- Ah, the Ethereum ETFs, they have gracefully logged a staggering $10M, leading to a total outflow of $100M over the past two days. Quite the spectacle, wouldn’t you agree?

- Could it be that the waning CME ETH yield is the culprit behind this ongoing exodus? A mystery worthy of a novel!

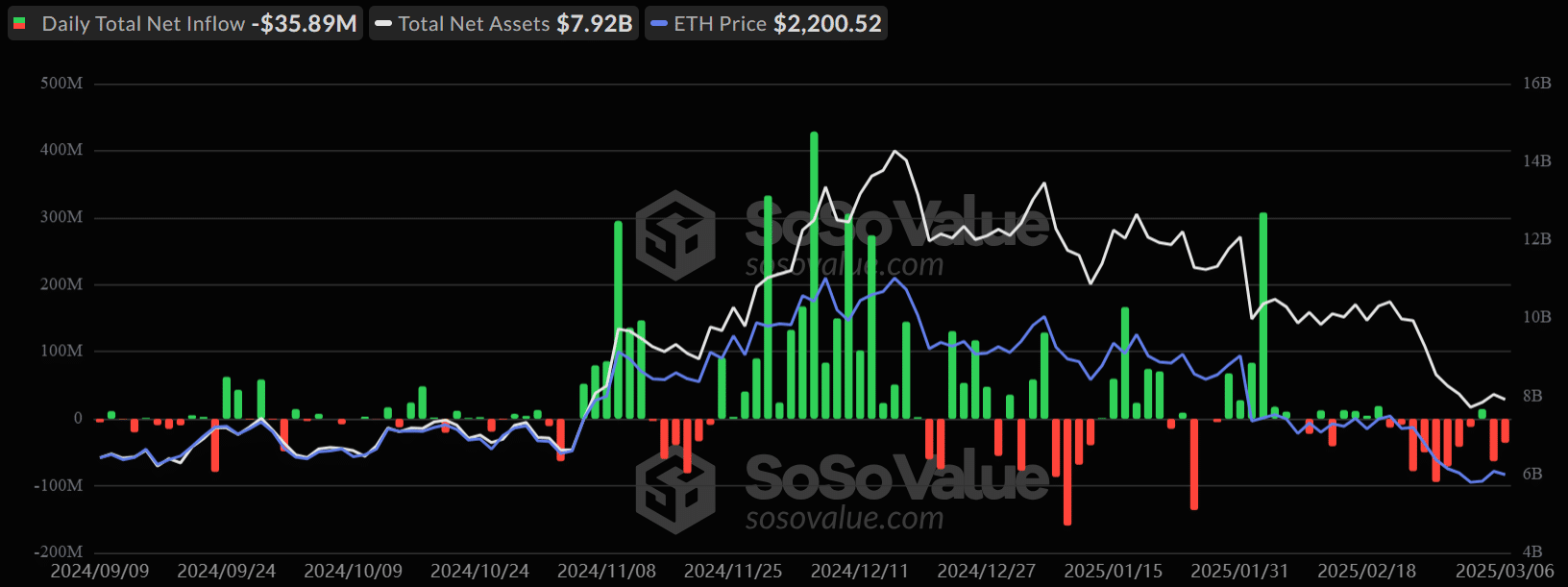

On the fateful day of March 6, the U.S. Ethereum [ETH] ETFs recorded yet another daily outflow of $35.89M, marking the second day of this rather unfortunate trend. The renewed sentiment of risk aversion followed a brief interlude on Tuesday, after a relentless eight-day streak of outflows. Oh, the drama!

In total, the investors of ETH ETFs have withdrawn a staggering $400M from this product in the last fortnight. One might say, it’s a veritable exodus!

This stands in stark contrast to the stable inflows observed in the early days of February, particularly as the market turmoil deepened amidst the ongoing Trump tariff wars. Who knew tariffs could be so riveting?

ETH CME yield drops

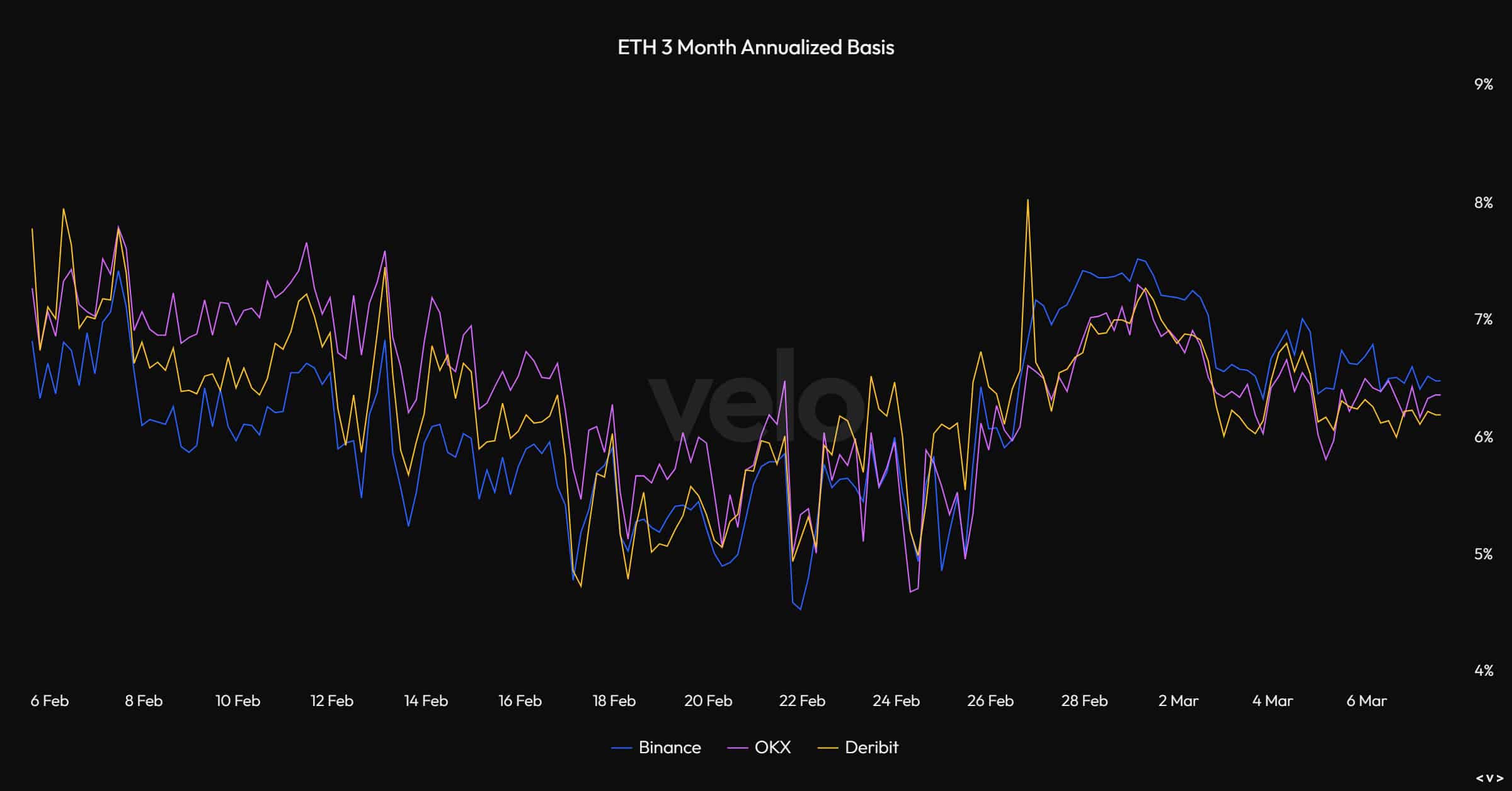

In the month of February, ETH ETFs basked in the glow of relatively higher inflows compared to their BTC counterparts—a trend that the astute analysts at Coinbase attributed to the irresistible allure of high yield from the CME ETH basis trade. Ah, the sweet scent of profit!

For those unacquainted, this trade involves institutions purchasing spot ETH ETFs while simultaneously opening a corresponding short on CME Futures, all in the name of pocketing the price difference (yield). Quite the clever ruse!

According to the ever-reliable Velo, the ETH yield soared to an impressive 8% towards the end of February, marked by a flurry of strong ETH ETF flows. A veritable feast for the senses!

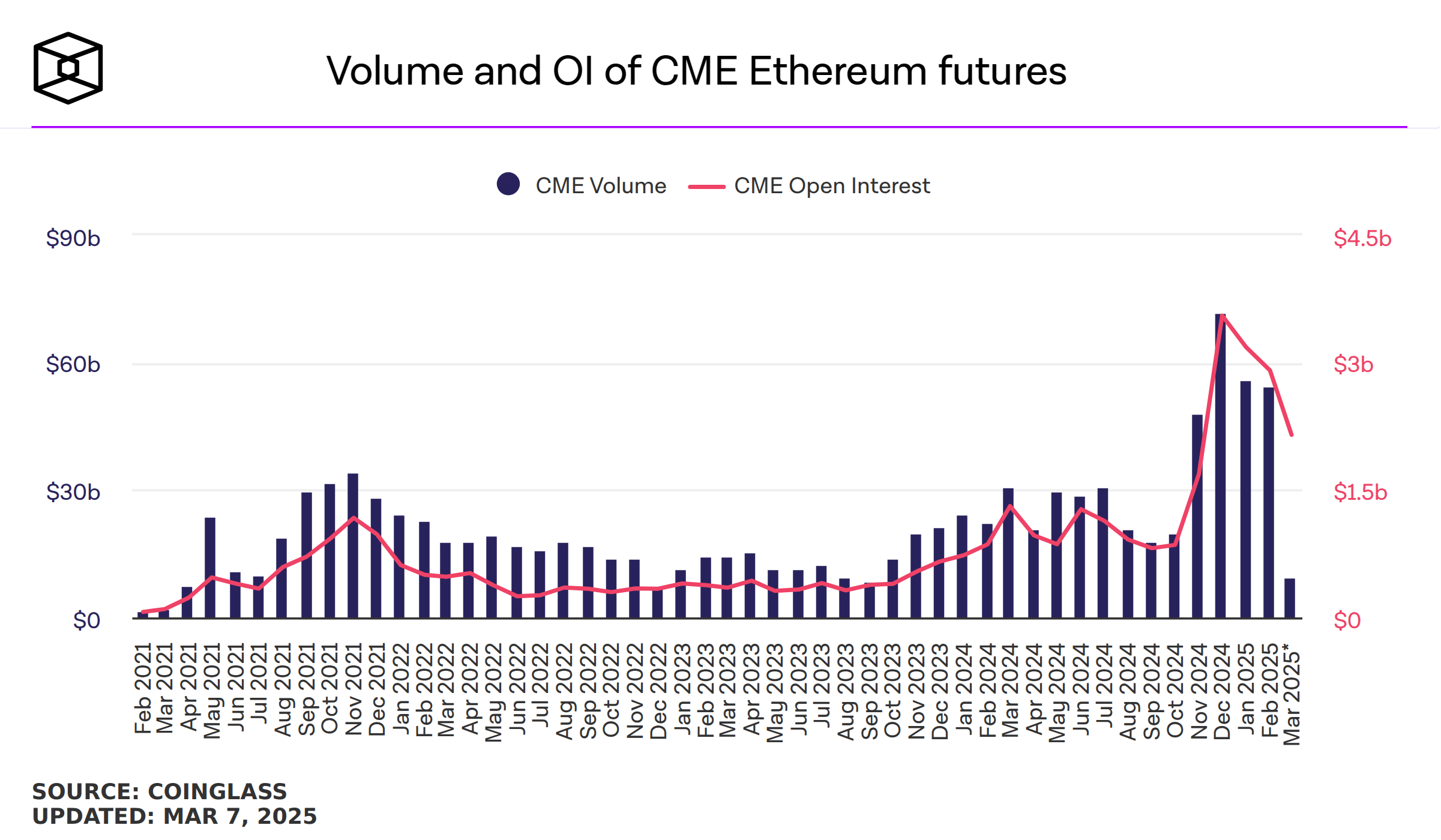

However, as March rolled in, the yield took a nosedive to 6%. This decline could very well dampen the appetite for carry trades and ETH ETFs. Indeed, the notion was further solidified by the CME Futures Open Interest (OI) rate.

The OI has been on a steady decline in 2025, slipping from a robust $3.18 billion in January to a mere $2.15 billion in March, suggesting a slight unwinding or perhaps carry-trade players closing their positions. Oh, the intrigue!

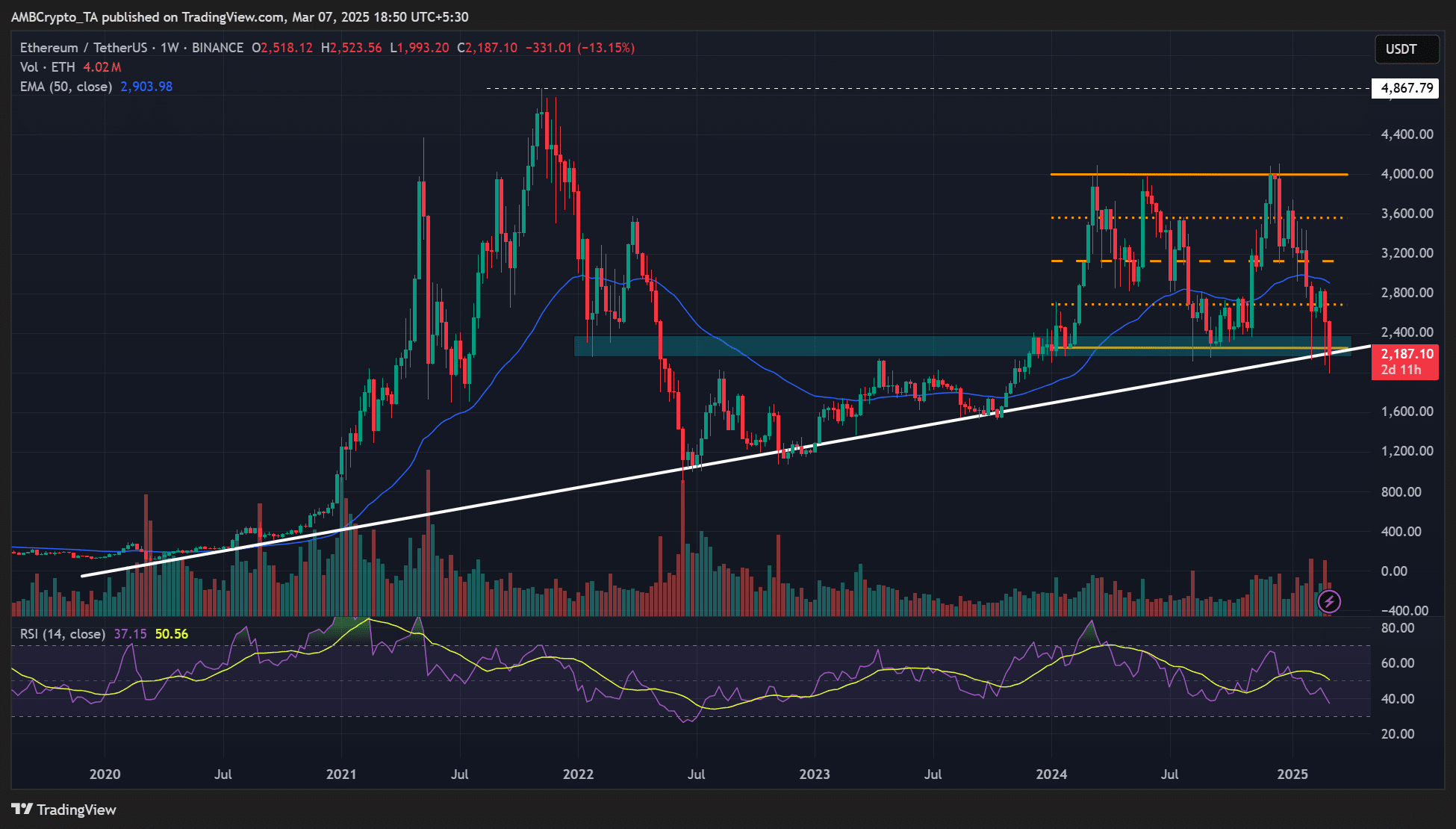

Yet, the broader weak market sentiment has not been kind to our noble king altcoin. As such, the altcoin’s downside risk looms large, casting a shadow over its future.

From a technical perspective, ETH appears to be at a pivotal crossroads, teetering between range-low and long-term trendline support above the $2000 mark. A breach below this level could very well alter the higher timeframe market structure and traders’ interest in this illustrious altcoin. The suspense is palpable!

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2025-03-08 09:20