-

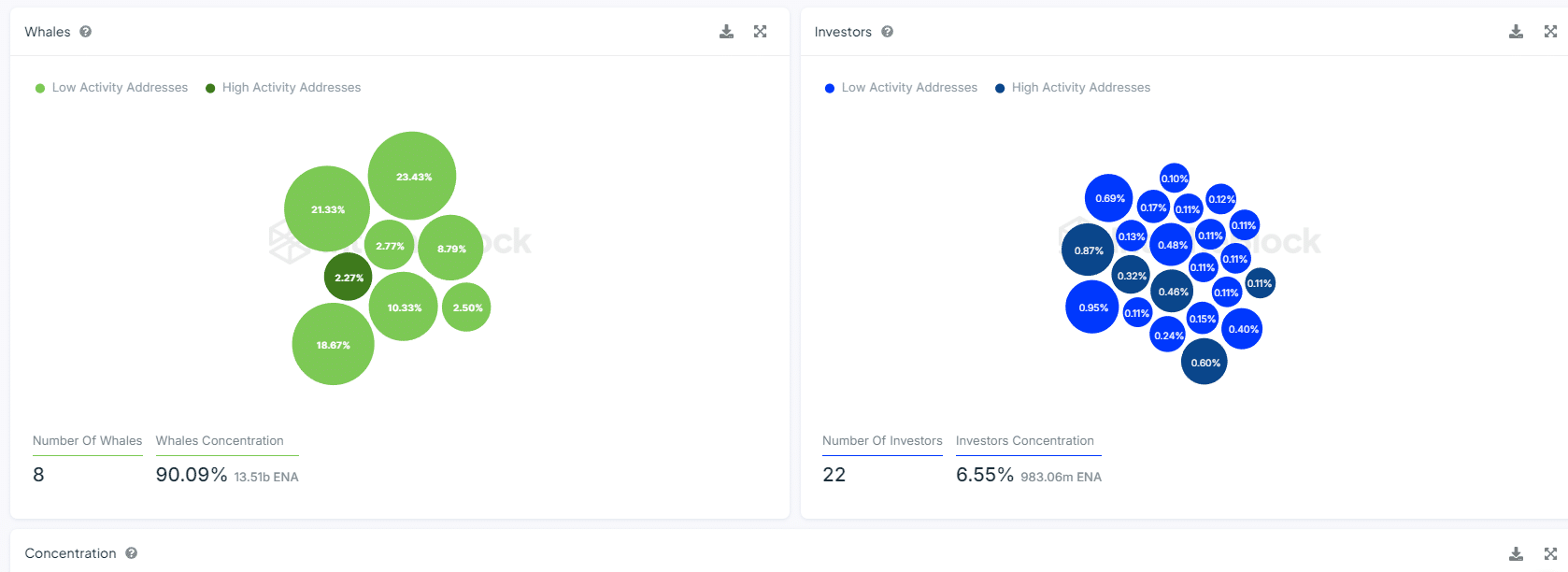

ENA can be easily manipulated, as eight whales hold 90.09% of Ethena’s total supply.

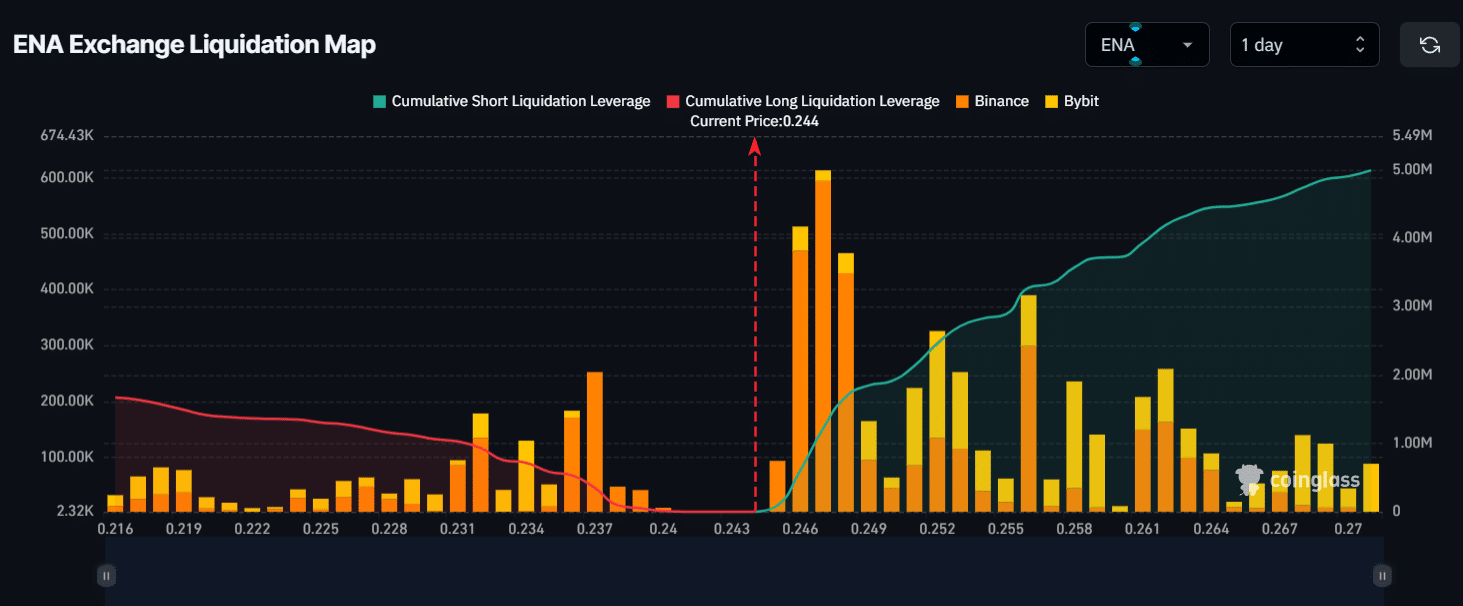

If the price rises to the $0.260 level, nearly $2.8 million worth of short positions will be liquidated.

As a seasoned researcher with over two decades of experience in the financial markets, I’ve seen my fair share of market manipulations and bearish sentiments. The current state of Ethena (ENA) is causing me significant concern, especially given the high concentration of supply among a few whales.

As an analyst, I’m observing a rather gloomy mood in the crypto market right now. Notably, heavyweight cryptos like Bitcoin [BTC], Ethereum [ETH], and Solana [SOL] are experiencing significant losses.

In the current economic slump, significant holders of Ethena (ENA), known as “whales,” have offloaded approximately 22 million Ethena tokens, valued at around $6.9 million, onto Binance (BNB).

Whale activity signals alarm for ENA investors

On August 30, 2024, the online analytics company Spotonchain posted on their platform (previously known as Twitter) that large investors (whales) had withdrawn their ENA tokens from the staking system and subsequently sold them on Binance at a substantial loss of more than $5 million.

Based on records, these whales removed ENA from the exchange during the period spanning April to August 2024. Yet, they too, purchased ENA at reduced prices not only in July but also in August of that same year.

Additionally, it’s been reported that another Ethena whale, using the wallet address 0x0A7, transferred 6.49 million ENA valued at approximately $1.65 million to Binance. However, this transaction resulted in a loss of around $1.96 million for the whale.

The potential behind the extremely bearish outlook for ENA is the market sentiment and its manipulative concentration.

Market manipulation concerns

According to data from IntoTheBlock, Ethena’s supply seems highly concentrated, with just eight ‘whale’ investors controlling approximately 90.09%, while 22 other significant investors, or ‘sharks’, hold about 6.55% of the total Ethena supply. This suggests a potential for easy manipulation due to this high concentration of ownership.

Meanwhile, retailers held only 3.36% of the total supply. This whale concentration potentially makes ENA the most alarming investment option.

Key liquidation levels

Currently, significant liquidation points are approximately at $0.232 (lower) and $0.260 (higher), based on recent trading activity over the past week. It appears that traders have heavily leveraged positions at these levels, as indicated by data from Coinglass, a company specializing in blockchain analytics.

If the current sentiment persists and the ENA‘s price drops to around $0.232, approximately $526,000 in long positions could get closed out.

If the sentiment shifts and the price climbs up to around $0.260, it would force a liquidation of about $2.8 million in short positions.

This data indicates short sellers are currently dominating and liquidating the long positions.

ENA price and market performance

Currently, ENA is close to $0.242 in value, marking a decrease of more than 4% over the past day as per information from CoinMarketCap.

During the same timeframe, I observed a decrease of 15% in trading volume, suggesting reduced involvement and perhaps apprehension among participants.

Read Ethena’s [ENA] Price Prediction 2024–2025

Meanwhile, ENA‘s Open Interest saw a decrease too, lowering by approximately 2.5% over the past 24 hours. This reduction in Open Interest may be attributed to contracts being terminated, possibly due to apprehension or forced liquidation.

In addition to ENA, significant digital currencies like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) have all seen a drop in value by approximately 0.6%, 1.3%, and 4.1% respectively during the past day.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- SOL PREDICTION. SOL cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

2024-08-30 16:40