- Asset has been trading within a defined channel, with press time technical indicators suggesting a possible move lower

- A divergence between the Money Flow Index (MFI) and TIA’s price could have a say too

As a seasoned analyst with years of market observation under my belt, I find myself scrutinizing Celestia [TIA]’s current price action with a mix of skepticism and intrigue. The 7.47% dip over the last 24 hours is certainly noteworthy, especially considering its impact on the broader trend that TIA has been maintaining since July.

Currently, Celestia [TIA] is experiencing a downward trend, having dropped by 7.47% in the last 24 hours. This decline has partially undone the progress TIA made over the past week. Given the mounting selling pressure, it’s important to consider various possibilities for TIA’s price evolution as diverse market opinions emerge. These viewpoints could suggest instability, but they also hint at the potential for substantial price fluctuations on the charts.

TIA price movement analysis

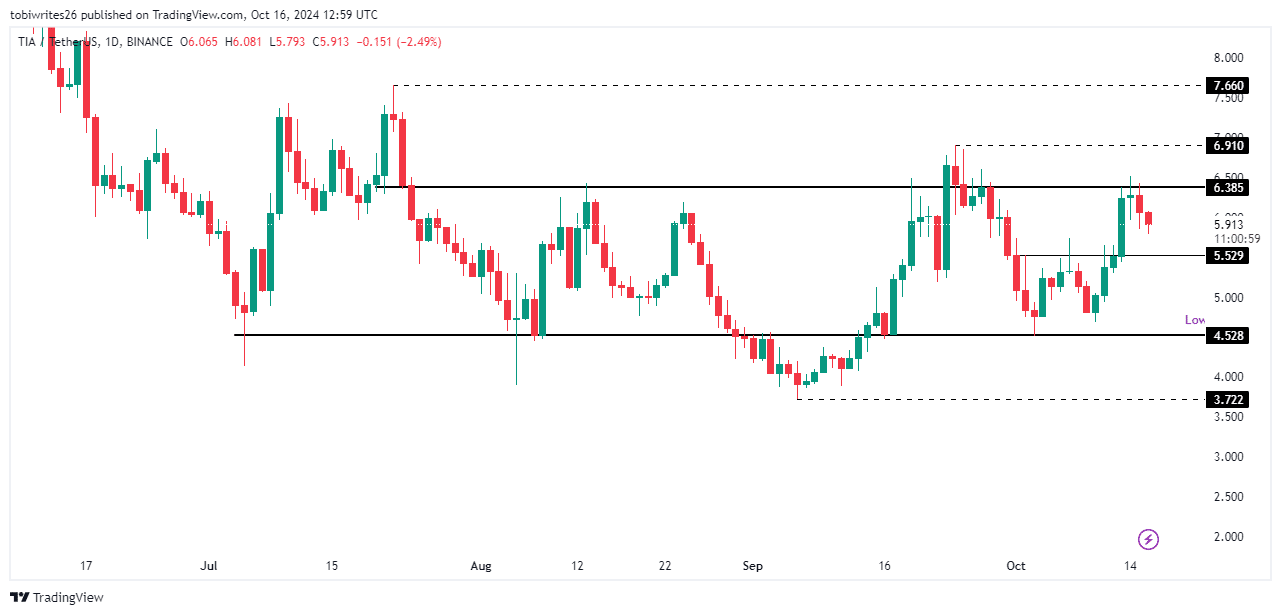

Currently, the TIA appears to be stuck within a consolidation trend lasting about a month, which has been ongoing since July.

Following an obstacle at the top of the channel, TIA has experienced a decrease over the last two days, suggesting a continued downward trend that might push the price to the support level of approximately $4.528. However, it’s worth noting that a brief reversal could occur. If TIA manages to reach the mid-term resistance at around $5.52 – a point with high liquidity – this could trigger a short-term surge, lifting the price before it resumes its downward course.

According to AMBCrypto’s analysis, there seems to be a dominant trader opinion that TIA might continue falling, given its current price of $5.895. In simpler terms, the general feeling among traders is that TIA could go down further.

Traders are selling aggressively

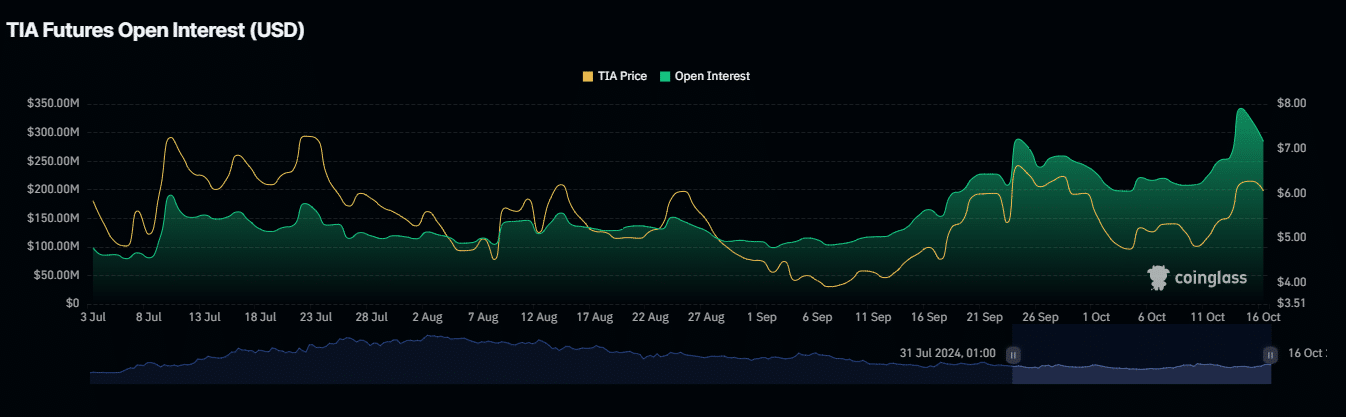

There’s been a noticeable surge in transactions for TIA, as evidenced by several on-chain indicators such as the Funding Rate and Open Interest. At the moment, the Funding Rate for TIA stands at -0.0377%, suggesting that short positions are currently paying long positions, which is often a signal that the contract price could be lower than the market price.

If the current downward pattern persists, the price of TIA may drop even more below its current value at the time of reporting.

Divergence suggested bullish momentum still exists

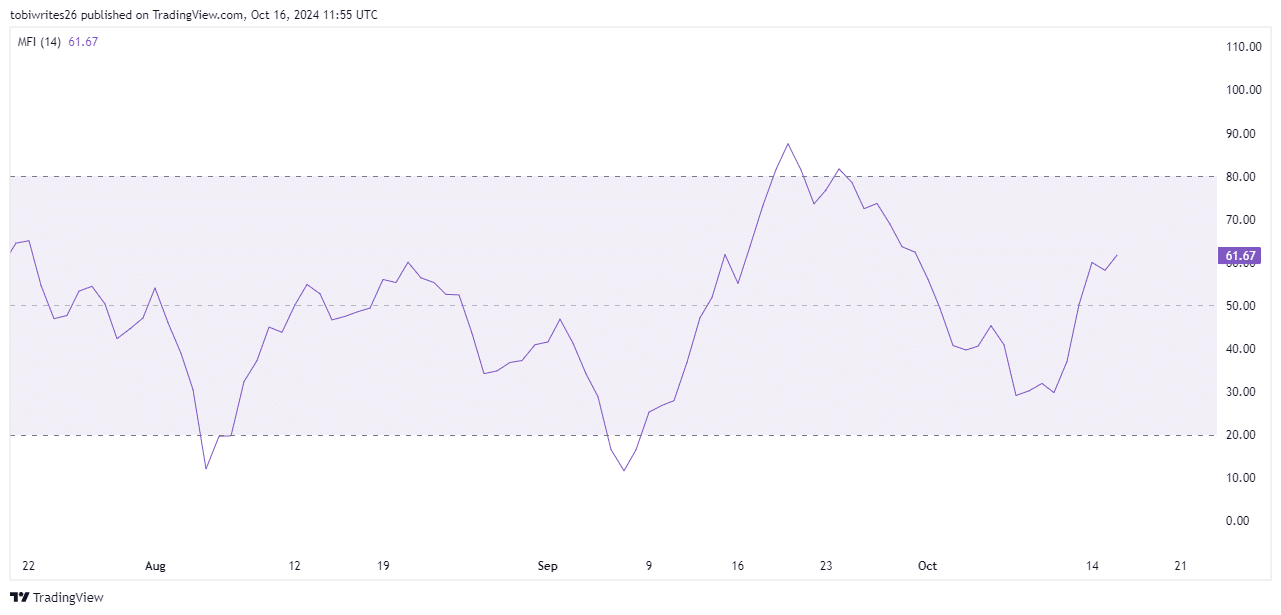

Based on the Money Flow Index (MFI), which gauges the movement of funds into and out of an asset, it appears that TIA might reverse its trend – more likely towards an increase in value. At present, while TIA’s price is falling, the MFI is heading northwards, suggesting a possible bullish indication. This pattern implies that even though the price is decreasing, there could be growing buying interest or accumulation in TIA.

If this trend continues, a reversal could be on the horizon for TIA’s price action.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-10-17 08:07