- As of press time, dYdX was the second best performing coin by gains.

- Approximately $1 million worth of DYDX was liquidated at $1.18 on Binance.

As a seasoned analyst with over a decade of experience in the crypto market, I have seen my fair share of bull runs and bear markets. The recent performance of dYdX (DYDX) has caught my attention, especially its impressive 38% surge in the last 24 hours, making it the second best performer among cryptos in the top 100 by market cap.

In the past day, dYdX [DYDX] has seen a significant jump of more than 38%, making it the second-strongest performer among the top 100 cryptocurrencies by market capitalization on CoinMarketCap.

dYdX, with its primary protocol fees going primarily to stakers in USDC, remains a cryptocurrency that garners interest for accumulation, particularly as we approach what’s expected to be a bullish last quarter of the year.

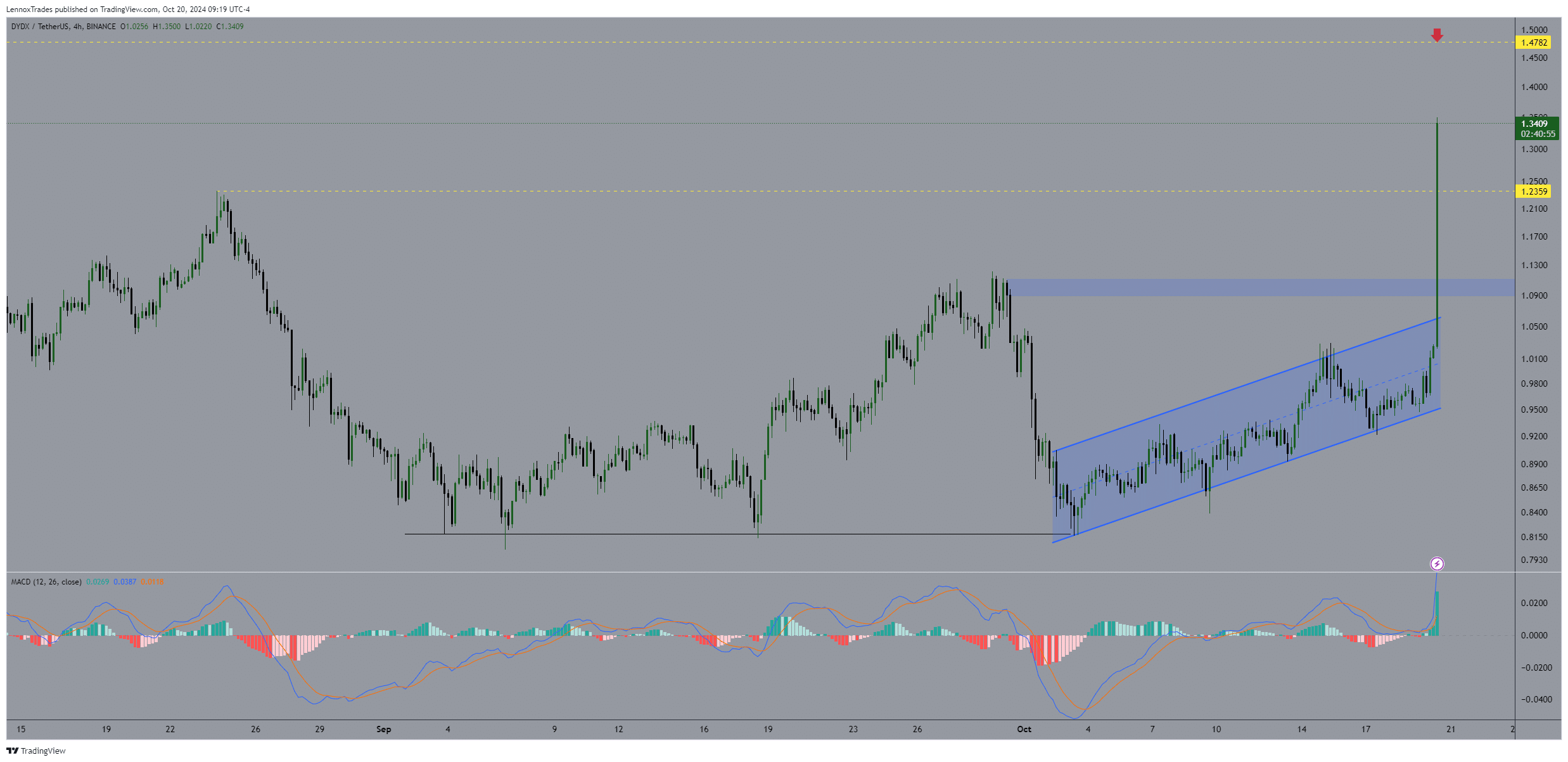

dYdX price action and prediction

Currently priced at $1.24, DYDX experienced an impressive 892% increase in trading volume, amounting to approximately $130 million within a day. This high trading activity equates to around 11% of its market cap, signifying substantial liquidity. This increased liquidity may help minimize potential significant price fluctuations in the coming days.

Regarding its price movements, it’s surged past the boundaries of an uptrend channel, contributing significantly to its strong advancements. The DYDX/USDT combination is persistently breaching resistance points, suggesting a possible target of $2 or more by the end of this month.

Despite DYDX being 48% lower this year, today’s surge may indicate a potential turnaround, provided it maintains its position above $1.4. This could pave the path for the projected price of $2 to be reached.

As a researcher analyzing market trends, I’ve noticed that the $0.83 level, tested on four occasions without being breached, appears to mark the bottom for this market cycle. This suggests a potential bullish trend could unfold into 2025. Additionally, the Moving Average Convergence Divergence (MACD) indicator has recently shifted bullish, lending further credence to the case for increasing prices.

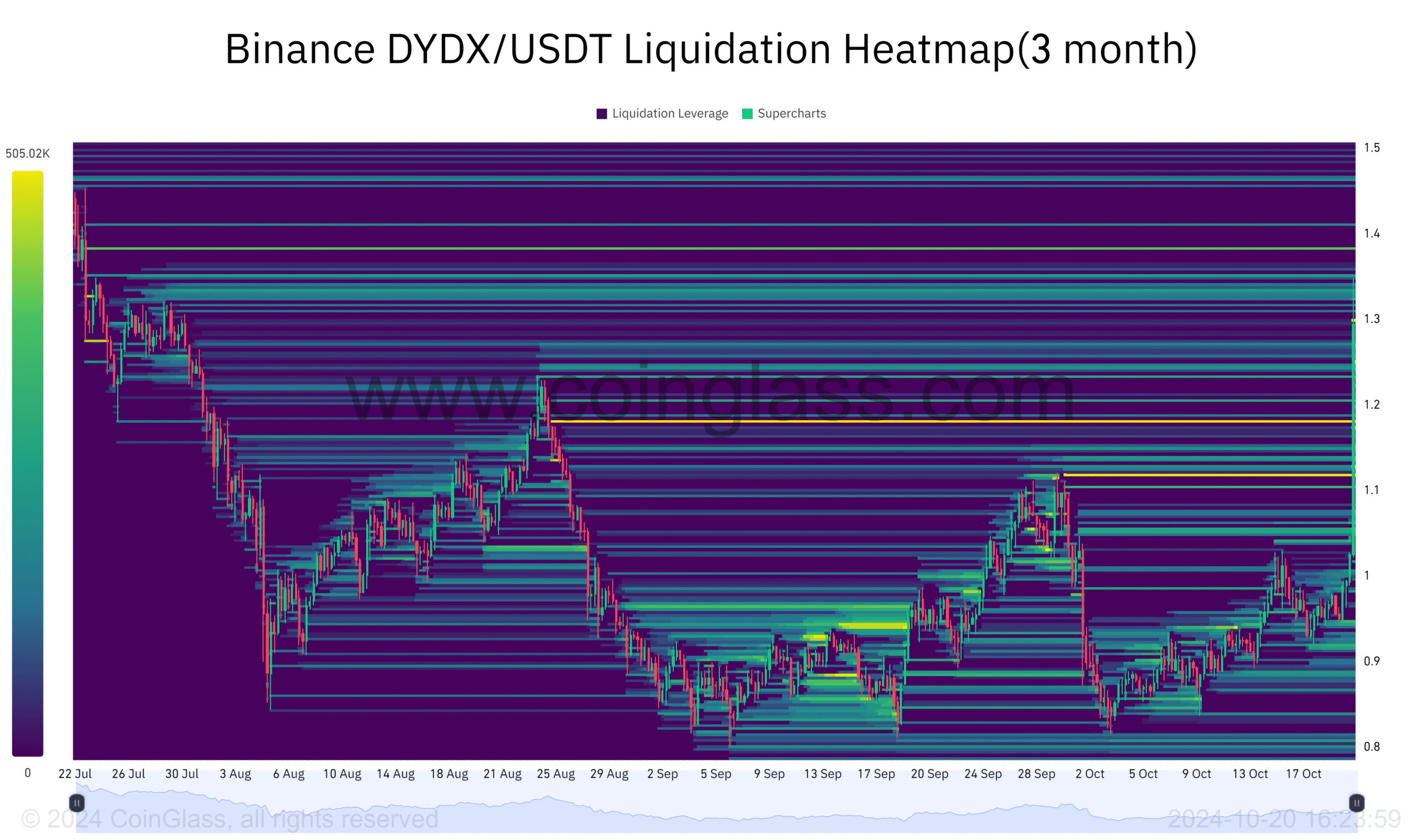

Liquidation and open interests

Furthermore, the liquidation heatmap indicates that DYDX’s price is trending towards regions with high liquidity levels, leading to substantial liquidations.

At the point of this writing, I’ve observed that approximately $1 million worth of DYDX was offloaded at a price point of $1.18 on Binance. Current market trends suggest a potential move towards the $1.3 zone for future liquidations.

With liquidity rising beyond its current state, it’s reasonable to expect that the price of DYDX may also rise, strengthening the optimistic viewpoint for the end of the year. A price target of $2 therefore appears plausible.

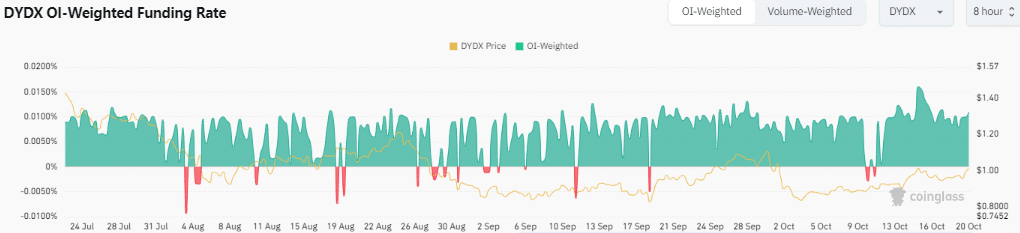

Regarding open interest, the funding rate (calculated by considering the open positions’ weight) currently stands at 0.0109%. This suggests that long traders are compensating short traders, implying a net payment from long traders to short traders.

Realistic or not, here’s DYDX market cap in BTC’s terms

A high rate of positivity indicates that token holders are optimistic about the token’s future, as they show growing enthusiasm for purchasing and keeping the chain’s digital currency.

It appears that DYDX is exhibiting significant market thrust, backed by advantageous technical signals and increasing trading volume. This could potentially lead to profitable returns by the end of the year.

Read More

- OM PREDICTION. OM cryptocurrency

- Solo Leveling Season 3: What You NEED to Know!

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Oblivion Remastered – Ring of Namira Quest Guide

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Gumball’s Epic Return: Season 7 Closer Than Ever!

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Lisa Rinna’s Jaw-Dropping Blonde Bombshell Takeover at Paris Fashion Week!

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

2024-10-21 11:35