-

Ethereum Foundation moved 35,000 ETH to an exchange

ETH has responded positively to the development, with more of it leaving exchanges

As a seasoned analyst with over two decades of experience in the cryptocurrency market, I’ve seen my fair share of unexpected events. The recent move by the Ethereum Foundation to transfer a significant amount of ETH to an exchange raised eyebrows initially, given the potential implications for the asset’s price. However, the subsequent response from the ETH market has been quite intriguing.

Lately, the Ethereum Foundation moved a large amount of its Ethereum (ETH) reserves to an exchange, which often sparks worries about possible sell-offs and negative impact on the cryptocurrency’s value.

Yet, ETH‘s response deviated significantly from typical market responses upon similar transfers.

Ethereum Foundation sells a chunk of its holdings

Based on Spot On Chain’s records, on August 23rd, the Ethereum Foundation moved 35,000 Ether to Kraken, a transaction worth around $94 million. This is the biggest transfer the Foundation has made in 2021 so far. Prior to this, they had sold off approximately 2,516 Ether in smaller transactions throughout the year.

Due to the continuous fluctuations in Ethereum’s value, a major shift like this might influence its market behavior. Such large transactions frequently trigger worries about impending sell-offs, which may cause the price to drop.

However, the market reaction may vary depending on several factors, including overall market sentiment.

Ethereum exchange flows show a more positive trend

35,000 Ether, recently moved from the Ethereum Foundation to Kraken, has stirred excitement among crypto enthusiasts as they speculate about potential changes in trading activities due to this notable transaction.

It turned out to be quite unexpected, but a review of the exchange activity on August 23 showed that there was a greater outflow of ETH from exchanges compared to the inflow that day.

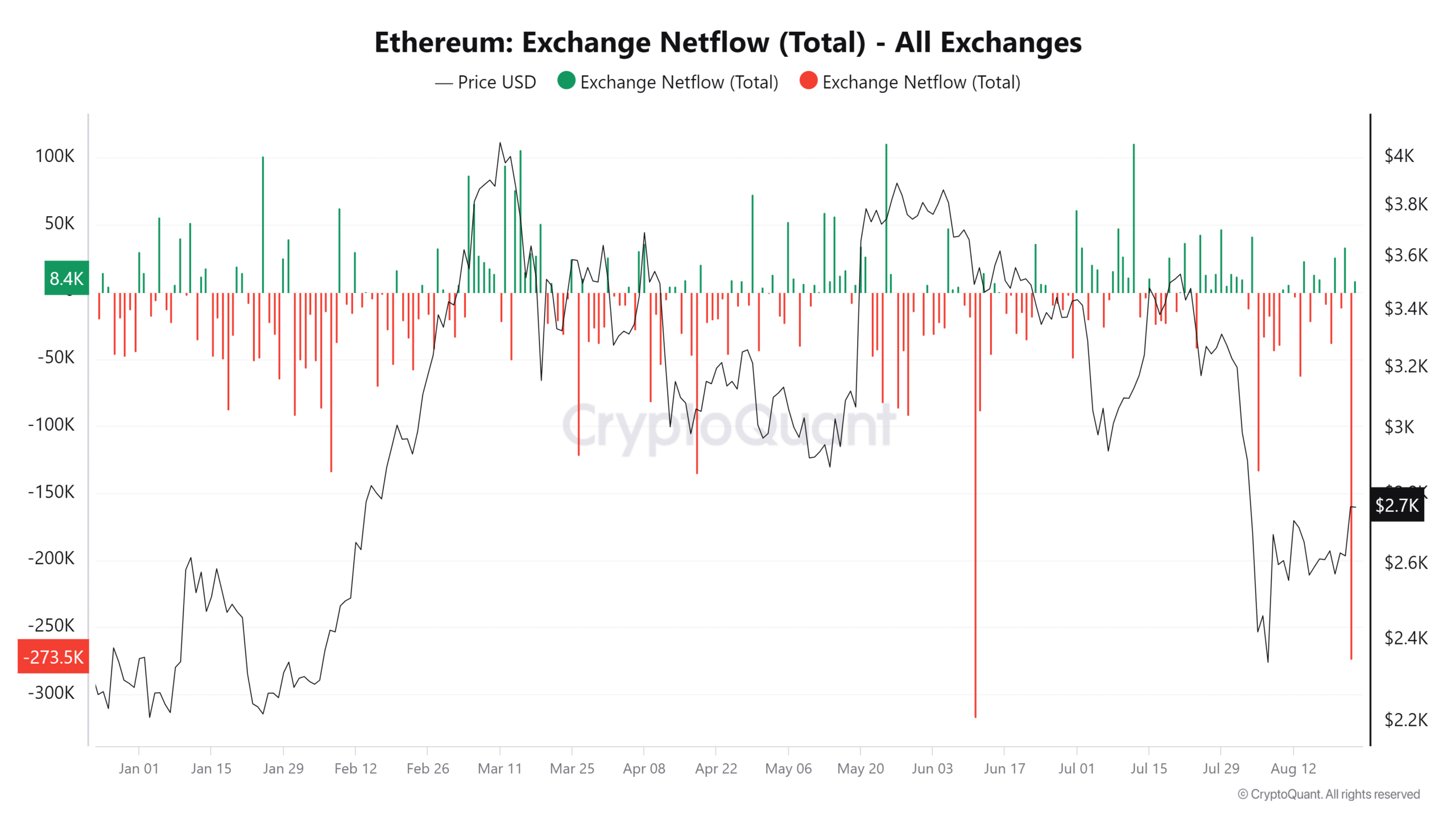

The analysis of netflow data also showed significant outgoing transactions, and Ethereum (ETH) had the second-largest negative netflow for the year. As per CryptoQuant’s data, on August 23, the netflow was approximately -273,596 ETH, with the highest negative netflows occurring in June at around -317,197 ETH.

As a seasoned cryptocurrency investor with several years of experience under my belt, I have learned that movements of large amounts of Ethereum (ETH) away from exchanges is often a sign that investors are taking their holdings out of circulation for personal use or storage. This could mean that they are either planning to hold onto their ETH for the long term or participating in staking activities. Based on my own investment strategies and market analysis, I believe that such movements indicate a strong belief among investors in the potential growth of Ethereum and a confidence in its future value. In my experience, it’s always important to keep an eye on these types of trends as they can offer valuable insights into the overall health of the crypto market.

As a confident crypto investor, I view such actions as a positive indication, signaling my faith in Ethereum’s (ETH) enduring worth over the long term.

Social and volume metrics see slight bumps

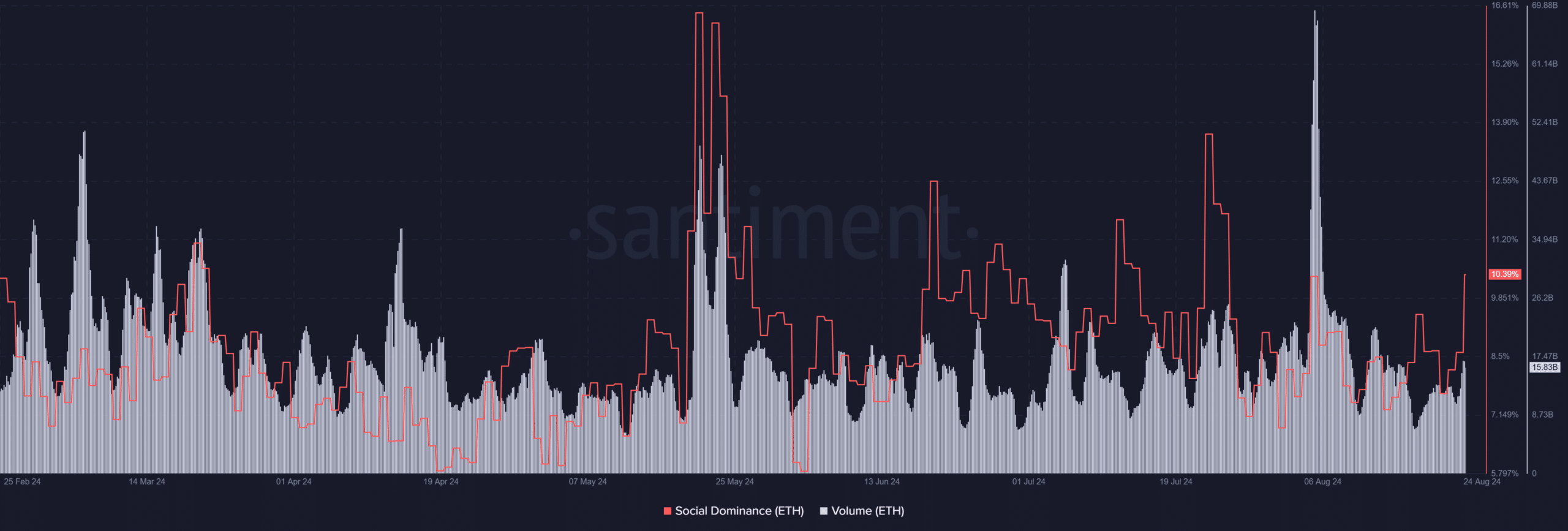

An examination of Ethereum’s influence in the social sphere, as reported by Santiment, has shown a significant increase within the last day. As I write this, Ethereum’s share of total cryptocurrency conversations stands at over 10%, suggesting that it is responsible for more than one tenth of all discussions related to digital currencies.

Furthermore, I noticed a modest increase in our trading volume during that timeframe. It escalated to roughly $15.8 billion, marking an uptick of more than $2 billion compared to the preceding days.

The increase in activity, along with its growing influence, indicates a promising trajectory for Ethereum.

Needless to say, these metrics are bullish indicators.

1. As talk about Ethereum escalates and trading increases, it’s evident that market players are becoming more involved with ETH. If this trend persists, there might be additional price growth ahead.

ETH spikes by 5% on the charts

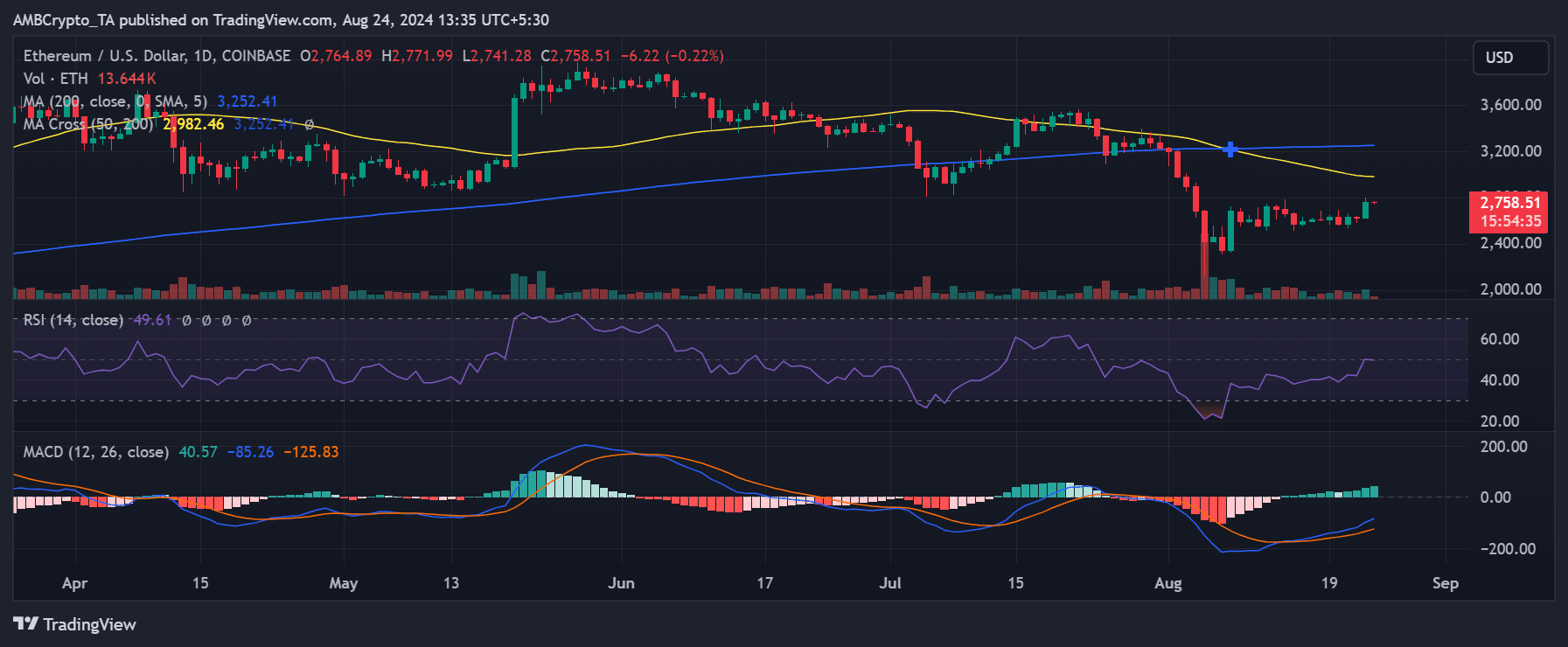

Investigating Ethereum’s day-to-day price fluctuations showed a substantial increase in its value during the most recent trading period.

As per AMBCrypto’s assessment, the value increased by 5.39%, putting Ethereum at $2,764. Yet, while this represents a significant rise, the complete bullish pattern that Ethereum has been aiming for has not yet become fully evident.

This was evidenced by its moving averages and Relative Strength Index (RSI).

To put it simply, Ethereum’s current trade value is lower than both its immediate and long-term trendlines (represented by yellow and blue lines). At present, these trendlines are serving as significant barriers, hindering any substantial increase in its price.

Moreover, the Relative Strength Index (RSI) of Ethereum appeared to be sitting right on the neutral threshold, indicating that it wasn’t showing signs of being either overbought or oversold.

– Read Ethereum (ETH) Price Prediction 2024-25

In simpler terms, this suggests that although Ethereum prices have temporarily increased, it’s currently encountering strong opposition from its average pricing trends. To verify the onset of a prolonged upward movement (bull run), it needs to surge past these obstacles first.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-08-24 23:04