- Ethereum’s netflow neutrality hinted at accumulation, with potential volatility ahead.

- Active addresses and Open Interest surged, signaling growing retail interest.

As a seasoned crypto investor with battle scars from the 2017 bull run and the subsequent bear market, I can’t help but feel a sense of cautious optimism when analyzing Ethereum’s current market dynamics. The recent neutral netflow on Binance hints at an accumulation phase, which could be a precursor to a significant price shift. However, as we all know too well, the crypto market can be as unpredictable as a rollercoaster ride in a funhouse mirror maze.

Ethereum [ETH], trading at $3,135 at press time, gained merely 0.6% over the past 24 hours.

Contrastingly, this small rise stands out when compared to Bitcoin‘s [BTC] remarkable progression. The leading cryptocurrency reached a record peak of $97,836 following a 4.9% surge in value for the day.

The surge in Bitcoin’s value has generally boosted the entire cryptocurrency market, yet Ethereum has fallen slightly short, experiencing a 2% decrease in its weekly performance.

Although Ethereum’s price seems stable at the moment, the market indicators hint at potential major shifts ahead for ETH.

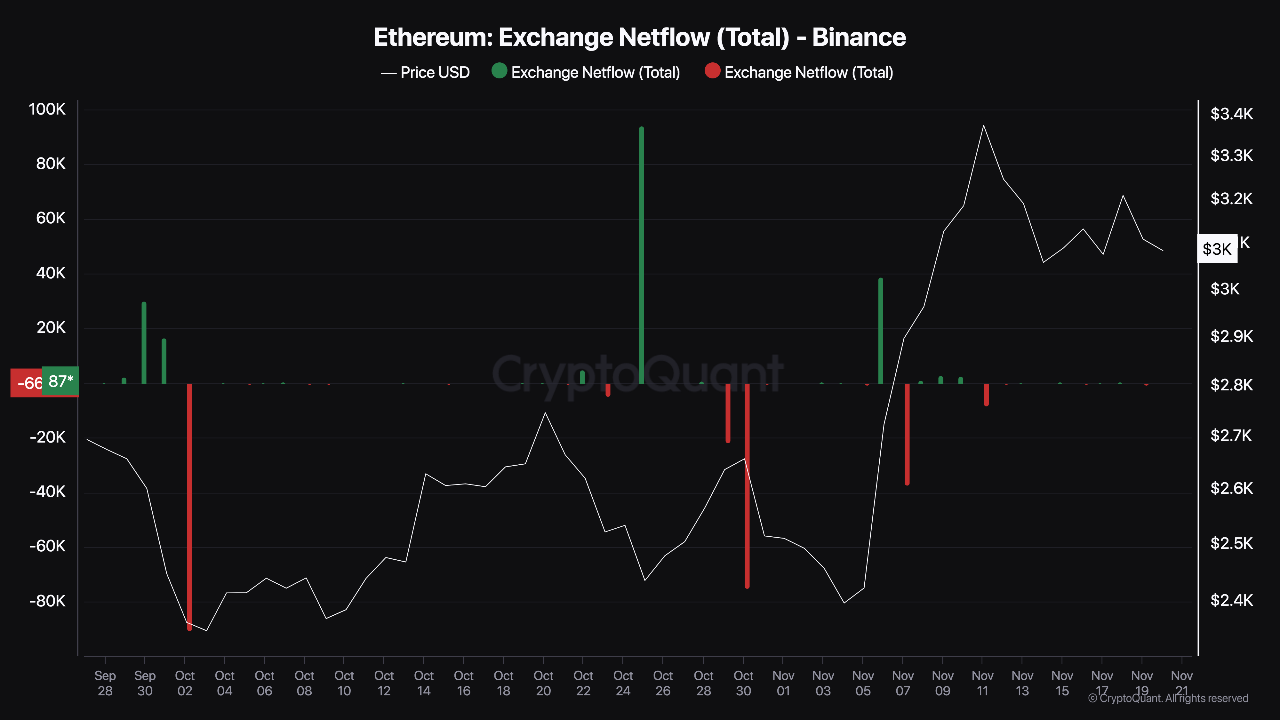

A researcher from CryptoQuant, going by the name Darkfost, pointed out a fascinating development in the net flow of Ethereum on Binance, which currently shows a state of equilibrium.

What this means for Ethereum

Ethereum’s netflow on Binance showed a balance between deposits and withdrawals on the exchange.

As I, the researcher, delve into the data provided by Darkfost, it appears that Ethereum is currently experiencing an accumulation stage. This implies that investors are neither aggressively buying nor selling the cryptocurrency, suggesting a balance between demand and supply.

The neutral netflow could point to a potential buildup of momentum in Ethereum’s market.

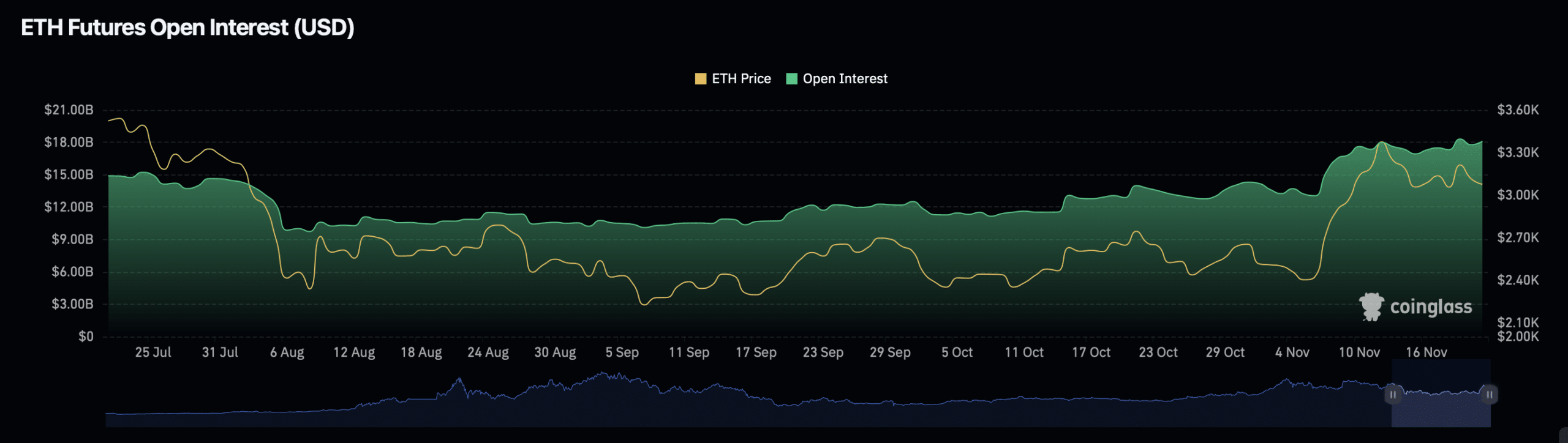

Darkfost explained that the increasing demand for Ethereum Futures contracts on Binance, approaching a record peak currently, might indicate an upcoming change in Ethereum’s price.

The Open Interest refers to the overall quantity of derivative agreements that are still active. An uptick in Open Interest frequently signals an upcoming surge in market action.

The equilibrium between inflows and increasing Open Interest might signal a period of tranquility, much like the “calm before the storm,” implying that Ethereum could undergo a substantial price change, moving upward or downward.

Rising Open Interest and Active Address growth

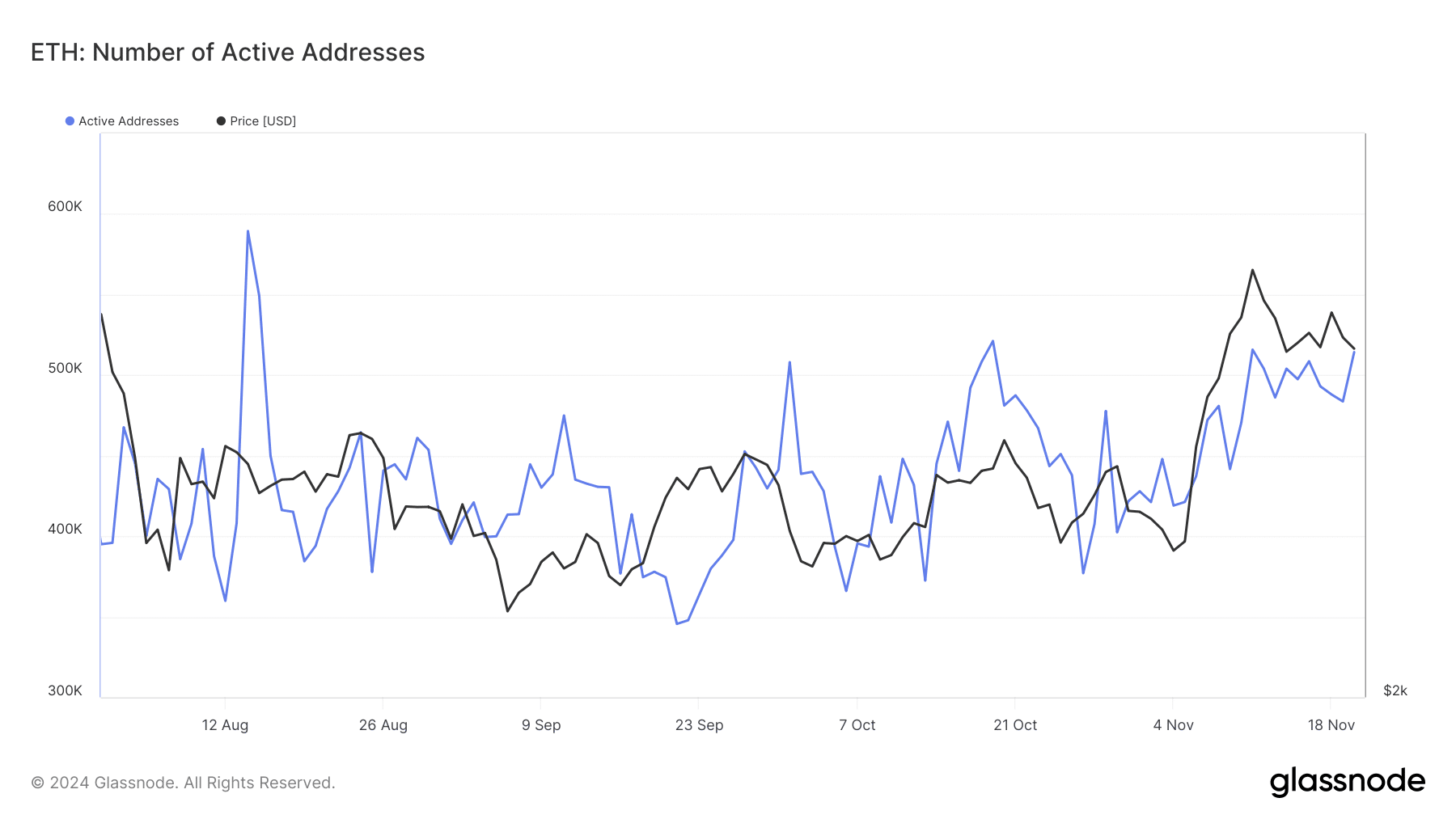

The essential aspects of Ethereum were indicating growing interest within the market. As shown by data from Glassnode, the number of active Ethereum addresses, reflecting retail involvement, has consistently risen.

Starting from around mid-November, the count of active cryptocurrency addresses dropped to approximately 500,000. However, by the 20th of November, this figure had climbed up to 514,000.

The increase in active addresses indicates a revived curiosity among individual investors, potentially boosting Ethereum’s price in the short run.

Boosted actions typically lead to larger trading amounts and more price fluctuations, suggesting a potential trend towards an increase.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Moreover, there’s been a significant leap of 3.86% in the Open Interest for Ethereum Futures contracts, bringing it up to $18.56 billion. At the current moment, there’s also a substantial 40.41% increase in the volume of Open Interest, amounting to approximately $42.88 billion.

The data suggests an increase in participation within the derivative market related to Ethereum, which underscores investor attention towards both immediate and future prospects.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Rick and Morty Season 8: Release Date SHOCK!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-11-21 20:40