- ETH/BTC is like the ultimate relationship test: if Ethereum can outpace Bitcoin, it’s a total win-win!

- And volume indicators are like the ultimate sign of a rebound – will it finally happen?

So, after the Federal Open Market Committee (FOMC) meeting, which basically said the economy is slowing down, both Bitcoin [BTC] and Ethereum [ETH] decided to reclaim their critical resistance levels. Whoa, talk about a power move!

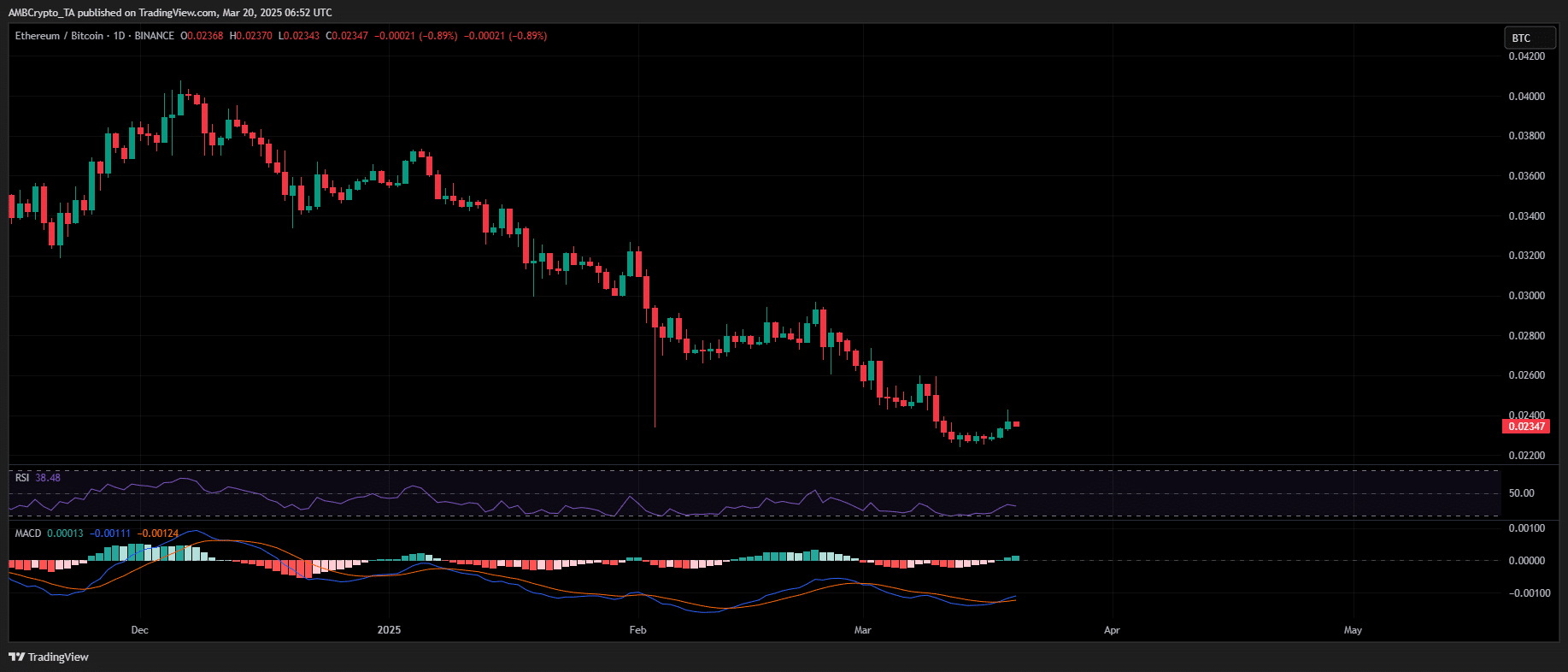

This got us wondering: could Ethereum, currently at a five-year low against BTC in the ETH/BTC pair, finally outpace Bitcoin in the next market rebound?

Market dilemma: Execution or speculation?

So, the Federal Reserve kept borrowing rates the same, but markets went wild because they thought they might lower rates instead. Yep, it’s like when you think you’re getting a surprise party, but it’s actually just a surprise bill.

Anyway, with inflation easing and labor market pressures increasing, the Fed might be like, “Hey, let’s be more chill.” And that’s when the markets got all excited and risk assets went up.

At the time of writing, Bitcoin was up 5.02%, breaking through the $85k resistance level, while Ethereum was up 6.45%, reclaiming the $2k mark after a long time. It’s like they were playing a game of “catch up”!

Also, the 1-day ETH/BTC MACD indicator turned bullish, and trading volume reached a two-week high, which is like a big thumbs up for Ethereum. But, you know, it’s not all sunshine and rainbows – without clear policy execution, post-FOMC volatility has increased, making it harder to confirm those resistance zones as strong support levels.

ETH vs. BTC: Who’s gonna dominate the next market recovery?

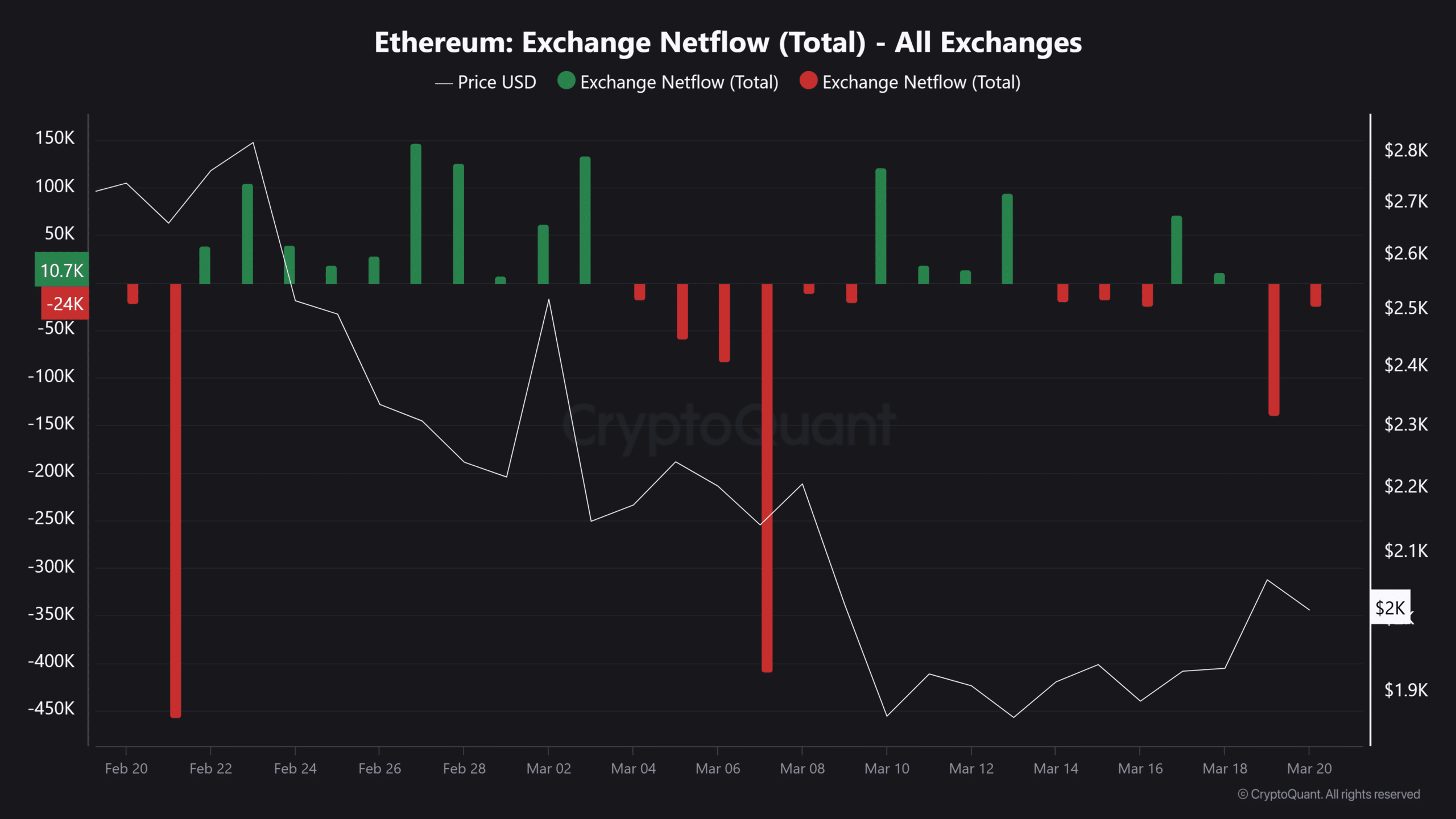

Fundamentals are like the ultimate deciding factor. As ETH reclaimed the $2k level, large capital inflows hinted at a potential bottom formation. It’s like the Ethereum community was all, “Hey, we’re back, baby!”

On-chain data shows that Donald Trump’s World Liberty Financial has resumed ETH accumulation. They moved 25 million USDC to a new multi-sig wallet and executed a 4,468 ETH ($10 million) purchase at $2,238. It’s like they were sent from Ethereum heaven!

Simultaneously, retail demand surged at $2,059, triggering the largest ETH exchange outflow in over two weeks – 139k ETH moving off exchanges. It’s like the Ethereum community was all, “We’re outta here!”

Meanwhile, BTC ETFs recorded four consecutive days of net inflows, reinforcing its current market price as a strong “dip-buying” zone. It’s like Bitcoin was all, “Hey, I’m still got this!”

However, for Ethereum to establish dominance, ETH/BTC must break key resistance at $0.025, backed by a sustained capital rotation from BTC into ETH. It’s like the ultimate test of strength.

Currently, Bitcoin’s strong fundamentals continue to drive long-term holding sentiment, while Ethereum’s recovery hinges on reclaiming the $2.5K resistance. It’s like the ultimate game of tug-of-war!

Without a confirmed breakout, speculation-driven volatility persists, leaving the broader market rebound uncertain. Failure to hold key support could see Ethereum risk losing the critical $2k support level. It’s like the ultimate cliffhanger!

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2025-03-20 12:12