Bitcoin and ether ETFs are currently experiencing outflows that would make a desert feel like a monsoon. Solana, meanwhile, is sipping from a bottomless cup of investor cash, and XRP’s ETF debut? Let’s just say it’s throwing confetti at everyone’s expense.

Bitcoin and Ether ETFs: A Tale of Two Cryptocurrencies (That Are Both Losing Money)

Friday’s ETF trading was a masterclass in financial theatrics. While Bitcoin and ether ETFs bled like a sadistic horror movie, Solana and XRP strutted in like they’d just won the crypto lottery. Investors, apparently, are now taking a crash course in “abandon ship” strategy. 🚫💸

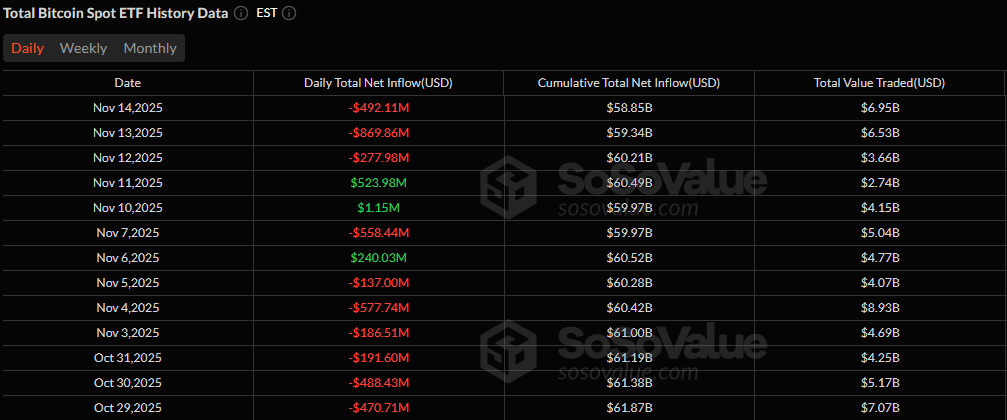

Bitcoin ETFs? They’re on a three-day losing streak that would make a toddler cry. Blackrock’s IBIT alone lost $463 million-enough to buy a small island, or at least a decently sized yacht. Grayscale’s GBTC added insult to injury with a $25 million outflow. Wisdomtree’s BTCW and Fidelity’s FBTC? They’re just here to sprinkle salt on the wound. The only bright spot? Grayscale’s Bitcoin Mini Trust managed a $4.17 million inflow. It’s like throwing a life preserver to a sinking Titanic. 🌊

Trading volume hit $6.95 billion, but net assets plummeted to $125.34 billion-a local low that’s less “record” and more “embarrassment.”

Ether ETFs? They’re following Bitcoin’s lead with a $177.90 million outflow. Blackrock’s ETHA led the exodus with a $173 million exit, while Grayscale’s ETHE added $4.63 million to the chaos. Total value traded? $2.01 billion. Net assets? $20 billion. Investors are clearly channeling their inner Scrooge. 🧣

Solana ETFs, however, are the party crashers we didn’t know we needed. Bitwise’s BSOL raked in $12 million, pushing net assets to $541 million. It’s like crypto’s underdog finally got a standing ovation. 🎉

The real shocker? XRP ETFs debuted with a $243 million inflow. Canary’s XRPC didn’t just enter the market-it threw a parade. 🎊 This isn’t just a win for XRP; it’s a middle finger to anyone who thought altcoins couldn’t steal the spotlight.

With investors swapping majors for alternatives faster than you can say “HODL,” the ETF landscape is becoming a wild west of financial chaos. Buckle up. 🤠

FAQ 💸

- Why did Bitcoin and ether ETFs see another major outflow day?

Investors fled $670 million from BTC and ETH ETFs, likely because they’re tired of watching their portfolios turn into modern art. 🎨 - How did Solana ETFs perform despite the broader market weakness?

Solana’s ETFs are the equivalent of a superhero in a world of villains-$12 million inflow and rising net assets. 🦸♂️ - What was the biggest surprise in Friday’s ETF flows?

XRP ETFs’ debut was so flashy, it made Bitcoin blush. $243 million in one day? That’s not just a win; it’s a flex. 💪 - What does this mean for the broader crypto ETF landscape?

It’s like the crypto equivalent of a restaurant chain suddenly specializing in kale smoothies. Investors are pivoting faster than you can say “alt-season.” 🥦

Read More

- Best Controller Settings for ARC Raiders

- Survivor’s Colby Donaldson Admits He Almost Backed Out of Season 50

- How to Get the Bloodfeather Set in Enshrouded

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

- How to Build a Waterfall in Enshrouded

- Best Werewolf Movies (October 2025)

- These Are the 10 Best Stephen King Movies of All Time

- Yakuza Kiwami 3 And Dark Ties Guide – How To Farm Training Points

- Meet the cast of Mighty Nein: Every Critical Role character explained

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

2025-11-15 21:54