-

Demand for ENA increased as collateralized BTC and ETH surpassed $1.40 billion.

On-chain metrics supported a price increase despite issues with USDe’s APY.

ENA, the native token for the dollar savings platform called Ethena, entered the market with a strong push over the past week. The value of ENA has experienced a significant surge, rising an impressive 96.57% in just seven days.

During this period when various altcoins underwent corrections up until the 8th of April, ENA managed to outperform its peers for several reasons, given its comparative newness in the market.

To begin with, let’s explore the essentials. Ethena is known for providing a cryptocurrency option for individuals seeking a replacement for conventional banking systems.

Big promise, more demand?

Using simple and clear language,

Despite the potential risks, the project appears to be taking preventative measures to avoid a collapse. According to their website, they had invested in Bitcoin (BTC) with a value of approximately $594 million.

At that location, Ethereum [ETH] held a value of collateral equal to $809.1 million. Such precautions were essential due to Ethena’s impressive 37.1% annual return rate on USDe deposits, which is equivalent to an Annual Percentage Yield (APY).

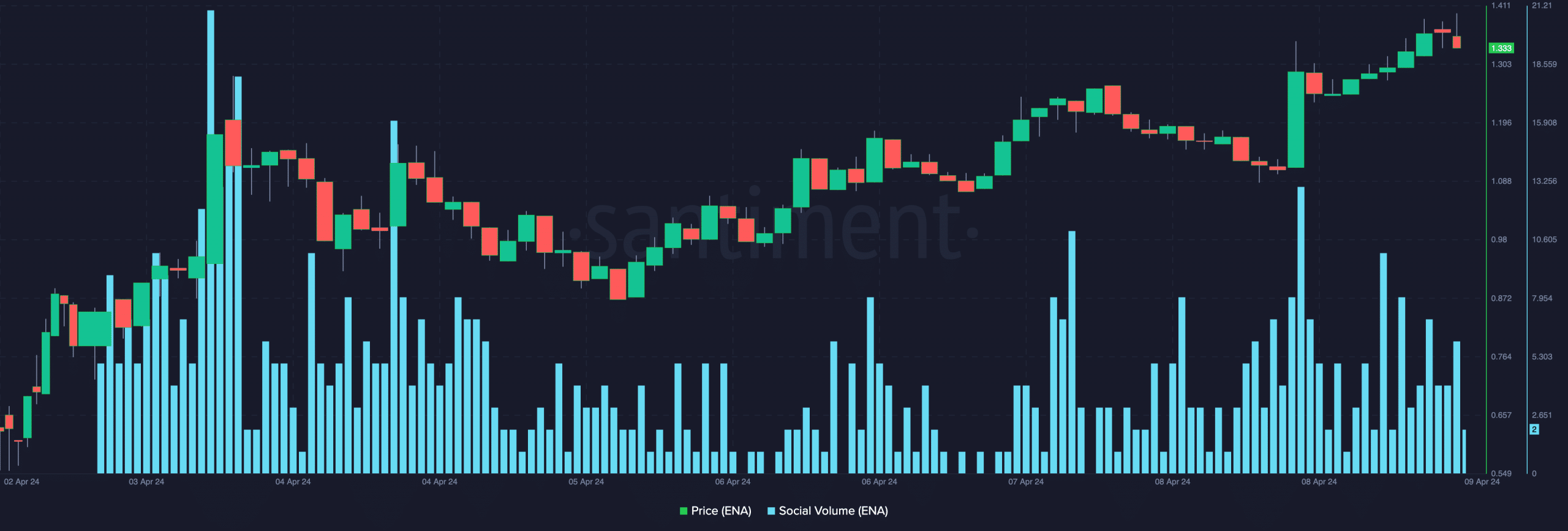

In spite of this, there’s been optimism among market players regarding the project, as indicated by increased social activity. After its debut, ENA‘s social media buzz experienced several peaks.

Participants’ searches for the token reached remarkable highs during this process, suggesting a strong interest. Should this trend persist with periodic spikes, the desire for ENA could potentially increase even further.

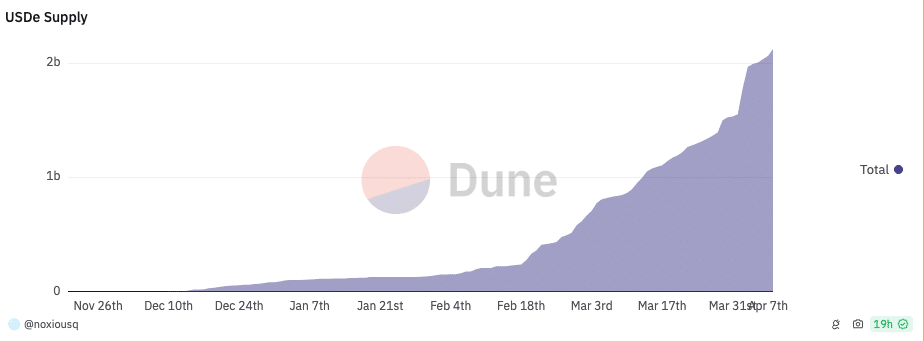

At the same time, the price behavior of ENA could be influenced by USDe’s involvement. This is due to the increasing acceptance of the stablecoin in the market.

Based on Dune Analytics’ data, the USDe supply amounted to approximately $1.55 billion on the 4th of April. However, as of when this press release was written, that figure had risen to $2.13 billion.

With a surge of this magnitude and a total supply of 11,257 units, other decentralized stablecoins such as DAI could face challenges. If this trend persists, ENA may hold its ground during the upcoming altcoin boom.

Not all parties will place big bets

It’s worth noting that Arthur Hayes expressed optimism towards the price of ENA. As the co-founder of BitMEX shared, he believed that ENA could potentially reach a value of $10.

Yet, some industry leaders like Andre Cronje of Fantom [FTM] have voiced apprehensions regarding this project. Specifically, Cronje expressed caution over the potential risks associated with the yields Ethena is providing in his newsletter.

“The main concern I have about this protocol is the underlying presumptions regarding the continuity of returns. These assumptions hinge on the short position generating substantial payouts, but such an outcome is not always certain.”

Although he acknowledged the project’s intrigue and challenge, he expressed his hope for their achievement. Meanwhile, the attendees appeared unfazed by this for the moment.

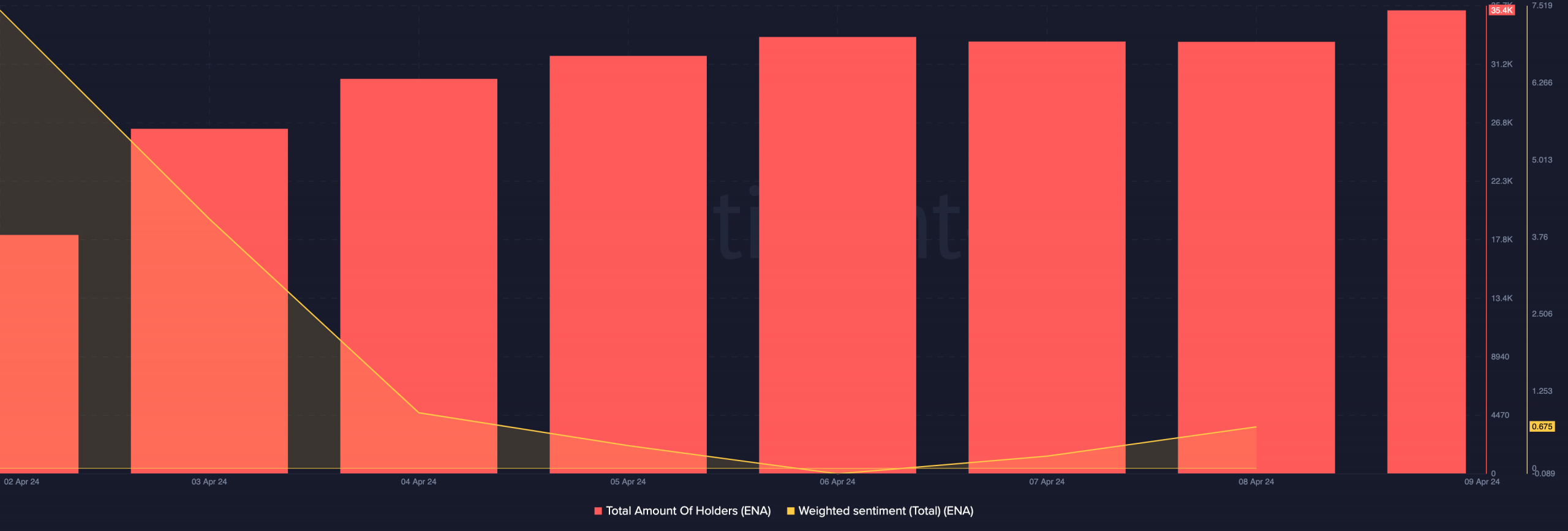

On-chain figures indicated a rise in the count of wallets holding the asset, while the sentiment analysis for ENA stayed optimistic.

Realistic to not, here’s ENA’s market cap in BTC terms

Should the situation continue as is, ENA‘s price may become noteworthy. If the project delivers on its promises, there could be an unparalleled surge, leading to impressive growth.

However, this does not mean that the value would not undergo a downtime,

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-04-10 02:15