- EOS has fallen by over 90% from its ATH

- The network is set to have its hard fork on 25 September

As a seasoned crypto investor with a knack for finding diamonds in the rough, I’ve seen my fair share of ups and downs in this wild world of digital assets. I’ve been following EOS closely since its inception, and it’s safe to say that this coin has had quite the rollercoaster ride.

More recently, EOS unveiled an eagerly anticipated network overhaul prior to the forthcoming hard fork, signifying its significant first update in quite some time. This revamp includes numerous novel attributes intended to boost the network’s performance. Nevertheless, while there has been much optimism surrounding the upgrade and the upcoming hard fork, EOS has experienced a relatively subdued response in the marketplace.

Also, EOS continues to rank outside the top 50 cryptocurrency assets by market capitalization.

EOS gets stable upgrade

As stated by the EOS Network Foundation’s official declaration, the network has recently deployed the Spring 1.0 update, which is known as Antelope Spring v1.0.0. This is the largest upgrade that EOS has experienced since it was first established approximately seven years ago.

The update is emphasized as being designed to boost the system’s speed, safety, and capacity for growth, thereby preparing it to manage higher transaction numbers more effectively and increase network efficiency overall. These advancements are anticipated to position EOS more favorably in competition and allow it to accommodate a wider variety of decentralized applications (dApps).

After implementing the latest update, EOS is strategically preparing to tackle significant problems and smooth the path towards its forthcoming hard fork. This move could indicate a notable shift for the network as it strives to reclaim its pace in the cryptocurrency market.

EOS sees minimal response

Over the last few months, a study of EOS’s price movement has shown a consistent drop in its value.

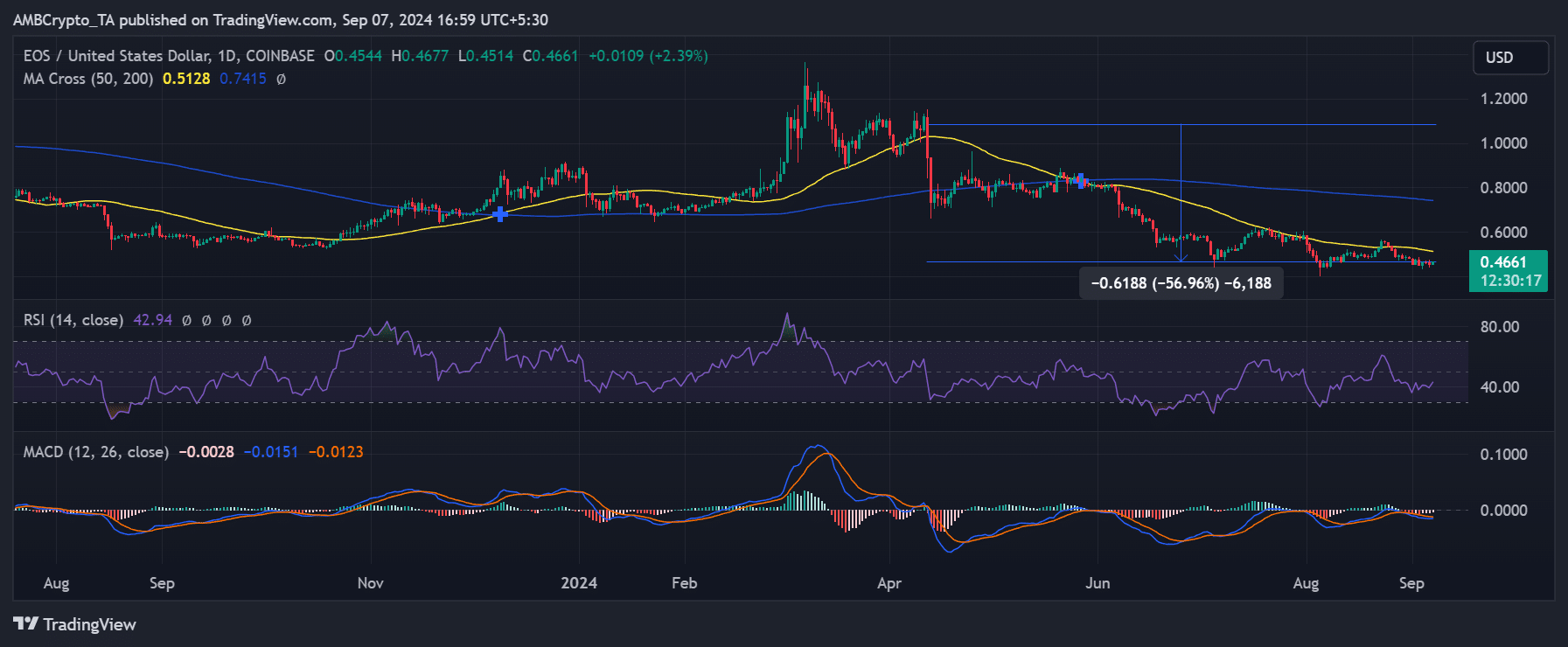

The rapidly increasing trend line (depicted in yellow) has doubled, supporting the downward trend, and this trend has held strong as a barrier to EOS’s price increase for approximately six months, hindering any significant upward momentum.

As I pen this analysis, EOS is hovering roughly around $0.466, reflecting a moderate surge of approximately 2%. Yet, since April, when the yellow line transitioned from a support level to resistance, EOS has experienced a significant drop exceeding 50%, as per the price range indicator’s indication.

Upon closer examination of the Moving Average Convergence Divergence (MACD), it was found that both the histogram and signal lines were below zero, suggesting a dominant downtrend. This pattern of indicators implies that while there has been a minor rise recently, EOS is still in a bearish state.

And, the asset faces challenges in overcoming resistance and reversing its downward momentum.

How it compares with other crypto assets

As an analyst, I’ve recently observed that EOS, a cryptocurrency I’m tracking, currently stands at the 70th spot in terms of market capitalization, according to data from CoinMarketCap. At this moment, EOS holds a market cap of approximately $706 million. Regrettably, EOS has experienced a steep decline since it hit its all-time high of $22.71, marking an 98% drop from its peak value.

This significant drop indicates that EOS may be facing challenges in holding its ground within the crypto market.

TVL sees short-term hike

To sum up, according to DeFiLlama’s assessment, EOS’s Total Value Locked (TVL) has noticeably decreased over the years. Interestingly, contrary to this trend, the TVL values have been on an upward trajectory for the past three days, rising from $115 million to $119 million.

And yet, despite this modest hike, the overall trend showed no major activity or growth on the network. Simply put, there’s no telling if and when the altcoin’s long-term decline will ever reverse itself.

Read More

2024-09-08 06:15