- Ethereum long-term holders sold $89.72 million worth of ETH.

- Market fundamentals suggested a potential price correction as transfers into exchanges spiked.

As a seasoned researcher with years of experience in the dynamic world of cryptocurrencies, I’ve seen my fair share of market fluctuations and whale activities. The recent selling spree by Ethereum long-term holders is a familiar sight, albeit a bittersweet one. On one hand, it’s a testament to the profitability of long-term investments in crypto; on the other, it could potentially signal a correction in the near future.

Over the last two days, the cryptocurrency market experienced a significant boost, pushing Bitcoin‘s price to an all-time high of $75,000. This surge also propelled several alternative cryptocurrencies to reach their highest recorded values.

As a crypto investor, I’ve noticed that the value of Ethereum (ETH) has soared to a three-month peak, opening up lucrative chances for cashing out some gains. In light of this, it seems like long-term investors and dormant ‘whales’ are stirring from their slumber, seizing these profits while simultaneously aiming to boost their wealth even further.

Ethereum long-term whales dump

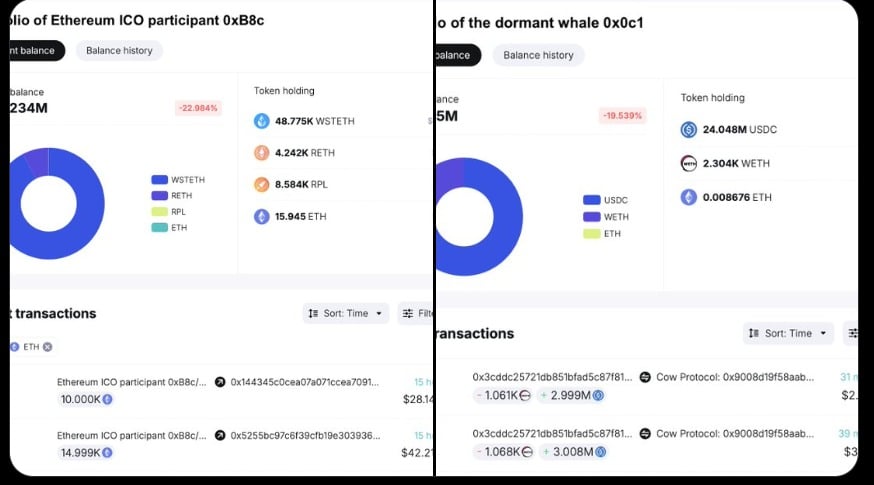

Based on a recent report from SpotonChain, it appears that three Ethereum (ETH) investors have been selling off their holdings after significant price increases over the previous day.

Consequently, two individuals holding ETH sold approximately 33,701 ETH, which is equivalent to around $89.72 million. This sale triggered a significant 13.75% increase in the Ethereum price graphs.

As reported, the initial ICO “big fish” (or whale) transferred 25,000 Ether tokens worth approximately $2,627 each, to Kraken, leaving a remaining balance of 64,450 Ether in their holdings.

After an absence of eight and a half years, another whale resurfaced to exchange 8,701 Ether (ETH) for approximately 24.05 US Dollar Coin (USDC), equivalent to around $2,764 per token. This action left the whale with remaining ETH valued at roughly $6.48 million and generated a profit of about $30.48 million.

After the recent significant transactions, I – as a researcher – have observed an active Ethereum account holding 12,001 ETH, equivalent to approximately $34.1 million, which had been inactive for eight years. This account has now commenced offloading its Ether on-chain.

The increased whale activity caused fears of potential sell-offs that could push ETH prices towards correction. This is because, massive transfers into exchanges and selling by whales cause selling pressure, which negatively impacts prices.

Impact on ETH’s price charts?

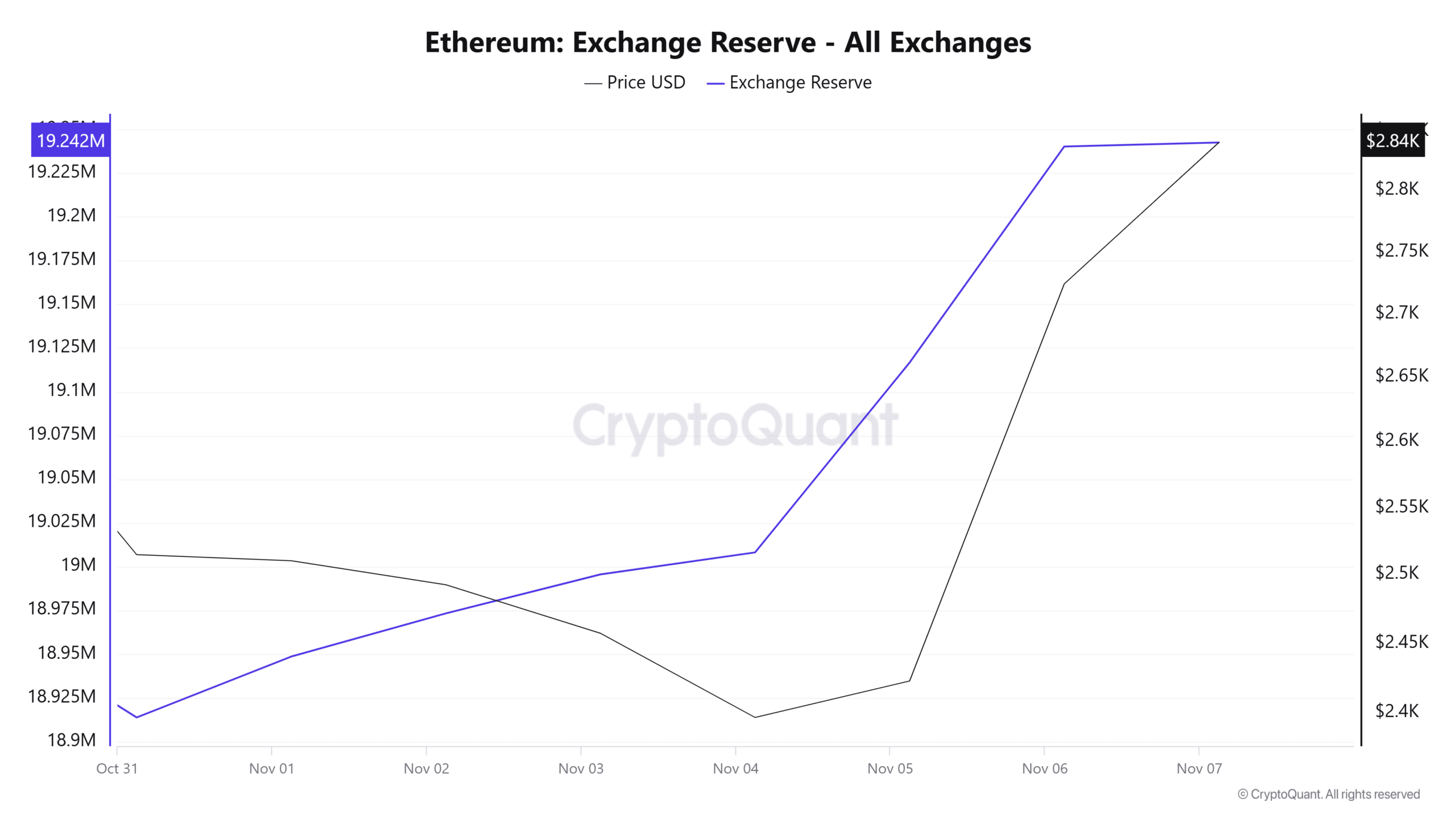

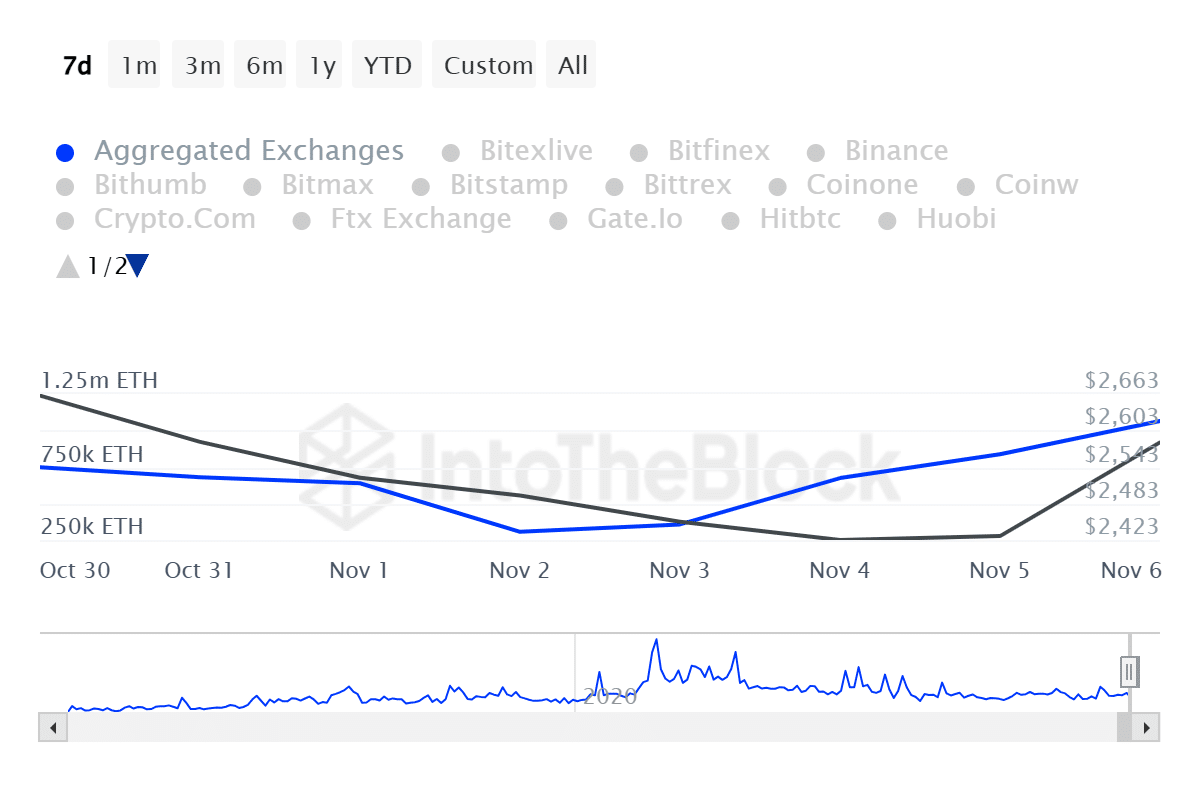

Based on AMBCrypto’s assessment, there was a rapid increase in Ethereum deposits into trading platforms. This type of market condition leads to higher supply, potentially undermining the stability of its price.

For example, Ethereum’s supply exchange ratio has spiked over the past week.

This suggested that investors were moving their tokens onto exchanges with the intention of selling, which put pressure on the prices to decrease.

Moreover, the inflow volume of Ethereum has significantly increased during the last week, rising from a minimum of 306,020 thousand to 1.07 million.

It appears that the current surge in ETH prices is leading many investors to get ready for selling, aiming to reap maximum profits.

What next for Ethereum?

Notably, ETH has experienced a strong uptrend over the past week.

Currently, as I’m typing this, Ethereum is being traded at approximately $2804. Over the past day, this value represented an increase of 8.11%. On a weekly basis, Ethereum saw a growth of 6.31%.

The recent upsurge has put the altcoin to reach a 3-month-high, signaling a strong upward momentum.

If bulls maintain their control over the market, it’s plausible that the altcoin could see further growth, potentially surpassing the $3000 resistance point.

Read Ethereum’s [ETH] Price Prediction 2024–2025

To maintain the upward trend, the market needs to handle the recent whale selloffs without experiencing significant price declines as a result.

If the latest whale interventions lead to unfavorable consequences for the market, there’s a possibility that the altcoin may experience a downturn prior to another upward trend.

Thus, if this dump reflects on price charts, Ethereum could decline to $2670.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-11-07 19:59