- SEC sued Elon Musk for delaying disclosure of his X share acquisitions in 2022.

- Musk criticized the SEC as the community backed him.

In early 2022, the United States Securities and Exchange Commission (SEC) filed a lawsuit against Elon Musk, alleging that he did not promptly disclose his significant purchase of Twitter shares as required.

According to the SEC, this delay enabled Musk to purchase his shares at a lower-than-normal price, resulting in a savings of approximately $150 million.

Additionally, other investors were impacted by the late revelation. Unfortunately, they did not have the opportunity to cash out their stocks for possibly greater prices, as they were uninformed about Elon Musk’s role in the situation.

Why did the SEC sue Musk?

As an analyst, I’m bound to comply with SEC regulations, which stipulate that any investor who reaches more than a 5% ownership in a publicly-traded company must disclose this position within a ten-day window. It appears that Elon Musk may have overlooked this rule, as his reporting was allegedly delayed by eleven days.

The SEC alleged stating,

As an analyst, I find that Musk’s late disclosure of his beneficial ownership allowed him to acquire these assets from the general public at prices lower than their true market value, which might be considered artificial.

The SEC also added,

“That day, Twitter’s stock price increased more than 27% over its previous day’s closing price.”

In the given scenario, it is stated that Elon Musk, being the CEO of Tesla, started purchasing Twitter shares around early 2022. By March 14th, his ownership exceeded the 5% stake in Twitter.

From March 24th to April 4th, 2022, it’s said that Elon Musk acquired more shares worth over half a billion dollars, potentially costing Twitter shareholders around $150 million less than the market price.

According to the regulatory body, Musk not revealing his share ownership promptly enabled him to purchase stocks at unusually low costs because the market wasn’t aware of his substantial stockholding. This undisclosed essential information could have impacted the stock appraisals.

This occurred days before Gensler’s resignation

It’s worth noting that the SEC’s legal action falls in line with some notable changes in leadership, as Chair Gary Gensler is due to depart on 20th January, which signals the beginning of President Donald Trump’s term in office.

During this time, Musk is set to assume the leadership position in the freshly created “Department of Streamlined Government Operations” (DOSO), a role where he’ll provide suggestions to the incoming administration on improving and simplifying government functions.

The convergence of these advancements introduces a captivating dimension to the evolving tale about Musk’s role in relation to X (previously known as Twitter), from both a legal and political perspective.

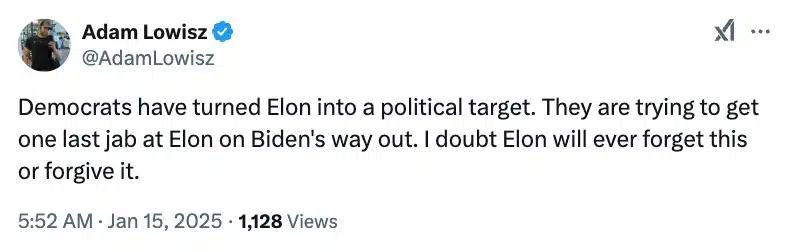

As anticipated, Musk took to X to voice his criticism of the SEC, and stated,

Completely disorganized, they seem to focus on trivial matters instead of addressing the numerous crimes that often remain unresolved.

Needless to say, the community stood in favor of Musk as highlighted by an X user who said,

Musk’a previous legal battle

Well, this isn’t the first instance of tensions between the Biden administration and Musk.

A little over a year ago, in August, accusations were made against Elon Musk claiming he deceitfully influenced the value of Dogecoin [DOGE] and engaged in illegal insider trading. These alleged actions are said to have resulted in substantial financial losses estimated in billions.

Instead, it’s worth noting that by August 29th, U.S. District Judge Alvin Hellerstein chose to rule in Musk’s favor and dismiss the lawsuit in Manhattan.

This version maintains the original meaning while using a more conversational tone.

Despite frequent spikes in value for meme-based cryptocurrencies such as Pepe [PEPE], Shiba Inu [SHIB], and Dogecoin [DOGE] after Elon Musk’s tweets, the court could find no clear proof that he intentionally manipulated the markets.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

2025-01-15 15:04