- The ETH/BTC pair is trading within a bullish pattern on the monthly timeframe, which could influence a positive price movement.

- Buying activity is gaining momentum as more traders adopt a bullish outlook.

As a seasoned analyst with over two decades of experience in the crypto market, I have witnessed countless bull and bear cycles. The current setup for Ethereum [ETH] is reminiscent of opportunities we seized back in 2017, when we successfully navigated the crypto boom.

The latest showing of Ethereum (ETH) has been rather underwhelming. It peaked at $4,100 on December 2nd, but then dropped by 20.13% to $3,200 according to Trading View, indicating a persistent selling trend among market participants.

Regardless of current sales, there’s a strong indication of a bullish trend emerging – a high-likelihood configuration suggesting that the selling pressure could wane soon, allowing buyers to take control and potentially push prices upwards.

High-probability setup emerges: Will ETH rally soon?

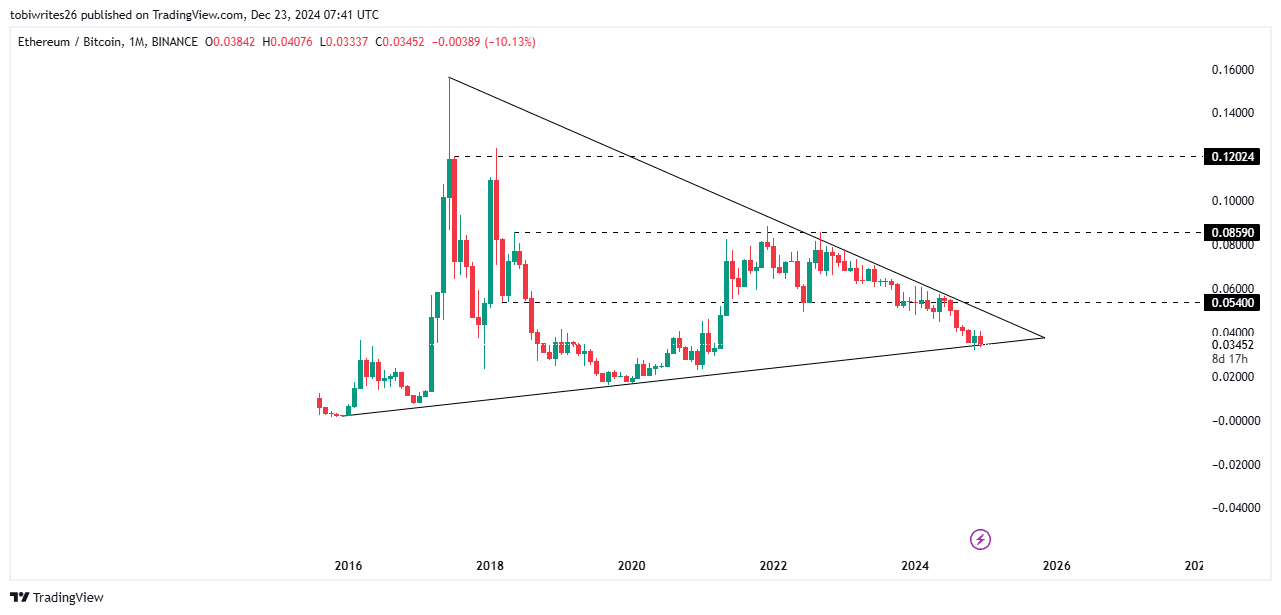

There’s a possibility that the value of ETH relative to BTC could increase, as a specific pattern called a symmetrical triangle has appeared. This pattern is formed by the price fluctuating between two lines (support and resistance) that are gradually converging towards each other. This setup suggests a high probability for a significant move in either direction, often leading to a breakout or a breakdown of the triangle.

Viewing this pattern on a monthly scale increases the confidence that there will be a rise beyond the current levels.

Right now, the price is hovering close to the lower part of the pattern, which acts as a strong foundation, suggesting it could soon experience a substantial increase.

If this trend continues, Ethereum (ETH) might surge. Keep an eye on these three crucial points: $0.0540, $0.0859, and $0.1202. This implies that the cost of purchasing 1 ETH using Bitcoin (BTC) could potentially rise.

As ETH/BTC continues to climb toward those levels, it will likely boost the ETH/USDT price, currently sitting at $3,200. Should the upward momentum continue, Ethereum could regain its former heights around $4,000 and potentially reach even higher prices.

Sellers are losing steam

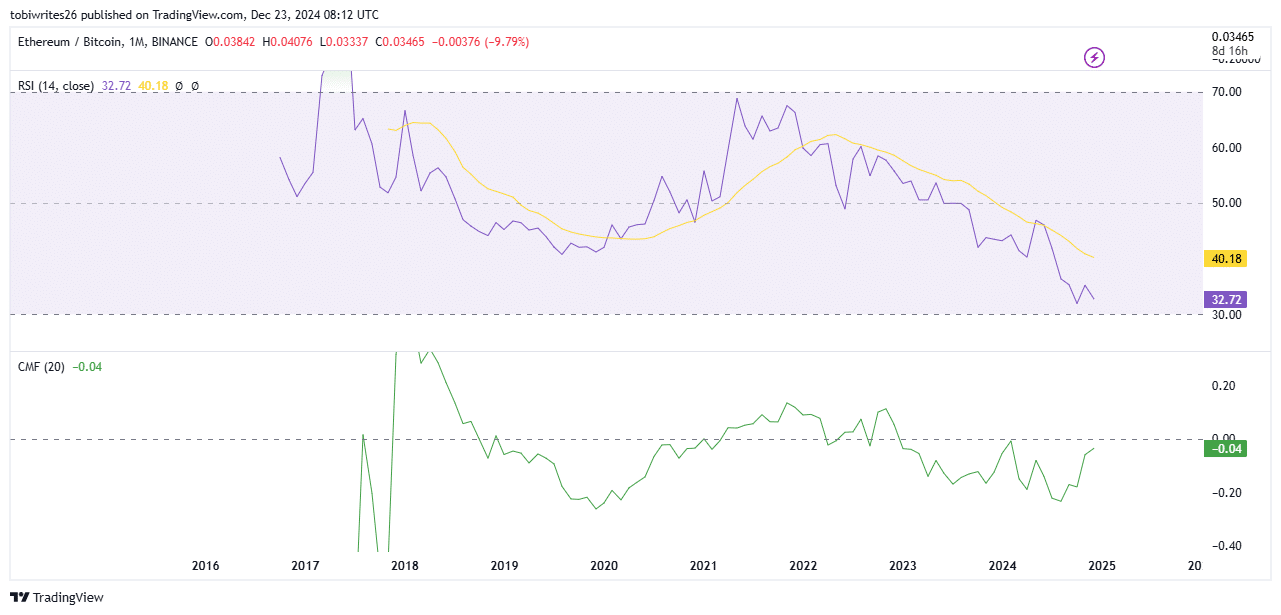

It seems that sellers have been gradually losing their strong position in the market lately. The Relative Strength Index (RSI), which had been decreasing for several months, is nearing the oversold zone at 32.19.

As an asset approaches the oversold region, typically marked at 30, it often signals a decrease in selling pressure, potentially hinting at forthcoming buying activity. Should this pattern persist, Ethereum’s (ETH) price might increase due to growing demand, thereby becoming more costly.

The decrease in selling pressure becomes more evident as the Chaikin Money Flow (CMF) indicator climbs up and moves closer to a positive range.

The Capital Movement Factor (CMF) gauges the ratio of purchasing and selling activity within the market. When it tilts positively, this indicates that buyers have gained an upper hand, as their trading volume exceeds that of the sellers, suggesting a potential market uptrend.

Moving higher might boost the cost of Ethereum (ETH), suggesting a possible change in market direction and an upsurge in its worth.

Accumulation spree for ETH

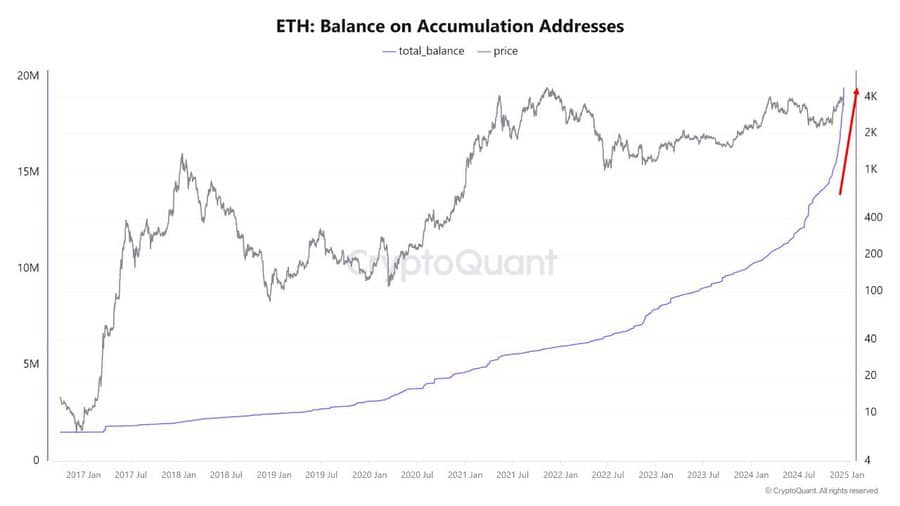

Information from CryptoQuant suggests an escalation in the ongoing hoarding of Ethereum (ETH), suggesting that an increasing number of wallets view the asset as a long-term investment.

Presently, there’s been a 60% rise in the number of Ethereum addresses. These addresses now represent around 16% of the total Ethereum supply, which is approximately 19.4 million ETH. This figure was only at 10% back in August, indicating a substantial change in investing patterns among users.

Read Ethereum’s [ETH] Price Prediction 2024-25

Such an accumulation trend is often considered a bullish indicator. It suggests growing confidence among investors and the potential for a substantial price rally.

If this trend continues, ETH could be in position for a significant upward move in the near future.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2024-12-24 08:07