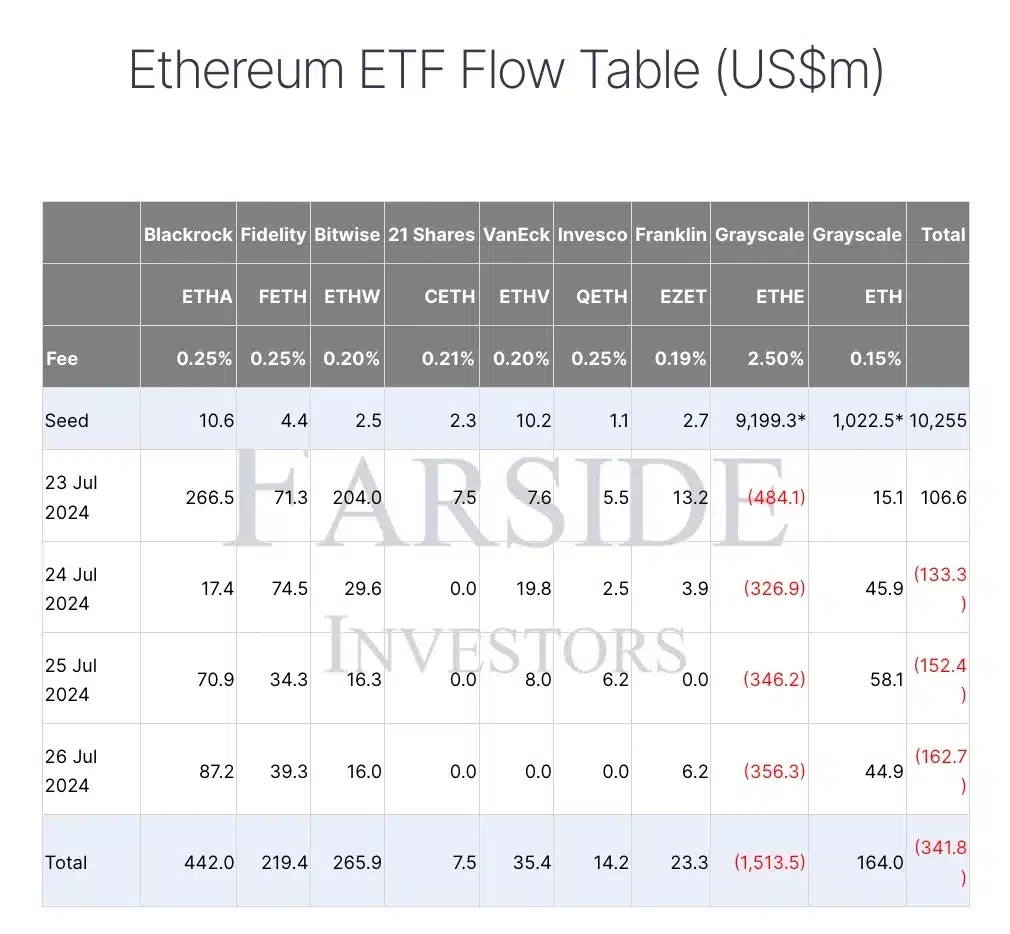

- Grayscale’s Ethereum Trust ETF saw $1.5 billion in outflows from the 23rd to the 26th of July.

- BlackRock’s iShares Ethereum Trust ETF attracted $87.2 million in inflows on the 26th of July.

As a seasoned crypto investor with a deep understanding of the market dynamics, I have witnessed firsthand the significant impact of ETF approvals and investor sentiment shifts on various digital assets, including Ethereum [ETH]. The recent events surrounding Grayscale’s Ethereum Trust ETF [ETHE] and BlackRock’s iShares Ethereum Trust ETF [ETHA] have piqued my interest.

After the Security and Exchange Commission (SEC) gave its green light for trading the Ethereum [ETH] exchange-traded fund (ETF), Grayscale Ethereum Trust ETF [ETHE] has seen substantial withdrawals.

Grayscale breaks record

Between the 23rd and 26th of July, there were ETH exchange-traded fund (ETF) withdrawals amounting to over $1.5 billion in total, with a daily net withdrawal of approximately $356 million recorded on the 26th of July, as reported by Farside Investors.

The significant drop in value underscores a substantial change in investor attitude, prompting the query: Is it advisable for investors to purchase Ethereum ahead of potential price increases resulting from Grayscale’s decreasing holdings and escalating demand?

In response to this, market analysts @CuratedByR noted on X (formerly Twitter),

Tradeing Ethereum with Grayscale before they run out of supply is as simple as it gets. Avoid making things unnecessarily complicated.

Impact on ETH’s price

In examining Ethereum’s market developments, AMBCrypto reported that ETH was currently priced at $3,366 based on data from CoinMarketCap, representing a 4% rise in value over the previous 24 hours.

In simpler terms, when the RSI value is above 51, it suggests that the market is experiencing a strong uptrend.

Another interpretation: The convergence of the Bollinger Bands at the end suggested decreasing market volatility, strengthening the belief that the ongoing bullish market trend would persist.

ETH ETF flow analysis

On July 26th, there was a notable increase in investment for Grayscale’s Ethereum Mini Trust ETF (ETH), with a total inflow of $44.9 million. Since its launch, this figure adds up to a grand sum of $164 million in net inflows.

During the same day, there was notable investor interest in the iShares Ethereum Trust ETF by BlackRock (ETHA), resulting in a large inflow of $87.2 million.

It was anticipated, resulting in a significant increase in ETHA’s overall inflows to the amount of $442 million, underscoring its prominent role within the marketplace.

Despite Grayscale’s poor performance, there was robust enthusiasm among investors for Ethereum ETFs, as they continued to pour money into other related ETFs.

X user Joseph put it best when he said,

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

2024-07-29 17:12