In the grand theater of markets, where fortunes rise and fall like waves upon the sea, Ethereum has donned its golden armor once more. A 5% leap in price-ah, what a spectacle! The masses cheer as it scales new heights, dragging $2 billion worth of short positions to the brink of ruin. Institutions, those modern-day barons of finance, are circling like vultures over fresh carrion, while whispers of upgrades ripple through the air like wind through wheat fields. And so, traders ponder with furrowed brows: how high can this digital chariot ascend before gravity demands its due? 🌟

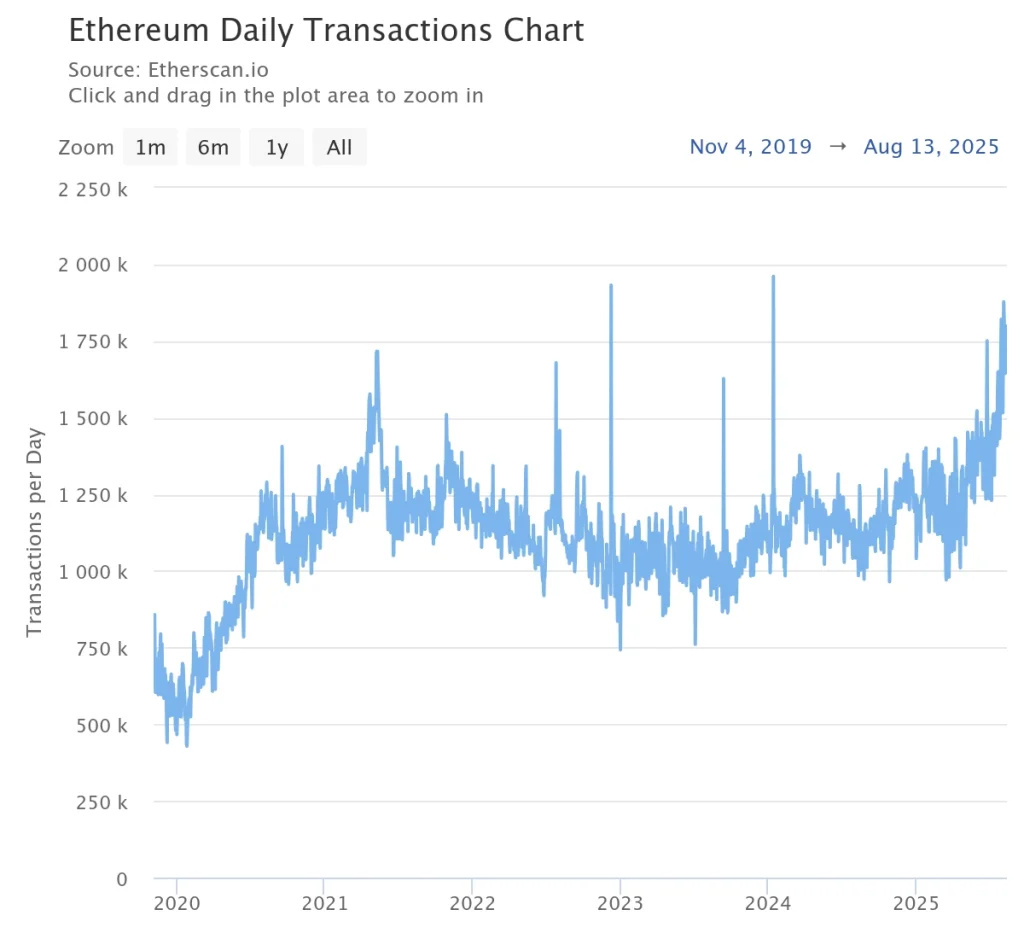

Ethereum’s Transactions Surge Like a Stampede 🏇

Behold, for Ethereum’s ascent is no solitary act-it is an orchestra played by many hands. Institutional coffers swell with ETH; network activity surges like rivers after spring rains. Upgrades loom on the horizon, their promise sweet as honey to the ears of speculators. All these forces coalesce into one magnificent crescendo, propelling ETH toward uncharted territories. Truly, we live in an age where even bytes and blocks inspire dreams of riches untold-or perhaps just memes about them. 😅

Daily transactions soar like eagles taking flight, reaching levels unseen since the halcyon days of 2021. This flurry of activity speaks volumes-not mere noise, but a chorus of engagement from both humble retail souls and mighty institutional titans. DeFi protocols hum with energy, NFTs change hands like treasures at a bazaar, and smart contracts execute their silent ballet. Such vitality breathes life into the rally, fueling optimism among believers and skeptics alike. Or maybe they’re just chasing the next dopamine hit from green candles. 📈

$5000 by Friday? Surely You Jest! 😏

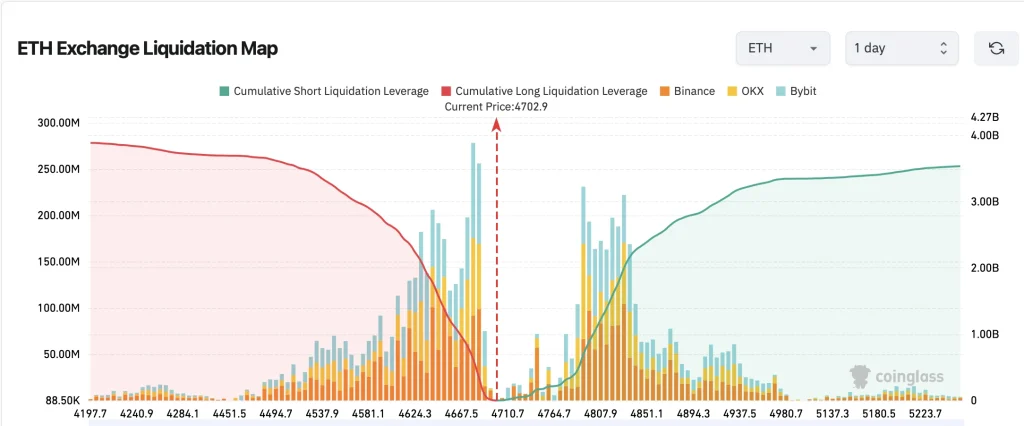

Ah, but let us not forget the battleground of liquidations-a veritable minefield for the unwary. As ETH dances near $4,702, exchanges reveal clusters of leveraged bets teetering precariously. Above lies a wall of shorts, trembling beneath the weight of potential liquidation. Below, longs cower, hoping against hope that the tide does not turn against them. It is here, dear reader, that fate shall decide whether bulls or bears emerge victorious-or if chaos reigns supreme. 🐻❄️

Should ETH break free above $4,710, the heavens themselves may open, unleashing a torrent of short squeezes. At $4,870-the fabled peak of yore-$2 billion in shorts await their doom. Were such a cascade to occur, prices could spiral upward like leaves caught in a whirlwind. Fibonacci extensions, those mystical guides of traders, whisper of targets yet unseen:

- 1.272 extension → ~$5,250

- 1.414 extension → ~$5,480

- 1.618 extension → ~$5,800

Thus, the path forward gleams with possibility. An initial target of $5,250-$5,300 beckons, though FOMO-fueled madness might carry ETH all the way to $5,800. But beware, for every rally carries within it the seeds of its undoing. As Tolstoy himself might say: “All happy rallies are alike; each unhappy correction is unhappy in its own way.” 📉

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Gold Rate Forecast

- 10 Movies That Were Secretly Sequels

- USD JPY PREDICTION

- Auto 9 Upgrade Guide RoboCop Unfinished Business Chips & Boards Guide

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Best Werewolf Movies (October 2025)

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

- These Are the 10 Best Stephen King Movies of All Time

2025-08-14 15:24