- EigenLayer finally rolls out its EIGEN crypto with an impressive FDV and major listings.

- A recap of the EigenLayer’s TVL and other performance metrics.

As a seasoned analyst with years of experience in the cryptocurrency market, I’ve seen my fair share of launches and listings. The rollout of EIGEN by EigenLayer is undeniably impressive, especially considering its fully diluted valuation and major listings on exchanges like Binance.

In October, the Ethereum-based restaking protocol EigenLayer made its EIGEN cryptocurrency available for trading and staking, as announced by the Eigen Foundation via their official Twitter account (@EigenFoundationX). This action signifies that the token has been unlocked.

The anticipated release of the EIGEN token is likely to propel EigenLayer onto a rapid growth trajectory, fostering increased economic development and user interaction. Additionally, it is anticipated that this event will strengthen governance within the project and secure its position within the decentralized ecosystem.

Multiple top exchanges have already listed the EIGEN token including Binance.

Initially, EIGEN started trading at $4.05 per share and had an overall valuation of approximately $6.8 billion. However, by the time of the press release, it had dropped slightly to $3.85 per share. This decrease in price resulted in a market capitalization of around $727.14 billion. The maximum number of EIGEN tokens that can be in circulation is 1.68 billion, but at its initial release, only 186.58 million coins were circulating.

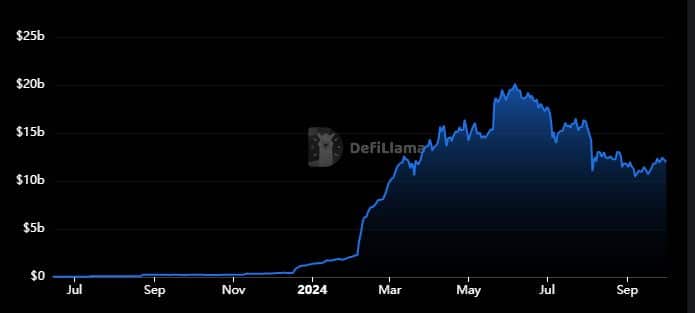

On its debut day, EIGEN reached a peak of $4.45 and a low of $3.52. Despite the token release event occurring recently within the past day, the EigenLayer network has been buzzing with activity throughout 2024. Remarkably, the total value locked in the network experienced a rapid growth spurt during the first half of the year, taking on a parabolic shape.

In December 2023, EigenLayer’s Total Value Locked (TVL) surpassed the $1 billion milestone and reached an all-time high of approximately $20 billion in June. However, since then, the staking protocol has seen substantial withdrawals. Currently, it maintains a respectable TVL of around $12 billion.

Will the EIGEN launch support more TVL growth?

Launching EIGEN could boost its social visibility, potentially leading to increased Total Value Locked (TVL). This increased visibility might motivate some token holders to deposit their tokens to earn rewards, which could result in a growth spurt.

As a researcher, I’ve noticed an upturn in the market, moving away from the bearish phase experienced between June and August. This positive trend, coupled with optimistic forecasts, seems to present favorable conditions for EIGEN staking.

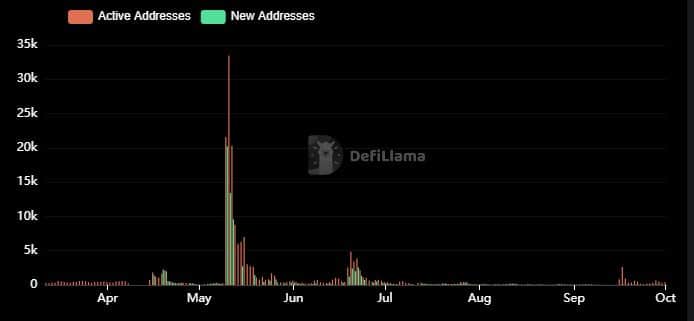

Restating the idea: EIGEN’s unlocking could potentially boost transactional activities at various addresses, which have seen a rather low level in recent months. The most active addresses we’ve observed in a single day this year were recorded in May.

33,000 active addresses reached a slight peak, while approximately 13,000 new addresses were added.

The active EigenLayer addresses have seen a significant decrease, with both the daily active addresses and newly created ones falling below 100 in August and September. However, there was a slight increase in address activity during the latter part of September.

With EIGEN now accessible, we’re eager to observe how this new phase may influence its future price trends.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- SOL PREDICTION. SOL cryptocurrency

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-10-02 09:43