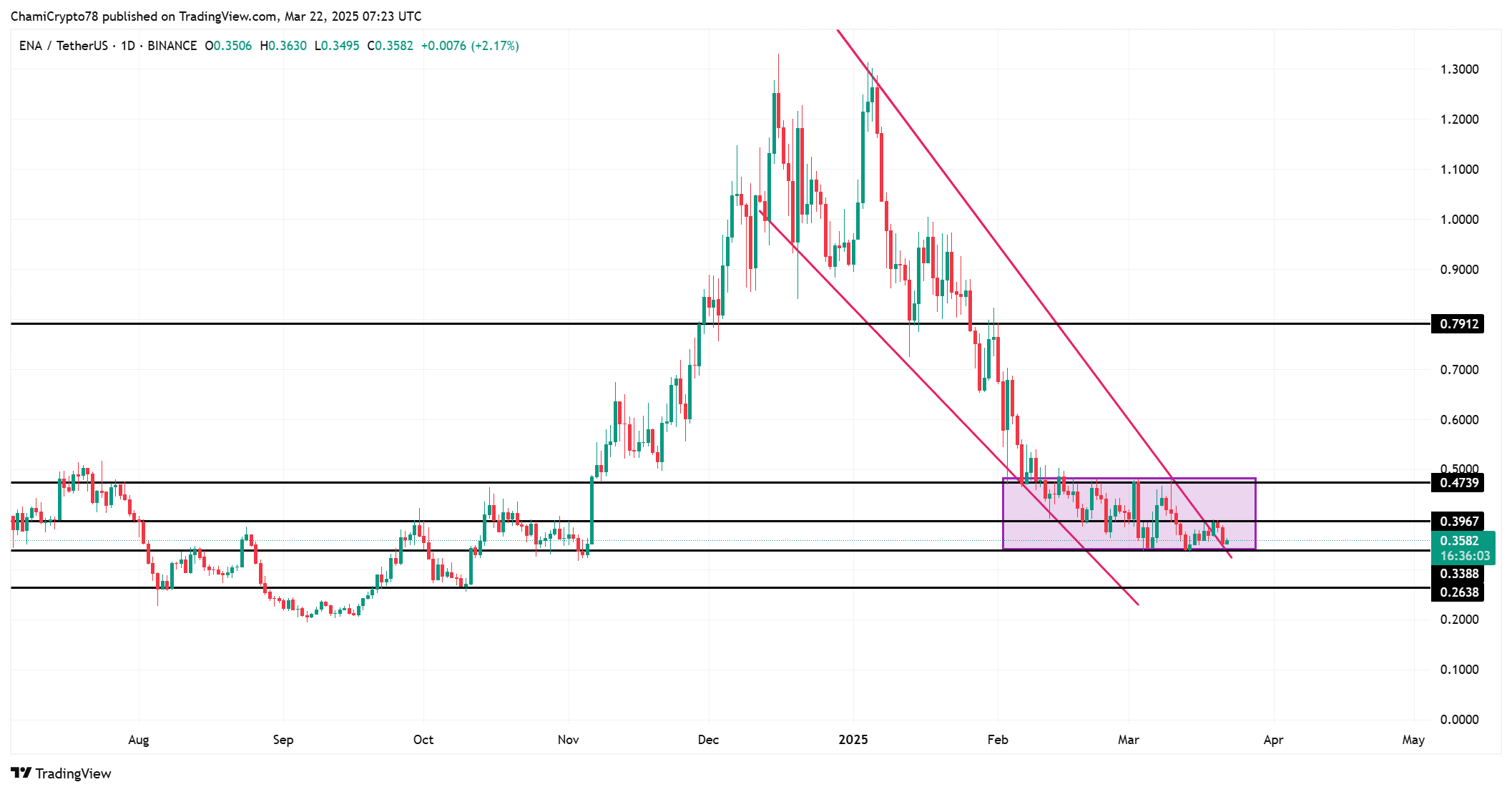

- ENA, the darling of the speculative set, has flung itself from a dreary descending channel, flirting with crucial supports – think of $0.35 and $0.47 as the lifebuoys in this tempestuous sea.

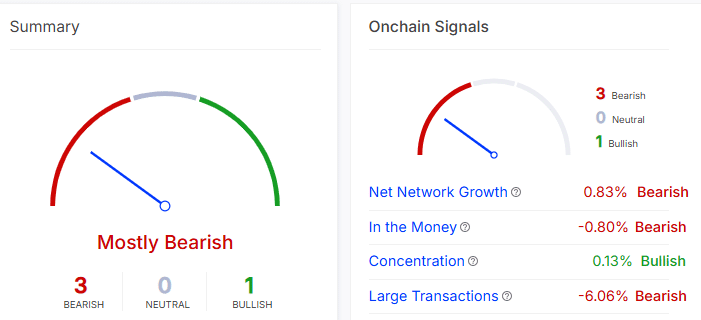

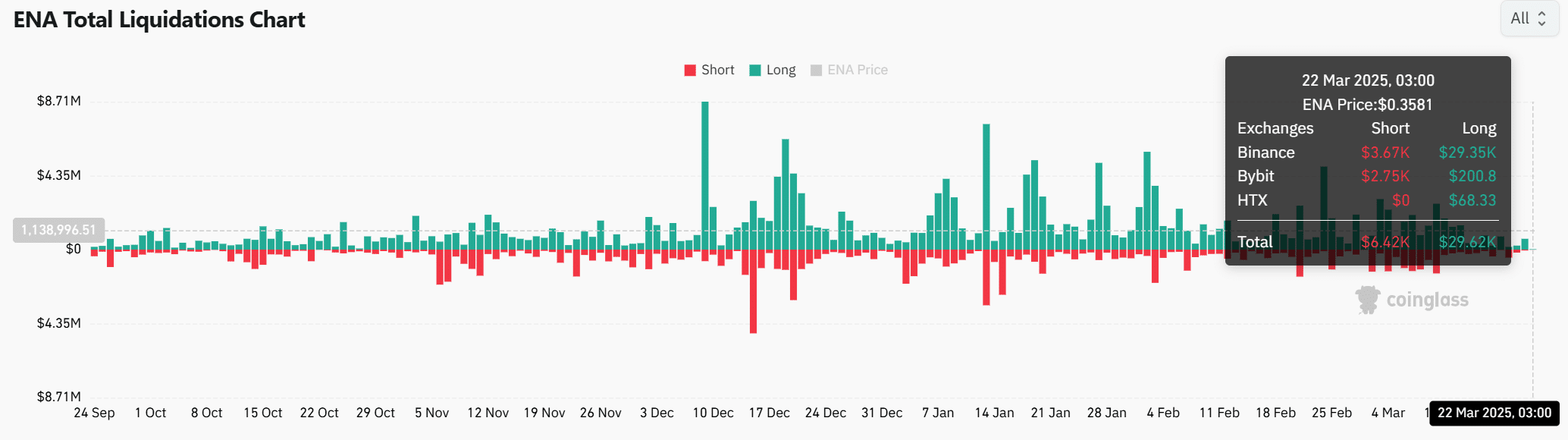

- On-chain signals, however, are as cheerful as a rainy day in London, with long liquidations outpacing shorts – decidedly bearish, my dear.

Ethena, or ENA as the chic financiers call it, has made a dramatic escape from its descending channel prison, igniting a spark of hope among the investment class. At the stroke of my pen, ENA is gallivanting at $0.3583, after a rather insignificant3.44% tumble. With a market capitalization that would make a small country blush (a cool $1.89 billion) and a daily trading volume that screams “look at me” ($135.5 million), ENA is the talk of the town. 🌟

But, my darlings, the question lingers like a bad perfume: Can ENA keep up this daring act, or will it falter under the weight of its own ambition?

Price action analysis – ENA: Rising Star or Falling Comet?

Before its grand escape, ENA was in a tedious phase of consolidation, much like waiting for a pot to boil. The breakout was a spectacle, reshaping the altcoin’s narrative. With ENA now hovering around $0.3583, the $0.35 support level is the make-or-break moment – the crux of our little drama. 🎭

If ENA can cling to this lifeline, it might dare to dream of reaching $0.47, perhaps even flirting with the likes of $0.48, $0.68, and the coveted $1.00. However, should it slip, a retreat to $0.26 could be its inglorious fate.

On-chain signals – The Plot Thickens

On-chain data, the oracle of our tale, paints a gloomy picture for ENA. Despite its breakout bravado, the network growth is declining by0.83% – a sign that the party might be winding down. The “in the money” metric, with its -0.80% change, suggests that many are holding wilting roses rather than blooming profits. 😢

Concentration, with its meager0.13% positivity, and large transactions, dropping a staggering -6.06%, point towards a market that’s more bearish than a grumpy old man. These signals hint that ENA’s path to glory might be littered with thorns.

ENA Open Interest and Liquidations – A Twist in the Tale

Open interest in ENA has seen a3.38% surge, reaching $345.78 million, a testament to its allure. Yet, liquidations tell a different story – $29.62k in longs versus a mere $6.42k in shorts. This imbalance suggests a market under pressure, but once the storm clears, a rebound might be on the horizon. 🌈

For a true Cinderella story, ENA must conquer the resistance at $0.47 and $0.48. Only then can it hope to dance at the ball until midnight and beyond.

ENA’s Breakout: A Comedy or a Tragedy?

ENA’s breakout, while thrilling, faces the dual challenge of bearish on-chain signals and critical support levels. Should it hold above $0.35 and breach the $0.47 resistance, a rally towards heavenly heights might be within reach. 🚀

However, failing to maintain these key levels could see ENA’s ascent turn into a descent faster than you can say “cryptocurrency.” The future, my friends, is as unpredictable as the British weather, but one thing’s for certain: ENA’s journey will be anything but dull. 🍸

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2025-03-23 02:20