orbit Token (DOT) might target the upcoming significant resistance level at approximately $12.61. Given its present value, this could potentially represent a substantial increase of around 101.53%. This potential growth is calculated based on DOT’s past price trends.

Should the $8.60 level not be maintained, traders may find the price returning to previously held support levels, potentially even dipping back down to $4.15.

Metrics show bullish momentum

At the moment of reporting, Polkadot was exchanging hands for approximately $8.86, marking a 4.40% gain in the previous 24 hours and a notable surge of 16.97% over the last week.

At present, the trading volume over a 24-hour period amounts to approximately $1.03 billion. Currently in circulation are around 1.5 billion DOT tokens, which translates to a market cap of about $13.48 billion for this cryptocurrency.

According to information from Coinglass, the Open Interest (OI) experienced a significant jump of 8.74%, reaching approximately $499.25 million, and the trading volume surged by 22.03% to about $915.97 million.

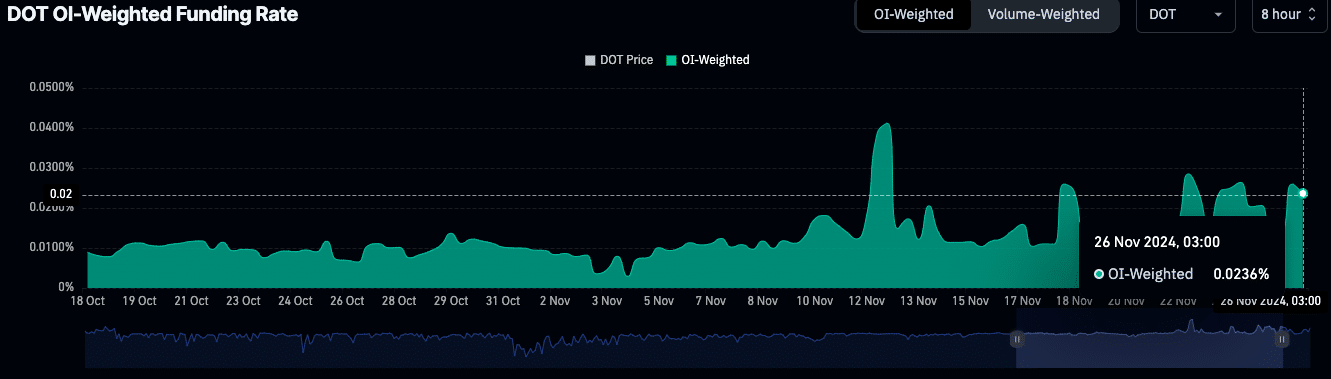

Furthermore, the OI-Weighted Funding Rate for DOT has consistently been positive since mid-November, indicating a robust interest in holding long positions.

On the 12th and 18th of November, we saw increases in investment rates, suggesting a strong optimism among investors. This trend is consistent with the market’s continued rise surpassing $8.60.

On-chain activity and technical patterns

The on-chain data indicates varying usage for Polkadot. As per DefiLlama, the current Total Value Locked (TVL) in Polkadot is approximately $55.89 million, representing a 27.44% drop over the past 24 hours.

The network’s stablecoin market capitalization is $89.13 million. Despite the TVL decline, the positive funding rates and rising open interest suggest traders are positioning for further upside.

Read Polkadot [DOT] Price Prediction 2024-2025

In simpler terms, Polkadot has just burst free from a bullish pattern called a falling wedge, which typically indicates an upcoming increase in price. This breakout coincides with the price surpassing $8.60, boosting the confidence of traders who are now more optimistic about its future growth.

Market observers are currently focused on the monthly closing price, as it might fortify the breakout should it remain above $8.60.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2024-12-01 02:15