- Ethena, oh Ethena, with a bearish structure on the daily chart, how you do torment us!

- OBV moved past local highs, but the price, alas, seems reluctant to follow. How ungrateful!

Ethena’s price [ENA] dipped below the $0.5 support zone in February, but fear not, for its decline appears to have paused at press time. Indeed, a range formation below the $0.5 resistance has emerged, presenting traders with the tantalizing prospect of profit. How delightful!

And what of Bitcoin [BTC]? The world’s leading crypto, with all its grandeur, visited the $92.8k resistance on Thursday, 6 March, only to be rejected once again. Will ENA share a similar fate and take a nosedive over the weekend? Only time will tell, and time, my dear friends, is a fickle friend. 🕰️

ENA buyers appear to have the upper hand now

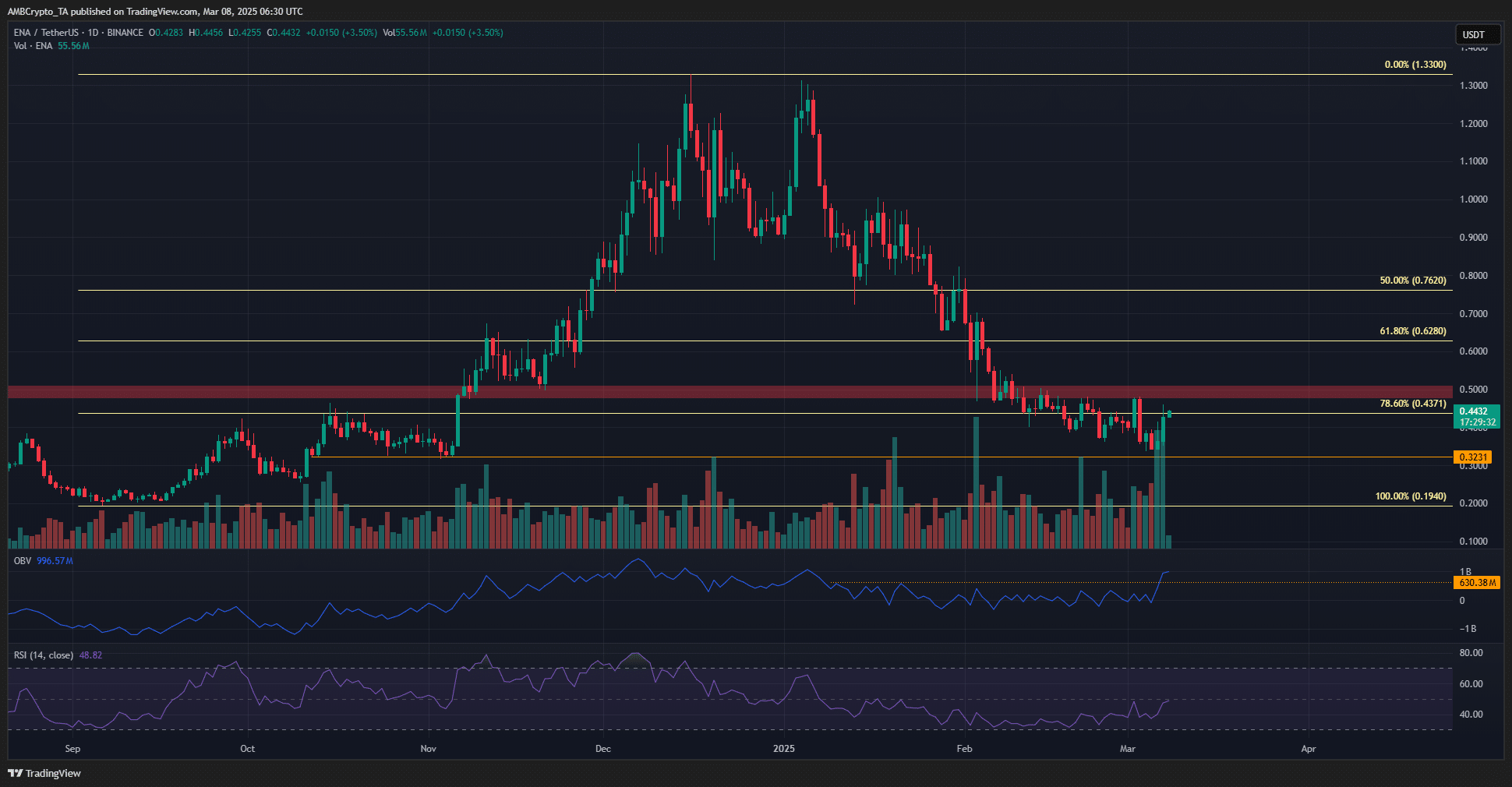

The market structure on the daily chart, dear reader, is decidedly bearish. The price has only made lower highs and lower lows in 2025, a true testament to the market’s melancholy. The most recent lower high was at $0.48, and a daily session close above that would hint at a market structure shift. How thrilling!

The trading volume has been high over the past couple of days, as evidenced by the volume bars below the price. This influx of volume has caused the OBV to break out beyond the last two months’ local highs. A true spectacle of market dynamics!

At press time, the RSI was testing neutral 50 as resistance, suggesting a potential momentum shift around the corner. Together, they hinted at a bullish move on the charts. How fortuitous!

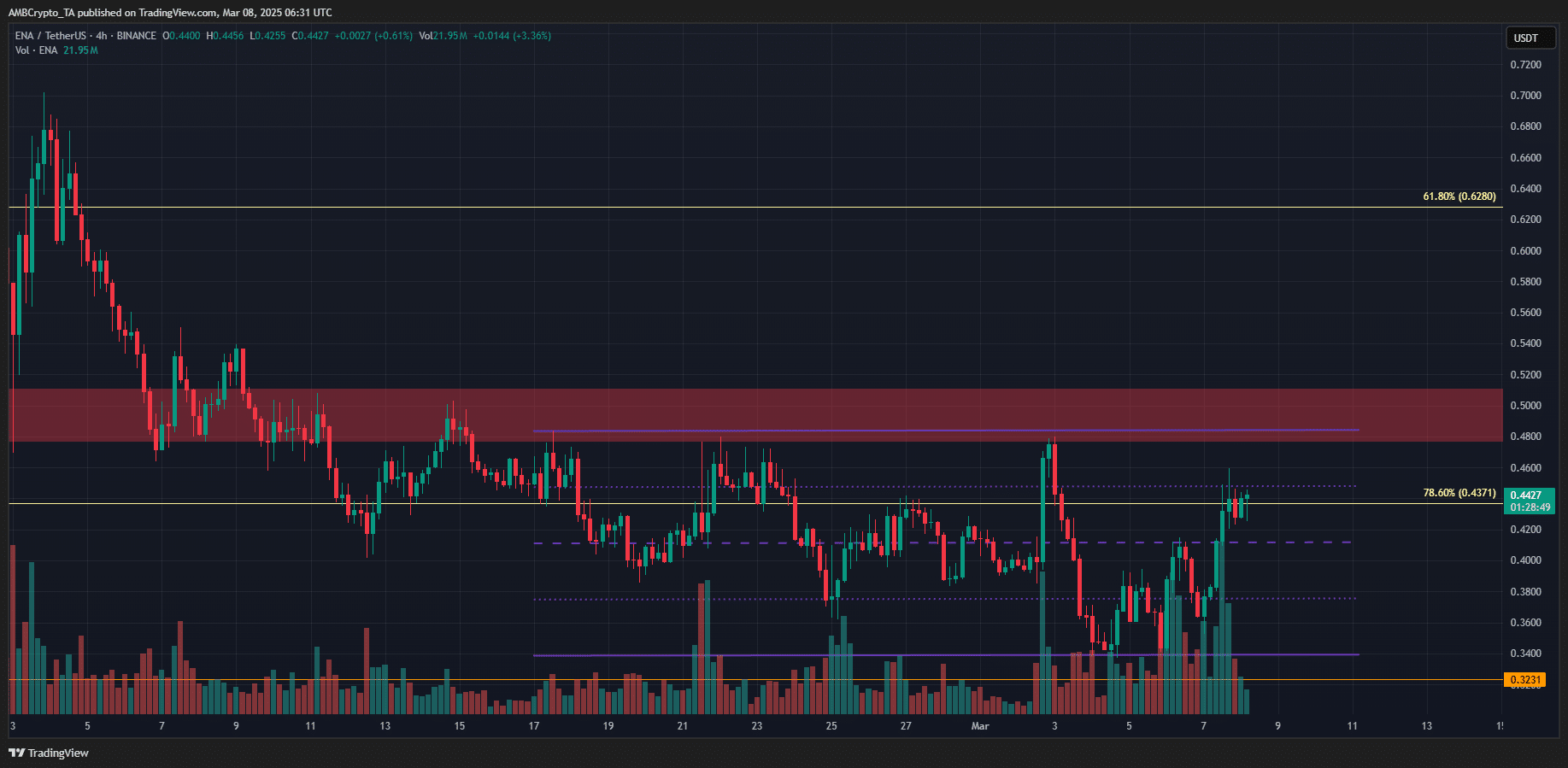

Zooming into the 4-hour chart, we can see a range formation (purple) with the highs within the $0.5 resistance zone. At press time, ENA bulls were wrestling with the range’s 25% level at $0.448. A true battle of wills!

Even if they manage to overcome it, a breakout beyond $0.5 may not yet be at hand. Despite the OBV breakout, traders should remain bearish and look to sell the retest of $0.48-$0.5. This, because the higher timeframe bias remains bearish. Oh, the irony!

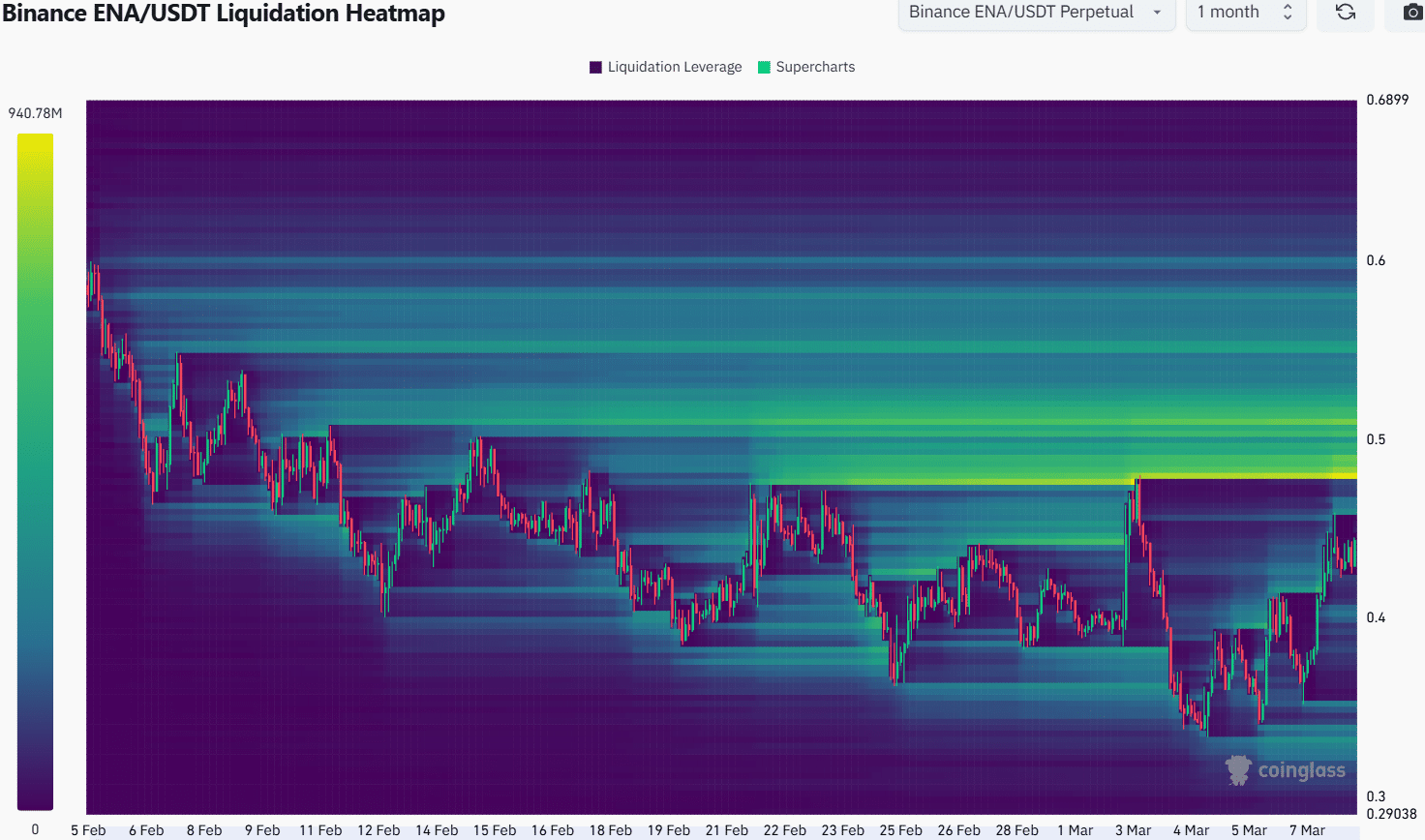

The past month’s liquidation heatmap highlighted the $0.48-$0.515 as a strong magnetic zone. Therefore, it may be highly likely the price would test this region soon, as price is attracted to liquidity. These liquidity clusters also formed prime reversal regions. How poetic!

Swing traders can use a move beyond $0.515-$0.52 to set up a stop-loss, if they were looking to sell. A move beyond $0.52 would invalidate the bearish idea laid out here. The mid-range level at $0.412 and the lows at $0.34 would be the bearish targets. How one must navigate the treacherous waters of the market! 🌊

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2025-03-08 11:18