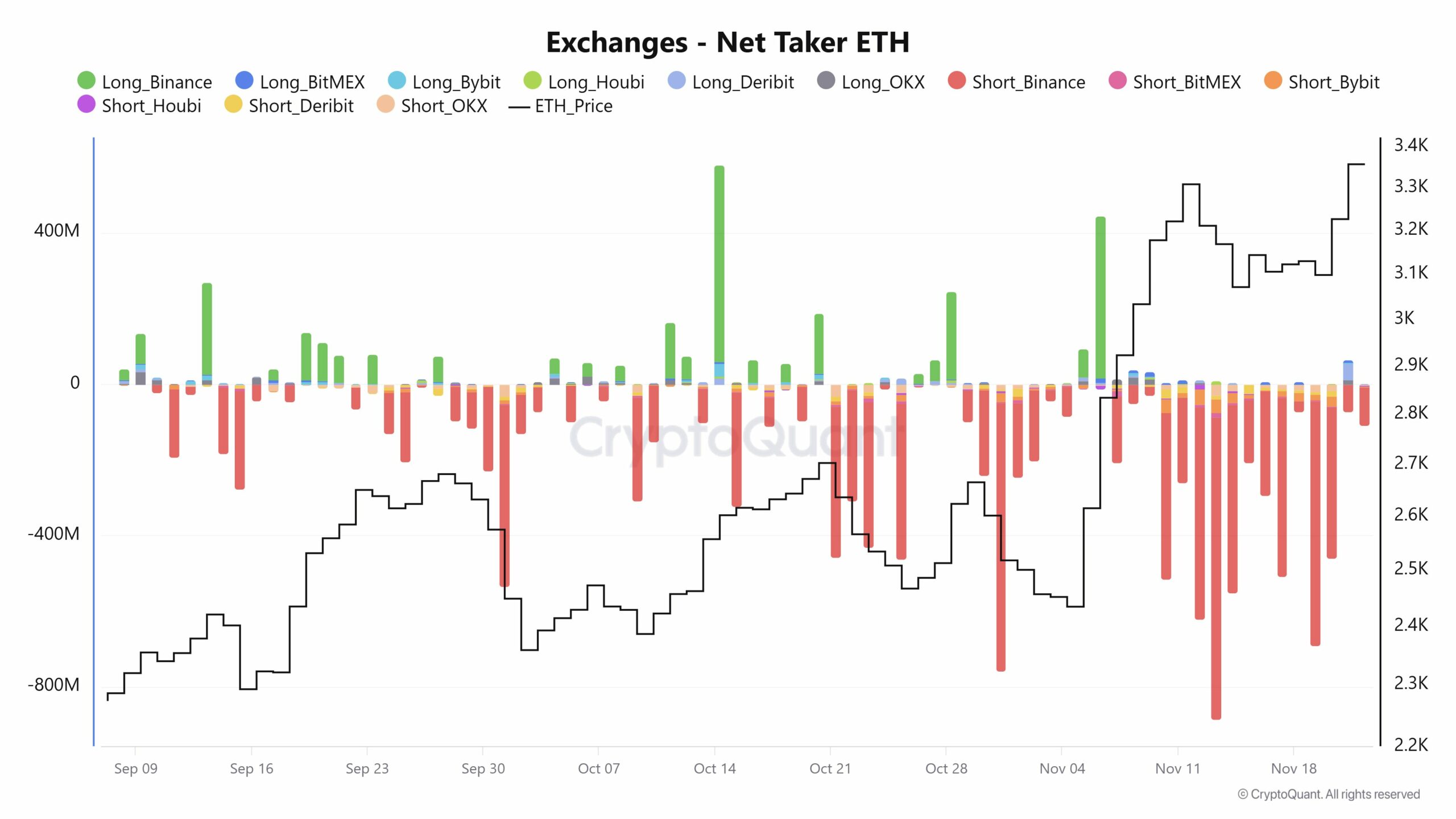

- There is a vast difference in the net taker volume in exchanges of Bitcoin and Ethereum.

- Three factors could influence ETH to change to the right side.

As a seasoned researcher with years of experience observing and analyzing the intricate dynamics of the crypto market, I find myself intrigued by the current state of Ethereum [ETH]. The discrepancy in net taker volume between ETH and Bitcoin [BTC] is palpable, and it’s a pattern that could significantly shape our understanding of these digital assets’ short-term and long-term outlooks.

The interactions between Bitcoin (BTC) and Ethereum (ETH) demonstrated a substantial impact on the market’s dynamics.

To put it simply, for those new to this, the Taker Buy/Sell Ratio on CryptoQuant offers a look at the general market feelings by presenting the number of buy orders compared to sell orders. This ratio is particularly significant during periods of market growth or decline.

At press time, both Bitcoin and Ethereum showed distinct patterns in net taker volume in exchanges.

In simpler terms, the total activity on Ethereum’s network indicates that its performance diverges from Bitcoin’s, a crucial factor influencing both the immediate and future perspectives of these digital currencies.

If a majority of negative Ethereum (ETH) values transition into positives, there’s a strong possibility that ETH might experience a significant surge due to an increase in buying activity among traders. However, it remains unclear when or under what circumstances this shift might occur.

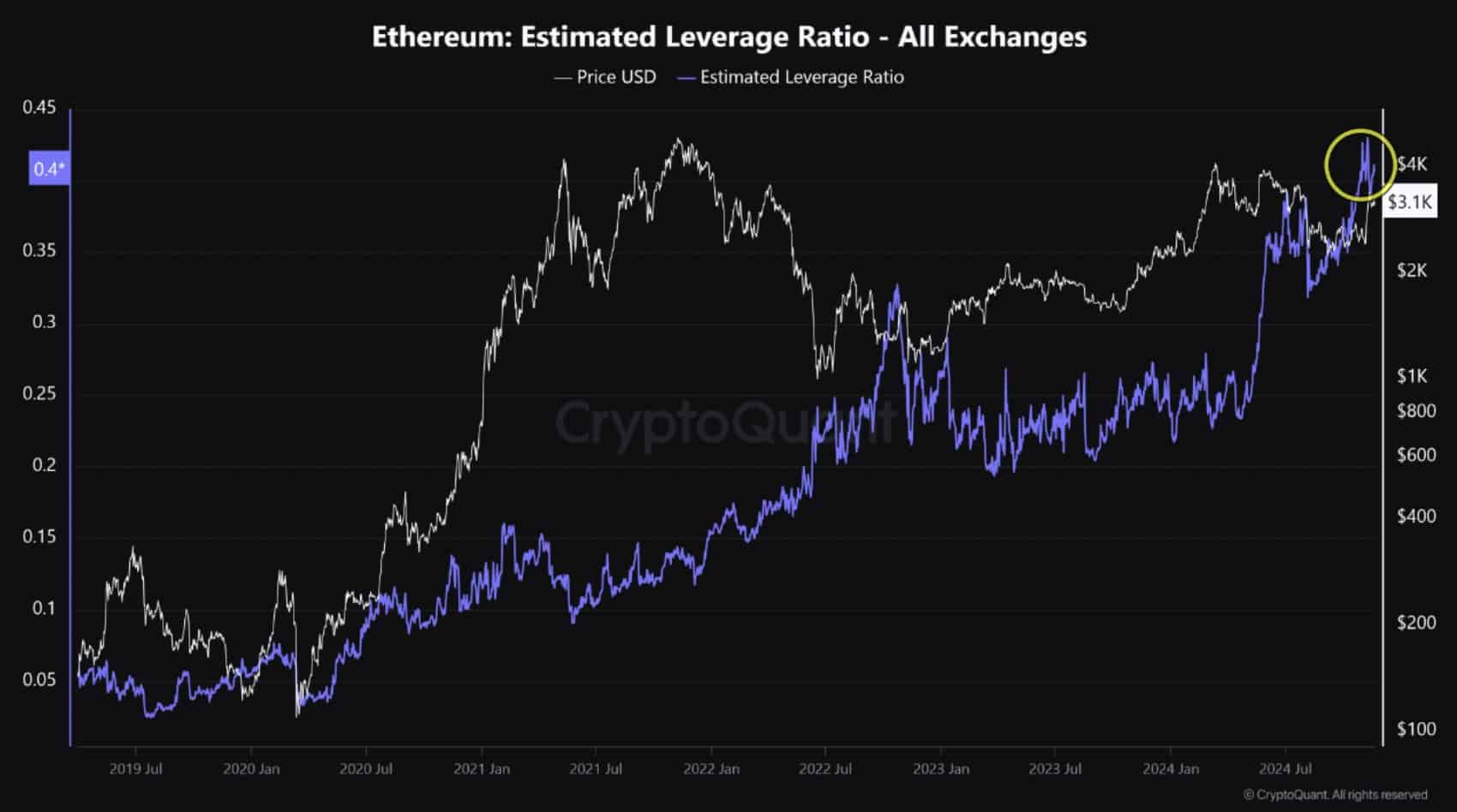

ETH derivatives signal bullish momentum

As an analyst, I’ve observed a significant contributing factor to be the robust bullish sentiment in the Ethereum derivative market. This is evident from the Open Interest surpassing its prior all-time high, reaching over $13 billion.

This 40% increase over the last four months suggested engagement in Ethereum’s derivatives sector.

A moderately favorable allocation of funds suggests that long-term investors were predominant, strengthening the belief in a bullish outlook for the immediate future.

Additionally, Ethereum’s estimated leverage ratio has reached an all-time high of 0.40 for the first time ever.

The increase in this leveraged position indicator suggests that investors are becoming more prone to taking on greater risks.

Even though there’s a sense of hopefulness, the heavy use of borrowed funds (leverage) and the predominance of long positions might increase the likelihood of a situation where sellers are forced to buy back due to losses, leading to a rapid increase in prices (long squeeze).

A sudden market correction could happen when rapid price fluctuations lead traders to quickly sell off their positions, serving as a reminder of the potential dangers linked to heavily leveraged trades.

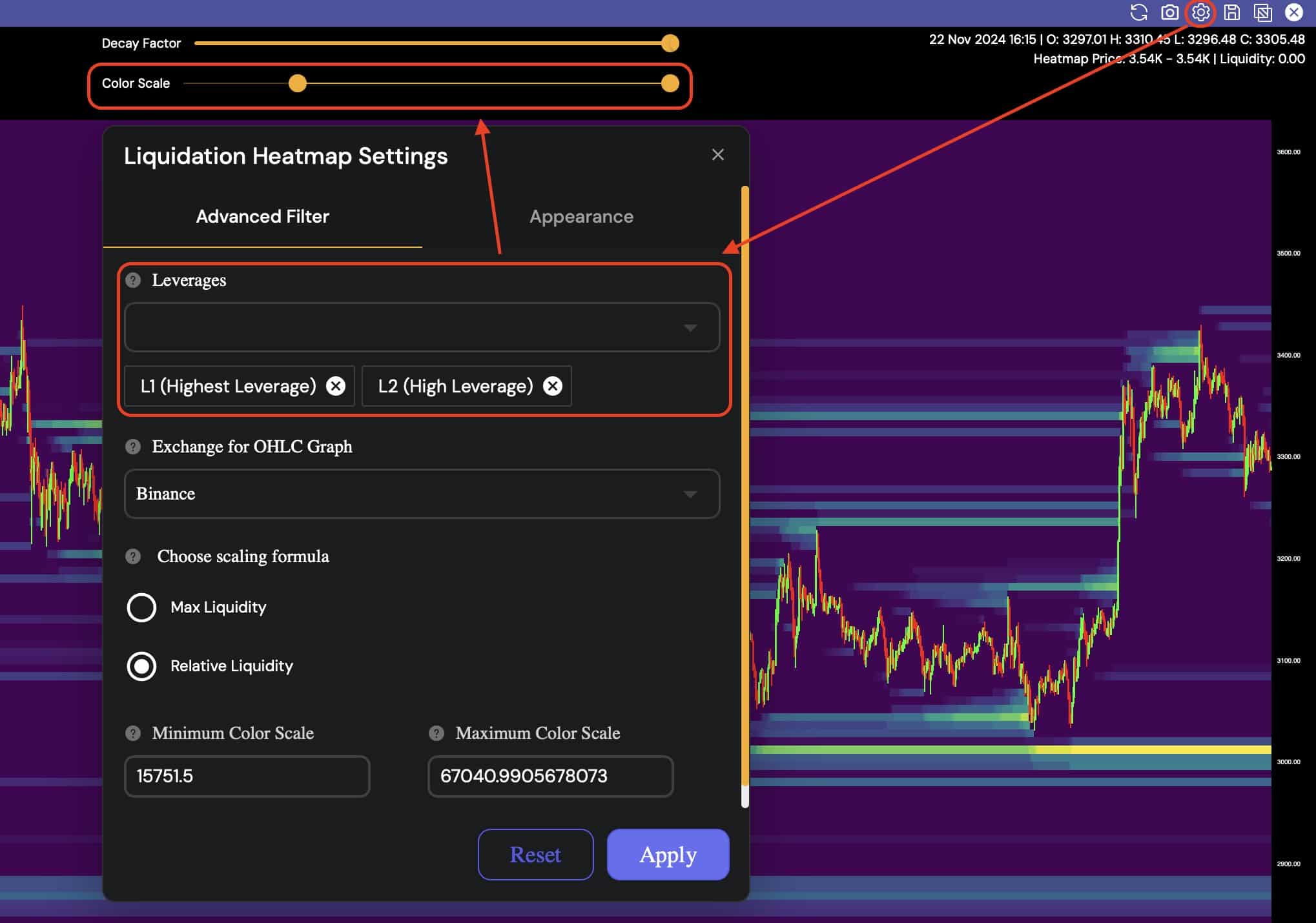

High-leverage liquidations and altcoin season

Again, high-leverage liquidations continued to loom over ETH’s price on the heatmap.

By concentrating specifically on the high levels (L1 and L2), the analysis revealed crucial spots where massive sell-offs might lead to substantial fluctuations in market prices.

Making this change brought into focus the primary groups of liquidations, exposing potential risk areas just above the present price level.

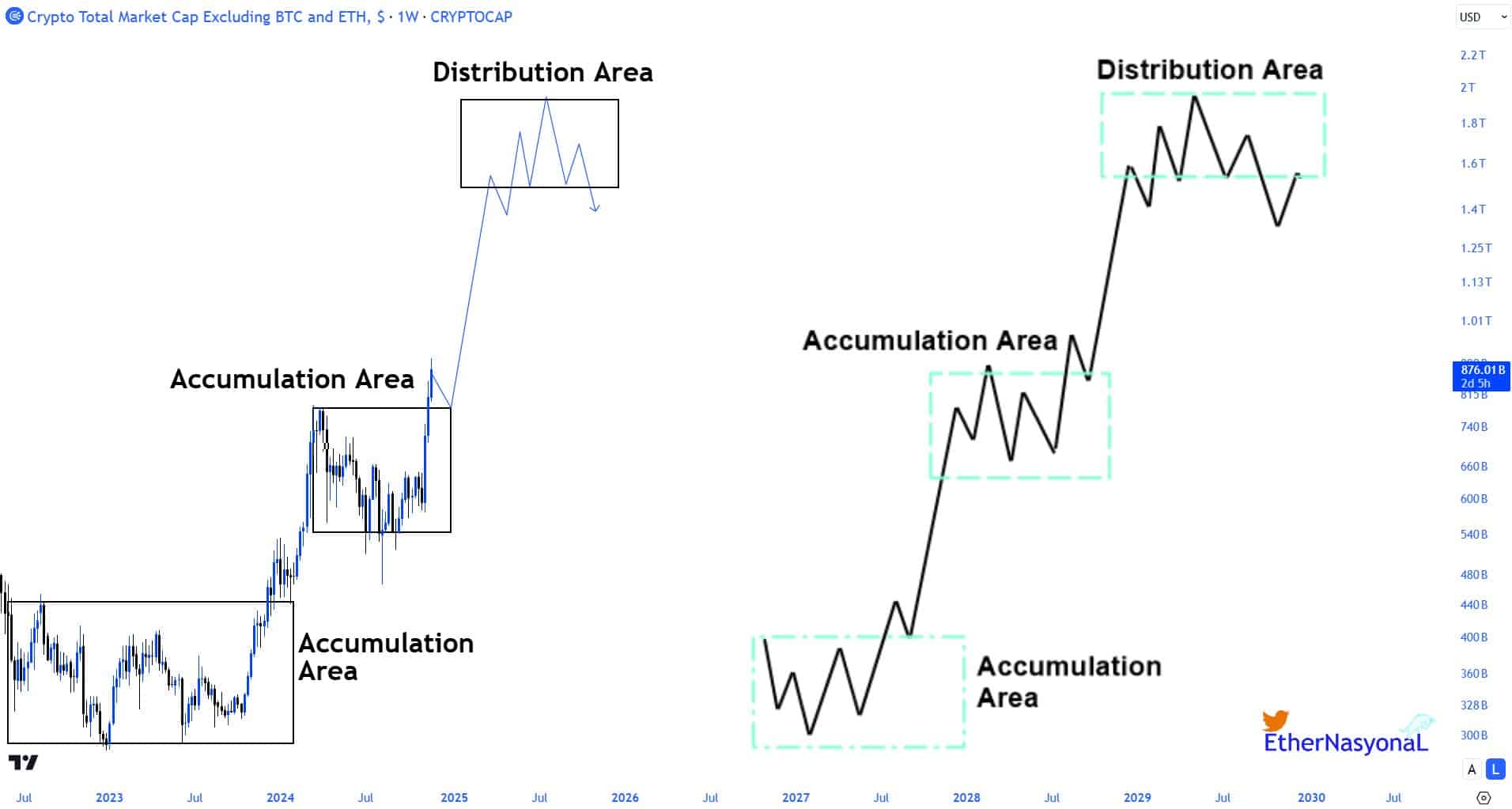

To put it simply, the total altcoin market, as reflected by the TOTAL3 index, embarked on its second period of exponential growth starting from October 2023.

Moving beyond the second accumulation phase of the Wyckoff approach, this action fueled a robust upward trajectory for cryptocurrencies.

In simple terms, the latest market trends have altcoins testing old resistance levels and subsequently breaking through them, even reaching higher than their peak from May 2024.

At the moment, a significant amount of investment is being directed towards established large-cap cryptocurrencies and chosen mid-level alternative coins, which is driving this surge in prices.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Although Ethereum is a significant player, its growth pattern has been relatively gradual compared to Bitcoin’s rapid increase, laying a strong base for itself distinctively.

This methodical climb could potentially lead to a change of behavior for the king of altcoins.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-11-24 02:16