- Euler Labs boosted ENA’s utility with $42k in incentives and a new collateral option

- ENA broke out of a descending triangle on the charts, setting up for potential gains of +100%

As a seasoned researcher who has navigated through numerous crypto market trends and cycles, I must admit that ENA’s recent breakout has piqued my interest. The bullish momentum backed by increased trading volume, Open Interest, and technical indicators like the Ichimoku Cloud, is a sight to behold.

After a strong breakout, ENA is now heading towards $1.20 with confidence. This surge has been reinforced by a significant increase in trading volume to approximately $538.61 million and an uptick in Open Interest by 22.15%. At the moment of reporting, the Open Interest stood at around $189.05 million.

The additional incentives worth $42,000 from New Euler Labs served to boost its market progression even more. In fact, these incentives encouraged traders to strategically position themselves in anticipation of ENA’s price rise as depicted in the charts.

ENA’s descending triangle breakout signals bullish path to $1.20

In simpler terms, the cryptocurrency token of Ethena, known as ENA, has just burst free from a downward widening triangle shape on its daily chart. This pattern often suggests a shift from bearish to bullish trends.

This specific chart pattern, marked by lines that diverge, frequently signals an impending increase in price. As per analyst ZAYK Charts’ assessment, there’s a potential for ENA to experience a rise of 100%-120%. The predicted price range for this altcoin is between $0.85 and $1.00.

As a crypto investor, I see a breakout from this pattern as a clear indication that buyers are picking up speed, and the increased trading volume suggests a robust bullish sentiment in the market.

If ENA consistently holds above its former resistance level, it might persist in its ascending trend, potentially reaching the forecasted goals.

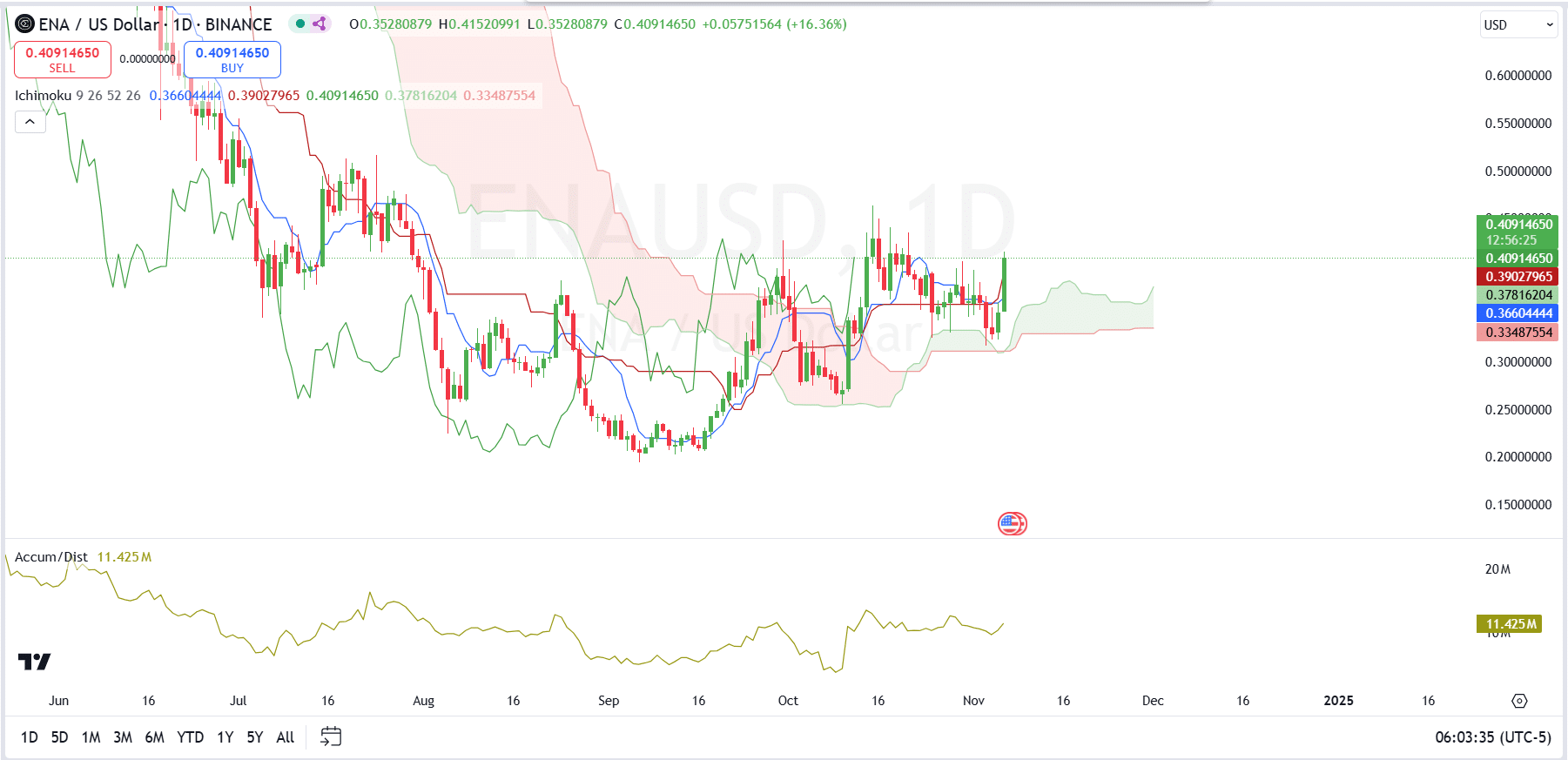

ENA climbs above the Ichimoku Cloud

The technical indicators appeared to support the optimistic outlook on Ethena as well, as the Ichimoku Cloud signaled an upward trend when ENA surpassed the cloud level.

On the Tenkan-sen line, there was a strong uptrend in short-term buying pressure, which was further bolstered by the Kijun-sen line, indicating a promising outlook for increases in ENA’s price.

As an analyst, I noticed that the Accumulation/Distribution line was consistently rising. This trend suggests growing buying interest among traders, indicating a sustained accumulation of the asset over time.

Euler Labs enhances ENA’s utility with new collateral options

Euler Labs has added PT-sUSDE as a fresh collateral choice on its Stablecoin Maxi platform, offering approximately $42,000 in incentives. This move includes 25,000 PYTH rewards and Euler-matching rewards amounting to roughly $17,000, all designed to encourage user participation.

Users are now able to loan sUSDE from Ethena Labs, using PT-sUSDE as security for borrowing sUSDE. This setup offers extra income possibilities within the platform.

Currently, the price of Ethena’s native token, ENA, is at approximately $0.41, marking a 21% increase over the past 24 hours. The market cap stands at a staggering $1 billion, and the token has seen a 24-hour trading volume of around $301 million.

Introducing PT-sUSDE as collateral, along with its rewards, could potentially boost the worth of ENA by enhancing the appeal of Ethena’s services, thereby increasing the demand.

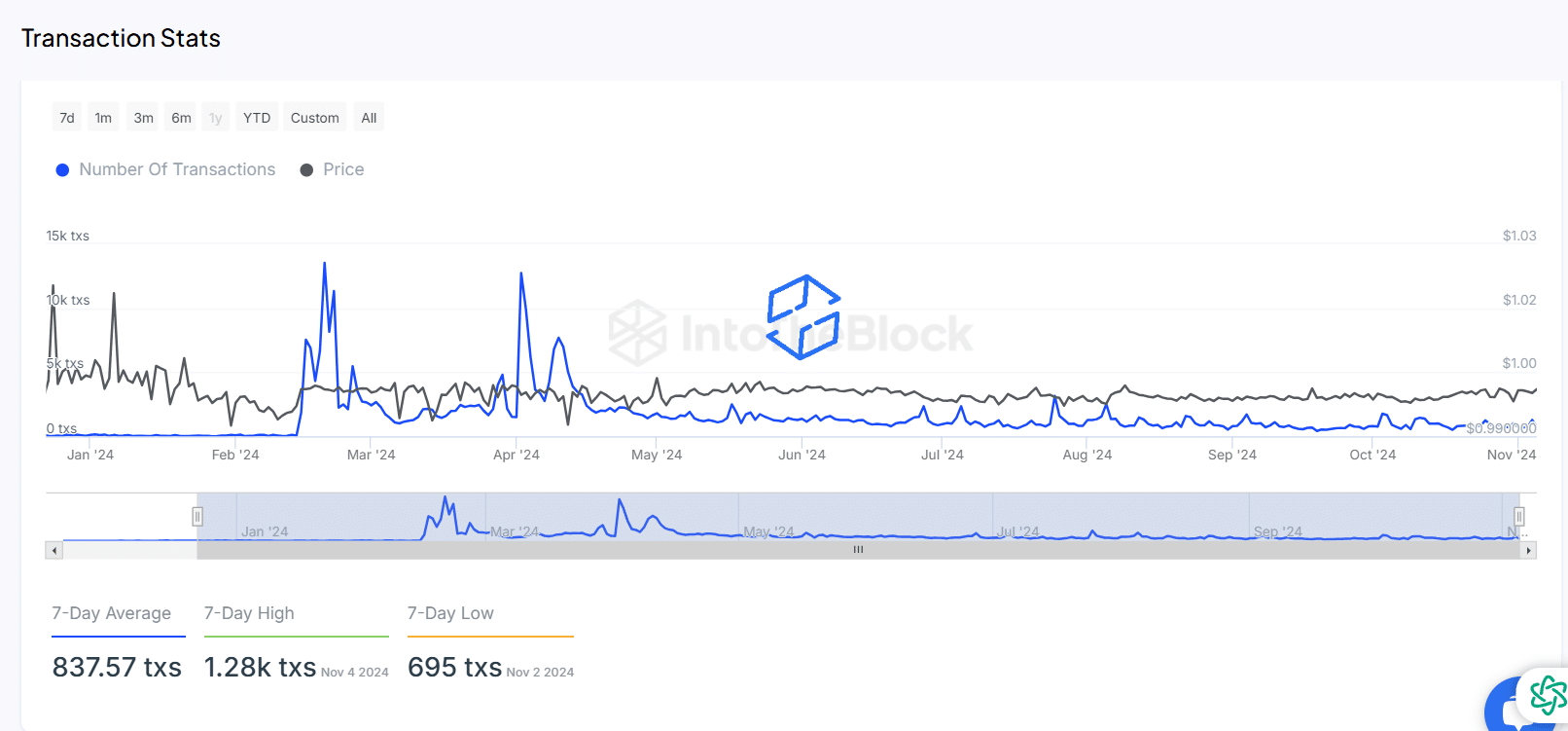

Consistent transaction volume highlights stable demand

Ethena’s consistent market standing was underscored by its daily transaction activity, averaging 837.57 transactions over the past week and peaking at an impressive 1,280 on November 4, 2024.

In recent times, regular transaction activity and a price that hovers near $1 suggest a sustained interest and low price fluctuations. This consistency in pricing, even with varying transaction volumes, indicates a well-balanced market scenario for ENA as well.

Collectively, these advancements suggest a promising future for ENA, as they align with optimistic forecasts backed by robust technical signs and an increase in market activity, indicating a steady path of growth.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- SOL PREDICTION. SOL cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

2024-11-07 12:08