- Ethena has made a notable comeback, climbing 36% in just over a week and positioning itself on the top weekly charts.

- While the current momentum is bullish, AMBCrypto advises exercising caution.

As a seasoned crypto investor with a decade-long journey through the wild west of digital currencies, I’ve seen my fair share of bull runs and bear markets. Ethena [ENA] has caught my attention lately, especially after its impressive 36% climb in just over a week. However, I’m not one to get carried away by short-term spikes.

Six months ago, Ethena was launched during an Initial Coin Offering (ICO) at a starting price of $0.57. It quickly soared to $1.46 within its first week. However, since that initial surge, it has been moving downwards due to a bearish market trend.

In mid-September, the price of ENA surpassed its earlier resistance point, climbing up to $0.413 – representing an impressive 36% increase over the course of only one week.

Based on AMBCrypto’s report, ENA aims to challenge the $0.46 resistance level again, as long as it maintains an uptrend.

Ethena proposes new developments

Ethereal Exchange recently suggested merging their Decentralized Exchange (DEX) with Ethena’s risk management system, causing a buzz in the market. This is reflected in the 10% increase in ENA‘s value over the past 24 hours.

If approved, ENA holders would receive 15% of any potential Ethereal governance token.

Fundamentally, this setup enables the Ethereal DEX to handle both on-chain spot and derivative contracts tied to USDe, the native stablecoin of Ethena. It’s anticipated that USDe will contribute significantly to future advancements as well.

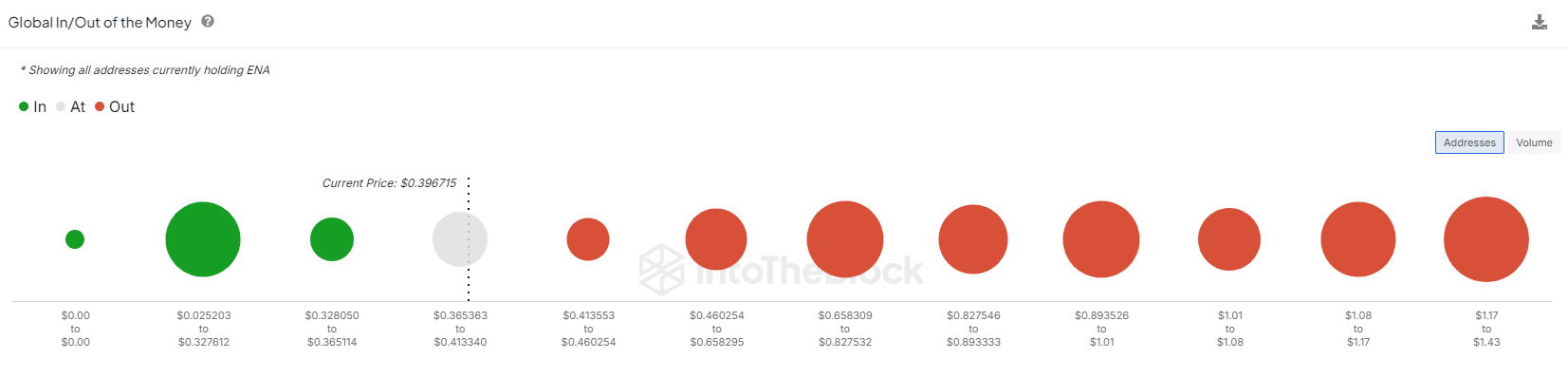

Source : IntoTheBlock

It’s worth noting that about 85% of all ENA allocations are owned by individuals who currently have net losses.

According to AMBCrypto, this high level of ownership implies that most investors might be holding assets below their purchase price, possibly waiting for a price increase or significant updates to boost their investment’s worth.

As an analyst, I find myself pondering over Ethena’s forthcoming roadmap, which seems promising in terms of enhancing network liquidity. However, it may not be enough to ignite a prolonged bullish trend unless certain conditions are met.

Large holders support these propositions

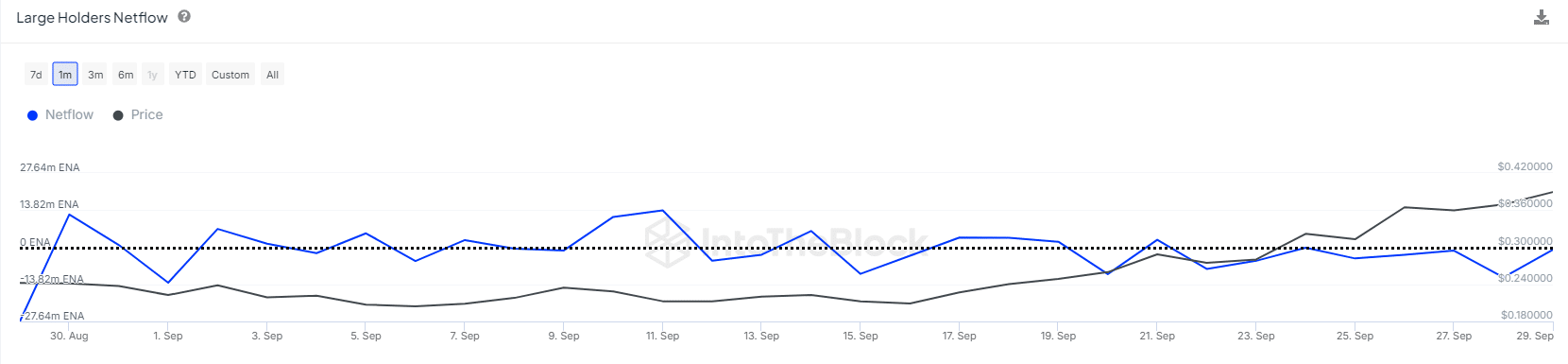

After Bitcoin‘s bearish decline towards the end of August, Ethena has seen a comparable dip, mainly due to significant investors cashing out their holdings.

Significantly, it’s worth mentioning that whale entities, accounting for about 85% of the group and possessing around 13.45 billion ENAs, have persistently disposed of parts of their assets.

Over the last seven days, the daily drain of funds from these investors has been escalating, peaking at roughly 12 million two days back.

Source : IntoTheBlock

While this is a bullish sign, a retracement could occur if these whales start selling off again.

Caution is advised

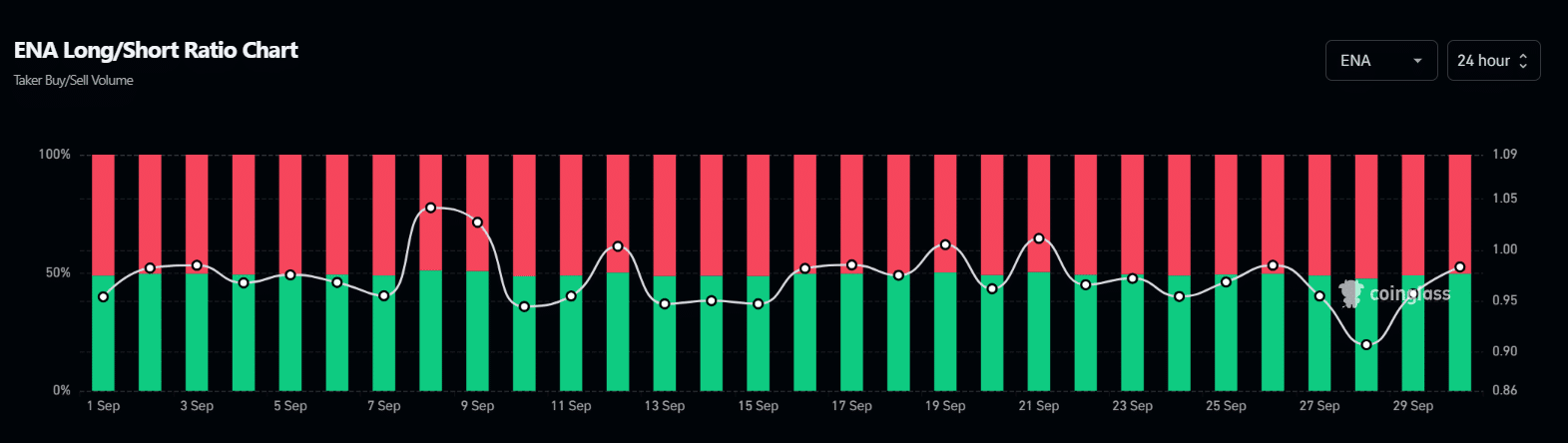

In the past seven days, speculative trading of Ethena has been driven by traders shorting ENA.

Previously, during the initial week of September, short sellers gained control, causing Ethena’s price to dip towards $0.19 in search of support.

Source : Coinglass

Regardless of the rise in short positions, these didn’t lead to a reversal or drop, because large-scale investors (whales) took up most of the strain, thereby setting up a favorable situation for a short squeeze.

If Bitcoin’s market experiences a decline, and large investors (whales) become doubtful about future profits, an increase in short positions might weaken the current rally, reducing the influence of the latest positive news.

Realistic or not, here’s ENA’s market cap in BTC terms

Consequently, it’s advisable for investors to approach with care. Although recent ideas have ignited curiosity among investors, a significant amount of power still lies in the hands of major shareholders.

According to AMBCrypto, closely watching their actions can help bring Ethena back towards the initial rejection point of $0.46 more quickly.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-09-30 21:12