In the grand theater of European finance, the central bank plays the stubborn old hero, clutching tightly to its beloved banknotes. Imagine the scene: Piero Cipollone, with a look of both determination and mild exasperation, proclaims that euros—those shining pieces of paper—are here to stay. Meanwhile, whispers swirl about a shiny new twin, a digital clone lurking behind the scenes, waiting to step into the spotlight. Oh, what a marvelous ballet of money we witness! 💶✨

He warns that if the public doesn’t embrace this digital apparition, those sneaky private stablecoins—like uninvited party crashers—might slip past, especially when crossing borders. Can you picture regulators trembling, clutching their calculators, as the digital dollar threatens to steal Europe’s thunder? Ah, modern chaos! 🧐📉

The Classic and the New: A Financial Double Feature

According to Cipollone’s charming blog post, the digital euro will be like a trusty sidekick—standing next to the cash, not replacing it. With full legal tender, you can choose your weapon—coin, note, or shiny digital token. It’s all about giving Europeans the *freedom* to pick their poison. 🍸💳

Back in April, Cipollone jabbed at stablecoins, warning that if Europe doesn’t launch its own digital euro, those sly foreign stablecoins could gobble up market share. The risk of being left in the digital dust is real, my friends! So, from the high towers of Brussels, a message rings out—“Let’s not miss the boat!” 🚤🚢

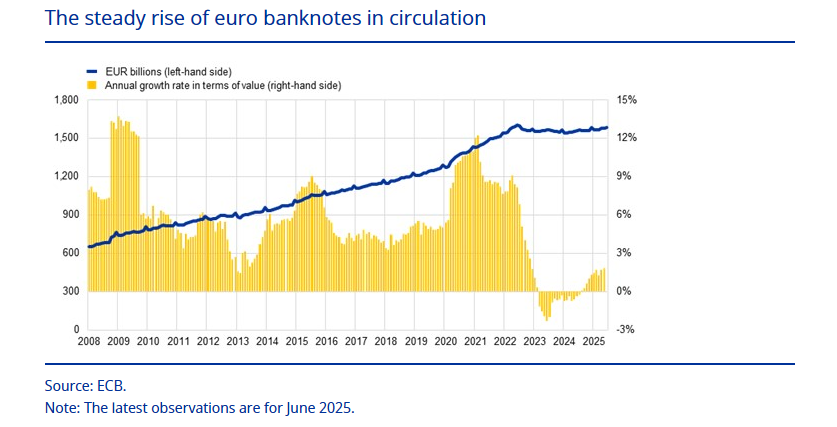

“Cash remains indispensable,” proclaims the dignified Cipollone, with a flourish. “We are modernizing banknotes, making sure they’re still the star of the show.”

And lo! The digital euro arrives, ready to sprinkle its benefits like fairy dust—combining old-fashioned tangible safety with the glitz of digital convenience. Truly, a spectacle to behold! ✨✨

— European Central Bank (@ecb) August 4, 2025

The Rise of the Private Coin Conspirators

Meanwhile, in the shadows, crypto payments are booming! Stablecoins—those enigmatic digital coins—are handling everyday shopping and cross-border deals faster than you can say “blockchain.” Most are tied to the US dollar, weaving their digital web beyond the reach of strict regulation. The ECB, trembling slightly, vows to keep its grip tight and not let these cyber-coins usurp Europe’s precious euros. 💻💸

Low Buzz, Heavy Wallets

Despite the hype, Europeans remain rather indifferent to the digital euro. A recent survey—conducted by tired economists—found that when asked to split a hefty sum among various assets, only a tiny fraction was allocated to the digital version. Cash still reigns supreme! Coins, bills, and good old bank deposits occupy the bulk of their wallets—predictably, perhaps, like an old reliable friend. 💰🤷♂️

Some clever analysts suggest the world needs a set of clear, universal rules for stablecoins. Basically, a legal playbook to tame the dollar-pegged digital beasts. Others advocate for regulated euro-stablecoins or the daring digital euro itself—anything to keep the chaos in check. The ECB, waving its flag high, yells: “Cash is here to stay,” but with a knowing wink—making it clear that innovation must not sacrifice stability. 🚀💼

And so, the grand orchestration continues: a digital euro unwieldy yet promising, ready to fit into every pocket—be it a bustling city or a tiny village where the ATM still reigns supreme. Ah, Europe’s money saga—never a dull moment! 🎭💶

Read More

- How to Get the Bloodfeather Set in Enshrouded

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Gold Rate Forecast

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- Best Thanos Comics (September 2025)

- Goat 2 Release Date Estimate, News & Updates

- Best Controller Settings for ARC Raiders

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

2025-08-04 23:12