- Trump-backed World Liberty Financials was bullish on ENA.

- Should you follow and jump on ENA too?

As a seasoned researcher with a keen interest in the DeFi space and a knack for recognizing patterns in the crypto market, I find myself intrigued by the latest move of World Liberty Financials (WLF) investing in Ethena [ENA]. While the potential upside seems promising due to ENA’s impressive performance post-WLF’s bid and its stablecoin USDe’s yield outperformance, there are factors that warrant caution.

The decentralized finance initiative supported by Donald Trump, World Liberty Financials (WLF), has recently incorporated Ethena [ENA] into their investment portfolio. As reported by blockchain analysis firm, SpotOnChain, WLF purchased a total of $500K worth of ENA.

WLF recently scooped top DeFi tokens including Ethereum [ETH], Aave [AAVE], and Chainlink [LINK]. In fact, AAVE and LINK pumped nearly 30% each after the bids.

Additionally, ENA experienced a surge following the WLF shift, achieving more than a 13% increase. However, it’s essential to consider ENA’s current valuation standing, and whether short-term investors should seize this trend.

ENA’s upside potential

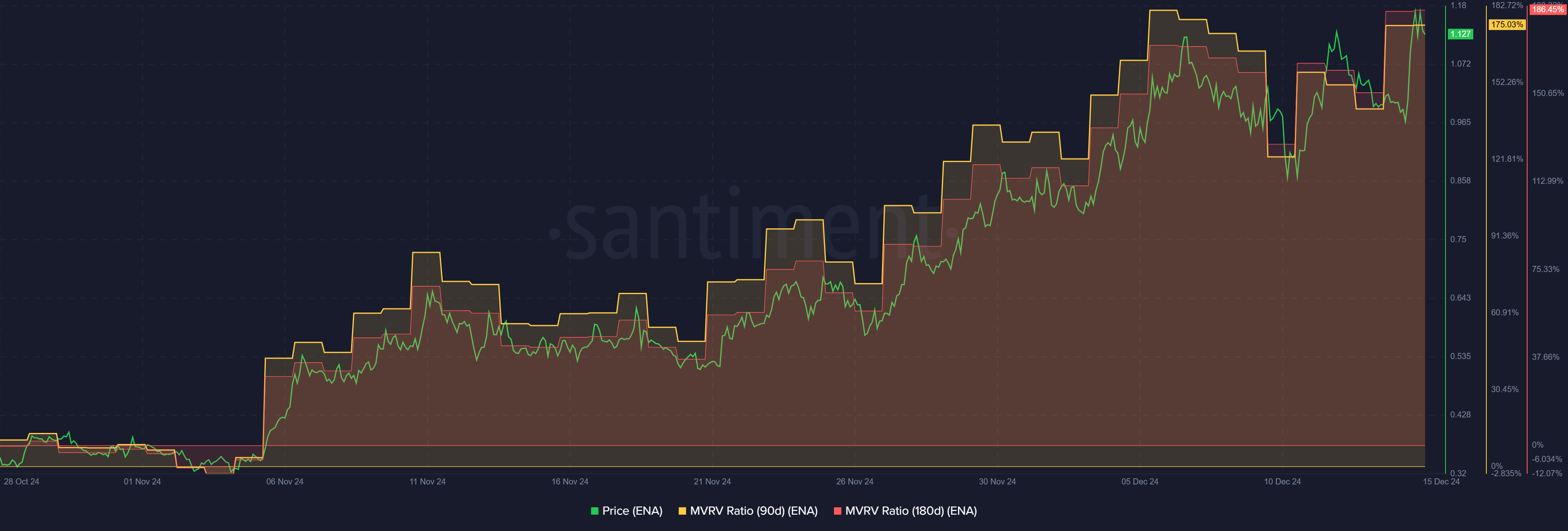

Currently, at the moment, individuals holding short and medium-term ENA have accumulated substantial triple-digit unrealized profits. This is clearly demonstrated by the 186% increase over a 180-day period in the MVRV metric, as well as the 175% gains achieved within a 90-day timeframe for the same metric.

This implied that individuals who owned ENA during the last six or three months had significant potential profits waiting to be realized. Consequently, using the MVRV metric, ENA appeared to be slightly overpriced.

Nevertheless, a different cryptocurrency investor, known as Byzantine General, expressed the viewpoint that ENA might still hold significant growth potential. This belief is based on its performance surpassing that of the stablecoin yield, USDe, which he mentioned. Essentially, he thinks that ENA could continue to grow substantially.

The ENA, offering a stablecoin that earns returns through favorable lending rates and staking, seems poised to thrive during a bull market. It appears to consistently climb higher.

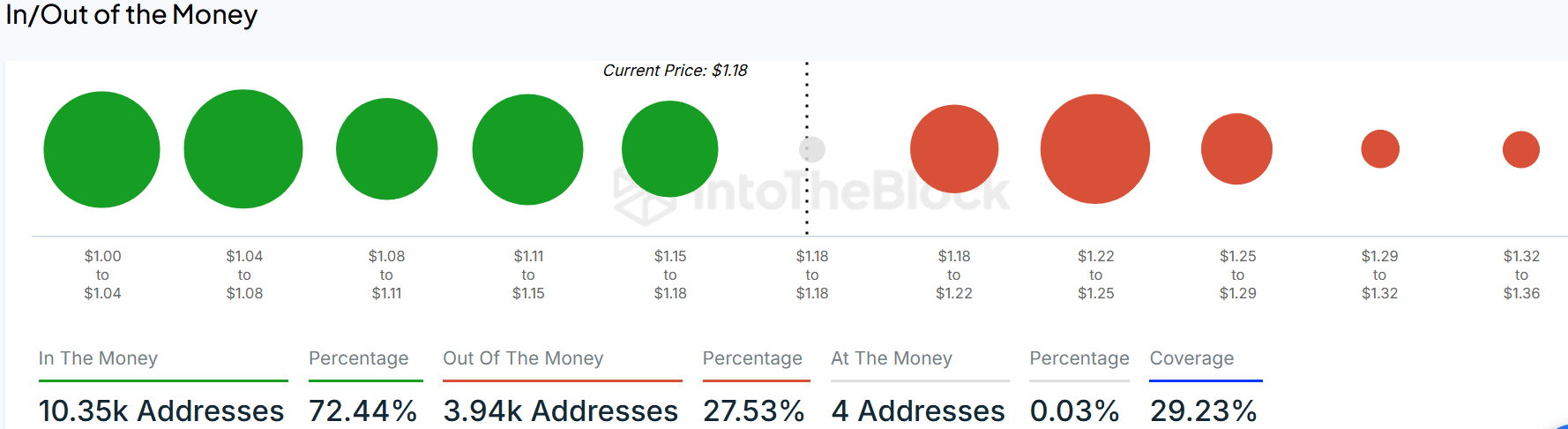

Approximately 95% of all Ethereum Name Service (ENA) owners are currently profitable, according to data from IntoTheBlock. As a result, those who bought later may find themselves providing liquidity for exit, which could make it costly for new investors to enter the altcoin market.

If these levels persist, the current obstacle lies between $1.22 and $1.25, as approximately 850,000 ENA (represented by the red bubble) were purchased at this point.

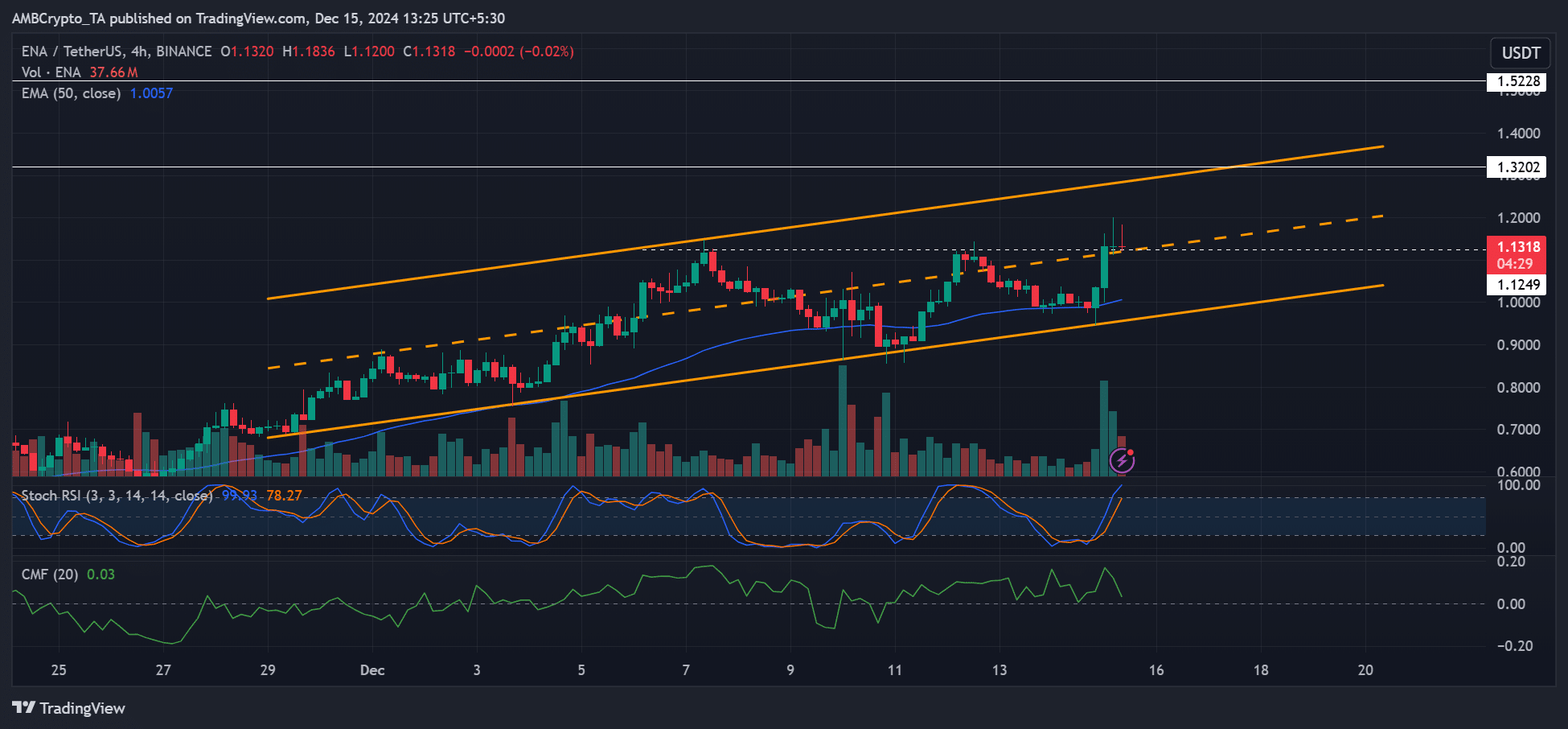

However, traders could still have potential opportunities. On the price charts, ENA faced rejection at $1.2 but defended the $1.12 and mid-range level.

If this development continues, it might pave the way for reaching approximately $1.23 at its peak. Under such circumstances, a possible profit margin of 15% could materialize.

Instead, if the price falls beneath the midpoint, it might pull ENA down to its range minimum or to the 50-day Moving Average (on the 4-hour graph).

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Gold Rate Forecast

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-12-16 00:07