-

ENS has seen consecutive price increases in the last 24 hours.

More traders are betting on a continued price rise.

As a seasoned crypto investor with a keen eye on the market trends, I have witnessed firsthand the remarkable surge of Ethereum Name Service (ENS) in the past 24 hours. The consistent price hikes and increasing trading volume are undeniably captivating, leaving me optimistic about its potential for further growth.

In recent cryptocurrency market activity, the Ethereum Name Service (ENS) coin has gained prominence, notably in the past day. Its favorable price movement has attracted noteworthy interest from investors.

The recent surge in demand has significantly influenced not just the spot markets, but also the derivatives market. This increased interest is clearly reflected in certain derivatives indicators hitting record highs.

ENS coin leads 24-hour gain

As a crypto investor, I’ve noticed some exciting movements in the market lately. Among them, the Ethereum Name Service (ENS) coin has caught my attention. Based on recent data from CoinMarketCap, ENS has experienced remarkable growth within the past 24 hours. At present, I’m observing a surge of over 24% for this coin. Earlier in the day, its peak increase even exceeded 30%.

The significant hike in price has resulted in a considerable expansion of the company’s market value, with a growth of more than 23% observed.

Reaching over $1 billion in market capitalization is a notable achievement for ENS, a milestone not attained in some time.

An extra noteworthy development is the significant surge in Ens’s trading activity within the past day. The trading volume has swelled by more than 80%, reaching approximately $293 million at present.

As a researcher observing the market trends, I notice an uptick in trading activity surrounding ENS, indicating a surge in market engagement and increased liquidity. This observation implies that a larger number of traders are actively participating in the ENS market.

ENS makes a strong price push

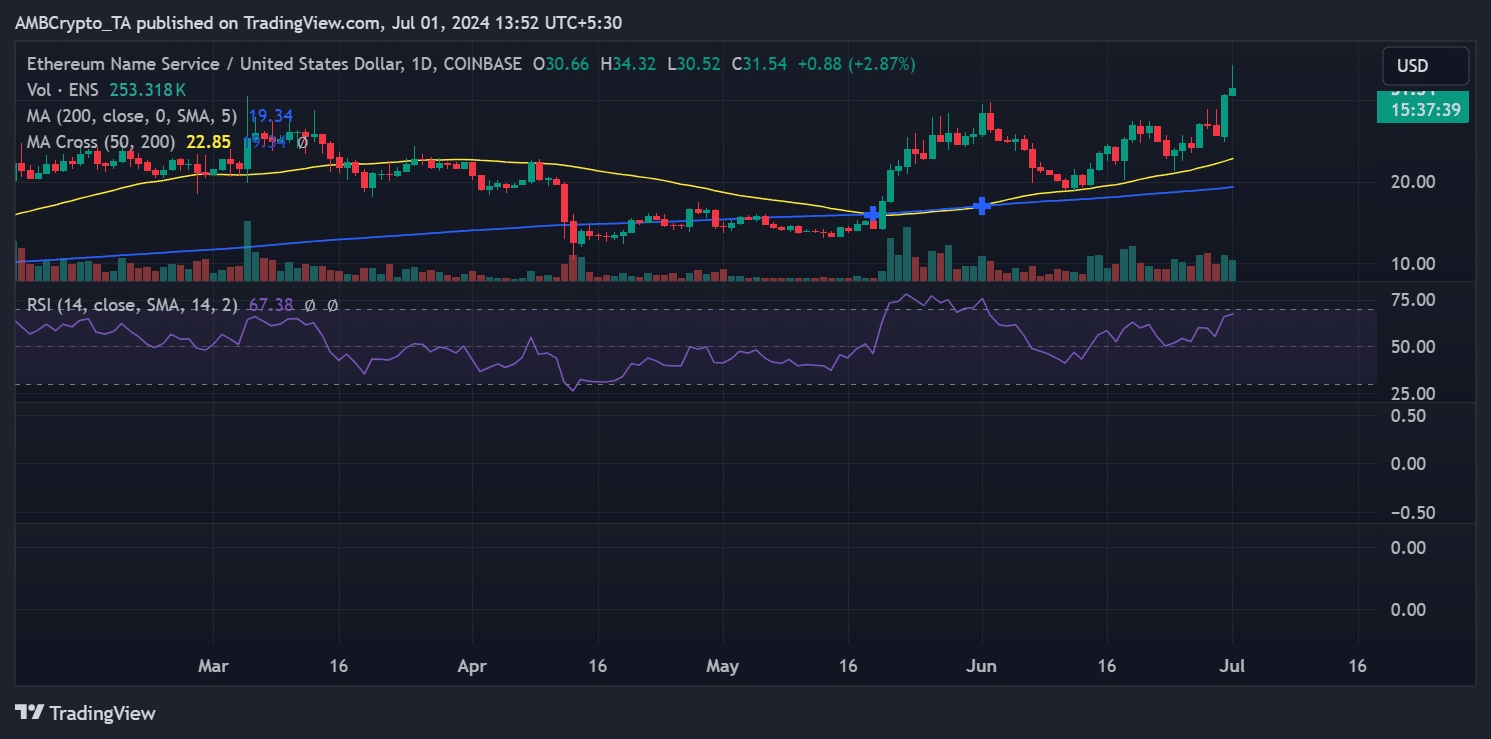

In the past several days, Ethereum Name Service (ENS) underwent contrasting patterns when examined on a daily basis. Nonetheless, a substantial surge in pricing occurred at the market’s end on June 30th.

The surge led to a significant 19% price jump, raising the value from approximately $25.6 to more than $30. The positive trend persists, as Ethereum Name Service (ENS) experiences an extra 2% rise and is now trading above $31.

As a crypto investor, I’ve been closely monitoring the Relative Strength Index (RSI) of ENS, and it has been signaling a robust bull trend. Currently, the RSI is hovering around 70, which typically suggests that the asset may be overbought. However, an RSI reading this high also indicates substantial buying momentum, so it’s essential to keep an eye on the market developments before making any decisions.

As a market analyst, I can observe that ENS‘s latest market performance showcases its resilience and significant impact within the industry. This noteworthy trend could pique the interest of both retail and institutional investors seeking opportunities to capitalize on these powerful market shifts.

Open interest sets record

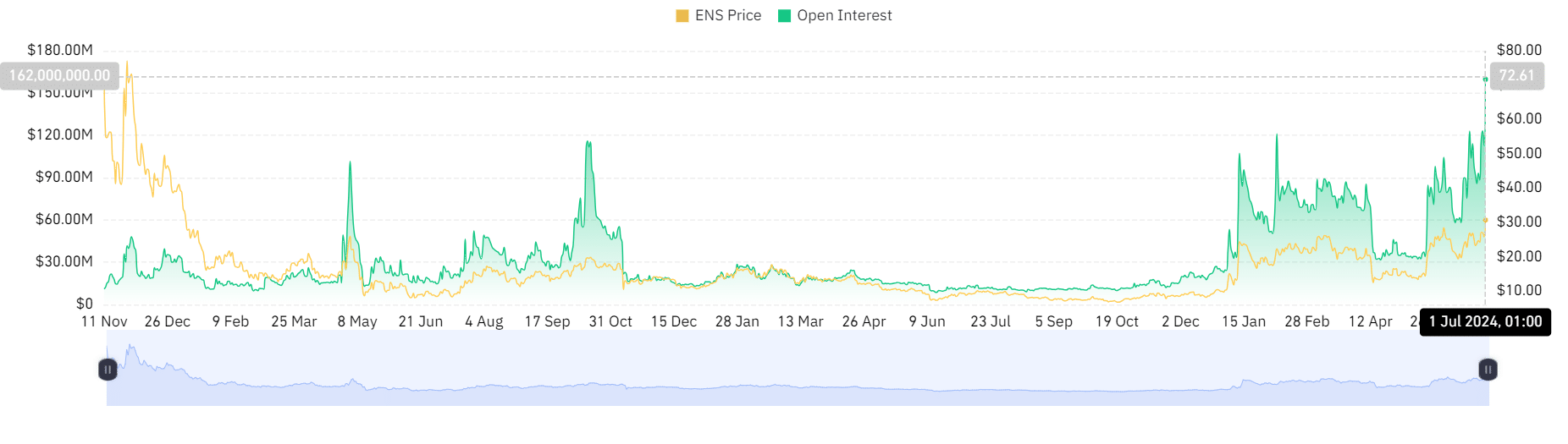

An examination of the open interest for the Ethereum Name Service token on derivatives trading platforms indicated a surge in investor activity and heightened anticipation.

In the past two days, open interest has seen significant back-to-back increases, surpassing $139 million on June 30th.

The upward trajectory persists, with open interest now approaching a record-high of around $160 million based on the most recent figures. This amount signifies the largest volume of open positions in ENS that has been seen to date.

Further insights were gained from examining the funding rate trends of ENS derivatives. This metric, representing the expense of maintaining open futures contracts, shifted from a negative to a positive value within the past day.

Realistic or not, here’s ENS market cap in BTC’s terms

At present, the funding rate hovered approximately around 0.0107%. Typically, this is indicative of heightened interest in acquiring long positions, which is often a positive market indicator.

In simpler terms, when the funding rate is positive, it means long traders are prepared to compensate short traders for holding their opposing positions. This situation frequently arises from market sentiment expressing bullishness and anticipation of future price growth.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-07-02 06:15