- Musk supports Trump’s push for presidential control over the Federal Reserve’s policies.

- Bitcoin gains momentum as a hedge against inflation amid rising U.S. national debt.

As an analyst with over two decades of experience in the financial sector, I find myself intrigued by the ongoing developments surrounding both the Federal Reserve and Bitcoin. The recent endorsement by Elon Musk for President Trump’s push for presidential control over the Federal Reserve’s policies is a fascinating turn of events. While I have my reservations about the potential consequences of such a move, it’s undeniable that the current system has its flaws, and change is often necessary.

In a straightforward manner, it can be said that Elon Musk, who holds key positions at Tesla and SpaceX, has often expressed his support for Donald Trump, notably during Trump’s presidential campaign in 2024.

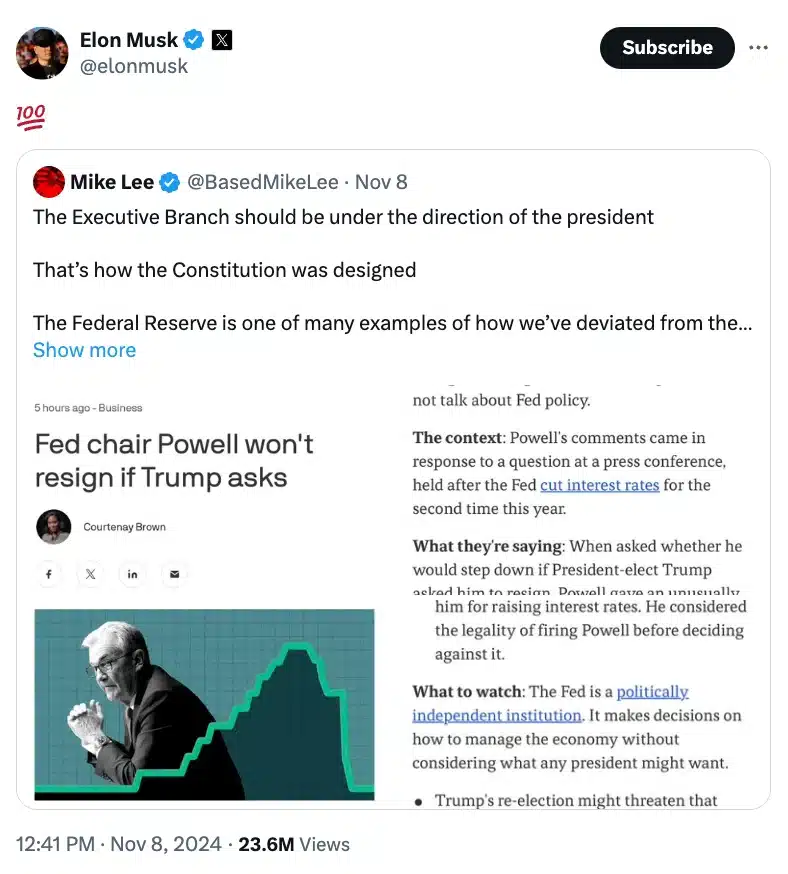

Following Donald Trump’s election as the 47th U.S. President, Elon Musk advocated for giving the president greater control over shaping Federal Reserve policies.

Senator Mike Lee on ending Federal Reserve’s power

This idea originated as a reaction to a recent statement made by Senator Mike Lee (R-Utah), who supports the notion that the Federal Reserve should be managed directly by the President.

Furthermore, the following day, Musk indicated his approval with a “100” emoji, which is often interpreted as indicating complete agreement.

To clarify, Senator Lee ended his tweet using the hashtag #EndtheFed, advocating for a significant change in the U.S.’s monetary policy strategy.

He said,

According to the Constitution’s design, the Executive Branch ought to be guided by the president. The Federal Reserve, like many other instances, represents a departure from this constitutional structure. This is just one more argument for dismantling the Federal Reserve.

How did this start?

In response to Federal Reserve Chair Jerome Powell’s decision not to resign at the request of President-elect Trump, which Lee saw as a symbol of an unchecked system, Musk expressed agreement with Lee on social media. This action ignited additional discussion about the influence of the Federal Reserve on the management of the U.S. economy.

In response to the community’s actions, I found noteworthy comments from a user identified as Truth Justice. As per their statement, the community responded in the manner they did.

“The end of government corruption.”

Tensions resurfaced when Federal Reserve Chairman Jerome Powell made clear that he had no intention of resigning, even at the behest of President-elect Trump. This implied a fresh bout of tension between the central bank and the White House.

What’s more?

Over time, the Federal Reserve has generally functioned autonomously when making decisions influenced only by economic factors. However, during Trump’s initial term in office, he often expressed criticism toward Powell’s policies.

As a crypto investor reflecting on the 2024 election campaign, I’ve noticed that Trump has shown an inclination towards exerting greater control over the Federal Reserve’s actions if he were to regain office. During a press conference at his Mar-a-Lago club in Florida, held in August, he made it clear that he intends to have more sway over the Fed’s decisions should he return as president.

“I feel the president should have at least [a] say in there.”

As expected, Musk also shared a similar sentiment in a recent tweet when he argued,

The federal bureaucracy that isn’t elected and doesn’t adhere to the constitution currently holds more authority than the presidency, congress, or the courts. It’s crucial that this imbalance is corrected.

How is Bitcoin the savior?

As the U.S. national debt surpasses $35 trillion, Bitcoin [BTC] is gaining recognition as a possible safeguard against inflation triggered by prolonged money printing. Advocates like Florida Chief Financial Officer Jimmy Patronis and Senator Cynthia Lummis are championing Bitcoin investments to preserve buying power.

As a researcher exploring the evolving landscape of U.S. economic strategies, I’ve noticed that President Trump has proposed utilizing Bitcoin to manage our national debt. This proposal underscores the expanding role of Bitcoin in our nation’s financial planning. Consequently, as the discourse on Bitcoin’s financial influence deepens, its potential as a shield against inflation is garnering more and more interest.

In fact, an X user put it best when he said,

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

2024-11-11 21:12