- Ethena maintained a higher timeframe bearish trend.

- The buying pressure was not commensurate with the momentum shift.

As a seasoned crypto investor with several years of experience under my belt, I have learned to read between the lines when analyzing market trends and evaluating potential investments. After closely monitoring Ethna (ENA), I cannot help but maintain a higher timeframe bearish trend despite the recent price recovery.

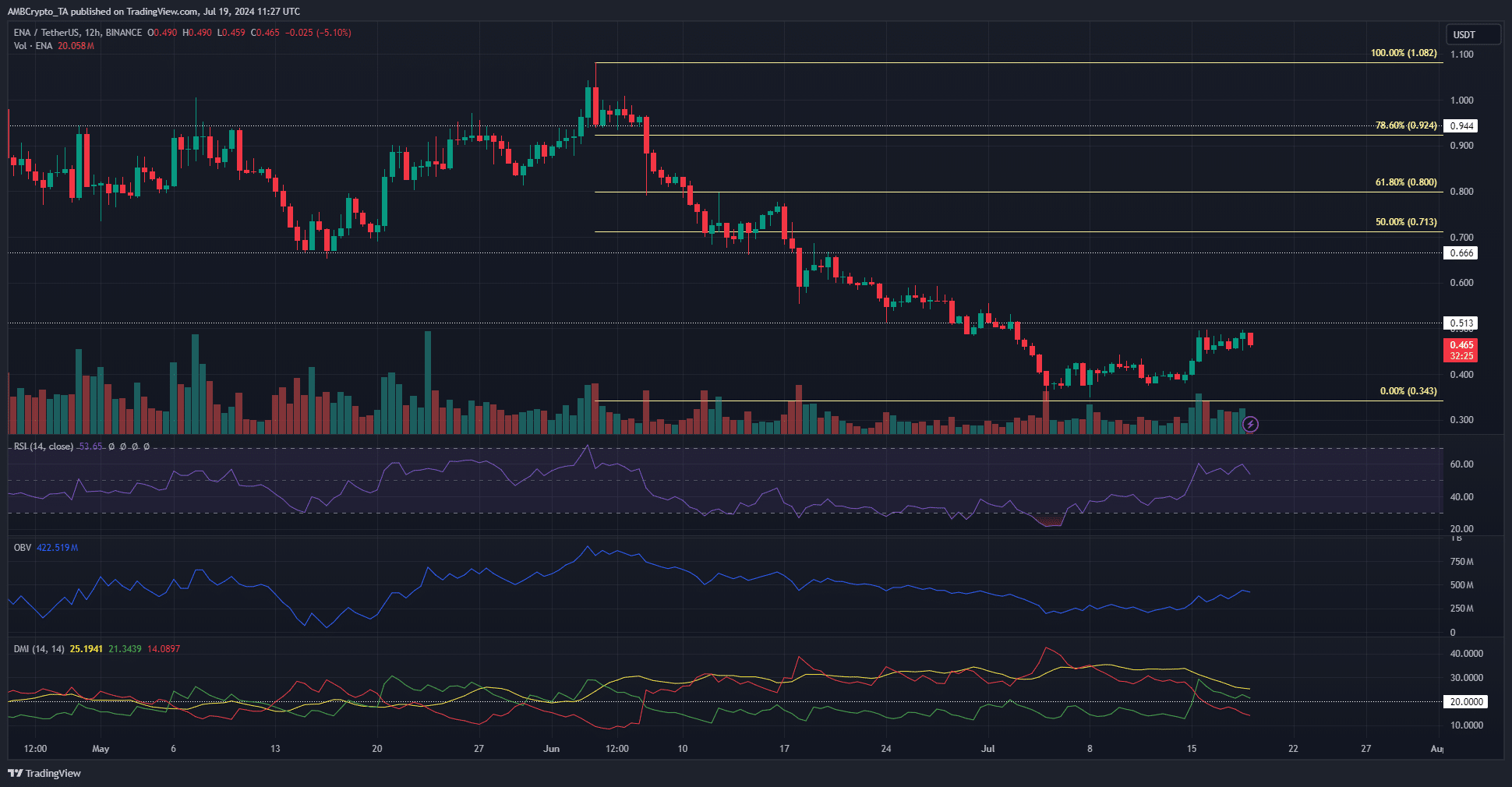

Following the decline in value during the first week of July, Ethena (ENA) experienced a significant rebound, increasing by approximately 44.9% from its lowest point at $0.343 on the 5th to reach a high of $0.497 on the 18th.

It was an encouraging start for the bulls, but not enough to flip the higher timeframe downtrend.

Toward the end of June, the psychological $0.5 mark served as a barrier of resistance for ENA when it was trending down. However, if ENA attempts to rise, this same level could potentially function as a point of support for buyers.

The bullish prospects of Ethena

On the 15th of July, the Relative Strength Index (RSI) for the 12-hour chart surpassed the 50-neutral mark. This event served as a precursor to the shift in market momentum.

“The DMI indicator indicated a possible change in trend as the +DI line (represented by green) surpassed the -DI line (signified by red).”

Although a definite upward trend hasn’t emerged yet, there’s been a noticeable decrease in the recent lowest price of $0.443. This signifies a change in market dynamics for Ethena, as it has displayed higher lows during the previous days.

To shift the attitude of long-term investors, we need a price break above the $0.5 resistance point. Furthermore, the On-Balance Volume (OBV) is picking up, which indicates increasing buying activity, adding to the optimistic outlook.

Traders need to be prepared for a rejection from $0.55 after the liquidity is tested.

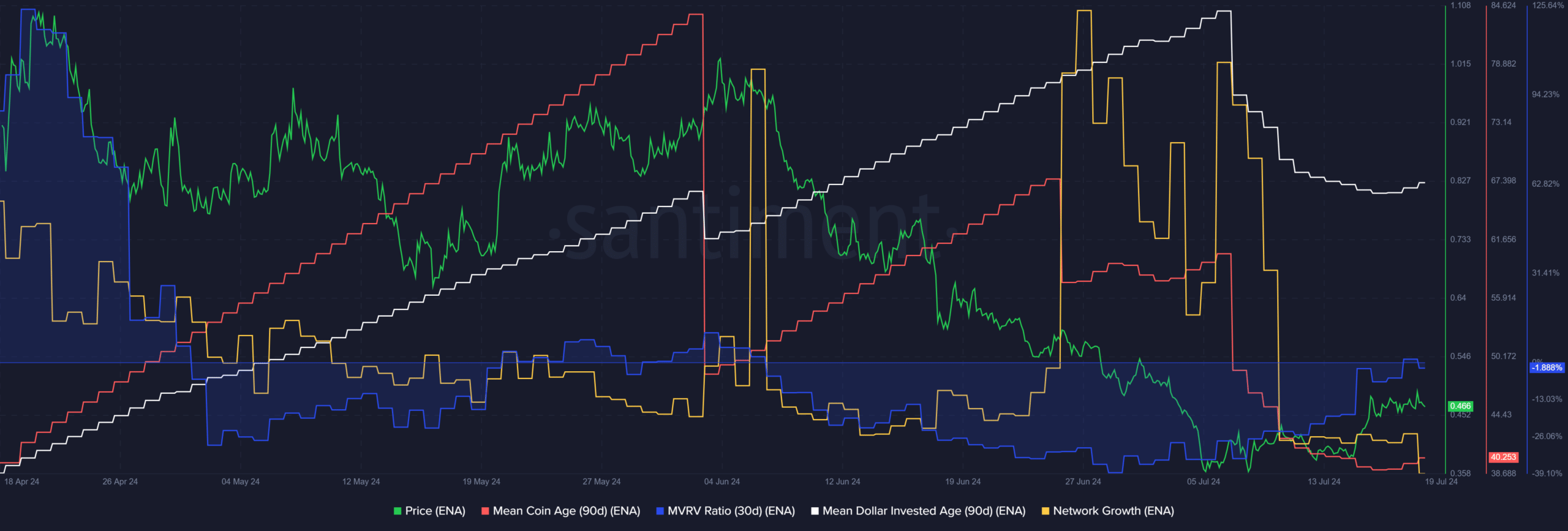

Network growth spiked before the price recovery began

In simpler terms, the 30-day MVRV ratio stood at a level of -1.88%, indicating that short-term investors experienced a small loss. It’s not unexpected that this ratio recovers given the recent price surge over the last fortnight.

As a researcher studying cryptocurrency trends, I was taken aback by the significant decrease in the average age of coins in circulation. This downturn indicated that we were entering a distribution phase.

Is your portfolio green? Check the ENA Profit Calculator

The decline in the average age at which dollars were being spent suggested heightened network activity and a return of coins to circulation. This trend was considered positive, or bullish, for the market.

In simple terms, the data indicated a negative outlook for Ethena as it failed to surpass the $0.5-$0.55 resistance level convincingly.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- PI PREDICTION. PI cryptocurrency

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-07-20 03:03