- Analysts predict peak cycle for Bitcoin and Ethereum amid regulatory uncertainty.

- Regulatory debates and SEC allegations intensify negative sentiment toward Ethereum.

As a researcher with extensive experience in the cryptocurrency market, I have closely monitored the recent trends and developments surrounding Bitcoin (BTC) and Ethereum (ETH). The current regulatory uncertainty has led some analysts to predict that both BTC and ETH may have reached their peak for this cycle.

From my perspective as a researcher studying the cryptocurrency market, when Bitcoin [BTC] falls below the $60,000 mark, some analysts raise the possibility that we’ve seen the highest point for this price cycle.

The price behavior of Ethereum [ETH] appears to align with that of Bitcoin, with both cryptocurrencies exhibiting a recent decline in value.

Commenting on the uniqueness of this crypto cycle, crypto veteran Alex Krüger said,

“The crypto cycle has been almost entirely driven by the bitcoin ETF.”

He further added,

As an analyst, I would rephrase that statement as follows: “From my perspective, ETH has underperformed significantly. However, it’s essential to acknowledge the impressive returns generated by stakers and airdrop farmers in the Ethereum ecosystem.”

Why is Ethereum losing its limelight?

Without a doubt, Bitcoin has excelled with new record-breaking heights during this cycle. In contrast, Ethereum’s standing has weakened, dropping beneath Solana in both product-market alignment and retail trader preference.

This raises a question: Can Ethereum’s price plummet to $2500 within the next 7 days?

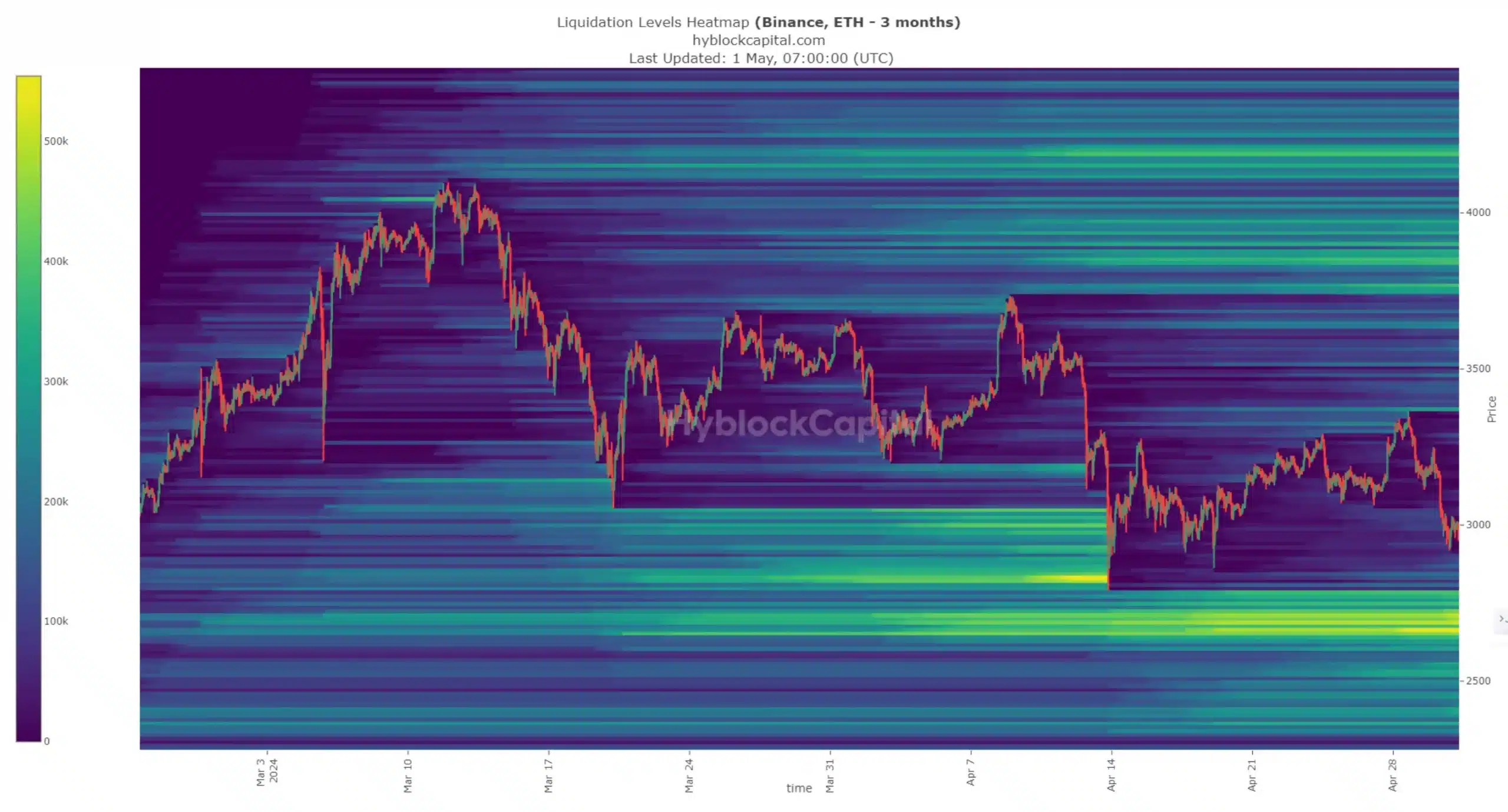

Well, to answer this, AMBcrytpo analyzed the liquidation levels for ETH.

Based on the examination, there is a concentration of potential stop-loss orders, or liquidation levels, in the Ethereum market between $2640 and $2750. This area draws traders due to its high liquidity. Furthermore, an accumulation of buy orders, or a bullish order block, can be seen at the upper end of this price range, enhancing its importance.

Ethereum’s price may dip towards this area of low liquidity before potentially rebounding.

The concerns surround ETH’s classification as a security

The controversy over whether Ethereum (ETH) qualifies as a security continues to fuel uncertainty among investors, potentially dampening interest in the cryptocurrency.

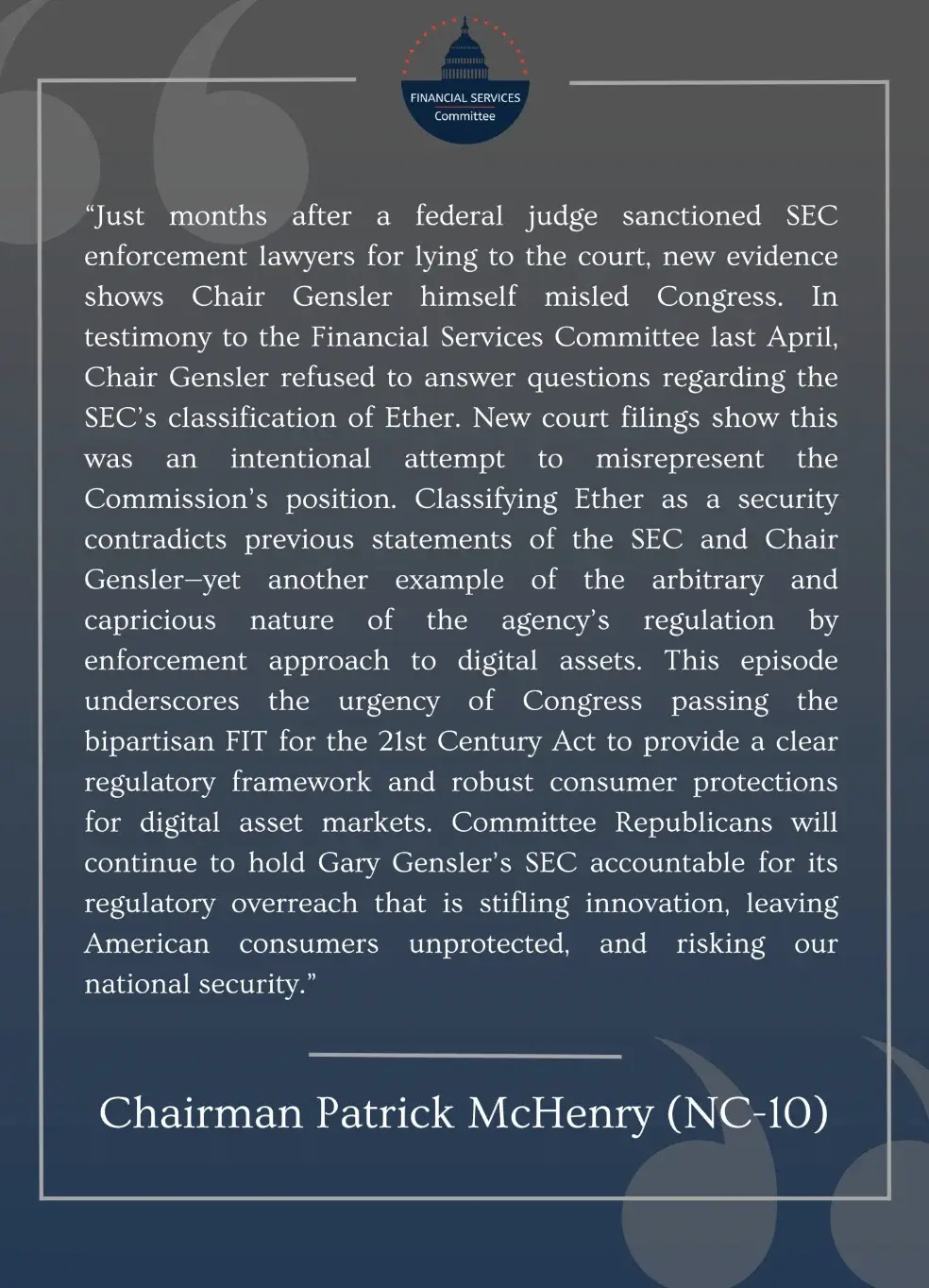

In the midst of examining various statistics, an additional noteworthy occurrence unfolded. Specifically, Rep. Patrick McHenry, who chairs the House Financial Services Committee, made a remark about it.

Recent court documents suggest that Chairman Gary Gensler of the SEC may have provided false information during a Financial Committee hearing regarding the categorization of Ethereum (ETH). Specifically, it appears that he may have intentionally misrepresented his understanding or position on this matter when answering questions from Congress for the purpose of overseeing his agency.

The growing ambiguity regarding Ethereum’s regulatory position is shedding light on the potential influence it may have on investor attitudes.

In agreement with @TheDustyBC, the content producer made this statement on X (previously known as Twitter):

“Ethereum not being kind on the feelings today.”

Way forward

Despite the hawkish shift in stance at the Federal Open Market Committee (FOMC) on May 1st, and the underperformance of Hong Kong ETFs, the executives remain hopeful that fortunes will improve soon, according to Krüger.

“The cycle is not over.”

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Solo Leveling Arise Tawata Kanae Guide

2024-05-02 12:39