Ah, the midday market-a ballet of numbers, a waltz of wealth, where the Dow Jones, that venerable matron, pirouettes ever so slightly upward, while the Nasdaq, a gauche adolescent, stumbles into the orchestra pit. The S&P 500, meanwhile, stands by, sipping its champagne, mildly perturbed by the spectacle.

Wall Street’s Grand Ball: Dow’s Elegance, Tech’s Tantrum

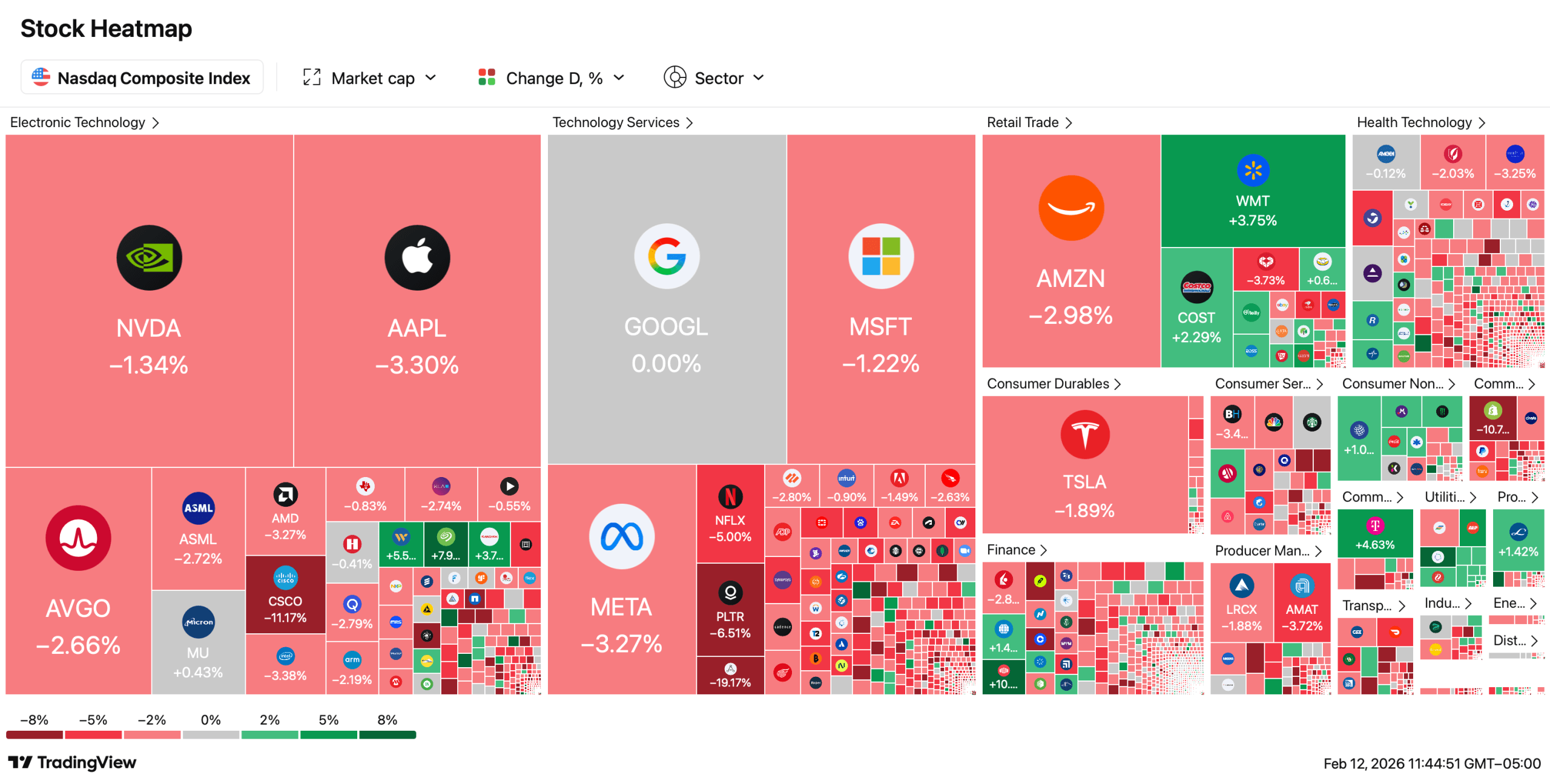

As the clock struck late morning on this February 12th, the Dow, with the poise of a seasoned dancer, hovered near 50,145, a mere 23 points, or 0.05%, above its starting position. The S&P 500, ever the wallflower, slipped modestly by 28 points, or 0.41%, to 6,913. But oh, the Nasdaq! That tempestuous prima donna, plunged 216 points, or 0.94%, to 22,850, its tutu in disarray. The NYSE Composite, a stalwart partner, gained 18 points to 23,498, unimpressed by the drama.

This divergence, my dear reader, is the fruit of a jobs report as robust as a Wagnerian overture. January added 130,000 nonfarm payrolls, a figure that dwarfed the meager 55,000 expected. Unemployment, that persistent specter, retreated to 4.3%, leaving the labor market as taut as a violin string. Yet, this very resilience has dashed hopes for the Federal Reserve’s dovish coos, sending Treasury yields into the 4.15% to 4.18% range on the 10-year note. Technology stocks, those delicate flowers, wilted under the heat, while financials and industrials, the burly suitors, flourished.

The rotation, a grand pas de deux, was evident across sectors. Energy and industrials, with their sturdy frames, led the charge, while software and semiconductors, those ethereal creatures, faltered under the weight of AI-driven anxieties and stretched valuations. Applovin, despite its earnings bravura, tumbled as investors pondered the long-term whims of artificial intelligence. Cisco Systems, too, declined, its revenue growth overshadowed by cost pressures. Yet, Novocure soared on FDA approval, and Vertiv and Globalfoundries advanced, their earnings a beacon of hope.

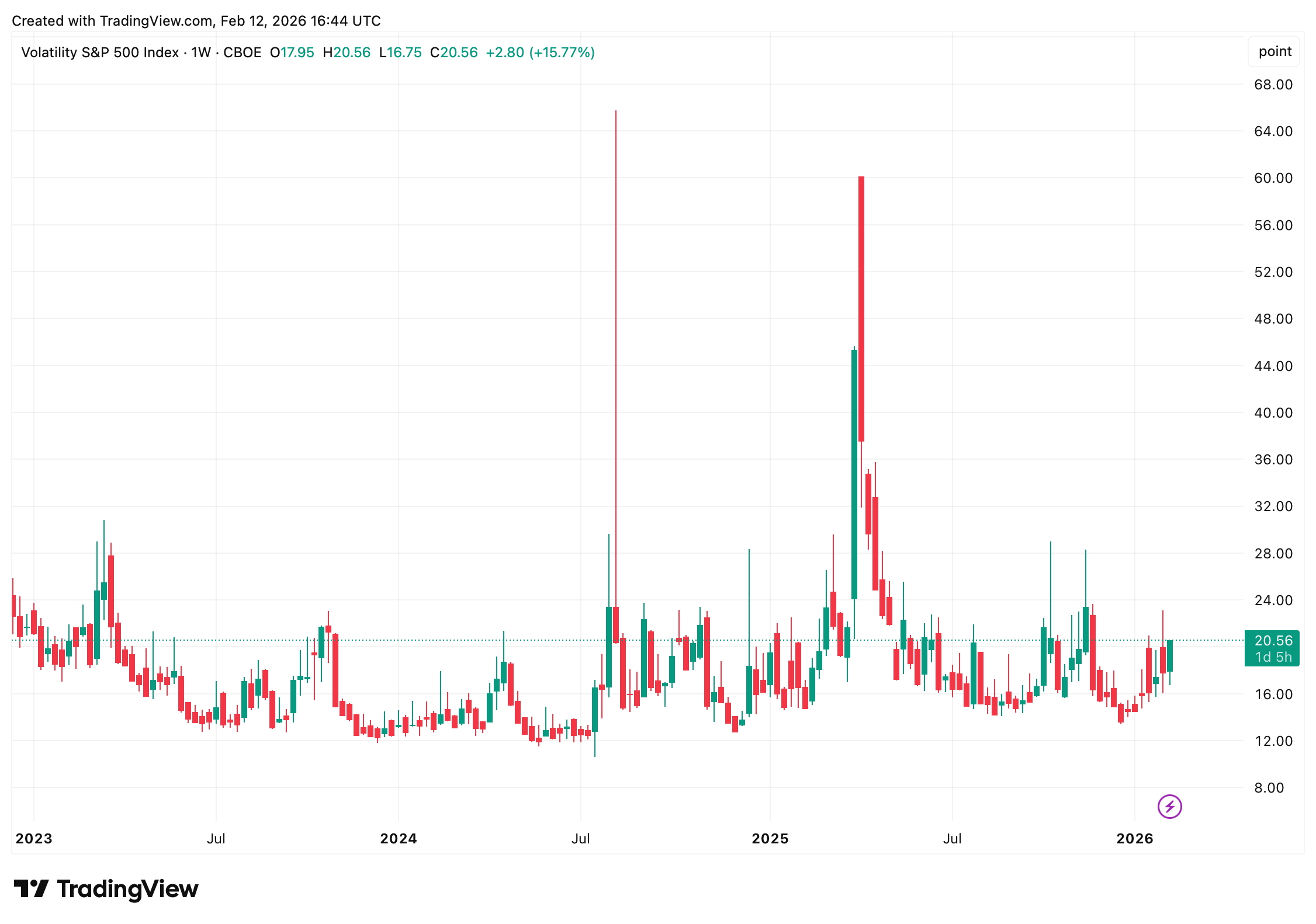

Volatility, that fickle muse, remained contained. The VIX, a mere 17.5, suggested only a mild flutter of concern, even as the Nasdaq wallowed in its misery. The S&P 500, ever the optimist, clings to its modest year-to-date gains, though its leadership has shifted like a fickle lover, from mega-cap technology to the broader embrace of cyclicals and value.

All eyes now turn to Friday’s Consumer Price Index (CPI) report, a climactic aria in this financial opera. Economists anticipate inflation near 2.5%. A softer reading might rekindle rate-cut fantasies, offering solace to growth stocks. A hotter number, however, could cement a “higher-for-longer” narrative, prolonging the rotation into cyclicals and value. For now, Wall Street stands neither in panic nor euphoria, merely repositioning its pieces on the chessboard as fresh data dictates the next move.

FAQ ❓

- Why does the Dow ascend while the Nasdaq descends?

Investors, those fickle beings, are swapping their tech darlings for the sturdy embrace of cyclicals and industrials. - How did the jobs report stir the markets?

Strong payroll growth dampened hopes for Fed rate cuts, sending yields skyward like a rocket. - What role does AI play in today’s trading?

AI, that modern sphinx, casts a shadow over software and semiconductors, its promises and perils alike. - Why is Friday’s CPI report so crucial?

Inflation data, the oracle of our times, may dictate the next move in this equities ballet.

Read More

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Survivor’s Colby Donaldson Admits He Almost Backed Out of Season 50

- Best Controller Settings for ARC Raiders

- Resident Evil Requiem cast: Full list of voice actors

- Gold Rate Forecast

- The 10 Best Episodes Of Star Trek: Enterprise

- How to Build a Waterfall in Enshrouded

- Best Shazam Comics (Updated: September 2025)

- Best Thanos Comics (September 2025)

- 10 Best Shoujo Manga Writers

2026-02-12 20:57