- Ethereum could fall under the $3k psychological support zone soon

- Metrics flashed a strong buy signal, but there’s more that investors need to consider

Recently, Ethereum [ETH] has experienced a surge in negative sentiment. Notably, data from Santiment indicated that there was an increase in bearish comments about both Bitcoin [BTC] and Ethereum before the halving event took place.

On April 18th, there was a surprising shift as negative interactions on social media led to a notable rise in Bitcoin’s price to $64,100 and Ethereum’s to $3,094. AMBCrypto delved into other data points to evaluate whether it would be advantageous for investors to purchase Ethereum at this time.

Drop in gas fee could be a disguised threat

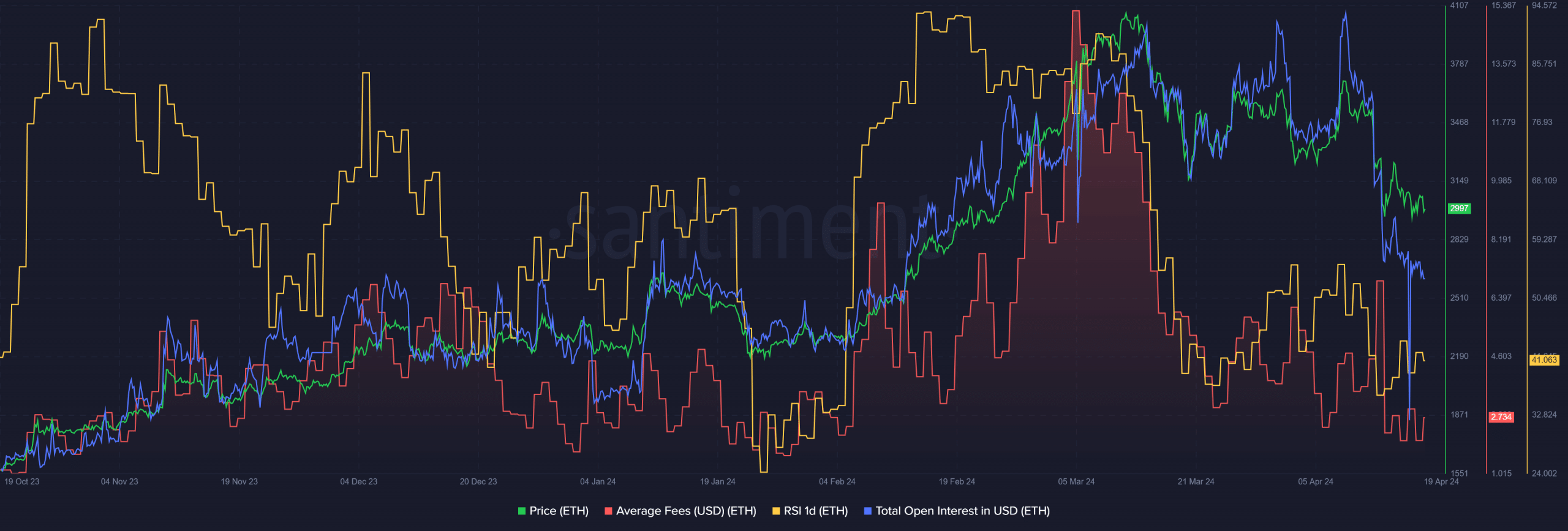

According to AMBCrypto’s report, Ethereum’s Open Interest has significantly decreased over the past ten days. The peak was reached on April 9th with a value of $7 billion (Ethereum costing $3638), but now stands at $4.6 billion as of press time (with Ethereum priced at $2997).

Speculators were hesitant to buy, as the significant drop in Open Interest indicated fear and doubt. Their bullish confidence waned, leading to a bearish outlook. For over a month, the one-day Relative Strength Index (RSI) remained below the neutral threshold of 50. This signified that the momentum had been in favor of sellers during this period.

The cost of using the network, on average, has been decreasing as per recent reports from AMBCrypto. While this is good news for users, it may indicate a decrease in the number of transaction requests being processed on the blockchain.

Addressing the buying opportunity

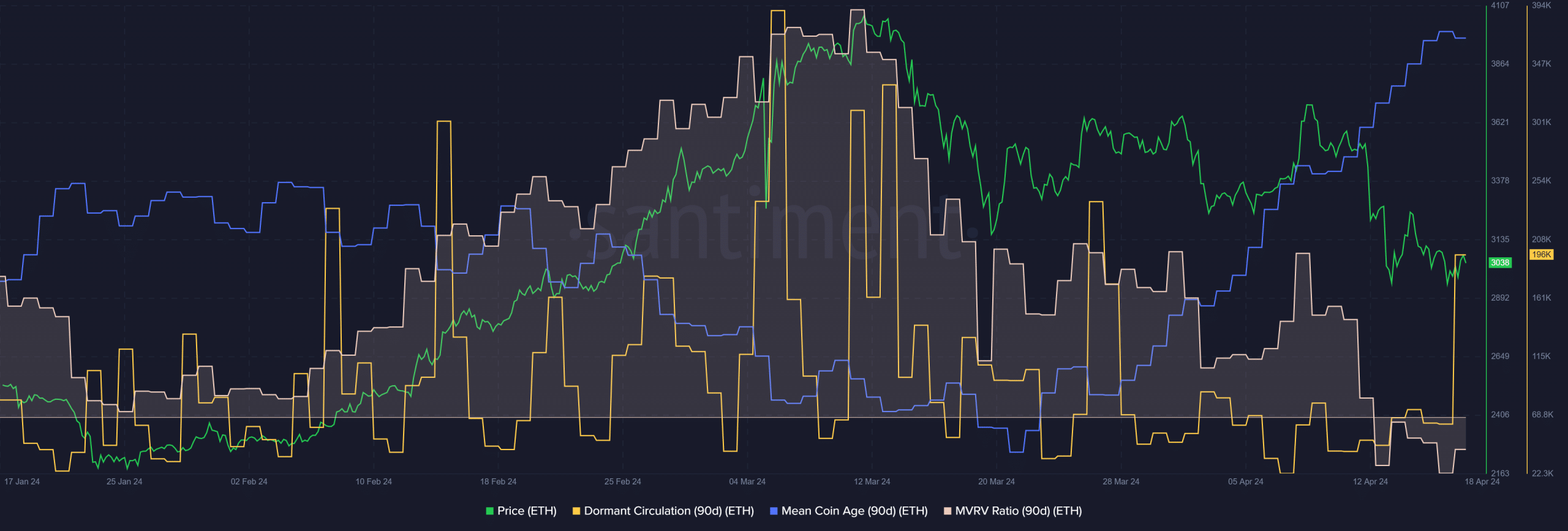

A little over three thousand dollars could have been an excellent purchase point for stocks a month ago, based on psychological factors. It may still be worth considering now. The moving average variance ratio (MVRV) for the past 90 days was below zero when checked, indicating that the asset was underpriced and its holders were experiencing losses.

Despite a consistent increase in the average age of Ethereum coins over the past three weeks, investors have been encouraged to purchase Ethereum based on this trending data.

Is your portfolio green? Check the Ethereum Profit Calculator

Despite being inactive prior, circulation of the dormant bitcoins surged significantly on April 18th. This sudden increase indicated a busy period for token transfers and could potentially signal an upcoming selling trend. Furthermore, Bitcoin was precariously clinging to the $61k support level during this time.

Waiting carefully and being patient can greatly advantage investors. There’s a significant chance that another market downturn may occur. Additionally, it’s likely that the market will experience a prolonged period of stability following the halving due to current market excesses.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Rick and Morty Season 8: Release Date SHOCK!

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-04-19 10:06