-

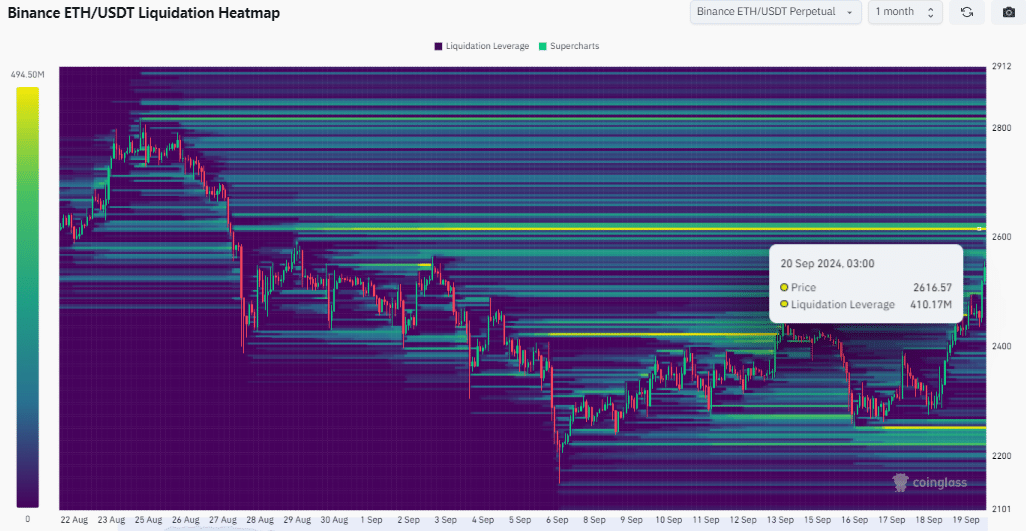

A cluster of $410 million worth of ETH could be liquidated.

Ethereum price action and whale activity are bullish.

As a seasoned researcher with a keen eye for crypto trends and market dynamics, I find myself intrigued by Ethereum’s recent trajectory. The potential $410.17 million liquidation at the $2,616.57 price level is certainly noteworthy, especially considering the impact such a large altcoin can have on the broader market.

Over the last fortnight, Ethereum (ETH) has demonstrated considerable resilience. Being the biggest alternative coin in terms of market value and a significant influencer in the blockchain sector, Ethereum’s performance carries substantial weight on the overall cryptocurrency market.

Based on figures from Coinglass, a potential $410.17 million worth of Ethereum could be liquidated if the price hits approximately $2,616.57. This is due to the fact that prices tend to move towards areas with high liquidity, which allows larger traders or “whales” to make trades at more advantageous rates.

In these areas where a lot of buying and selling is happening, there can be a significant influence on the market. Keeping this in perspective, it seems plausible that Ethereum could reach $2616.57, given its attempt to accumulate more trades in this specific zone.

Is it possible that the path leading to this significant liquidation event could propel Ethereum (ETH) towards a price of $3000, given its substantial growth over the last fortnight?

ETH price action shows momentum

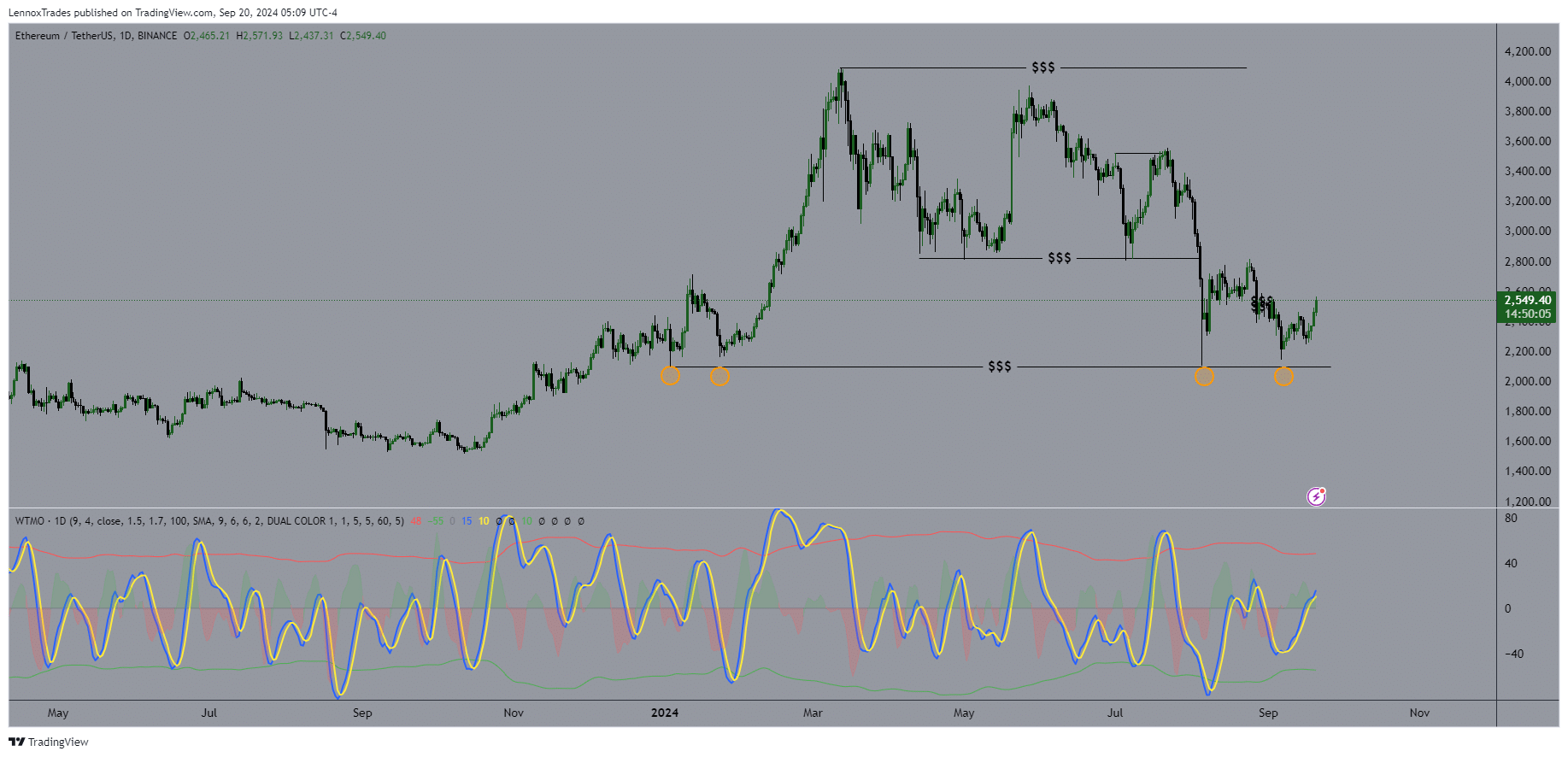

Analyzing the fluctuations in Ethereum’s value, particularly within its ETH/USDT market, consistently shows a recognizable trend when viewing the daily chart.

When the troughs of the Wave Trend Momentum Oscillator line up, it’s typically followed by significant increases in the price of ETH, with historical instances seeing a rise of more than 76.38%. This pattern has been observed frequently in the past.

At the moment, the price range surpassing $2,616 serves as a crucial resistance point. Over the past fortnight, the digital currency has persistently risen, even after experiencing four consecutive down days that were swiftly reversed.

The price is rapidly moving towards the $2,616 point. If it surpasses this threshold, the cancellation of orders placed above it might further boost the price, potentially pushing it beyond $3,000.

Whale activity fuels momentum

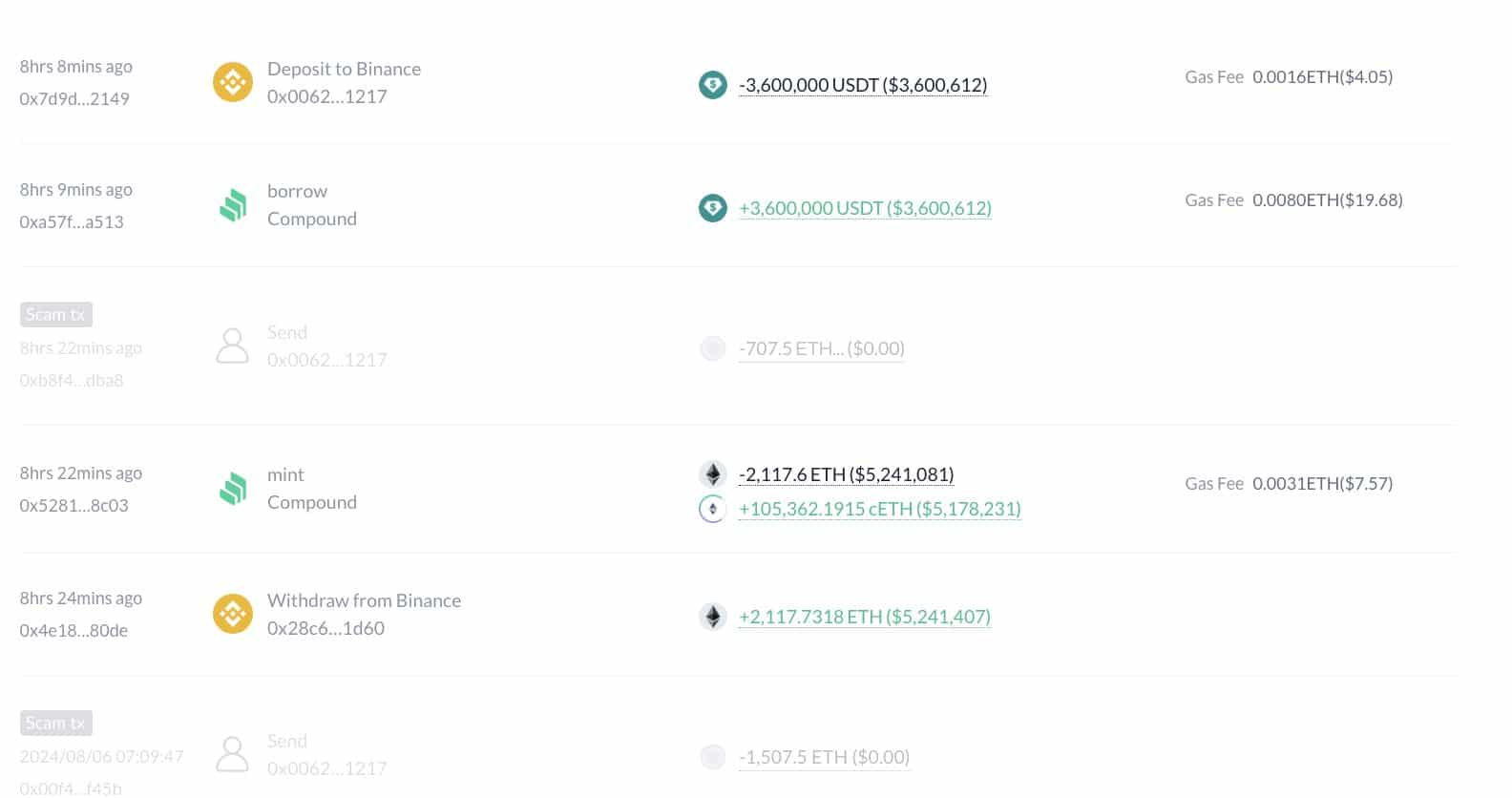

The number of whale transactions on the Ethereum blockchain is increasing, which strengthens the notion that Ethereum’s value might go up.

More recently, a significant investor bought approximately 2,117.7 Ether (ETH) valued at around $5.17 million as the price of ETH increased. This investor took a bullish position by acquiring ETH using a method known as circular borrowing.

As a researcher examining cryptocurrency transactions, I’ve noticed an intriguing pattern. A significant whale investor, much like myself in this virtual sea, has experienced a substantial loss. Specifically, on August 5, when the market took a steep dive, this whale lost approximately 6,078 Ether, equivalent to a staggering $14.7 million at the time. Over the past six months, this investor’s strategy of going long on ETH has resulted in a loss of around $13 million. Out of five attempts, they have managed to come out on top only once.

If a larger number of whales were to boost their Ethereum holdings, there’s a possibility that the price of ETH might surpass the current $2,616 mark and potentially reach even greater heights in the short term, given that each whale’s individual success rate is currently at 20%.

Ethereum’s future outlook

In conclusion, Vitalik Buterin shared his insights on Ethereum’s future developments in a video that is currently being widely discussed, originally posted on X (previously known as Twitter).

He emphasized Ethereum’s focus on scaling, usability, and zero-knowledge (ZK) infrastructure, which will expand the range of on-chain possibilities.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Vitalik imagines these technological breakthroughs leading to the development of applications capable of catering to a global user base of billions.

As a crypto investor, I firmly believe that Ethereum’s robust infrastructure and increasing popularity make it a key player in defining the future landscape of blockchain technology.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- You Won’t Believe Today’s Tricky NYT Wordle Answer and Tips for April 30th!

- ETH Mega Pump: Will Ether Soar or Sink Like a Stone? 🚀💸

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-09-21 14:16