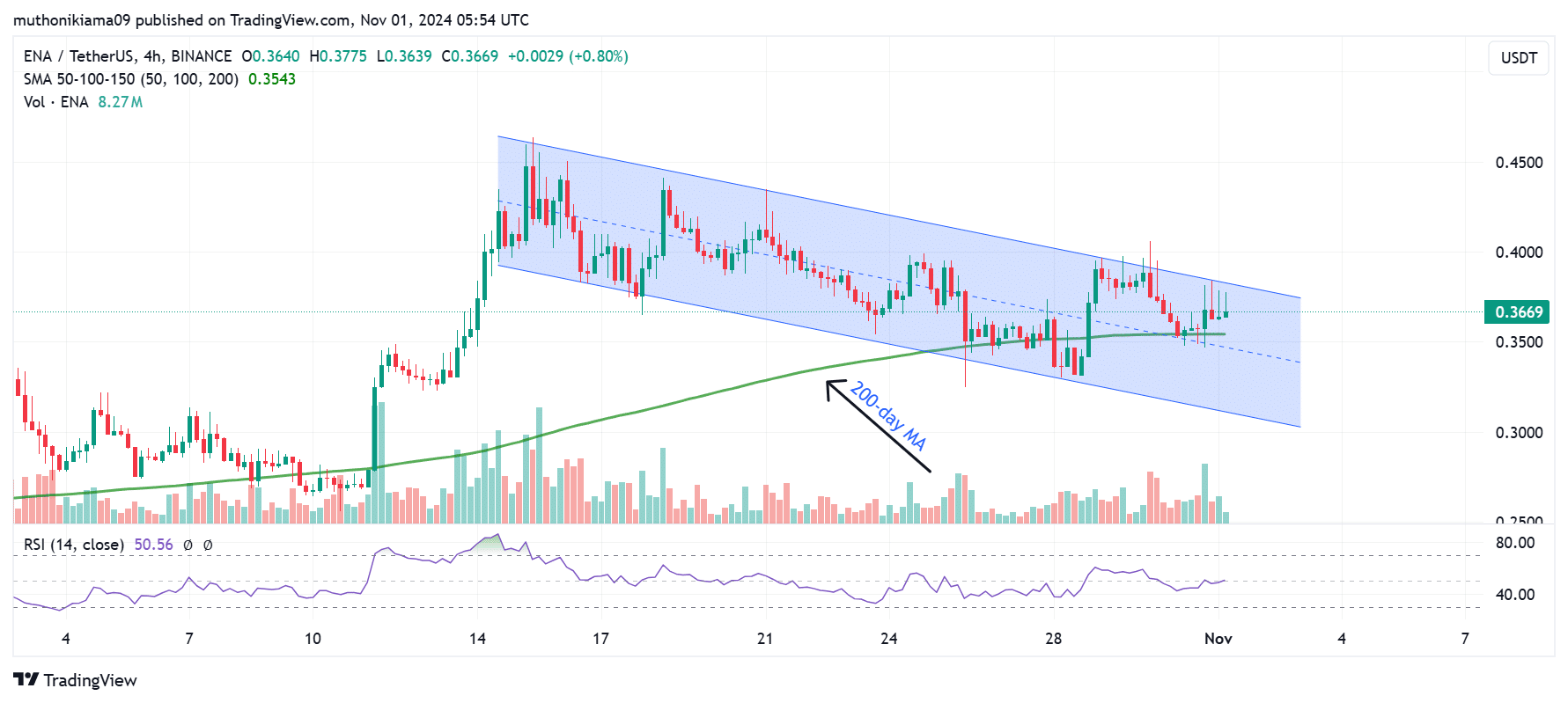

- Ethena, at press time, appeared ready for a bullish shift after the price broke past the 200-day SMA

- Whale activity was affected after large ENA transactions surged by more than 400% from $26M to $142M

As a seasoned researcher with a keen eye for spotting trends and patterns in the cryptocurrency market, I must say that the recent performance of Ethena (ENA) has piqued my interest. The altcoin’s 5% surge within 24 hours, defying the bearish trends across the broader market, is nothing short of impressive.

Despite the overall downturn in the crypto market, Ethena (ENA) bucked the trend and increased by 5% over the past day. Currently, it is being traded at $0.36, giving it a market cap of $1.02 billion.

After experiencing these recent profits, ENA could potentially shift gears and reverse its longstanding bearish pattern. For example, on its four-hour chart, the cryptocurrency appears to be moving inside a falling parallel channel, which typically indicates an extended period of decline.

If ENA surges past its current trading channel, indicating a potential upward trend, it might be due to the previously resistant 200-day Simple Moving Average (SMA) now acting as support. This leap above the resistance suggests that the market’s upward momentum has been growing steadily in recent times.

To maintain this upward trend, ENA requires substantial purchasing activity. This is also reflected in the Relative Strength Index, as its upward trajectory indicates that the market’s bullish forces are growing stronger.

In other words, since the Relative Strength Index (RSI) is currently at 50 which indicates neither an overbought nor oversold condition, there might be a need for additional buying pressure to keep the upward trend going. This extra buying force could potentially originate from whales or big traders.

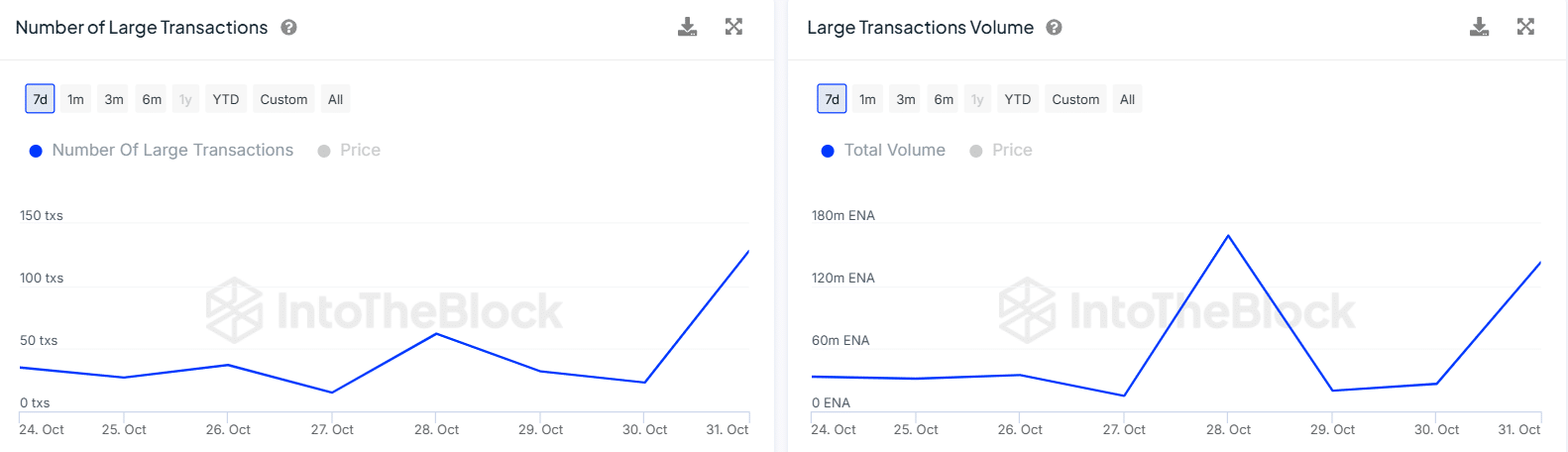

Whale activity could fuel ENA’s uptrend

It seems that the recent increase in Ethena’s price could be attributed to its emergence as a significant factor. Intriguingly, information from IntoTheBlock reveals that over the past day, the frequency of large ENA transactions above $100,000 has skyrocketed from 23 to a staggering 128.

The volume of transactions significantly increased, climbing from $26 million to a staggering $142 million. This surge in activity corresponds to more than a 400% rise in ‘whale’ transactions within just one day.

A hike in whale activity is often a catalyst for price volatility and bullish trends.

When it comes to ownership, a group representing approximately 88% of the total ENA supply holds the reins. As such, if this dominant group starts actively trading or using ENA, it’s likely that ENA will experience substantial price fluctuations.

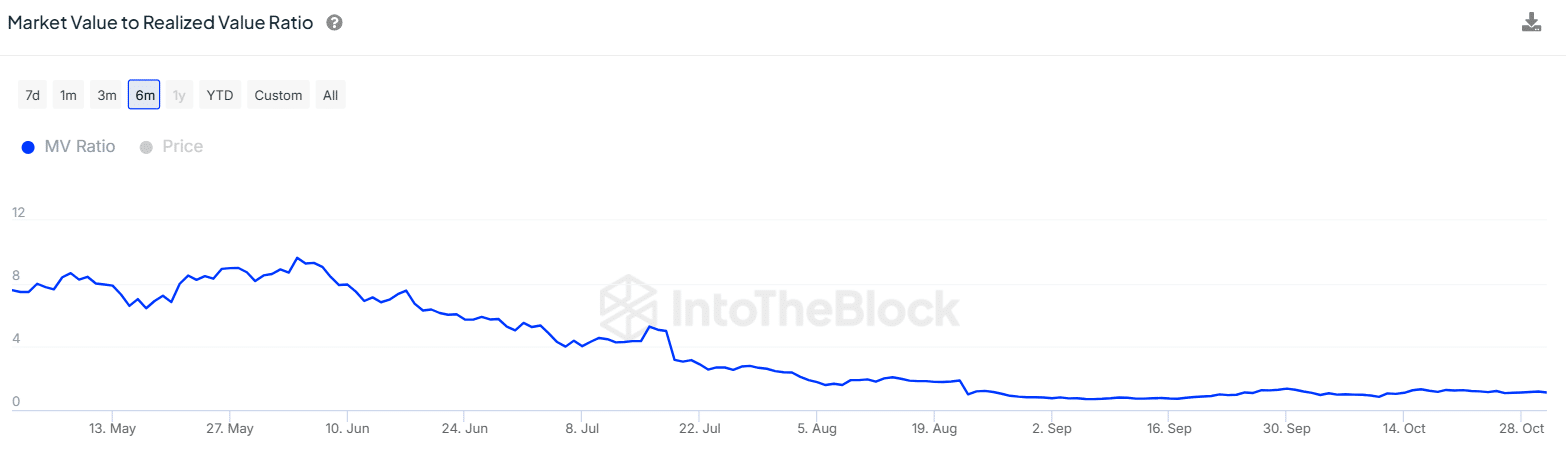

Is Ethena undervalued?

In September 2024, Ethena plummeted to its lowest point ever at $0.19, approximately five months following a peak. Since then, ENA has experienced a significant rebound with an impressive 87% price increase. However, various indicators suggest that this cryptocurrency may still be underestimated in value.

Over the past six months, the Market Value to Realized Value (MVRV) indicator has been steadily decreasing. At this moment, ENA’s MVRV ratio is 1.11, indicating that on average, traders are close to the point where their investments have broken even.

When a smaller number of traders are making money, there might be less selling activity, leading to more stable price levels. Furthermore, if ENA is priced lower than its actual worth, it could present an attractive opportunity for investors to buy in.

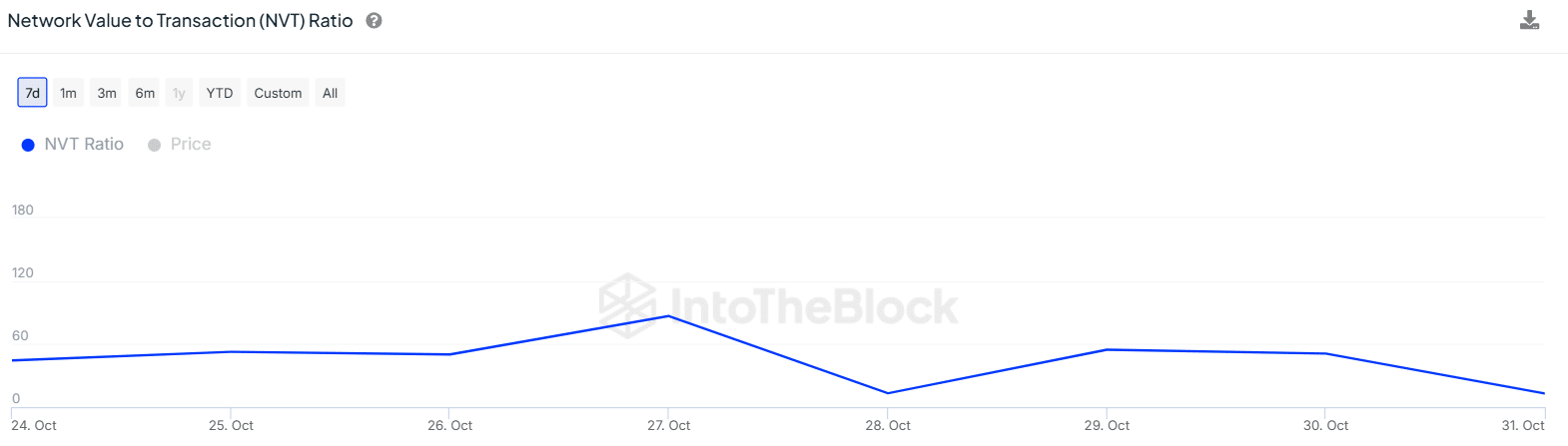

Ultimately, the Network Value to Transactions (NVT) ratio mirrored a comparable perspective. Over the past two days, there has been a significant decrease of approximately 77% in the NVT ratio.

A dropping NVT ratio also implied that ENA’s price is not reflecting the network’s growth. This is a bullish indicator as healthy network activity is a catalyst for long-term price growth.

Increased whale behavior near Ethena, combined with decreasing MVRV and NVT values, suggests a positive price trend might occur. Yet, for a bullish surge to happen, the general market opinion must become optimistic.

Currently, Market Prophit indicates that public opinion towards ENA is generally unfavorable. Such a sentiment might dampen the surge in purchases necessary to sustain an upward trend.

Read More

2024-11-01 23:04